Global Paraffin Wax Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fully Refined, Semi-Refined, and Others), By Application (Candles, Packaging, Cosmetics, Hot Melt, Board Sizing, and Rubber), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Paraffin Wax Market Size Insights Forecasts to 2035

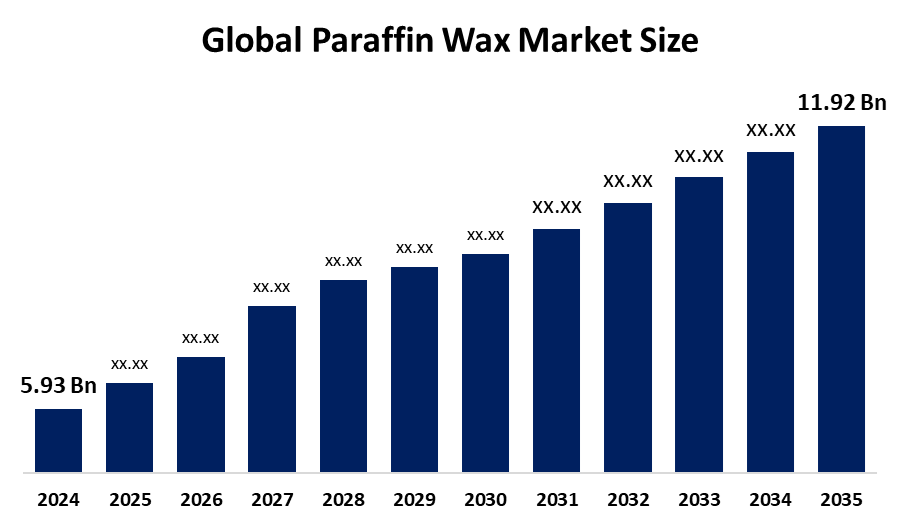

- The Global Paraffin Wax Market Size Was Estimated at USD 5.93 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.55 % from 2025 to 2035

- The Worldwide Paraffin Wax Market Size is Expected to Reach USD 11.92 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Paraffin Wax Market Size was valued at around USD 5.93 Billion in 2024 and is predicted to grow to around USD 11.92 Billion by 2035 with a compound annual growth rate (CAGR) of 6.55 % from 2025 to 2035. Growing demand in packaging, cosmetics, candles, rubber processing, pharmaceuticals, and sustainable formulations, bolstered by global industrial expansion, urbanization, and product innovation, presents growth opportunities for the Paraffin Wax Market Size.

Market Overview

The Paraffin Wax Market Size is the global commercial ecosystem involved in the processing, distribution, and consumption of paraffin wax. The market includes a variety of paraffin wax kinds, including completely refined, semi-refined, and specialty waxes, based on unique attributes such as oil content, melting points, and purities. Being a smooth wax that retains its shape, is chemically stable, and is non-absorbent, paraffin wax has found widespread use in various industries due to its properties. Recent developments, such as ExxonMobil's August 2025 announcement of an environmentally friendly paraffin wax line for cosmetics that improves biodegradability, highlight sustainability initiatives. Supply channels are strengthened by Sasol and PetroChina's production growth. The packaging, candle, and personal care industries are driving the worldwide Paraffin Wax Market Size, which is bolstered by growing consumer goods and e-commerce sectors. Consistent market expansion is also being fueled by rising industrial applications and rising disposable incomes in emerging markets.

Report Coverage

This research report categorizes the Paraffin Wax Market Size based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Paraffin Wax Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Paraffin Wax Market Size.

Paraffin Wax Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 5.93 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.55% |

| 2035 Value Projection: | 11.92 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Calumet Specialty Products Partners, L.P., Cepsa, Eni SpA, Ergon, Inc., Exxon Mobil Corporation, H&R GROUP, Holly Frontier Corporation, Honeywell International Inc., NIPPON SEIRO CO., LTD., Petro China Company Limited, Petrobras, Sasol Limited, Sinopec, The International Group, Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for paraffin wax is growing gradually owing to increasing demand in both consumer-facing and industrial applications. Strong demand from the candle, packaging, and personal care sectors is the main factor driving the market. The use of paraffin wax in corrugated containers, waterproofing materials, and insulating boards has been bolstered by the expansion of the construction and packaging industries. Soy and beeswax are two sustainable and renewable substitutes for paraffin wax that are gradually gaining traction in the worldwide environmental movement.

Restraining Factors

Crude oil price volatility, environmental concerns, strict regulations on petroleum-based products, and the growing usage of sustainable and bio-based wax substitutes in a variety of end-use industries all restricted the Paraffin Wax Market Size.

Market Segmentation

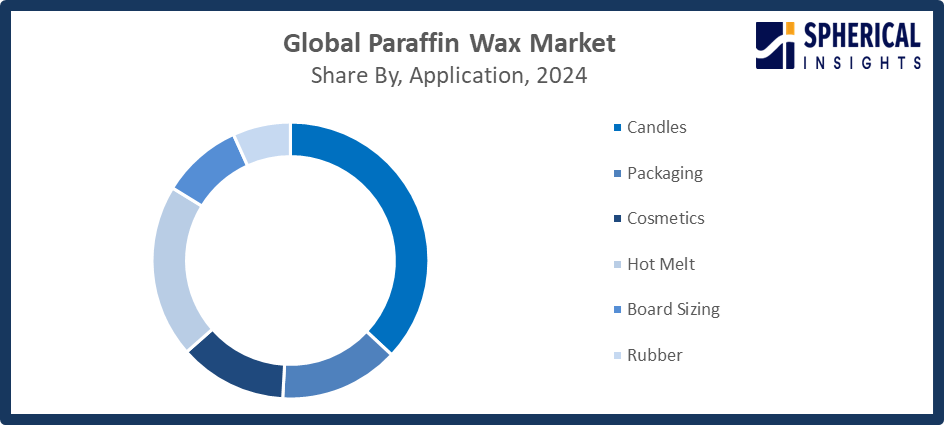

The Paraffin Wax Market Size share is classified into product type and application.

- The fully refined segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the Paraffin Wax Market Size is divided into fully refined, semi-refined, and others. Among these, the fully refined segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The Fully Refined sector is driven by its exceptional purity, which is distinguished by a very low oil content and colorless, odorless qualities that make it perfect for delicate applications. Due to highly refined wax complying with strict regulations, it has been preferred by industries like food packaging, medicines, and cosmetics.

- The candles segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the Paraffin Wax Market Size is divided into candles, packaging, cosmetics, hot melt, board sizing, and rubber. Among these, the candles segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market for candles is driven by consumers' ongoing desire for religious, fragrant, and ornamental candles in both developed and developing nations. Demand for luxury and artisanal candles has increased due to shifts in lifestyle toward wellness, aromatherapy, and home decor.

Get more details on this report -

Regional Segment Analysis of the Paraffin Wax Market Size

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the Paraffin Wax Market Size over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the Paraffin Wax Market Size over the predicted timeframe. The Asia Pacific region is supported by the increases in population, disposable incomes, and living standards in the emerging economies. In September 2025, Sinopec planned a major renovation at its Xinjiang refining plant that would boost petrochemical output by 70% in order to maintain paraffin production against rising regional needs. China's "Plan for Stabilizing Growth in Petrochemical Industries" was introduced in September 2025 with the goal of boosting capacity and innovation while increasing value addition by more than 5% each year through 2026.

North America is expected to grow at a rapid CAGR in the Paraffin Wax Market Size during the forecast period. The North American region is known for its extremely high per capita use of scented and decorative candles. An environmentally friendly paraffin wax formulation for cosmetics based on biodegradability and adherence to sustainability regulations was announced by ExxonMobil in August 2025. The U.S. Department of Energy's 2026 R&D goals, which include funding for the creation of low-carbon petrochemical routes to increase the resilience of domestic production, are consistent with this declaration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Paraffin Wax Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Calumet Specialty Products Partners, L.P.

- Cepsa

- Eni SpA

- Ergon, Inc.

- Exxon Mobil Corporation

- H&R GROUP

- Holly Frontier Corporation

- Honeywell International Inc.

- NIPPON SEIRO CO., LTD.

- Petro China Company Limited

- Petrobras

- Sasol Limited

- Sinopec

- The International Group, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In February 2025, Sasol launched an expanded micronized wax portfolio, featuring products with a 32% lower carbon footprint, targeting the low-carbon specialty market and reinforcing its commitment to sustainable, environmentally friendly wax solutions.

- In April 2024, Exxon Mobil Corporation launched Prowaxx™, a new paraffin wax brand offering scalable product naming. Prowaxx 1271 FR, a low-melting, fully refined wax, delivers excellent fragrance throw for mottled container candle applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Paraffin Wax Market Size based on the below-mentioned segments:

Global Paraffin Wax Market Size, By Product Type

- Fully Refined

- Semi-Refined

- Others

Global Paraffin Wax Market Size, By Application

- Candles

- Packaging

- Cosmetics

- Hot Melt

- Board Sizing

- Rubber

Global Paraffin Wax Market Size, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Paraffin Wax Market Size over the forecast period?The global Paraffin Wax Market Size is projected to expand at a CAGR of 6.55% during the forecast period.

-

2. What is the market size of the Paraffin Wax Market Size?The global Paraffin Wax Market Size is expected to grow from USD 5.93 billion in 2024 to USD 11.92 billion by 2035, at a CAGR of 6.55 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Paraffin Wax Market Size?Asia Pacific is anticipated to hold the largest share of the Paraffin Wax Market Size over the predicted timeframe.

-

4. Who are the top companies operating in the global Paraffin Wax Market Size?Calumet Specialty Products Partners, L.P., Cepsa, Eni SpA, Ergon, Inc., Exxon Mobil Corporation, H&R GROUP, Holly Frontier Corporation, Honeywell International Inc., NIPPON SEIRO CO., LTD., Petro China Company Limited, Petrobras, Sasol Limited, Sinopec, The International Group, Inc., and Others.

-

5. What factors are driving the growth of the Paraffin Wax Market Size?The growth of the Paraffin Wax Market Size is driven by rising demand across end-use industries, increasing industrialization, technological advancements, expanding applications in cosmetics, packaging, candles, and pharmaceuticals, and favorable regional production capacities.

-

6. What are the market trends in the Paraffin Wax Market Size?The creation of specialty and environmentally friendly waxes, product innovation, adoption in new applications, integration of sustainable practices, growing demand in the food and cosmetics industries, and growth in emerging markets are some of the primary ideas.

-

7. What are the main challenges restricting the wider adoption of the Paraffin Wax Market Size?Environmental concerns, crude oil price volatility, competition from alternative waxes, strict regulatory frameworks, and the growing demand for natural and bio-based wax replacements are all challenges to market expansion.

Need help to buy this report?