Global Packaging Wax Market Size, Share, and COVID-19 Impact Analysis, By Product (Mineral Wax, Synthetic Wax, and Natural Wax), By Packaging (Flexible and Rigid), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Packaging Wax Market Insights Forecasts to 2033

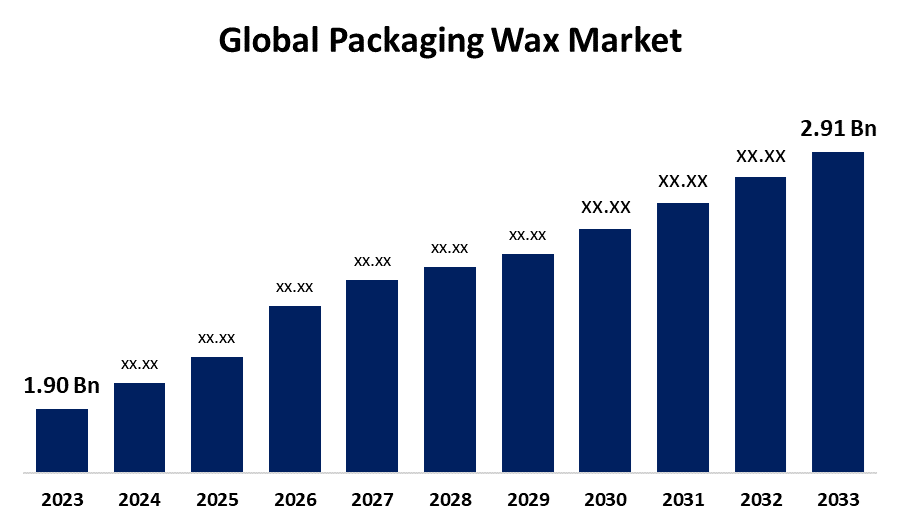

- The Global Packaging Wax Market Size Was Estimated at USD 1.90 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 4.36% from 2023 to 2033

- The Worldwide Packaging Wax Market Size is Expected to Reach USD 2.91 Billion by 2033

- Asia Pacific is Expected to Grow the fastest during the Forecast period.

Get more details on this report -

The global packaging wax market size was worth around USD 1.90 Billion in 2023 and is predicted to grow to around USD 2.91 Billion by 2033 with a compound annual growth rate (CAGR) of 4.36% between 2023 and 2033. In the packaging industry, packaging wax is both aesthetically pleasing and water-resistant. Additionally, manufacturers are using natural waxes derived from renewable resources as a result of the growing demand for eco-friendly and green packaging, which is driving market expansion. Additionally, the expansion of e-commerce in the food and beverage sector and growing awareness of the need to reduce plastic waste are fueling the sector's expansion.

Market Overview

The packaging wax industry is the business that makes and provides waxes for packaging use. The waxes used in packaging are usually applied on paper and paperboard to improve their characteristics, like moisture resistance and grease resistance, in order to maintain packaged food and other products. Both petroleum-derived and natural waxes are used in the market, and demand is on the rise due to the general packaging industry. The market for packaging wax is expected to grow based on the pharmaceuticals, cosmetics, and food & beverage sectors. These sectors are predominantly marketing products with wax-based packaging solutions. Beeswax, candelilla wax, and paraffin wax are the current trends in manufacturing sectors. Moreover, increasing demands for eco-friendly packaging are enhancing the use of mineral and synthetic wax materials in the packaging solution, resulting in increased market growth. Additionally, government spending on sustainability and green initiatives is expediting the use of sustainable packaging materials. Since regulations on packaging waste are becoming more restrictive, there is mounting pressure on manufacturers to adopt renewable and recyclable materials. Greenmatch estimates that 76% of UK, European, and United States consumers prefer packaging based on paper, which is frequently coated with waxes to enhance its functionality.

Report Coverage

This research report categorizes the packaging wax market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the packaging wax market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the packaging wax market.

Global Packaging Wax Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 1.90 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.36% |

| 2033 Value Projection: | USD 2.91 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Packaging, By Region and COVID-19 Impact Analysis |

| Companies covered:: | China Petrochemical Corporation, CNPC, HF Sinclair Corporation, BP p.l.c., NIPPON SEIRO CO. LTD, Exxon Mobil Corporation, Sasol Limited, The International Group. Inc., Evonik Industries AG, BASF, Dow, Honeywell International Inc., Royal Dutch Shell P.L.C, Mitsui Chemicals; Inc. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing worldwide focus on sustainability is one of the key drivers for the expansion of the packaging wax market. With consumers and companies moving towards green practices, demand for green packaging solutions is increasing, and natural waxes are emerging as a central component of this movement. Packaging wax, which is made from renewable and biodegradable sources, provides a natural substitute for traditional plastic and synthetic materials, which are significant causes of environmental pollution. Wax packaging not only saves the environment but also appeals to environmentally conscious consumers, increasing brand reputation and loyalty. Increased legislation prohibiting or limiting single-use plastics in most areas also serves as a driving force, encouraging businesses to implement more sustainable packaging alternatives. With sustainability increasingly influencing purchasing behavior, the packaging wax market is expected to experience ongoing growth and application across industries.

Restraining Factors

The cost of raw materials is holding back the packaging wax market. Crude oil is an important raw material that is utilized in the packaging wax manufacturing. The high price of crude oil is posing a challenge to manufacturers. Furthermore, an increase in the price of petroleum-based waxes and natural waxes is having an effect on the economies of manufacturing companies.

Market Segmentation

The packaging wax market share is classified into product and packaging.

- The mineral wax segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the product, the global packaging wax market is categorized into mineral wax, synthetic wax, and natural wax. Among these, the mineral wax segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Their application in various uses enables manufacturers to employ mineral wax in a wide range of industries, including pharmaceuticals, cosmetics, food packaging, and industrial products. Additionally, their enhanced performance characteristics and their ability to resist high temperatures without degrading make them perfect for applications demanding heat resistance.

- The rigid segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the packaging, the global packaging wax market is categorized into flexible and rigid. Among these, the rigid segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. Increased the need for tough packaging that is capable of safeguarding the products during transportation, where rigid materials are favored by manufacturers. Additionally, improvements in wax formulations improved barrier performance and compatibility with substrates, increasing the attractiveness of rigid packaging to industries like food and beverages, cosmetics, and pharmaceuticals.

Regional Segment Analysis of the Packaging Wax Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- As,ia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the packaging wax market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the packaging wax market over the predicted timeframe. The United States, especially, is at the forefront of packaging wax demand, mainly through the packaging and candle industries. Paraffin wax, with its affordability and all-around functional suitability, is by far the most widely used. In addition, consumer sensitivity to environmental issues and regulatory laws is driving a slow transition towards natural and man-made wax substitutes.

Asia Pacific is expected to grow at the fastest CAGR in the packaging wax market during the forecast period. The packaging wax demand is especially high for food packaging, cosmetics, and pharmaceutical applications. In addition, the movement toward sustainable and environmentally friendly packaging has fueled the growing utilization of natural waxes such as beeswax and carnauba, both biodegradable and responsive to the growing consumer demand for green products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the packaging wax market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- China Petrochemical Corporation

- CNPC

- HF Sinclair Corporation

- BP p.l.c.

- NIPPON SEIRO CO. LTD

- Exxon Mobil Corporation

- Sasol Limited

- The International Group. Inc.

- Evonik Industries AG

- BASF

- Dow

- Honeywell International Inc.

- Royal Dutch Shell P.L.C

- Mitsui Chemicals; Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2024, Sasol Chemicals introduced SASOLWAX LC100, a 35% lower-carbon-footprint industrial wax designed to enhance sustainability for packaging adhesives with good performance. This action was consistent with the firm's emphasis on environmentally friendly procedures and its quest to minimize greenhouse gas emissions from the packaging industry overall.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the packaging wax market based on the below-mentioned segments:

Global Packaging Wax Market, By Product

- Mineral Wax

- Synthetic Wax

- Natural Wax

Global Packaging Wax Market, By Packaging

- Flexible

- Rigid

Global Packaging Wax Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the packaging wax market over the forecast period?The global packaging wax market is projected to expand at a CAGR of 4.36% during the forecast period.

-

2. What is the market size of the packaging wax market?The Global Packing Wax Market Size is expected to grow from USD 1.90 Billion in 2023 to USD 2.91Billion by 2033, at a CAGR of 4.36 % during the forecast period 2023-2033

-

3. Which region holds the largest share of the packaging wax market?North America is anticipated to hold the largest share of the packaging wax market over the predicted timeframe.

Need help to buy this report?