Global P-Nitrotoluene Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade and Reagent Grade), By Application (Dyes and Pigments, Agrochemicals, Pharmaceuticals, Explosives, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal P-Nitrotoluene Market Size Insights Forecasts to 2035

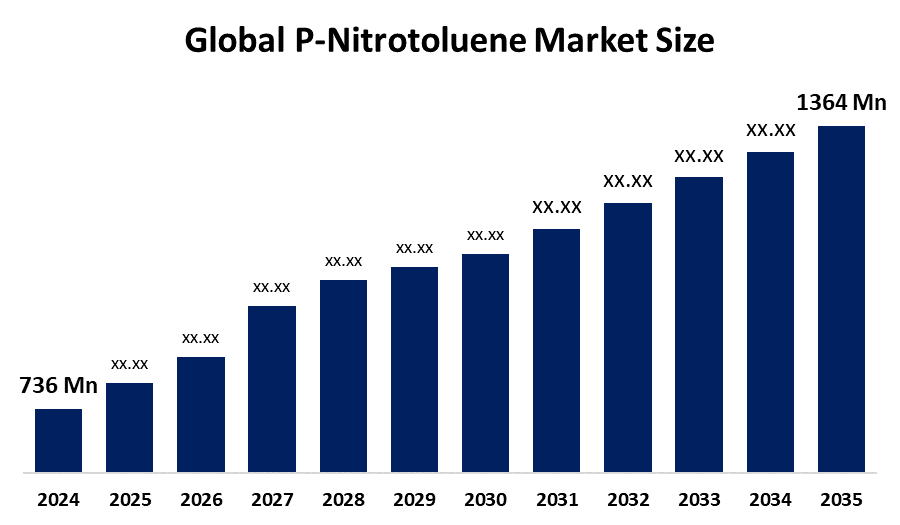

- The Global P-Nitrotoluene Market Size Was Estimated at USD 736 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.04% from 2025 to 2035

- The Worldwide P-Nitrotoluene Market Size is Expected to Reach USD 1264 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global P-Nitrotoluene Market Size was worth around USD 736 Million in 2024 and is predicted to Grow to around USD 1264 Million by 2035 with a compound annual growth rate (CAGR) of 5.04 % from 2025 to 2035. The p-nitrotoluene market opportunities include growing applications in agrochemicals and pharmaceuticals, rising demand for environmentally friendly production techniques, improvements in manufacturing technologies, and rising industrialization in emerging economies, all of which boost the market.

Global P-Nitrotoluene Market Forecast and Revenue Outlook

- 2024 Market Size: USD 736 Million

- 2035 Projected Market Size: USD 1264 Million

- CAGR (2025-2035): 5.04%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Market Overview

The global production, distribution, and trade of p-nitrotoluene (PNT), a crucial organic intermediate used in dyes, agrochemicals, and pharmaceuticals, are all included in the p-nitrotoluene market. Toluene nitration produces the nitroaromatic molecule P-Nitrotoluene (PNT), which has the chemical formula C7H7NO2. Its function as a precursor for p-toluidine and other derivatives, which support the textile and pesticide sectors, is the market's main focus. The European Commission’s Green Deal launched a €200 million incentive in 2025 for low-emission p-nitrotoluene production. Similarly, India’s Ministry of Chemicals initiated a 2024 safety-focused program to boost domestic PNT production by 20%. The market for p-nitrotoluene is expanding as a result of its widespread use in the production of dyes. The primary driver of this increase is the rising demand from the dyes and pigments sector, which is being driven by a strong expansion in the textile industry. A significant factor propelling the expansion of the P-Nitrotoluene market, in addition to the textile industry, is the agrochemical sector.

Key Market Insights

- Asia Pacific is expected to account for the largest share in the p-nitrotoluene market during the forecast period.

- In terms of grade, the industrial grade segment is projected to lead the p-nitrotoluene market throughout the forecast period

- In terms of application, the pharmaceuticals segment captured the largest portion of the market

P-Nitrotoluene Market Trends

- Extension of downstream uses for pigments, dyes, and explosives

- Strict environmental laws affecting business processes and market dynamics

- Growing demand for sustainable and environmentally friendly production methods

- Increasing need for intermediate chemicals in the agricultural and pharmaceutical sectors

- Consumption is driven by growing urbanization and industrialization in emerging markets

- Technological developments are improving the quality of products and manufacturing efficiency

Report Coverage

This research report categorizes the p-nitrotoluene market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the p-nitrotoluene market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the p-nitrotoluene market.

Global P-Nitrotoluene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 736 million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.04% |

| 2035 Value Projection: | USD 1264 million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 184 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Grade, By Application and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Clariant AG, Lanxess AG, Arkema S.A., Tosoh Corporation, Nippon Kayaku Co., Ltd., Huntsman Corporation, Aarti Industries Limited, Dow Chemical Company, Sumitomo Chemical Co., Ltd., Kumho Petrochemical Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Shandong Jinling Chemical Co., Ltd., Anhui Bayi Chemical Industry Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

P Nitro acetophenone’s adaptability and chemical reaction efficiency, which are critical for creating high-quality products in cutthroat marketplaces, are what fuel demand for the compound. The increasing demand for food due to population growth is putting pressure on the world's agriculture sector to boost production. Furthermore, the p-nitrotoluene market's growth trajectory is being enhanced by the expansion of industrial applications brought about by technological advancements, which is acting as a catalyst. The growth of the textile sector is anticipated to fuel demand for p-nitrotoluene, a crucial intermediate in the synthesis of azo dyes, as urbanization and industrialization continue to pick up speed, particularly in emerging economies.

Restraining Factor

The market for p-nitrotoluene is restricted by a number of issues, such as strict environmental restrictions, high manufacturing costs, varying raw material availability, and health risks related to handling nitro aromatic chemicals. The price volatility of raw materials is one of the primary challenges since it can have a big effect on production costs and profitability.

Market Segmentation

The global p-nitrotoluene market is divided into grade and application.

Global P-Nitrotoluene Market, By Grade:

- The industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on Grade, the global p-nitrotoluene market is segmented into industrial grade and reagent grade. Among these, the industrial grade segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Large-scale manufacturing processes, where cost effectiveness and mass production are more important than high purity, are the main applications for industrial-grade p-nitroluene. The demand for industrial-grade p-nitroluene has increased due to the global expansion of textile production, as producers look for economical ways to satisfy high-volume demands.

The reagent grade segment in the p-nitrotoluene market is expected to grow at the fastest CAGR over the forecast period. In research centers and laboratories where accuracy and precision are critical, reagent grade is crucial. The growing pharmaceutical and chemical research industries, which need premium intermediates for the synthesis of novel chemicals and medications, are the main drivers of the need for reagent-grade p-nitroluene.

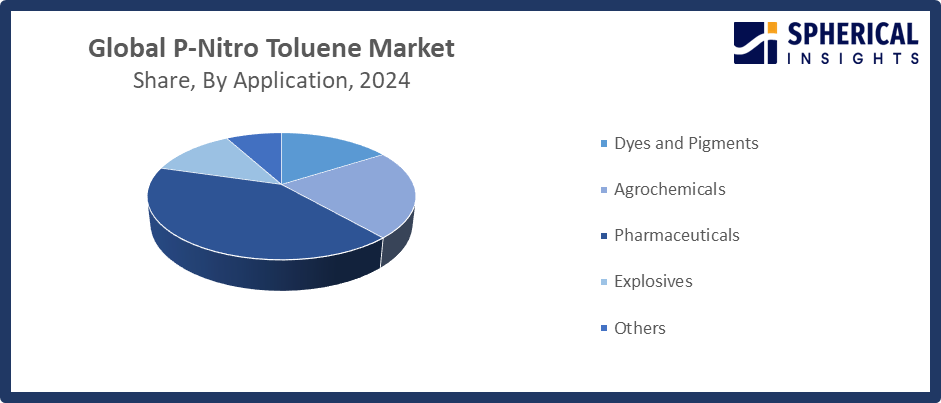

Global P-Nitrotoluene Market, By Application:

- The pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on application, the global p-nitrotoluene market is segmented into dyes and pigments, agrochemicals, pharmaceuticals, explosives, and others. Among these, the pharmaceuticals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The pharmaceutical sector is another crucial p-nitroluene use area. It helps produce medications that meet a variety of medical needs by being used in the synthesis of several pharmaceutical intermediates and active components. The pharmaceutical industry's dependence on p-nitroluene is fueled by the prevalence of chronic illnesses and the continuous need for efficient therapies.

Get more details on this report -

The agrochemicals segment in the p-nitrotoluene market is expected to grow at the fastest CAGR over the forecast period. P-nitrotoluene is an essential ingredient in the synthesis of several pesticides and herbicides used in the agrochemical sector. The growing world population is driving up demand for efficient agrochemicals, which in turn is driving up agricultural productivity and efficiency.

Regional Segment Analysis of the Global P-Nitrotoluene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific P-Nitrotoluene Market Trends

Get more details on this report -

Asia Pacific is expected to hold the largest share of the global p-nitrotoluene market over the forecast period.

Asia Pacific p-nitroluene market, driven by its expanding pharmaceutical, agricultural, and textile industries. China and India are significant contributors because of their extensive industrial bases and pro-chemical industry government policies. The Directorate General of Trade Remedies in India protected domestic companies like Aarti Industries from import surges that threatened 15% market erosion by imposing five-year anti-dumping charges at rates of up to 25% on four Chinese chemicals, including PNT precursors, in June 2025.

China P-Nitrotoluene Market Trends

China's P-Nitrotoluene market is growing significantly due to the country's growing agricultural and pharmaceutical sectors. The government's encouragement of sustainable chemical production and the expansion of indigenous manufacturing capabilities are important drivers. China's expanding industrial base and potential for exports keep it in a key position in the world market for P-nitro toluene. China's expanding industrial base and potential for exports keep it in a key position in the world market for P-nitro toluene.

Japan P-Nitrotoluene Market Trends

The pharmaceutical and fine chemical industries are the main drivers of the stable demand in the Japanese P-Nitrotoluene market. Advanced, environmentally friendly synthesis techniques have been used by manufacturers as a result of Japan's strict environmental legislation and emphasis on high-quality production requirements. In September 2025, METI introduced revised notification protocols for novel chemical substances with low and small volumes, and improved regulatory compliance and expedited PNT derivative approvals.

North America P-Nitrotoluene Market Trends

North America is expected to grow at the fastest CAGR in the p-nitrotoluene market during the forecast period.

The region's high priority for research and development, along with its sophisticated technological infrastructure, encourages innovation and raises the standard of chemical production in North America. The U.S. EPA announced a TSCA plan in September 2025 to expedite chemical evaluations, increasing PNT approval efficiency and cutting backlog by 20%. In an effort to promote safer PNT alternatives, the EPA suggested SNURs for new compounds in April 2025. Furthermore, manufacturers are being encouraged to develop greener methods by the strict constraints on the environment in place, which should further accelerate market growth.

U.S P-Nitrotoluene Market Trends

The pharmaceutical, agrochemical, and specialty chemical industries have a significant demand for P-nitro toluene, which propels the U.S. market. Advanced, environmentally friendly synthesis technologies have been used by manufacturers as a result of strict environmental restrictions and an emphasis on high-quality output. The nation's strong infrastructure for research and development fosters innovation in manufacturing procedures, increasing productivity and sustainability. Further driving market expansion are rising investments in chemical manufacturing and the expanding pharmaceutical sector.

Canada P-Nitrotoluene Market Trends

The need for P-Nitrotoluene in the specialty chemical, agricultural, and pharmaceutical sectors is driving the market in Canada. Manufacturers are encouraged to use green technology by Canada's strict regulatory framework and increasing focus on environmentally friendly and sustainable production practices. Furthermore, the nation's advantageous location and solid trading linkages support export prospects and supply chain optimization.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global p-nitrotoluene market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players In The P-Nitrotoluene Market Include

- BASF SE

- Clariant AG

- Lanxess AG

- Arkema S.A.

- Tosoh Corporation

- Nippon Kayaku Co., Ltd.

- Huntsman Corporation

- Aarti Industries Limited

- Dow Chemical Company

- Sumitomo Chemical Co., Ltd.

- Kumho Petrochemical Co., Ltd.

- Zhejiang Jianye Chemical Co., Ltd.

- Shandong Jinling Chemical Co., Ltd.

- Anhui Bayi Chemical Industry Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In March 2025, BASF SE launched a new P-Nitrotoluene production plant in China in 2025, aiming to meet growing Asia-Pacific demand. The facility is expected to enhance regional supply by 10–15% by the end of the year.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the p-nitrotoluene market based on the following segments:

Global P-Nitrotoluene Market, By Grade

- Industrial Grade

- Reagent Grade

Global P-Nitrotoluene Market, By Application

- Dyes and Pigments

- Agrochemicals

- Pharmaceuticals

- Explosives

- Others

Global P-Nitrotoluene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the p-nitrotoluene market over the forecast period?The global p-nitrotoluene market is projected to expand at a CAGR of 5.04% during the forecast period.

-

2. What is the market size of the p-nitrotoluene market?The global p-nitrotoluene market size is expected to grow from USD 736 million in 2024 to USD 1264 million by 2035, at a CAGR 5.04% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the p-nitrotoluene market?Asia Pacific is anticipated to hold the largest share of the p-nitrotoluene market over the predicted timeframe.

-

4. Who are the top companies operating in the global p-nitrotoluene market?BASF SE, Clariant AG, Lanxess AG, Arkema S.A., Tosoh Corporation, Nippon Kayaku Co., Ltd., Huntsman Corporation, Aarti Industries Limited, Dow Chemical Company, Sumitomo Chemical Co., Ltd., Kumho Petrochemical Co., Ltd., Zhejiang Jianye Chemical Co., Ltd., Shandong Jinling Chemical Co., Ltd., Anhui Bayi Chemical Industry Co., Ltd., and others.

-

5. What factors are driving the growth of the p-nitrotoluene market?Rising demand from agrochemicals and pharmaceuticals, technical developments, higher industrialization, and a growing focus on environmentally friendly production methods are some of the factors driving the p-nitrotoluene market.

-

6. What are market trends in the p-nitrotoluene market?Growing applications in dyes and pigments, adoption of sustainable manufacturing, technical advancements, increased use in medicines and agrochemicals, and more stringent environmental restrictions impacting production processes are some of the market trends.

-

7. What are the main challenges restricting wider adoption of the p-nitrotoluene market?The need for modern technologies to assure safer manufacturing processes, high production costs, health and safety concerns, fluctuating raw material supplies, and rigorous environmental restrictions are some of the challenges preventing wider use.

Need help to buy this report?