Global Orbital Spaceflight Market Size By Range [Low Earth Orbit (LEO), Medium Earth Orbit (MEO) and Geostationary Orbit (GEO)], By Spacecraft Type (Orbital, Rover, Lander), By Region, And Segment Forecasts, By Geographic Scope And Forecast to 2033

Industry: Aerospace & DefenseGlobal Orbital Spaceflight Market Insights Forecasts to 2033

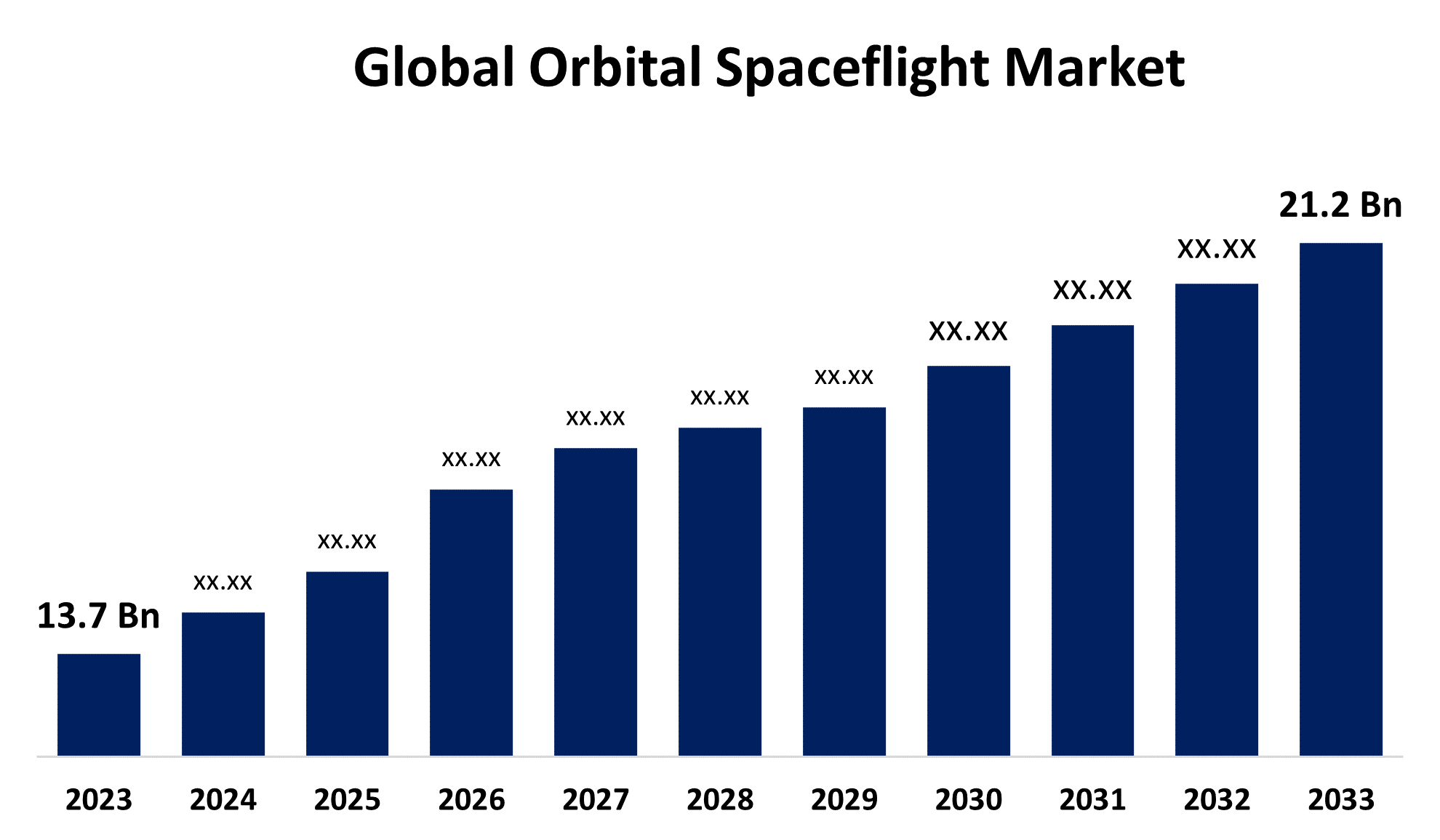

- The Orbital Spaceflight Market Size was valued at USD 13.7 billion in 2023.

- The Market Size is Growing at a CAGR of 4.46% from 2023 to 2033

- The Global Orbital Spaceflight Market Size is expected to reach USD 21.2 billion by 2033

- Asia Pacific is Expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Orbital Spaceflight Market is expected to reach USD 21.2 billion by 2033, at a CAGR of 4.46% during the forecast period 2023 to 2033.

Commercial organisations were taking a more prominent role in the space industry than just government organisations. Numerous private businesses providing satellite placement, space tourism, orbital launch services, and other space-related services emerged as a result of this change. The cost of putting payloads into orbit was decreasing due to technological advancements, especially in the area of reusable rocket technology, which was led by businesses. Space is becoming more affordable for a larger group of users, including small satellite operators, academic institutions, and commercial companies thanks to the decrease in launch expenses. Partnerships between government space agencies, commercial businesses, and international organisations have fueled innovation and increased potential for space activities, leading to an increase in international collaboration in space exploration and utilisation.

Global Orbital Spaceflight Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 13.7 billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 4.46% |

| 2033 Value Projection: | USD 21.2 billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Range, By Spacecraft Type, By Region, By Geographic Scope |

| Companies covered:: | Northrop Grumman Innovation Systems, Blue Origin, Scaled Composites, SpaceX, The Spaceship Company, Sierra Nevada Corporation, ARCA Space, PD Aerospace, Boeing, Copenhagen, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Orbital Spaceflight Market Value Chain Analysis

In the research and development (R&D) stage, technologies for spaceflight, such as propulsion systems, satellite parts, launch vehicles, and space habitats, are studied and developed. Production of spacecraft, satellites, launch vehicles, and related components is a component of manufacturing and assembly. Launch services include moving payloads from Earth into space, such as satellites and spacecraft. Once in orbit, satellites and spacecraft need to be operated and maintained. This includes communication, data collecting, manoeuvring, and monitoring. Utilising information and services from satellites and spacecraft for a range of uses, such as national security, scientific research, telecommunications, Earth observation, and navigation, is known as space applications. Infrastructure and support services encompass the establishment and upkeep of launch pads, spaceports, ground stations, and other infrastructure.

Orbital Spaceflight Market Opportunity Analysis

The need for satellite-based services like navigation, Earth observation, and telecommunications is only increasing. To increase service reliability and provide worldwide coverage, businesses are investing in the deployment of massive constellations of tiny satellites. Businesses in the satellite manufacturing, launch services, ground segment infrastructure, and satellite operations sectors can benefit from this trend. The building of commercial space stations is becoming more and more popular as the International Space Station (ISS) nears the end of its useful life. Space travel, manufacturing, scientific research, and in-orbit maintenance might all be conducted from these facilities. This is a chance for companies engaged in space station building, module manufacture, crew transit, and space-based research. Opportunities to increase the operational life of current satellites and facilitate new space missions are presented by in-orbit service capabilities, which include satellite assembly, refuelling, and repair.

Market Dynamics

Orbital Spaceflight Market Dynamics

Increasing number of space exploration programs

Launching satellites, spacecraft, and scientific instruments into orbit or beyond is a requirement of space exploration programmes. This increases the demand for the launch services offered by for-profit launch companies. The need for launch services rises as more nations and organisations take part in space exploration, which is advantageous for businesses that manufacture and operate launch vehicles. By generating new opportunities for satellite makers, spacecraft suppliers, ground segment providers, and space infrastructure developers, space exploration programmes increase the market for space-related goods and services. The demand for space-based services including navigation, Earth observation, and telecommunications is rising in tandem with space exploration activities, which is propelling market expansion. The public is captivated by space exploration programmes, which also serve as an inspiration for the upcoming generation of engineers, scientists, and explorers.

Restraints & Challenges

Significant funding is needed to construct and run space missions, such as satellite launches, spacecraft development, and space exploration initiatives. In the space business, high development expenses combined with little financial options can provide difficulties for both long-standing firms and recent arrivals. The market for orbital spaceflight may grow more slowly if launch infrastructure such as launch pads, ground support tools, and range facilities is harder to come by. Meeting the growing demand for space launches and assisting in the expansion of commercial space operations requires building new launch sites, updating current infrastructure, and boosting launch capacity. The market for orbital spaceflight is severely challenged by the abundance of space debris, which raises the possibility of collisions and spacecraft damage.

Regional Forecasts

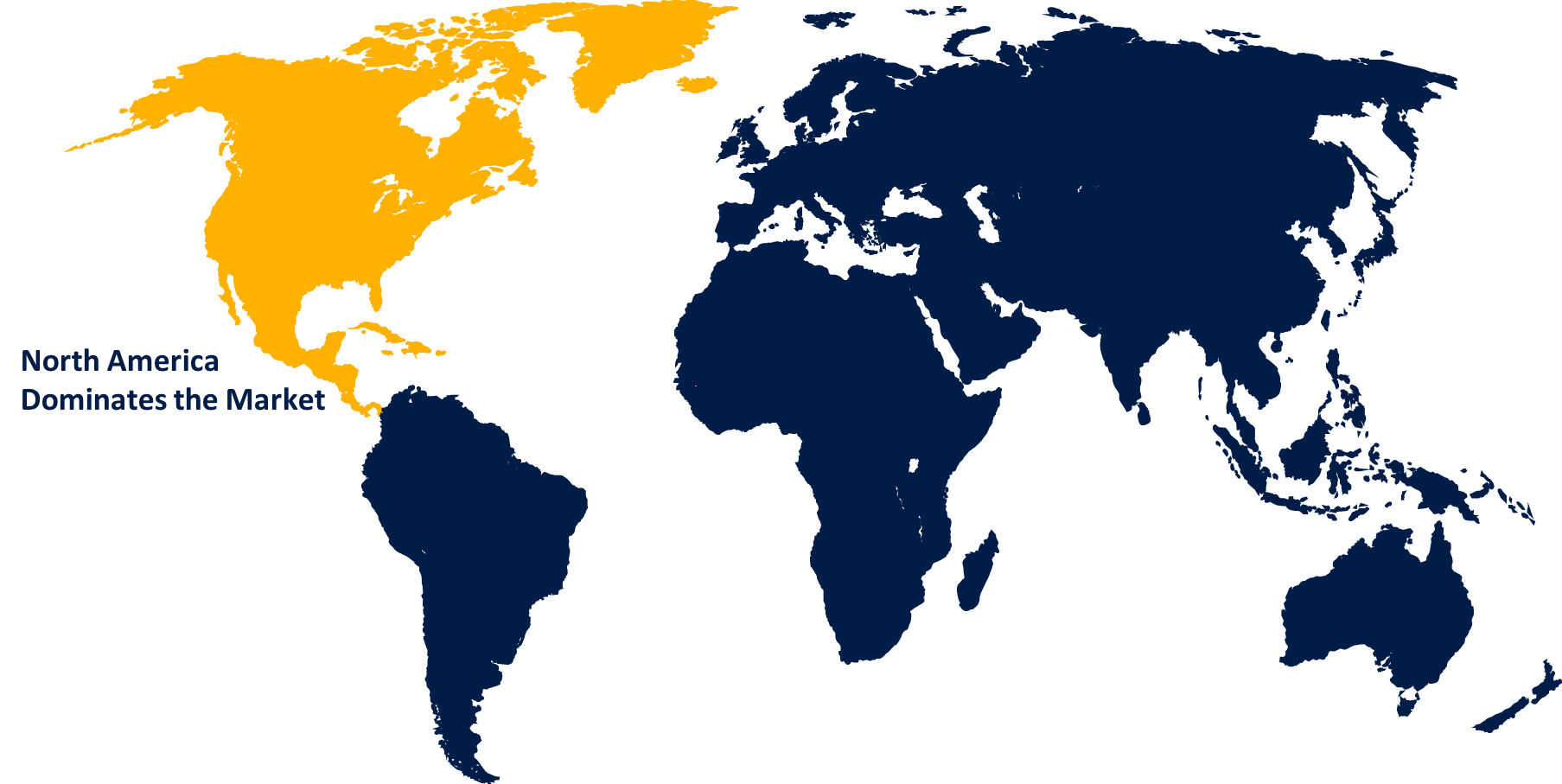

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Orbital Spaceflight Market from 2023 to 2033. With a rich history of space exploration and a thriving ecosystem of government agencies, private businesses, and academic institutions fostering innovation, the United States leads the world in orbital spaceflight. The country's space agency, NASA, is essential to technological advancement, scientific study, and space exploration. North American enterprises lead the industry in satellite manufacturing and technological research, making the region a hub for these endeavours. These businesses create, assemble, and launch a broad variety of satellites for national security, scientific research, communication, and Earth observation. Innovations in propulsion systems, on-board instruments, and satellite architecture are being propelled by advanced technology created in North America.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2033. With their ambitious space exploration programmes and satellite deployment projects, a number of Asia-Pacific nations are becoming space powers. Particularly in space technology development, satellite launches, and lunar exploration, China, India, Japan, and South Korea have achieved major advancements. The Asia-Pacific region is witnessing a sharp increase in the need for satellite-based applications, such as remote sensing, navigation, Earth observation, and telecommunications. Governments, businesses, and academic institutions are using satellite data and services to monitor environmental changes, assist economic development, and solve a variety of societal issues.

Segmentation Analysis

Insights by Range

The low earth orbit (LEO) segment accounted for the largest market share over the forecast period 2023 to 2033. The entrance hurdles for satellite deployment in low-Earth orbit have decreased because to developments in CubeSat technology and satellite miniaturisation. The demand for launch services to low-Earth orbit (LEO) is rising as a result of the affordability of small satellites and CubeSats for a variety of uses, such as scientific study, technology demonstration, and commercial services. As LEO is close to Earth and has a low height, it is a perfect orbit for remote sensing and Earth observation missions. In low Earth orbit, satellites may watch weather patterns, take high-resolution photos, monitor environmental changes, and aid in disaster relief operations. The LEO segment is expanding as a result of the increased need for Earth observation data for uses in urban planning, agriculture, and natural resource management.

Insights by Spacecraft Type

The orbital segment is dominating the market with the largest market share over the forecast period 2023 to 2033. Orbital spaceflight is mostly used to launch satellites into different orbits, such as low Earth orbit (LEO). Satellite deployment missions are expanding due to the growing need for satellite-based services including navigation, Earth observation, telecommunications, and remote sensing. In space exploration missions such as crewed trips to the International Space Station (ISS), robotic exploration of other planets and celestial bodies, and space science research, orbital spaceflight is essential. The expansion of space exploration missions and operations is being driven by international collaborations, government space agencies, and commercial enterprises. The market for orbital spaceflight is expanding due to the commercialization of space, as businesses are pursuing a variety of commercial endeavours.

Recent Market Developments

- In June 2022, Pioneering space infrastructure company D-Orbit and Isar Aerospace reached a legally binding agreement for launch services. Launched in 2023 from its launch base in Andoya, Norway, the company's Spectrum rocket designed for small and medium-sized satellites and satellite constellations will put D-Orbit's ION satellite carrier into sunsynchronous orbit.

Competitive Landscape

Major players in the market

- Northrop Grumman Innovation Systems

- Blue Origin

- Scaled Composites

- SpaceX

- The Spaceship Company

- Sierra Nevada Corporation

- ARCA Space

- PD Aerospace

- Boeing

- Copenhagen Suborbitals

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2033.

Orbital Spaceflight Market, Range Analysis

- Low Earth Orbit (LEO)

- Medium Earth Orbit (MEO)

- Geostationary Orbit (GEO)

Orbital Spaceflight Market, Spacecraft Type Analysis

- Orbital

- Rover

- Lander

Orbital Spaceflight Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1.What is the market size of the Orbital Spaceflight Market?The Global Orbital Spaceflight Market is expected to grow from USD 13.7 billion in 2023 to USD 21.2 billion by 2033, at a CAGR of 4.46% during the forecast period 2023-2033.

-

2.Who are the key market players of the Orbital Spaceflight Market?Some of the key market players of the market are Northrop Grumman Innovation Systems, Blue Origin, Scaled Composites, SpaceX, The Spaceship Company, Sierra Nevada Corporation, ARCA Space, PD Aerospace, Boeing, Copenhagen Suborbitals.

-

3.Which segment holds the largest market share?The Orbital segment holds the largest market share and is going to continue its dominance.

-

4.Which region is dominating the Orbital Spaceflight Market?North America is dominating the Orbital Spaceflight Market with the highest market share.

Need help to buy this report?