Global Ortho Xylene Market Size, Share, and COVID-19 Impact Analysis, By Type (Ortho-Xylene, Meta Xylene, and Para Xylene), By Application (Phthalic Anhydride, Bactericides, Herbicides, and Lube Oil Additives), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Ortho Xylene Market Size Insights Forecasts to 2035

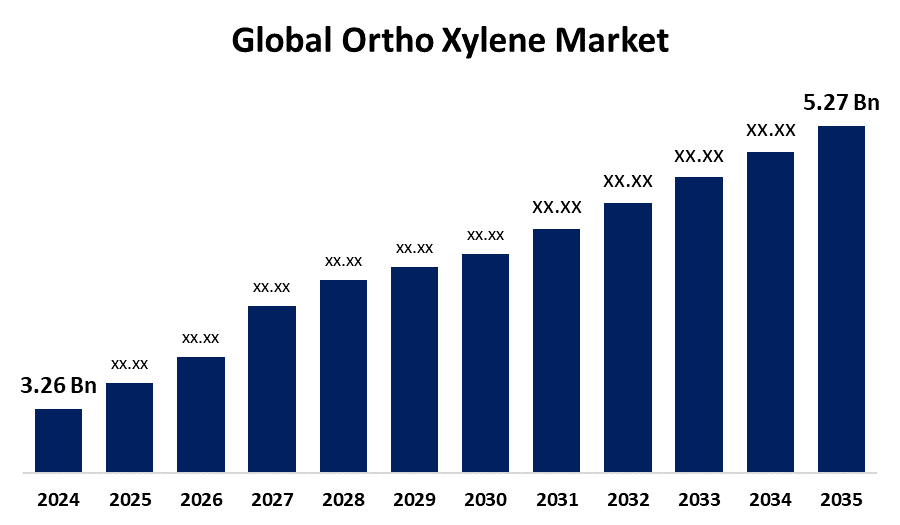

- The Global Ortho Xylene Market Size Was Estimated at USD 3.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.46% from 2025 to 2035

- The Worldwide Ortho Xylene Market Size is Expected to Reach USD 5.27 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Ortho Xylene Market Size was worth around USD 3.26 Billion in 2024, Growing to 3.41 Billion in 2025, and is predicted to Grow to around USD 5.27 Billion by 2035 with a compound annual growth rate (CAGR) of 4.46% from 2025 to 2035. The market for ortho-xylene presents opportunities for increased industrial uses, rising demand in the production of chemicals and plastics, improvements in production technologies, and rising investments in developing nations for long-term growth.

Global Ortho Xylene Market Forecast and Revenue Size

- 2024 Market Size: USD 3.26 Billion

- 2025 Market Size: USD 3.41 Billion

- 2035 Projected Market Size: USD 5.27 Billion

- CAGR (2025-2035): 4.46%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The production, distribution, and consumption of ortho-xylene, an aromatic hydrocarbon generated from petroleum that is mainly used as a feedstock for the synthesis of phthalic anhydride, make up the global commercial ecosystem known as the ortho-xylene market. The production of phthalate plasticizers, polyester resins, alkyd resins, dyes, and coatings necessary for polyvinyl chloride (PVC) applications in the automotive, aviation, and construction industries is made easier by this intermediate compound. The International Trade Administration (ITA) estimates that the Indian government spent $645 million on civil aviation, with a two-decade need for 2,300 aircraft valued at $320 billion. This increased demand for lightweight, long-lasting PVC components from ortho-xylene. The market is mostly driven by the widespread usage of ortho-xylene as a raw material in the synthesis of phthalic anhydride, an essential component in the production of coatings, resins, and plasticizers. A further factor driving the expansion of the ortho-xylene market is the plastics industry, which is a significant user of phthalic anhydride.

Key Market Insights

- North America is expected to account for the largest share in the ortho xylene market during the forecast period.

- In terms of type, the para xylene segment is projected to lead the ortho xylene market throughout the forecast period

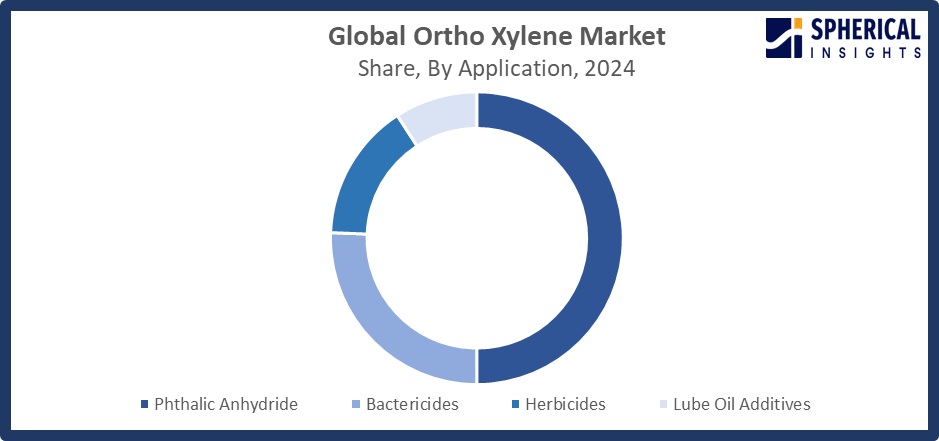

- In terms of application, the phthalic anhydride segment captured the largest portion of the market

Ortho Xylene Market Trends

- Growing demand for plasticizers and phthalic anhydride manufacturing

- Growth in the building and automotive industries is increasing consumption.

- Increasing application in the production of synthetic fabrics, dyes, and solvents

- Improvements in technology that increase production efficiency

- Growing focus on environmentally friendly and sustainable production methods

Report Coverage

This research report categorizes the ortho xylene market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the ortho xylene market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the ortho xylene market.

Global Ortho Xylene Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.46% |

| 2035 Value Projection: | USD 5.27 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 145 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Dyna Chem Inc., Shell Chemicals, Sonoco Chemicals, Royal Dutch Shell PLC, Exxon Mobil Corporation, Reliance Industries Limited, Minda Petrochemicals Ltd., Formosa Chemicals & Fibre Corp., USA Petrochemical Industries Ltd., China National Petroleum Corporation, JXTG Nippon Oil & Energy Corporation, Creasyn Finechem (Tianjin) Co., Ltd., Doe & Ingalls of North Carolina Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving factors:

Ortho-xylene demand driven by PVC, paints, adhesives.

The growing need for ortho-xylene as a PVC production intermediate and its widespread use in paint and adhesive manufacturing are the main factors driving the ortho xylene market. The market is also growing as a result of the packaging industry's increase, which is driven by consumer demand for sustainable and lightweight materials. The synthesis of phthalic anhydride, a crucial intermediary in the creation of plasticizers, dyes, and synthetic fibers, is the main factor propelling the expansion of the ortho-xylene market. The need for phthalic anhydride, which is used to make resins and plasticizers, is one of the main drivers. Furthermore, the demand for ortho-xylene derivatives is increased by the expansion of the automobile and construction industries.

Restraining Factors: Ortho-xylene market is restricted by price, regulations.

The market for ortho-xylene is restricted by the price volatility of raw materials, strict environmental laws, and health risks associated with chemical exposure. Furthermore, the availability of substitute raw materials and solvents restricts market expansion and influences the stability of total demand.

Market Segmentation

The global ortho xylene market is divided into type and application.

Global Ortho Xylene Market, By Type:

What has caused the dramatic increase in demand for para-xylene?

The para xylene segment led the ortho xylene market, generating the largest revenue share. The demand for para-xylene has increased dramatically due to the growing need for polyester in textiles, packaging, and plastic bottles. This has cemented para-xylene's dominant position in both consumer-driven and big industrial uses across the globe. Para-xylene is a vital feedstock in the polyester value chain since it is the primary source of PTA through a number of chemical processes.

The ortho-xylene segment in the ortho xylene market is expected to grow at the fastest CAGR over the forecast period. Ortho-xylene, owing to its strategic use as a phthalic anhydride intermediate, is essential for the production of plasticizers, resins, and colors. Growing product applications in the consumer, construction, and automotive sectors are factors driving the need for ortho-xylene.

Global Ortho Xylene Market, By Application:

What drives the market demand for phthalic anhydride?

The phthalic anhydride segment held the largest market share in the ortho xylene market. Phthalic anhydride is most commonly used in the manufacturing of alkyd resins, which are large binders for paint and coatings. The market for phthalic anhydride is driven by its widespread use in the production of plasticizers, which are essential for creating flexible PVC for use in the packaging, automotive, and construction sectors.

Get more details on this report -

The bactericides segment in the ortho xylene market is expected to grow at the fastest CAGR over the forecast period. The growing need for sanitation goods and crop protection solutions, which include ortho-xylene derivatives in their formulation, is responsible for the bactericides segment's expansion.

Regional Segment Analysis of the Global Ortho Xylene Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Ortho Xylene Market Trends

Get more details on this report -

Where is the demand for ortho-xylene strongest within North America?

North America, due to the region's strong petrochemical sector and strong demand for phthalic anhydride, a crucial ortho-xylene derivative. The manufacture and use of ortho-xylene, a crucial component of the worldwide petrochemical industry, is mainly as a feedstock for phthalic anhydride, which is utilized in plasticizers, coatings, and resins for the packaging, automotive, and construction industries. Ortho-xylene is produced and distributed efficiently in the region due to a strong petrochemical infrastructure and sophisticated manufacturing capabilities.

What industries are driving the strong demand for phthalic anhydride in the US?

The strong demand for phthalic anhydride from the flexible packaging and automotive wire coating industries has kept the US ortho-xylene market strong. The growing automotive and construction sectors' need for plasticizers, coatings, and resins made from ortho-xylene is predicted to propel a 3.5% yearly rise in domestic manufacturing capacity, according to the U.S. Energy Information Administration.

What government initiatives are supporting the growth of the ortho-xylene market in Canada?

The demand from the packaging, construction, and automotive sectors is propelling the sluggish expansion of the ortho-xylene market in Canada. Natural Resources Canada projects that during the next five years, the nation's capacity to produce petrochemicals will grow by around 2.8% a year. The market's growth is also aided by government programs that support sustainable industrial practices.

Asia Pacific Ortho Xylene Market Trends

What factors are contributing to the rising demand for ortho-xylene in the Asia Pacific region?

The Asia Pacific region as a result of growing manufacturing activities, fast industrialization, and the rising need for coatings and plastics. Rapid urbanization, industrialization, and growing manufacturing sectors are expected to propel the Asia Pacific ortho-xylene market's substantial rise. Government programs encouraging sustainable industrial growth and investments in cutting-edge production technologies are also driving market expansion.

What is ortho-xylene used for in Japan's specialized chemicals industry?

In Japan's specialized chemicals industry, ortho-xylene is still used in sophisticated polyester composites and specialty performance coatings. In order to reduce production-related carbon emissions, Japan is balancing its move to solvent-free manufacturing with investments in xylene stream purification and reprocessing facilities.

Why does China hold a leading position in the Asia Pacific ortho-xylene market?

China's strong petrochemical sector and strong demand for phthalic anhydride, which is used in plasticizers, coatings, and resins, have given the country a leading position in the Asia Pacific ortho-xylene market. China's Ministry of Industry and Information Technology projects that the country's capacity to produce petrochemicals is going to rise at a consistent yearly rate of 5–6%.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global ortho xylene market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Ortho Xylene Market Include

- Dyna Chem Inc.

- Shell Chemicals

- Sonoco Chemicals

- Royal Dutch Shell PLC

- Exxon Mobil Corporation

- Reliance Industries Limited

- Minda Petrochemicals Ltd.

- Formosa Chemicals & Fibre Corp.

- USA Petrochemical Industries Ltd.

- China National Petroleum Corporation

- JXTG Nippon Oil & Energy Corporation

- Creasyn Finechem (Tianjin) Co., Ltd.

- Doe & Ingalls of North Carolina Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In November 2023, ExxonMobil Chemical Company and BASF SE announced a joint venture to build a world-scale ortho-xylene (OX) production facility in the United States. This partnership aims to leverage the companies' combined expertise and resources to meet the surging demand for OX in the North American market.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ortho xylene market based on the following segments:

Global Ortho Xylene Market, By Type

- Ortho-xylene

- Meta xylene

- Para xylene

Global Ortho Xylene Market, By Application

- Phthalic Anhydride

- Bactericides

- Herbicides

- Lube Oil Additives

Global Ortho Xylene Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the ortho xylene market over the forecast period?The global ortho xylene market is projected to expand at a CAGR of 4.46% during the forecast period.

-

2. What is the market size of the ortho xylene market?The global ortho xylene market size is expected to grow from USD 3.26 billion in 2024 to USD 5.27 billion by 2035, at a CAGR 4.46% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the ortho xylene market?North America is anticipated to hold the largest share of the ortho xylene market over the predicted timeframe.

-

4. Who are the top companies operating in the global ortho xylene market?Dyna Chem Inc., Shell Chemicals, Sonoco Chemicals, Royal Dutch Shell PLC, Exxon Mobil Corporation, Reliance Industries Limited, Minda Petrochemicals Ltd., Formosa Chemicals & Fibre Corp., USA Petrochemical Industries Ltd., China National Petroleum Corporation, JXTG Nippon Oil & Energy Corporation, Creasyn Finechem (Tianjin) Co., Ltd., Doe & Ingalls of North Carolina Inc., and others.

-

5. What factors are driving the growth of the ortho xylene market?Rising demand for phthalic anhydride, rapid industrialization, infrastructure development, and expansion in the automotive, construction, and packaging sectors are key drivers fueling growth in the ortho-xylene market.

-

6. What are market trends in the ortho xylene market?Increasing use in the production of plasticizers, improvements in purification technology, increased investments in petrochemical capacity, and a move toward solvent-free and sustainable manufacturing methods in different locations are some of the major trends.

-

7. What are the main challenges restricting wider adoption of the ortho xylene market?Important challenges include fluctuating raw material costs, strict environmental laws, health risks associated with chemical exposure, and the increasing use of safer and more environmentally friendly substitute chemicals in industrial settings.

Need help to buy this report?