Global Paper & Pulp Mills Market Size, Share, and COVID-19 Impact Analysis, By Product & Service (Paperboard & Packaging, Paper, and Pulp), By Major Market (Manufacturers, Publishers, Retailers, Wholesalers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Advanced MaterialsGlobal Paper & Pulp Mills Market Insights Forecasts to 2035

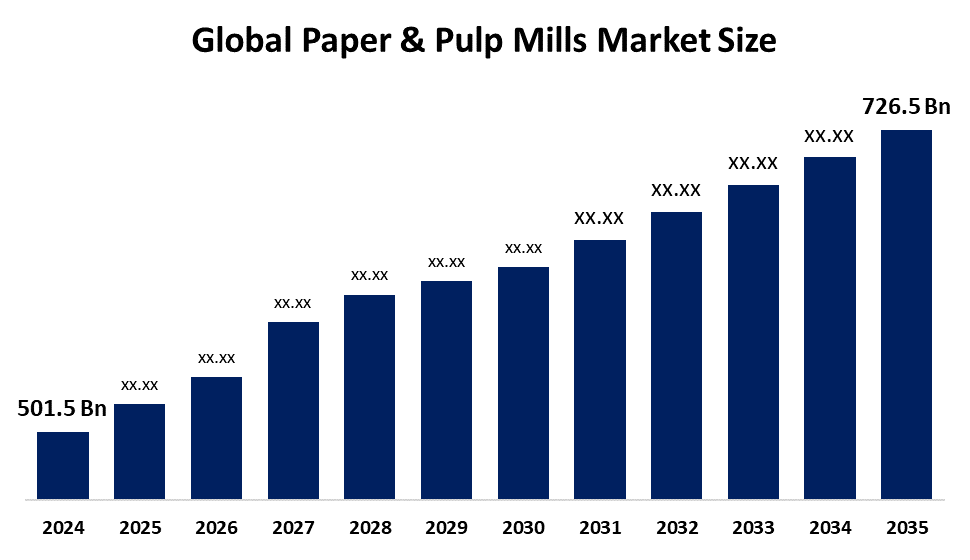

- The Global Paper & Pulp Mills Market Size Was Estimated at USD 501.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.43% from 2025 to 2035

- The Worldwide Paper & Pulp Mills Market Size is Expected to Reach USD 726.5 Billion by 2035

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Global Paper & Pulp Mills Market Size was Worth around USD 501.5 billion in 2024 and is predicted to grow to around USD 726.5 billion by 2035 with a compound annual growth rate (CAGR) of 3.43% from 2025 to 2035. The growing inclination towards sustainability, hygiene awareness, and the need for eco-friendly packaging materials are driving the paper & pulp mills market globally.

Market Overview

The paper & pulp mills market is the industry encompassing the production of paper, pulp, and paperboard products from raw materials, including wood, recycled paper, and other fibers. Paper & pulp mills, wood is used as raw material, producing pulp, paper, paperboard, and other cellulose-based products. The paper manufacturing process involves the introduction of pulp into a paper machine, where it is shaped into a paper web and water is extracted through pressing and drying stages. There is robust demand for paper-based products in various sectors, including packaging, education, and sanitation. Paper products, including writing and printing paper, packaging paper, and specialty paper, are in high demand, along with extensive promotion of recycling programs in the paper sector. The trend towards sustainability involves the use of recycled paper and the adoption of eco-friendly pulp production methods. The increasing adoption of paper & pulp in the manufacturing of sanitary products like toilet paper, facial tissues, napkins, and feminine hygiene products, owing to growing awareness about hygiene and personal care, is offering market opportunities. Further, the development of more absorbent, soft, and eco-friendly sanitary products is promoting the market.

Report Coverage

This research report categorizes the paper & pulp mills market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the paper & pulp mills market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the paper & pulp mills market.

Global Paper And Pulp Mills Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 501.5 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.43% |

| 2035 Value Projection: | USD 726.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product & Service, By Major Market, By Region |

| Companies covered:: | International Paper, Georgia-Pacific Corporation, Nine Dragon Paper Ltd, Sappi Ltd, UPM-Kymmene Oyj, Nippon Paper Industries, The Smurfit Kappa Group, WestRock, Stora Enso Oyj, Kimberly-Clark Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Paper manufacturing has great potential to be truly sustainable and ecological, with fully renewable raw material for producing a recyclable product. Thus, the increasing inclination towards sustainability is supporting the paper & pulp mills market. Introduction of paper-based hygiene products ranging from tissue papers to disposable wipes and sanitary napkins, with the increasing hygiene awareness across various sectors, is propelling the market growth. Technological advancement in paper recycling, promoting eco-friendly packaging materials, is bolstering the market growth. Additionally, cutting-edge developments in digital printing and their widespread applications in the paper product production are promoting the market growth.

Restraining Factors

Deforestation and water crises are restraining the paper & pulp mills market. Further, the government's stricter regulations on wood sourcing from forests are challenging the market.

Market Segmentation

The paper & pulp mills market share is classified into product & service and major market.

- The paperboard & packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product & service, the paper & pulp mills market is divided into paperboard & packaging, paper, and pulp. Among these, the paperboard & packaging segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Paperboard and packaging are derived from wood pulp, possess the flexibility to be shaped into various forms and sizes. They are used in corrugated boxes, cartons, labels, and more. An increasing investment in paper and pulp materials for creating diverse product lines, including food packaging to industrial uses, is propelling the market growth.

- The manufacturers segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the major market, the paper & pulp mills market is divided into manufacturers, publishers, retailers, wholesalers, and others. Among these, the manufacturers segment accounted for the largest revenue share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. Paper and pulp are the foundational materials, including wood fiber, used for creating various products such as printing paper, packaging, and tissues. An increasing significance of adopting environmentally friendly materials among manufacturers, along with a shift towards sustainable practices, is promoting the market.

Regional Segment Analysis of the Paper & Pulp Mills Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the paper & pulp mills market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the paper & pulp mills market over the predicted timeframe. The increasing adoption of pulp and paper-based products, along with the growing inclination towards improved lifestyles and healthier economic growth, is contributing to driving the market. Increasing urbanization and increasing consumption of paper in the stationery sector in countries like China and India are contributing to propel regional market demand.

North America is expected to grow at a rapid CAGR in the paper & pulp mills market during the forecast period. E-commerce platforms driving the use of paper for transportation are contributing to promoting the paper & pulp mills market. The growing demand for paper from both chemical and industrial processing sectors, along with heightened investment in R&D, is promoting the market growth.

Europe is anticipated to hold a significant share of the paper & pulp mills market during the predicted timeframe. The rising focus on sustainable goals by recycling paper-based products is contributing to promoting the paper & pulp mills market. An increasing investment in technologies and processes in paper recycling, enabling efficient resource use and lower emissions, is promoting the paper & pulp mills market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the paper & pulp mills market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- International Paper

- Georgia-Pacific Corporation

- Nine Dragon Paper Ltd

- Sappi Ltd

- UPM-Kymmene Oyj

- Nippon Paper Industries

- The Smurfit Kappa Group

- WestRock

- Stora Enso Oyj

- Kimberly-Clark Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In November 2024, ABB launched a series of industry papers as part of its global Real Progress sustainability program for the process industries, highlighting innovation in pulp and paper.

- In August 2023, Atlas Holdings closed the acquisition of Thunder Bay pulp and paper mill. The new incoming Connecticut owners of Thunder Bay’s pulp and paper mill have finalized its acquisition from Resolute Forest Products.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Paper & Pulp Mills market based on the below-mentioned segments:

Global Paper & Pulp Mills Market, By Product & Service

- Paperboard & Packaging

- Paper

- Pulp

Global Paper & Pulp Mills Market, By Major Market

- Manufacturers

- Publishers

- Retailers

- Wholesalers

- Others

Global Paper & Pulp Mills Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the paper & pulp mills market?The global paper & pulp mills market size is expected to grow from USD 501.5 Billion in 2024 to USD 726.5 Billion by 2035, at a CAGR of 3.43% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the paper & pulp mills market?Asia Pacific is anticipated to hold the largest share of the paper & pulp mills market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Paper & Pulp Mills Market?The market is expected to grow at a CAGR of around 3.43% during the period 2024-2035.

-

4. Who are the top 10 companies operating in the Global Paper & Pulp Mills Market?Key players include International Paper, Georgia-Pacific Corporation, Nine Dragon Paper Ltd, Sappi Ltd, UPM-Kymmene Oyj, Nippon Paper Industries, The Smurfit Kappa Group, WestRock, Stora Enso Oyj, and Kimberly-Clark Corporation.

-

5. Can you provide company profiles for the leading companies of the paper & pulp mills?Yes. For example, International Paper is a provider of sustainable packaging solutions, primarily engaged in the production of renewable fiber-based packaging and pulp products. Nine Dragon Paper Ltd. is the world’s largest paper manufacturing group in terms of production capacity, and the leading enterprise in the integrated production of pulp and paper.

-

6. What are the main drivers of growth in the paper & pulp mills market?Inclination towards sustainability, hygiene awareness, and technological advancements are the main drivers of growth in the paper & pulp mills market.

-

7. What challenges are limiting the paper & pulp mills market?The government's stringent regulations on wood sourcing from forests, with increasing concerns related to deforestation, are challenging the paper & pulp mills market.

-

8. What are the latest trends in the paper & pulp mills market?With the focus on sustainability, the use of recycled paper and the adoption of eco-friendly pulp production methods are the latest trends in the market.

-

9. What are the top investment opportunities in the Global Paper & Pulp Mills Market?Investment in the paper & pulp mills industries for enhancing the operating efficiency and improved competitiveness is anticipated to propel the market growth opportunity. Further, investment in local paper production capacity aids in reducing the reliance on imports.

Need help to buy this report?