Global Oxcarbazepine Market Size, Share, and COVID-19 Impact Analysis, By Dosage Form (Tablets and Oral Suspension), By Application (Epilepsy, Bipolar Disorder, Neuropathic Pain, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Oxcarbazepine Market Size Insights Forecasts to 2035

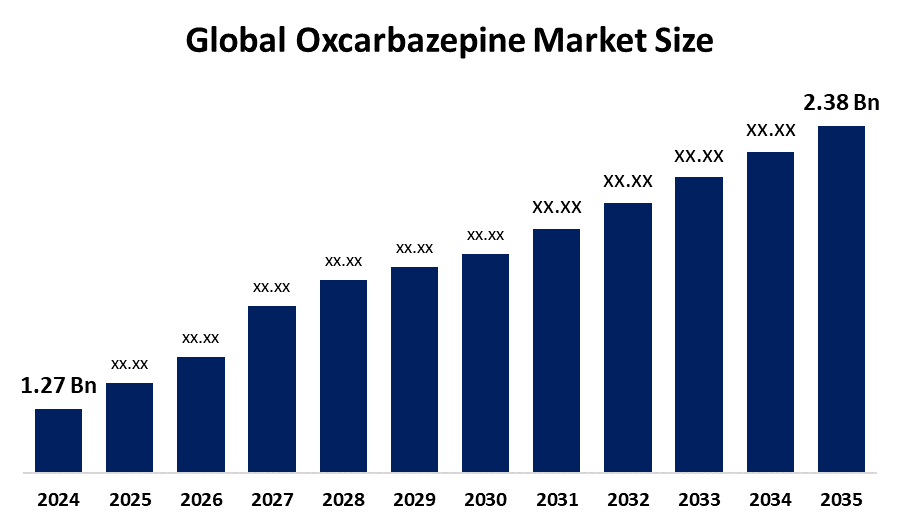

- The Global Oxcarbazepine Market Size Was Estimated at USD 1.27 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.88% from 2025 to 2035

- The Worldwide Oxcarbazepine Market Size is Expected to Reach USD 2.38 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Oxcarbazepine Market Size was worth around USD 1.27 Billion in 2024 and is predicted to Grow to around USD 2.38 Billion by 2035 with a compound annual growth rate (CAGR) of 5.88% from 2025 to 2035. The oxcarbazepine market is growing due to the increasing incidence of epilepsy and other neurological conditions. Good safety and tolerability profiles, along with expanded access to more cost-effective generics, are also driving demand.

Market Overview

The global oxcarbazepine market refers to the production, sale, and distribution of oxcarbazepine, an anticonvulsant and mood stabilizer used mainly in the treatment of epilepsy and bipolar disorder. Oxcarbazepine is a carbamazepine derivative that works by stabilizing the brain's electrical activity and suppressing the nerve impulses that create seizures. It is also favored because of its improved safety profile and reduced side effects compared to its parent molecule. The market is driven by the rising prevalence of neurological disease, particularly epilepsy, accounting for over 50 million victims worldwide. Greater awareness of mental illness and neurological disorders, enhanced access to healthcare in emerging markets, and the demographic pattern of an aging population further enhance demand. Technological advances in the form of extended-release products and combination therapy have improved patient compliance and expanded therapeutic indications.

Leading pharmaceutical companies in the oxcarbazepine market include Novartis AG (subsidiary company Novartis Pharmaceuticals), Supernus Pharmaceuticals, Glenmark Pharmaceuticals, and Apotex Inc., among others. Generic competition is still the dominant force in the market landscape, particularly in low-priced markets. The opportunities are to raise the use of oxcarbazepine for off-label purposes, consolidate distribution networks in emerging markets, and integrate digital health choices in the treatment of epilepsy. In addition, increased R&D investment and collaborations among global and domestic drug companies are poised to drive market penetration. The U.S. Food and Drug Administration approved Lupin's Abbreviated New Drug Application (ANDA) for Oxcarbazepine Extended-Release (ER) tablets (150 mg, 300 mg, 600 mg) with tentative approval on 7th June 2025. It is a bioequivalent to Oxtellar XR (by Supernus) and will be manufactured by Lupin's Nagpur, India, facility.

Report Coverage

This research report categorizes the oxcarbazepine market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oxcarbazepine market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oxcarbazepine market.

Global Oxcarbazepine Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.27 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.88% |

| 2035 Value Projection: | USD 2.38 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Dosage Form, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Novartis, Mylan (Viatris), Supernus Pharmaceuticals, Apotex, Teva Pharmaceutical Industries, Amneal Pharmaceuticals, Sun Pharmaceutical Industries, Glenmark Pharmaceuticals, Jubilant Generics, Lupin Limited, Taro Pharmaceutical Industries, Hikma Pharmaceuticals, Zydus Cadila Healthcare, Dr. Reddy’s Laboratories Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The oxcarbazepine industry is driven by the growing incidence of epilepsy and other neurological conditions across the world. Growing awareness, enhanced diagnostic rates, and increased access to healthcare, particularly in emerging markets, drive demand. Technological innovation, such as once-daily formulations, improves treatment compliance. Furthermore, increasing geriatric populations, positive government policies, and increasing generic drug production also drive market growth. Encouraging regulatory approvals and partnerships among global and local drug firms also increases availability and affordability, promoting continued market growth.

Restraining Factors

The oxcarbazepine industry is hindered by factors such as possible side effects, lower awareness in low-income countries, and strict regulatory approvals. Patent expirations and high generic competition can also affect profitability, while supply chain disruptions can limit drug availability on a regular basis.

Market Segmentation

The oxcarbazepine market share is classified into dosage form, application, and distribution channel.

- The tablets segment dominated the market in 2024, approximately 70% and is projected to grow at a substantial CAGR during the forecast period.

Based on the dosage form, the oxcarbazepine market is divided into tablets and oral suspension. Among these, the tablets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Tablets are the most prescribed oxcarbazepine dosage form due to ease of use, stability, and convenience, particularly for adults. Steady growth in the market is fueled by long-term treatment conditions such as bipolar disorder and epilepsy. Improved therapeutic effects and patient compliance are enhanced by developments such as extended-release tablets, further increasing demand for the dosage form.

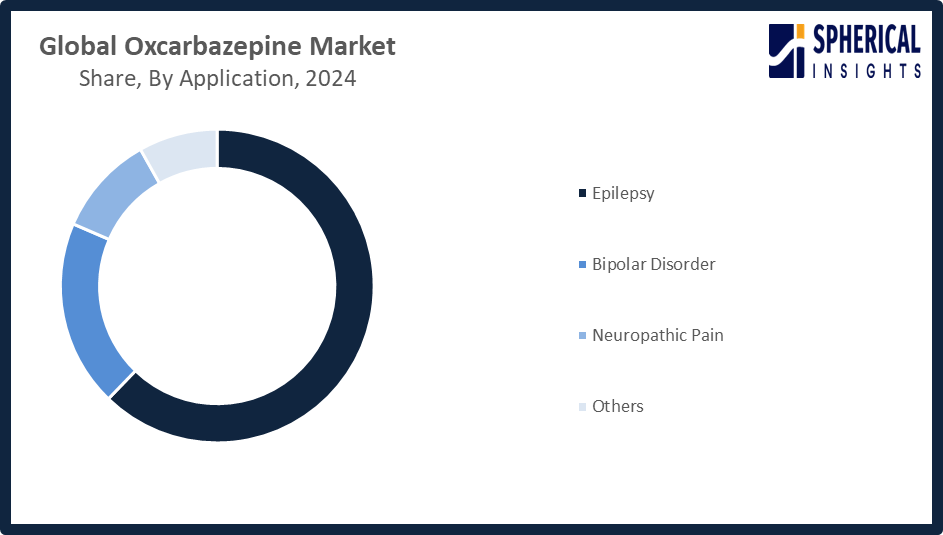

- The epilepsy segment accounted for the largest share in 2024, approximately 62% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the oxcarbazepine market is divided into epilepsy, bipolar disorder, neuropathic pain, and others. Among these, the epilepsy segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Epilepsy is the most prevalent use of oxcarbazepine, which is extensively used to treat partial seizures. Increased prevalence and awareness of epilepsy, as well as an understanding of treatments available, fuel demand. Oxcarbazepine's positive efficacy and safety profile when compared with other antiepileptic medications render it a favored option among patients and medical professionals, underpinning further market growth.

Get more details on this report -

- The retail pharmacies segment accounted for the highest market revenue in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the oxcarbazepine market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. Among these, the retail pharmacies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Retail pharmacies serve as major distribution channels, providing easy access to prescriptions of oxcarbazepine. With their extensive presence and availability of both generic and brand formulations, they become the choice for patients living with chronic illnesses such as epilepsy and bipolar disorder, catering to multiple needs and budgets and consolidating this channel's position in the marketplace.

Regional Segment Analysis of the Oxcarbazepine Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the oxcarbazepine market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the oxcarbazepine market over the predicted timeframe. North America is expected to have approximately 38% of the market share for oxcarbazepine during the forecast period, based on well-developed healthcare infrastructures, high-tech diagnostic techniques, and good awareness of neurological disorders. The United States dominates the region due to a high incidence rate of epilepsy, good insurance coverage, and the strong presence of key pharmaceutical corporations. Moreover, ongoing FDA approvals of generic drugs, such as extended-release tablets, favor market growth. Canada also contributes to growth with better access to care for epilepsy and government efforts supporting mental health and treatment of chronic disease.

Asia Pacific is expected to grow at a rapid CAGR in the oxcarbazepine market during the forecast period. Asia Pacific is rapidly growing in the market for oxcarbazepine during the forecast period, accounting for approximately a market share of 24%, with rising awareness of epilepsy, rising healthcare spending, and increasing access to treatment. India is a major driver with its huge patient base, emerging generic pharmaceuticals sector, and government programs to enhance neurological treatment. China is also a major contributor to healthcare reforms and the increasing need for cheaper medicines. Furthermore, developments in the health infrastructure and coverage of anti-epileptic drugs under national programs contribute to market expansion in emerging nations in the region.

Europe demonstrates consistent growth in the market for oxcarbazepine with increasing cases of epilepsy, robust healthcare infrastructures, and favorable reimbursement systems. Leading the way in the region is Germany, with advanced neurology treatment and uptake of drugs at a high rate. The UK also plays an important role through the NHS, supporting the treatment of epilepsy and the availability of branded and generic forms of oxcarbazepine, driving overall market growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oxcarbazepine market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novartis

- Mylan (Viatris)

- Supernus Pharmaceuticals

- Apotex

- Teva Pharmaceutical Industries

- Amneal Pharmaceuticals

- Sun Pharmaceutical Industries

- Glenmark Pharmaceuticals

- Jubilant Generics

- Lupin Limited

- Taro Pharmaceutical Industries

- Hikma Pharmaceuticals

- Zydus Cadila Healthcare

- Dr. Reddy's Laboratories Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In August 2025, Supernus Pharmaceuticals, Inc., a CNS-focused biopharmaceutical company, announced its financial results for Q2 2025 along with key company developments, highlighting its ongoing commitment to advancing treatments for central nervous system disorders.

- In September 2024, Apotex Corp. announced it is the first generic manufacturer to launch oxcarbazepine ER tablets in the U.S., a once-daily anticonvulsant indicated for treating partial-onset seizures in patients aged 6 years and older.

- In July 2023, Zydus Lifesciences Limited received final approval from the USFDA for Oxcarbazepine Tablets USP (150 mg, 300 mg, and 600 mg). Used to treat epilepsy, the product will be manufactured at the company’s formulation facility in Baddi, Himachal Pradesh, India.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oxcarbazepine market based on the below-mentioned segments:

Global Oxcarbazepine Market, By Dosage Form

- Tablets

- Oral Suspension

Global Oxcarbazepine Market, By Application

- Epilepsy

- Bipolar Disorder

- Neuropathic Pain

- Others

Global Oxcarbazepine Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Global Oxcarbazepine Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the oxcarbazepine market over the forecast period?The global oxcarbazepine market is projected to expand at a CAGR of 5.88% during the forecast period.

-

2. What is the market size of the oxcarbazepine market?The global oxcarbazepine market size is expected to grow from USD 1.27 billion in 2024 to USD 2.38 billion by 2035, at a CAGR of 5.88% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the oxcarbazepine market?North America is anticipated to hold the largest share of the oxcarbazepine market over the predicted timeframe.

-

4. What is the oxcarbazepine market?The oxcarbazepine market refers to the market for oxcarbazepine, a generic drug used to treat epilepsy and partial-onset seizures in adults and children, and sometimes for other neurological conditions.

-

5. Who are the top 10 companies operating in the global oxcarbazepine market?The major players operating in the oxcarbazepine market are Novartis, Mylan (Viatris), Supernus Pharmaceuticals, Apotex, Teva Pharmaceutical Industries, Amneal Pharmaceuticals, Sun Pharmaceutical Industries, Glenmark Pharmaceuticals, Jubilant Generics, Lupin Limited, Taro Pharmaceutical Industries, Hikma Pharmaceuticals, Zydus Cadila Healthcare, Dr. Reddy's Laboratories Ltd., and others.

-

6. What factors are driving the growth of the oxcarbazepine market?The oxcarbazepine market is driven by its effectiveness in treating epilepsy and neuropathic pain, the availability of generic formulations, and advancements in extended-release and once-daily dosage forms that improve patient adherence.

-

7. What are the market trends in the oxcarbazepine market?Major market trends for oxcarbazepine, an anti-epileptic drug, include an overall market expansion fueled by a rising prevalence of neurological disorders, the dominance of generic drugs due to patent expirations, and a geographical shift in growth towards emerging markets.

-

8. What are the main challenges restricting wider adoption of the oxcarbazepine market?The oxcarbazepine market faces several challenges that restrict wider adoption, including significant generic competition, side effects that can be life-threatening, and competition from newer, more effective drugs.

Need help to buy this report?