Global Orthopedic Trauma Devices Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Internal Fixators and External Fixators), By End User (Hospitals, Orthopedic and Trauma Centers, and Ambulatory Surgical Centers), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Orthopedic Trauma Devices Market Insights Forecasts to 2035

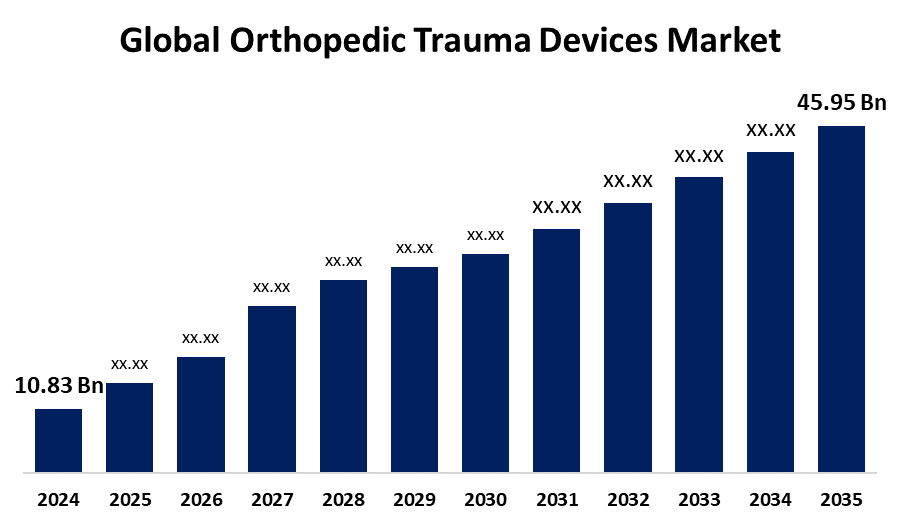

- The Global Orthopedic Trauma Devices Market Size Was Estimated at USD 10.83 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.26% from 2025 to 2035

- The Worldwide Orthopedic Trauma Devices Market Size is Expected to Reach USD 45.95Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The global orthopedic trauma devices market size was worth around USD 10.83 billion in 2024 and is predicted to grow to around USD 21.12 billion by 2035 with a compound annual growth rate (CAGR) of 6.26% from 2025 and 2035. Opportunities in 3D printing, robotically assisted surgery, and bioresorbable implants are presented by the orthopedic trauma devices market. The need for less intrusive techniques that improve recovery and surgical accuracy, as well as the aging of the population and the increase in fracture cases, are important trends in orthopedic trauma devices market.

Market Overview

The global industry that develops, manufactures, and distributes medical devices for the treatment of musculoskeletal injuries especially fractures and trauma-related conditions is known as the orthopedic trauma devices market. In order to stabilize and promote bone healing, these devices include internal and external fixation systems like plates, screws, rods, and pins. The development of sophisticated fixation solutions to treat fractures and musculoskeletal injuries, improving surgical results and patient recovery, and incorporating bioresorbable and minimally invasive technologies are the main objectives of the orthopedic trauma devices market.

The increasing demand for cutting-edge trauma treatment options and surgical procedures is being driven by the rising number of traffic accidents and sports injuries. The need for orthopedic trauma devices is anticipated to be driven by an increase in the frequency of fractures, sports-related injuries, and degenerative bone disorders. The increasing number of traffic accidents and sports-related injuries is driving the global market for orthopedic trauma devices market. The demand for sophisticated trauma fixation devices is rising as a result of the growing popularity of minimally invasive surgical techniques.

Report Coverage

This research report categorizes the orthopedic trauma devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the orthopedic trauma devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the orthopedic trauma devices market.

Global Orthopedic Trauma Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.83 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.26% |

| 2035 Value Projection: | USD 21.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 239 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product, By End User, By Region and COVID-19 Impact Analysis |

| Companies covered:: | Acumed, OsteoMed, Invibio Ltd., Arthrex, Inc., Citieffe S.R.L., Medtronic, Inc., Smith & Nephew, Integra LifeSciences, Stryker Corporation, Weigao Group Co Ltd., B. Braun Melsungen AG, Orthofix International N.V., Zimmer Biomet Holdings, Inc., Johnson & Johnson Services, Inc., Others, and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The expansion of insurance coverage, better trauma care infrastructure, and rising healthcare costs are driving the market in emerging economies. In addition to growing orthopedic surgery volumes among older populations, this growth is being driven by the rising rates of fractures, sports injuries, and auto accidents. The market is anticipated to be driven by the population's focus on the need for trauma devices that are especially made to satisfy the needs of senior patients. The market's changing tendencies for orthopedic trauma devices show a clear trend toward the creation of biodegradable implants.

Restraining Factors

High surgical expenses, restrictive reimbursement systems, a lack of awareness in developing nations, the possibility of implant failure, and regulatory obstacles that postpone product approvals and market entry are some of the problems that are restricting the orthopedic trauma devices market.

Market Segmentation

The orthopedic trauma devices market share is classified into product type and end user.

- The internal fixators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the orthopedic trauma devices market is divided into internal fixators and external fixators. Among these, the internal fixators segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The internal fixators segment is the recommended option for treating severe fractures since it provides excellent patient comfort, stability, and a quicker recovery after surgery. Plates, screws, intramedullary nails, and other parts, like cables and staples, are examples of internal fixators.

- The hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the orthopedic trauma devices market is divided into hospitals, orthopedic and trauma centers, and ambulatory surgical centers. Among these, the hospitals segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The supremacy of hospitals can be attributed to their well-equipped surgical units, highly qualified orthopedic specialists, and access to cutting-edge imaging and fracture diagnosis equipment. Hospitals are crucial to the implementation of both internal and exterior fixation systems because they continue to be the first medical facility to treat patients after accidents or catastrophic injuries.

Regional Segment Analysis of the Orthopedic Trauma Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the orthopedic trauma devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the orthopedic trauma devices market over the predicted timeframe. The growing acceptance of bioresorbable plates and screws has been the primary driver of demand for orthopedic trauma treatment products in the North American region. The increasing incidence of arthritis, back discomfort, and neck pain is expected to fuel a substantial increase in the need for orthopedic trauma devices in North America. The aging population, greater awareness, and advantageous government payment schemes are all contributing to the rise in demand for orthopedic operations.

Asia Pacific is expected to grow at a rapid CAGR in the orthopedic trauma devices market during the forecast period. The market is expanding as a result of the rise in sports injuries in Asia Pacific, especially in nations like China and India, due to an increase in athletic activity. In China, traumatic fractures are on the rise due to factors like urbanization, industrialization, and population aging, particularly in young and middle-aged patients. Due to technology advancements, health insurance policies in Asia Pacific nations are expanding access to cutting-edge trauma care, propelling market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the orthopedic trauma devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Acumed

- OsteoMed

- Invibio Ltd.

- Arthrex, Inc.

- Citieffe S.R.L.

- Medtronic, Inc.

- Smith & Nephew

- Integra LifeSciences

- Stryker Corporation

- Weigao Group Co Ltd.

- B. Braun Melsungen AG

- Orthofix International N.V.

- Zimmer Biomet Holdings, Inc.

- Johnson & Johnson Services, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, the Galaxy Fixation Gemini system, a robust external fixation for trauma fractures, was launched by Orthofix Medical. It is perfect for intensive care units and trauma bays since it removes the need for tray sterilization and space restrictions.

- In August 2024, Stryker announced the FDA-approved Pangea Plating System for arthrodesis, osteotomies, and bone fractures. With anatomically shaped implants, it improves screw placement and plate fit, boosting the plating market.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the orthopedic trauma devices market based on the below-mentioned segments:

Global Orthopedic Trauma Devices Market, By Product Type

- Internal Fixators

- External Fixators

Global Orthopedic Trauma Devices Market, By End User

- Hospitals

- Orthopedic and Trauma Centers

- Ambulatory Surgical Centers

Global Orthopedic Trauma Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the orthopedic trauma devices market over the forecast period?The global orthopedic trauma devices market is projected to expand at a CAGR of 6.26% during the forecast period.

-

2. What is the market size of the orthopedic trauma devices market?The global orthopedic trauma devices market size is expected to grow from USD 10.83 billion in 2024 to USD 45.95Billion by 2035, at a CAGR of 6.26% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the orthopedic trauma devices market?North America is anticipated to hold the largest share of the orthopedic trauma devices market over the predicted timeframe.

Need help to buy this report?