Global Paneer Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fresh Paneer, Frozen Paneer, and Flavored Paneer), By Application (Household, Food Service Industry, and Food Processing Industry) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East,

Industry: Food & BeveragesGlobal Paneer Market Insights Forecasts to 2035

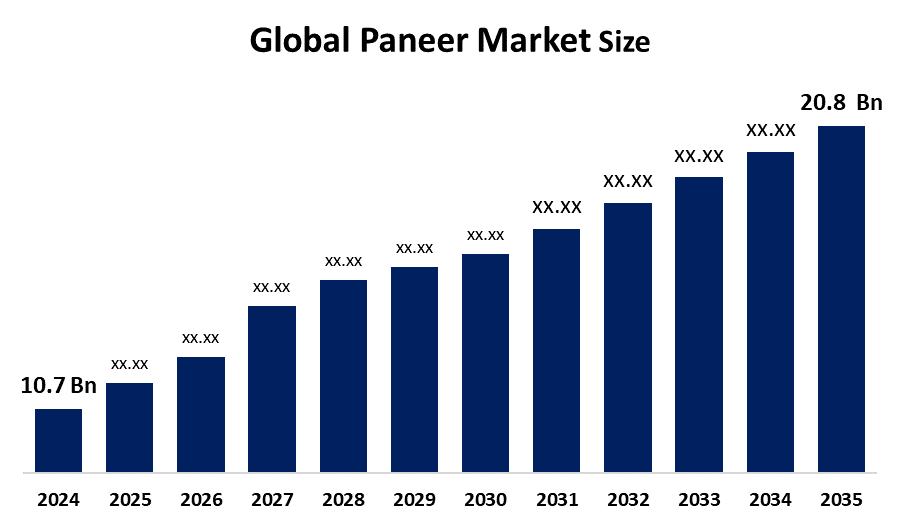

- The Global Paneer Market Size Was Estimated at USD 10.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.23% from 2025 to 2035

- The Worldwide Paneer Market Size is Expected to Reach USD 20.8 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Paneer Market Size was worth around USD 10.7 Billion in 2024 and is predicted to Grow to around USD 20.8 Billion by 2035 with a compound annual growth rate (CAGR) of 6.23% from 2025 to 2035. The global paneer market is set to attract more and more investors because of the growing health-conscious demand, plant-based innovations, premium exports, ready-to-cook variants, halal/Kosher certification expansion, cold chain improvements, sustainability focus, and foodservice adoption.

Market Overview

Paneer is a fresh, non-melting acid-set cheese that is predominantly used in South Asian cuisine and known for its high protein content and versatility. The steady growth of the global paneer market is mainly due to the increasing dairy consumption, rise of vegetarian and flexitarian populations, and growing knowledge about protein-rich diets. The expanding Indian diaspora and the global spread of ethnic cuisines are factors that are increasing the demand for paneer in North America, Europe, and the Middle East. The market is also being driven by product innovations such as flavored, low-fat, organic, and ready-to-cook paneer. The growth of modern retail, cold-chain logistics, and foodservice sectors is also a major factor supporting the market's expansion. Moreover, the increasing use of paneer in quick-service restaurants and packaged foods is improving its potential in the global market.

Report Coverage

This research report categorizes the paneer market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the paneer market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the paneer market.

Global Paneer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.23% |

| 2035 Value Projection: | USD 20.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | • Amul, • Mother Dairy, • Parag Milk Foods, • Gujarat Cooperative Milk Marketing Federation (GCMMF), • Nandini (Karnataka Cooperative Milk Producers Federation), • Britannia Industries, • Nestlé, • Hatsun Agro Product Ltd, • Verka (Punjab State Cooperative Milk Producers Federation), • VRS Foods Limited (Paras), • Kwality Limited, • Heritage Foods Limited, • Milky Mist, • Dairy Craft, and Others, Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The paneer market, although availing in the opportunities, still has some threats that may influence its growth. One of the main difficulties is the possibility of disruption in the supply chain, especially in areas with no established paneer production. Supply and price stability can be at risk due to such factors as unsteady milk prices, difficulties in transportation, and strict regulations. Also, the growing competition from other plant-derived protein sources might threaten the market of paneer, since consumers would be more willing to try a variety of proteins that are believed to be better for the environment and more humane.

Restraining Factors

The production cost that is mainly due to the very high quality of milk and hygiene standards might be a big obstacle for the manufacturers’ profits. Besides, the regulations concerning food safety and labeling might also make things difficult for the newcomers in the market.

Market Segmentation

The paneer market share is classified into product type and application.

- The fresh paneer segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product type, the paneer market is divided into fresh paneer, frozen paneer, flavored paneer. Among these, the fresh paneer segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segment is fueled by consumers' strong preference for natural and minimally processed dairy products, their extensive use in traditional dishes, strong demand from both households and restaurants, and the increasing accessibility of such products due to organized retail and cold-chain infrastructure.

Get more details on this report -

- The household segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the paneer market is divided into household, food service industry, and food processing industry. Among these, the household applications segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The sheer volume of paneer consumption in India is what actually fuels its production. The convenience and nutritional value of paneer indeed make it an easy choice for daily meals. Besides, the health benefits of this dairy product are also becoming known, hence, household consumption is gradually rising in those global markets where Indian culinary habits are already taking roots.

Regional Segment Analysis of the paneer Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the paneer market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the paneer market over the predicted timeframe. India is the origin of paneer and its consumption patterns greatly affect the dynamics of the regional market. The main factors driving the demand are the country's large and young population along with increasing income, which together result in a remarkable CAGR of 7.2% during the forecast period. Moreover, the regional market is gaining momentum from the rising interest in Indian food in adjacent countries, and consequently the exports are showing a significant rising trend.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the paneer market during the forecast period. The market of the area is going to observe a constant growth rate of 5.8% for the entire duration of the forecast period. The opening up of Indian restaurants across the country and the increased knowledge of paneer's health advantages are the main contributors to this healthy trend. In addition to that, the smooth and easy availability of paneer through dominating grocery marts and online shopping is attracting a wider population in North America.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the paneer market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amul

- Mother Dairy

- Parag Milk Foods

- Gujarat Cooperative Milk Marketing Federation (GCMMF)

- Nandini (Karnataka Cooperative Milk Producers Federation)

- Britannia Industries

- Nestlé

- Hatsun Agro Product Ltd

- Verka (Punjab State Cooperative Milk Producers Federation)

- VRS Foods Limited (Paras)

- Kwality Limited

- Heritage Foods Limited

- Milky Mist

- Dairy Craft

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, [KG1] Pizza Hut India had unveiled a refreshed brand identity with a modern logo and global tagline “Feed Good Times,” and had introduced the Ultimate Cheese Crust to its pan pizzas, which enhanced indulgence and modernized the dining experience.

- In June 2025, [KG2] Chennai-based start-up Roll Baby Roll gained popularity by embracing global food trends such as bold, fusion flavours and Korean-inspired ingredients, adapted its kathi roll offerings to modern tastes, and expanded its quick-service footprint.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the paneer market based on the below-mentioned segments:

Global Paneer Market, By Product Type

- Fresh Paneer

- Frozen Paneer

- Flavored Paneer

Global Paneer Market, By Application

- Household

- Food Service Industry

- Food Processing Industry

Global Paneer Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the paneer market over the forecast period?The global paneer market is projected to expand at a CAGR of 6.23% during the forecast period.

-

2. What is the market size of the paneer market?The global paneer market Size is expected to grow from USD 10.7 billion in 2024 to USD 20.8 billion by 2035, at a CAGR of 6.23% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the paneer market?Asia Pacific is anticipated to hold the largest share of the paneer market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global paneer market?Amul, Mother Dairy, Parag Milk Foods, Gujarat Cooperative Milk Marketing Federation (GCMMF), Nandini (Karnataka Cooperative Milk Producers Federation), Britannia Industries, Nestlé, Hatsun Agro Product Ltd, Verka (Punjab State Cooperative Milk Producers Federation), VRS Foods Limited (Paras), Kwality Limited, Heritage Foods Limited, Milky Mist, Dairy Craft, and Others.

-

5. What are the market trends in the Paneer market?Trends that are prominent in the paneer industry consist of the demand for protein-rich foods getting higher, the packaged and frozen paneer getting more and more popular, innovations in the products like the introduction of flavored and low-fat types, acceptance of the foodservice industry getting broader, and unorganized retail channels getting less and less penetration.

Need help to buy this report?