Global Orthopedic Software Market Size, Share, and COVID-19 Impact Analysis, By Product (Digital Templating/Preoperative Planning Software, Orthopedic EHR, Orthopedic Practice Management, Orthopedic PACS, Orthopedic RCM, and Others), By Mode of Delivery (Web/Cloud Based and On-Premise), By Application (Orthopedic Surgeries, Fracture Management, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Orthopedic Software Market Insights Forecasts to 2035

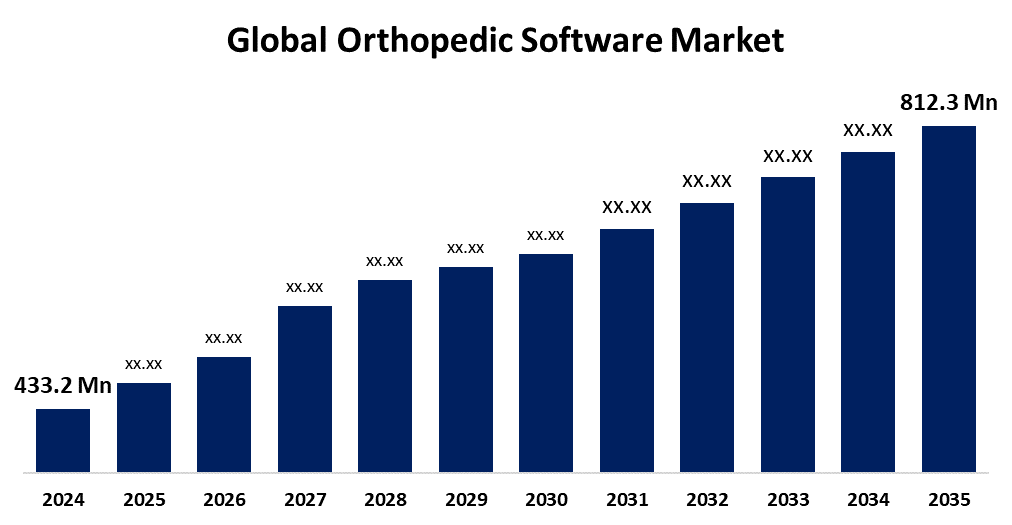

- The Global Orthopedic Software Market Size Was Estimated at USD 433.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.88% from 2025 to 2035

- The Worldwide Orthopedic Software Market Size is Expected to Reach USD 812.3 Million by 2035

- Asia Pacific is Expected to Grow the Fastest during the forecast period.

Get more details on this report -

The Global Orthopedic Software Market Size was worth around USD 433.2 Million in 2024 and is predicted to grow to around USD 812.3 Million by 2035 with a compound annual growth rate (CAGR) of 5.88% from 2025 to 2035. The market growth is boosted by the rising surgeries, tech adoption, and support from organizations like AAOS. Despite initial disruptions, the pandemic accelerated digital transformation, positioning the market for sustained long-term growth.

Market Overview

The orthopedic software market refers to a specific digital solution made to optimize orthopedic offices' administrative and clinical procedures. It usually consists of practice management (PM) systems for scheduling, invoicing, and patient communication, as well as electronic health records (EHR) for recording patient treatment. Orthopedic professionals have certain needs, and these systems are designed to address them. These needs include documenting recovery status, organizing imaging data, and simplifying contact with referral sources. For contemporary orthopedic practices, cloud-based orthopaedic software improves operational efficiency, data security, and accessibility.

The market growth is driven by the aging population, the rising incidence of orthopedic disorders, and the growing need for high-quality, reasonably priced care. Clinical effectiveness and surgical planning are improved by the use of EHRs and their connection with imaging systems. AI is revolutionizing the profession by making predictive analytics, better diagnostics, and individualized treatment possible. Notwithstanding these developments, issues like a shortage of qualified staff, high deployment costs, and data privacy concerns still exist. The market environment is still shaped by regulatory compliance. All things considered, orthopedic software offers a wealth of chances for advancement and better patient results.

Report Coverage

This research report categorizes the orthopedic software market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the orthopedic software market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the orthopedic software market.

Orthopedic Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 433.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.88% |

| 2035 Value Projection: | USD 812.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product, By Mode of Delivery, By Application and By Region |

| Companies covered:: | IBM, OPIE Software, CureMD Healthcare, Exactech, Inc., GreenWay Health LLC, Stryker, Brainlab AG, athenahealth, Medstrat, eClinicalWorks, Materialise, Allscripts Healthcare, LLC, NextGen Healthcare LLC, DrChrono, Inc, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is driven by the growing need for effective, tech-driven treatment and the rise in orthopedic operations. Initiatives from the government and organizations, including AAOS, are encouraging innovation and technological breakthroughs. The necessity for efficient orthopedic processes is further highlighted by the rising injury burden and surgeon shortage. Although the COVID-19 pandemic first caused market disruption, it eventually sped up the use of digital technology and brought attention to the benefits of integrated and remote care solutions. For patient management, virtual consultations, and preoperative planning, orthopedic software is becoming more and more essential. All of these elements work together to set the market for long-term growth.

Restraining Factors

The market growth is hindered by the lack of qualified HCIT specialists for the uptake and efficient use of orthopaedic software. Healthcare facilities find it difficult to maintain and maximize these systems in the absence of sufficient infrastructure and technical support. This shortage of workers could impede market expansion even in the face of growing demand and technical improvements.

Market Segmentation

The Orthopedic Software Market Share is classified into product, mode of delivery, and application.

- The orthopedic EHR segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the orthopedic software market is classified into digital templating/preoperative planning software, orthopedic EHR, orthopedic practice management, orthopedic PACS, orthopedic RCM, and others. Among these, the orthopedic EHR segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the customized treatment plans and efficient processes that are improving patient care as a result of the increasing use of orthopedic EHR software in clinical settings. This trend is being driven by features that may be customized, such as referral management and patient education. Recent deployments, like the one at Atlantis Orthopedics, demonstrate the trend toward cloud solutions with AI integration. These developments are increasing operational effectiveness and driving segment growth.

- The web/cloud based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the mode of delivery, the orthopedic software market is divided into web/cloud based and on-premise. Among these, the web/cloud based segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by its benefits, including precise information transmission to stop data misuse or address problems at a critical study stage, and remote access to patient health data. Consistent uptime, cost savings, scalability, and data consolidation are other benefits. The expanding consolidation of the healthcare sector and the rise of multispecialty hospitals that need one-stop solutions for all specialties, as well as data collection and management, are further factors propelling the expansion of web/cloud-based software segmental growth.

- The orthopedic surgeries segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the orthopedic software market is classified into orthopedic surgeries, fracture management, and others. Among these, the orthopedic surgeries segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth can be attributed to the need for orthopedic software, which is being greatly increased by the growing number of orthopedic procedures and age-related bone disorders. This increase is a result of an older population, a rise in arthritis cases, and an increase in injuries. The necessity for effective digital tools in orthopedic care is highlighted by these trends. Orthopedic software is therefore being used more and more by hospitals and specialty clinics to improve patient care and treatment.

Regional Segment Analysis of the Orthopedic Software Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the orthopedic software market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the orthopedic software market over the predicted timeframe. The regional growth can be attributed to the developments in technology in the area. The market may be boosted by the successful integration of eHealth, mHealth, and sophisticated visualization technologies into healthcare systems in nations like the United States and Canada. The market may be further driven by the growing demand for minimally invasive procedures and the ongoing improvement of reimbursement scenarios.

Asia Pacific is expected to grow at a rapid CAGR in the orthopedic software market during the forecast period. The region's growth is being driven by the governments and healthcare providers, placing more emphasis on lowering medical costs while enhancing population growth and general well-being. The desire to enhance the patient experience and the rising demand for population health management are the main drivers of this. As a result, the market for healthcare software in the area is expanding quickly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the orthopedic software market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IBM

- OPIE Software

- CureMD Healthcare

- Exactech, Inc.

- GreenWay Health LLC

- Stryker

- Brainlab AG

- athenahealth

- Medstrat

- eClinicalWorks

- Materialise

- Allscripts Healthcare, LLC

- NextGen Healthcare LLC

- DrChrono, Inc

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Exactech released new ExactechGPS software aimed at improving patient-centered planning and current alignment methodologies for total knee replacement. This version improves the company's Newton knee balancing technique, allowing surgeons to plan tibia and femur resections simultaneously, utilizing real-time ligament alignment and laxity information.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the orthopedic software market based on the below-mentioned segments:

Global Orthopedic Software Market, By Product

- Digital Templating/Preoperative Planning Software

- Orthopedic EHR

- Orthopedic Practice Management

- Orthopedic PACS

- Orthopedic RCM

- Others

Global Orthopedic Software Market, By Mode of Delivery

- Web/Cloud Based

- On-Premise

Global Orthopedic Software Market, By Application

- Orthopedic Surgeries

- Fracture Management

- Others

Global Orthopedic Software Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the orthopedic software market over the forecast period?The global orthopedic software market is projected to expand at a CAGR of 5.88% during the forecast period.

-

2. What is the market size of the orthopedic software market?The global orthopedic software market size is expected to grow from USD 433.2 Million in 2024 to USD 812.3 Million by 2035, at a CAGR of 5.88% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the orthopedic software market?North America is anticipated to hold the largest share of the orthopedic software market over the predicted timeframe.

Need help to buy this report?