Global Pallet Wraps Market Size, Share, and COVID-19 Impact Analysis, By Material (LLDPE (Linear Low-Density Polyethylene), LDPE (Low-Density Polyethylene), PVC, and Others), By Application (Logistics & Transportation, Food & Beverage, Pharmaceutical, Automotive, Building & Construction, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Pallet Wraps Market Insights Forecasts to 2035

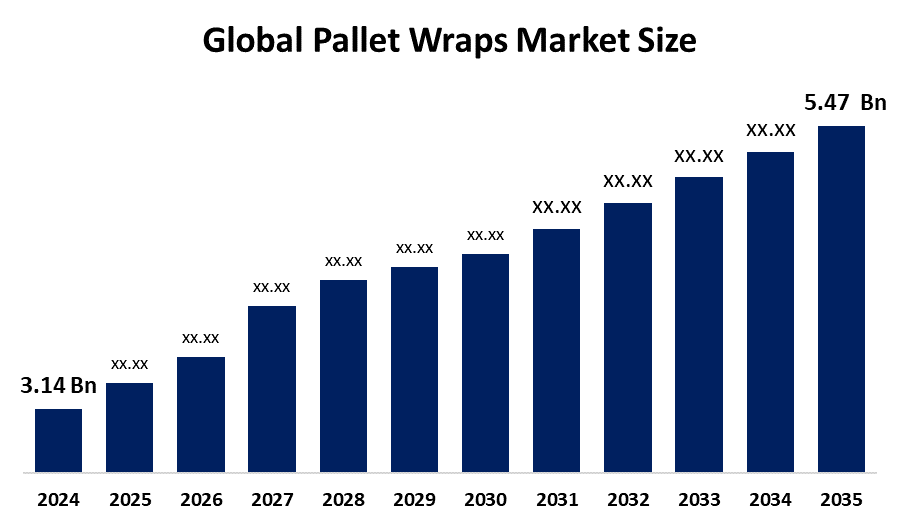

- The Global Pallet Wraps Market Size Was Estimated at USD 3.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.18 % from 2025 to 2035

- The Worldwide Pallet Wraps Market Size is Expected to Reach USD 5.47 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global pallet wraps market size was worth around USD 3.14 billion in 2024 and is predicted to grow to around USD 5.47 billion by 2035 with a compound annual growth rate (CAGR) of 5.18% from 2025 to 2035. The pallet wraps market offers opportunities through rising global logistics activities, growth in e-commerce, increased demand for product protection, advancements in sustainable materials, and expanding applications across manufacturing, distribution, and retail sectors.

Market Overview

The pallet wraps market involves the manufacturing, supplying, and use of stretch films made primarily of linear low-density polyethylene (LLDPE) for the purpose of securing, protecting, and stabilizing palletized products during logistics, warehousing, and transport. Thus, these films have the properties of load containment, resist penetration, and enable easy material handling, which are the main drivers of supply chain optimization for food & beverage, pharmaceuticals, and e-commerce industries. Among the government initiatives are California's 2025 Plastic Pollution Reduction Act, requiring a 25% decrease in single-use plastic packaging by 2032 and a 65% recycling rate goal. Besides, Oregon's Plastic Pollution and Recycling Modernization Act has made it mandatory for industries to adopt eco-friendly innovations in wrapping. For instance, in March 2025, Ranpak launched pallet wrap machines, replacing plastic with Mondi’s kraft paper, aiming to boost transit efficiency and reduce greenhouse gas emissions across its logistics and packaging solutions. The use of high-performance wrapping materials is fueled by developments in manufacturing and warehouse operations, including automation and better inventory management systems. Pallet wraps are used by retailers and logistics companies to guarantee the secure, damage-free transportation of large shipments, which further increases demand due to the quick growth of e-commerce.

Report Coverage

This research report categorizes the pallet wraps market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the pallet wraps market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the pallet wraps market.

Pallet Wraps Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.14 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 5.18% |

| 2035 Value Projection: | USD 5.47 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Application, By Region |

| Companies covered:: | AEP Industries, Berry Global, Clondalkin Group, Coveris, Dara, Inc., Green Spider Pallet Wraps, Inteplast Group, Intertape Polymer Group, Jhone Maye Company, Paragon Films, Seaman Paper, Sigma Plastics Group, ULINE, US Packing and Wrapping, Others, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Growing environmental sustainability awareness has prompted companies to develop eco-friendly, recyclable, and downgauged pallet wrap films, which has accelerated pallet wrap market expansion. The modernization of the supply chain, the accelerated use of automated storage systems, and the growing demand across several industrial sectors are all causing major structural changes in the industry. Additionally, there is a constant need for reliable and flexible pallet wrapping solutions due to the expansion of industries, including consumer goods, food and beverage, and pharmaceuticals. The market for pallet wraps is directly correlated with the growth of e-commerce fulfillment due as protective wrapping solutions are necessary for every order that travels via distribution networks.

Restraining Factors

The market for pallet wraps is restricted by a number of factors, including fluctuating raw material prices, growing environmental regulations regarding the use of plastic, the availability of substitute packaging options, and the growing demand for sustainable materials, which necessitate expensive innovations and limit adoption among cost-sensitive industries.

Market Segmentation

The pallet wraps market share is classified into material and application.

- The LLDPE segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the pallet wraps market is divided into LLDPE (Linear Low-Density Polyethylene), LDPE (Low-Density Polyethylene), PVC, and others. Among these, the LLDPE segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The LLDPE segment is due to its extensive use in various logistics and industrial packaging sectors, as well as its important function as a crucial component in stretch wrapping applications. LLDPE is essential for high-volume wrapping operations due to its exceptional stretch features, which include remarkable elongation characteristics, exceptional puncture resistance, and balanced cost-effectiveness.

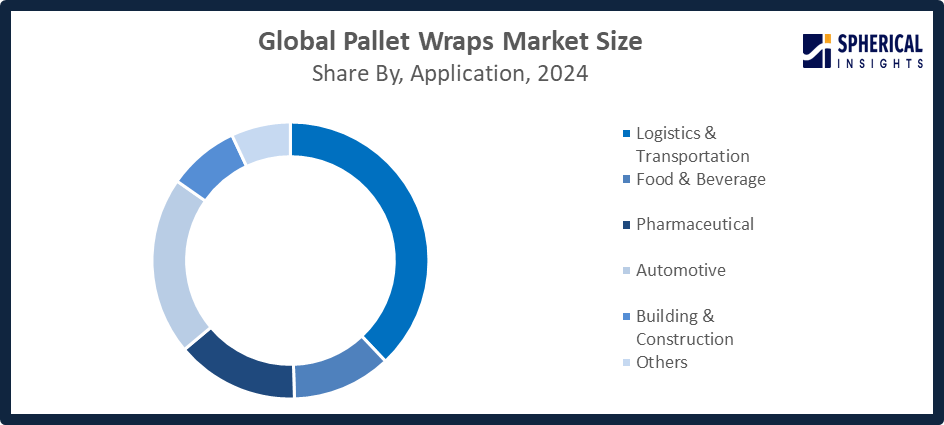

- The logistics & transportation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the pallet wraps market is divided into logistics & transportation, food & beverage, pharmaceutical, automotive, building & construction, and others. Among these, the logistics & transportation segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The widespread usage of pallet wraps in distribution centers, freight operations, shipping facilities, and cargo handling, where films function as both protective systems and load-securing tools, drives the logistics and transportation sector. The logistics sector's leading position is sustained by the industry's constant investment in operational efficiency.

Get more details on this report -

Regional Segment Analysis of the Pallet Wraps Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

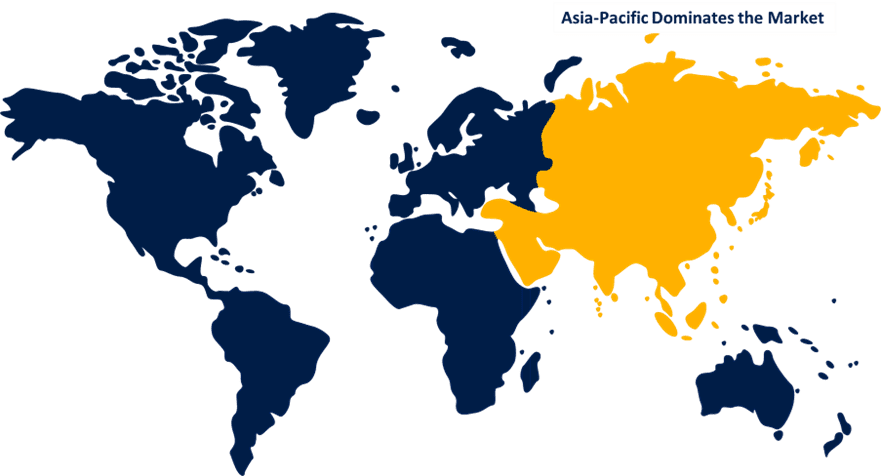

Asia Pacific is anticipated to hold the largest share of the pallet wraps market over the predicted timeframe.

Asia Pacific is anticipated to hold the largest share of the pallet wraps market over the predicted timeframe. Pallet wrapping solutions' demand for safe and effective bulk transportation is noticeable in the Asia-Pacific region, primarily because of the huge consumer spending and digital retail infrastructure growth. The growth that comes along with the Asia-Pacific region is complemented by the likes of China, India, Japan, and South Korea, which are experiencing a very rapid rise in logistics, warehousing, and export-oriented businesses. India has set a target of 25% recycled plastic integration into packaging by 2025 plastic enforcement. On the other hand, China requires 30% recycled content in PET bottles and containers by April 2025, increasing the requirement to 50% by 2030. IoT-enabled automated wrapping systems for real-time efficiency and bio-based LLDPE sheets with 40% lower carbon footprints, as introduced by local entrepreneurs in 2025, are examples of innovations.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the pallet wraps market during the forecast period. North America's sophisticated logistics infrastructure and extensive use of automated material-handling systems are its main drivers. The USA market places a strong emphasis on advanced wrapping features, such as cutting-edge automation technologies and integration with all-inclusive warehouse platforms that use unified packaging systems to handle load protection, operational efficiency, and quality control applications. While federal measures under the U.S. Plastics Pact aim to achieve 100% reusable, recyclable, or compostable packaging by 2025, California's revised Plastic Pollution Reduction Act, which was introduced in 2025, mandates a 35% recycled content limit in industrial films.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the pallet wraps market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AEP Industries

- Berry Global

- Clondalkin Group

- Coveris

- Dara, Inc.

- Green Spider Pallet Wraps

- Inteplast Group

- Intertape Polymer Group

- Jhone Maye Company

- Paragon Films

- Seaman Paper

- Sigma Plastics Group

- ULINE

- US Packing and Wrapping

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, European Plastic Films (EuPF) launched a statement welcoming the EU Commission’s exemption of pallet wrapping films and straps from 100% reuse targets, urging a science-based approach for balanced environmental and operational efficiency.

- In April 2025, Springpack announced the launch of Armour Wrap ECO, a 100% post-consumer recycled hand and machine-pallet wrap, offering tear resistance, superior cling, reduced material use, and lower virgin plastic consumption and emissions.

- In January 2025, Smurfit Westrock launched a 100% paper-based pallet wrap using Nertop® Stretch Kraft, providing a recyclable alternative to polyethylene, enhancing supply chain sustainability, reducing CO2 emissions, and maintaining high performance in humid conditions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the pallet wraps market based on the below-mentioned segments:

Global Pallet Wraps Market, By Material

- LLDPE (Linear Low-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- PVC

- Others

Global Pallet Wraps Market, By Application

- Logistics & Transportation

- Food & Beverage

- Pharmaceutical

- Automotive

- Building & Construction

- Others

Global Pallet Wraps Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the pallet wraps market over the forecast period?The global pallet wraps market is projected to expand at a CAGR of 5.18% during the forecast period

-

2. What is the market size of the pallet wraps market?The global pallet wraps market size is expected to grow from USD 3.14 billion in 2024 to USD 5.47 billion by 2035, at a CAGR of 5.18 % during the forecast period 2025-2035.

-

3. Which region holds the largest share of the pallet wraps market?Asia Pacific is anticipated to hold the largest share of the pallet wraps market over the predicted timeframe

-

4. Who are the top 10 companies operating in the global pallet wraps market?AEP Industries, Berry Global, Clondalkin Group, Coveris, Dara, Inc., Green Spider Pallet Wraps, Inteplast Group, Intertape Polymer Group, Jhone Maye Company, Paragon Films, Seaman Paper, Sigma Plastics Group, ULINE, US Packing and Wrapping, and Others.

-

5. What factors are driving the growth of the pallet wraps market?Growing e-commerce, expanding global trade, rising logistics activities, emphasis on product safety, load stability, and innovations in sustainable, recyclable, and high-performance pallet wrap materials drive market growth

-

6. What are the market trends in the pallet wraps market?Increasing adoption of eco-friendly and downgauged films, integration of automated packaging systems, rising demand in food, pharmaceuticals, and e-commerce, and innovations in stretch and shrink wrap technologies.

-

7. What are the main challenges restricting the wider adoption of the pallet wraps market?Fluctuating raw material costs, strict environmental regulations, availability of alternative packaging solutions, high production expenses for sustainable materials, and limited awareness among small-scale users restrict wider adoption.

Need help to buy this report?