Global Ortho Pediatric Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Joint Replacement/Orthopaedic Implants, Trauma, Sports Medicine, Spine, and Others), By End Use (Hospitals and Outpatient Facilities), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035.

Industry: HealthcareGlobal Ortho Pediatric Devices Market Insights Forecasts to 2035

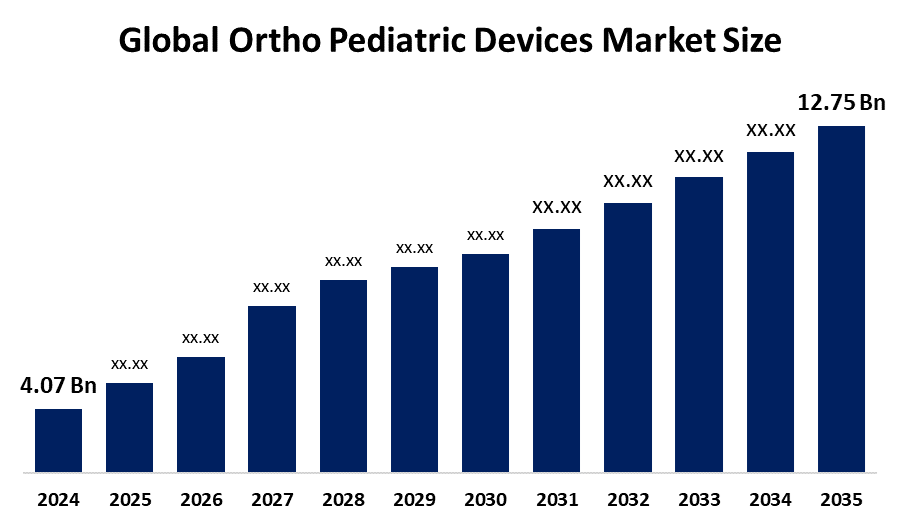

- The Global Ortho Pediatric Devices Market Size Was Estimated at USD 4.07 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.94% from 2025 to 2035

- The Worldwide Ortho Pediatric Devices Market Size is Expected to Reach USD 12.75 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global ortho pediatric devices market size was worth around USD 4.07 Billion in 2024 and is predicted to grow to around USD 12.75 Billion by 2035 with a compound annual growth rate (CAGR) of 10.94% from 2025 and 2035. The market for ortho pediatric devices has a number of opportunities to grow due to the growing prevalence of orthopedic conditions and awareness regarding early diagnosis and intervention.

Market Overview

The global ortho pediatric devices industry is a segment of the healthcare industry focused on developing, manufacturing, and sale of medical devices specifically designed to treat musculoskeletal conditions in children and adolescents. Ortho pediatric devices include high-quality pediatric implants that are known for precision engineering and a deep understanding of the unique anatomical and physiological needs of children. There is an upsurge in innovation in orthopediatric devices by the strategic alliance between key market players. For instance, in March 2025, OrthoPediatrics Corp., a company focused exclusively on advancing the field of pediatric orthopedics, announced its partnership with Crossroads Pediatric Device Consortium (CPDC). The growing innovation in ortho pediatric devices is driving a huge surge in the global ortho pediatric devices market. For instance, in November 2025, Advita Ortho, LLC, announced patients' lives through innovative orthopedic solutions.

Report Coverage

This research report categorizes the ortho pediatric devices market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the ortho pediatric devices market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the ortho pediatric devices market.

Driving Factors

The ortho pediatric devices market is driven by an increasing prevalence of pediatric musculoskeletal trauma. An increasing application of 3D printing in pediatric orthopaedics, emphasizing the image acquisition, 3D model creation, and printing techniques within specific applications like pediatric limb deformities, pediatric orthopaedic oncology, and pediatric spinal deformities, is escalating the market growth. Further, an increasing number of sports-related injuries is contributing to propel the ortho pediatric devices market. For instance, as per the estimates of Stanford Medicine, in the U.S., about 30 million children and teens participate in some form of organized sports, and more than 3.5 million injuries occur each year.

Restraining Factors

The ortho pediatric devices market is restricted by regulatory complexities and reimbursement policies. Further, the increased cost of devices and product recalls are challenging the market growth.

Market Segmentation

The ortho pediatric devices market share is classified into product and end use.

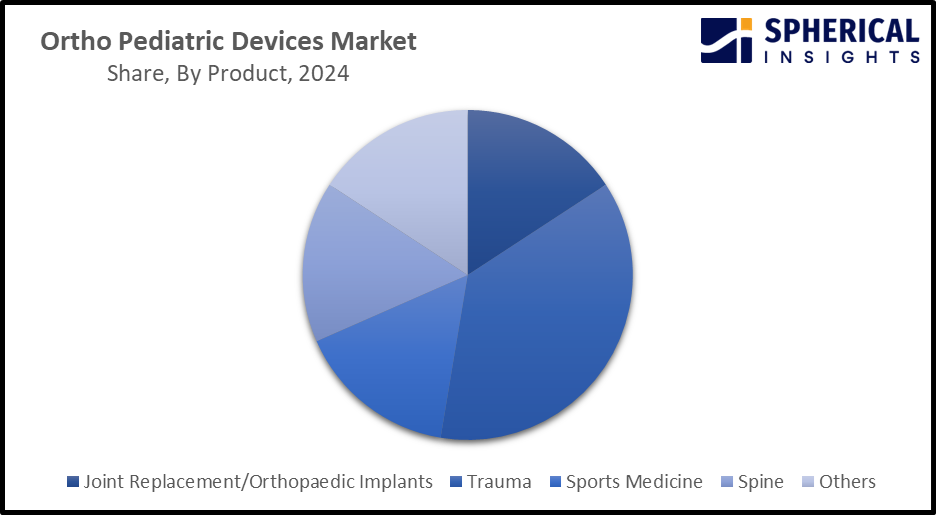

- The trauma segment dominated the market with over 35% share in 2024 and is projected to grow at a rapid CAGR during the forecast period.

Based on the product, the ortho pediatric devices market is divided into joint replacement/orthopaedic implants, trauma, sports medicine, spine, and others. Among these, the trauma segment dominated the market with over 35% share in 2024 and is projected to grow at a rapid CAGR during the forecast period. With an increasing emphasis on child safety, the implementation of regulations for ensuring better safety standards in children’s environments is propelling the market in the trauma segment. For instance, in May 2025, OrthoPediatrics Corp. announced the expansion of its Trauma and Deformity portfolio with the 3P pediatric plating platform Hip System.

Get more details on this report -

- The hospitals segment accounted for the largest share of over 51% in 2024 and is anticipated to grow at a rapid CAGR of over 11.2% during the forecast period.

Based on the end use, the Ortho Pediatric Devices market is divided into hospitals and outpatient facilities. Among these, the hospitals segment accounted for the largest share of over 51% in 2024 and is anticipated to grow at a rapid CAGR of over 11.2% during the forecast period. Increasing collaborative efforts among healthcare providers and the enhancement of resource sharing & improved accessibility to specialized trauma services are contributing to propel the market. For instance, in June 2025, Apollo children’s hospital, Chennai, launched Tamil Nadu’s first center of excellence in pediatric orthopedics and trauma care.

Regional Segment Analysis of the Ortho Pediatric Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the ortho pediatric devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of about 44% in the ortho pediatric devices market over the predicted timeframe. The market ecosystem in North America is strong, due to the presence of orthopaedics startups, including Nevro, Flexion Therapeutics, Ekso Bionics, OrthoPediatrics, and Avidity Biosciences. The market for ortho pediatric devices has been driven by the region's advanced healthcare infrastructure, adoption of innovative medical technologies, along increasing pediatric population. Due to their innovative ortho pediatric device products and partnerships with other industry players, they play a significant role in propelling the market's expansion. For instance, in November 2023, the Foundation for the National Institutes of Health (FNIH) is leading the design phase of a public-private partnership to address the lack of availability of pediatric medical devices for children in the U.S. The United States is leading the ortho pediatric devices market, holding the largest share in 2024, driven by the presence of skilled healthcare professionals and the availability of modern medical equipment.

Asia Pacific is expected to grow at a rapid CAGR of about 9.5% in the ortho pediatric devices market during the forecast period. The Asia Pacific area has a thriving market for ortho pediatric devices due to its increasing birth rates, healthcare facilities and investment in pediatric care. Due to their governments actively supporting the orthopaedic devices market, which includes innovative implants to advanced surgical tools, and rehabilitation technologies for bringing cutting-edge solutions. The increasing product launches by well-established industries have also fueled the expansion of the Ortho Pediatric Devices market. For instance, in November 2024, OrthoPediatrics announced an update to the DF2 brace with expanded indications and international launch. China is the leading country in the Asia Pacific ortho pediatric devices market, driven by an increasing middle-class population and improvement in healthcare infrastructure, along with an increased prevalence of chronic orthopaedic ailments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the ortho pediatric devices market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- OrthoPediatrics Corp.

- Johnson & Johnson

- Stryker

- Arthrex Inc.

- Zimmer Biomet

- Smith & Nephew

- Orthofix US LLC

- WishBone Medical

- Merete GmbH

- Samay Surgical

- NuVasive

- Medtronic plc

- Globus Medical

- Pega Medical

- KLS Martin Group

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2025, OrthoPediatrics Corp., a company focused on advancing the field of pediatric orthopedics, announced the U.S. launch of the new VerteGlide Spinal Growth Guidance System, used to treat Early Onset Scoliosis (“EOS”).

- In March 2025, OrthoPediatrics Corp., a company focused exclusively on advancing the field of pediatric orthopedics, announced its partnership with the Crossroads Pediatric Device Consortium (CPDC).

- In December 2023, Orthopediatrics Corp., a company focused exclusively on advancing the field of pediatric orthopedics, announced the launch of its specialty bracing division, focused on non-surgical intervention for pediatric orthopedics.

- In October 2023, OrthoPediatrics Corp., a company focused exclusively on advancing the field of pediatric orthopedics, announced a strategic partnership with Children’s National Hospital in Washington, DC under the “Alliance for Pediatric Device Innovation” (APDI), to advice the development and commercialization of medical devices designed for children.

- In June 2023, OrthoPediatrics Corp. KIDS, a prominent name in pediatric orthopedics, made a significant breakthrough with the limited launch of the GIRO Growth Modulation System. This latest development is poised to transform the field of pediatric orthopedics and advance patient care, broadening the company’s offering within the Trauma and Deformity Correction business.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ortho pediatric devices market based on the below-mentioned segments:

Global Ortho Pediatric Devices Market, By Product

- Joint Replacement/Orthopaedic Implants

- Trauma

- Sports Medicine

- Spine

- Others

Global Ortho Pediatric Devices Market, By End Use

- Hospitals

- Outpatient Facilities

Global Ortho Pediatric Devices Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the ortho pediatric devices market?The global ortho pediatric devices market size is expected to grow from USD 4.07 Billion in 2024 to USD 12.75 Billion by 2035, at a CAGR of 10.94% during the forecast period 2025-2035.

-

2. Which region holds the largest share of the ortho pediatric devices market?North America is anticipated to hold the largest share of the ortho pediatric devices market over the predicted timeframe.

-

3. What is the forecasted CAGR of the Global Ortho Pediatric Devices Market from 2024 to 2035?The market is expected to grow at a CAGR of around 10.94% during the period 2024–2035.

-

4. Who are the top companies operating in the Global Ortho pediatric devices Market?Medical, Pega Medical, and KLS Martin Group.

-

5. Can you provide company profiles for the leading ortho pediatric devices manufacturers?Yes. For example, OrthoPediatrics Corp. is an American bio-science company engaged in designing, developing, manufacturing, and distributing orthopedic implants and instruments for pediatric issues, based in Warsaw, Indiana. Johnson & Johnson is an American multinational pharmaceutical, biotechnology, and medical technologies corporation headquartered in New Brunswick, New Jersey, and publicly traded on the New York Stock Exchange.

-

6. What are the main drivers of growth in the ortho pediatric devices market?An increasing prevalence of pediatric musculoskeletal trauma, application of 3D printing in pediatric orthopaedics, and an increasing number of sports-related injuries are major market growth drivers of the ortho pediatric devices market.

-

7. What challenges are limiting the ortho pediatric devices market?Regulatory complexities, reimbursement policies, increased costs, and product recalls remain key restraints in the ortho pediatric devices market.

Need help to buy this report?