Global OPS Shrink Film Market Size, Share, and COVID-19 Impact Analysis, By Type of Film (Polyolefin (POF), Polyvinyl Chloride (PVC) and Polyethylene (PE)), By Application (Packaging, Industrial and Retail), By End User (Agriculture, Consumer Products and Healthcare), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal OPS Shrink Film Market Insights Forecasts to 2035

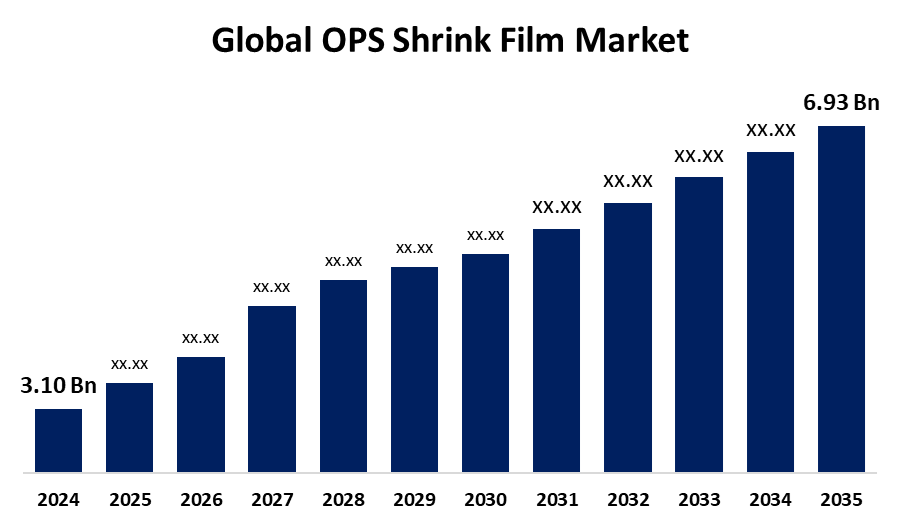

- The Global OPS Shrink Film Market Size Was Estimated at USD 3.10 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.59% from 2025 to 2035

- The Worldwide OPS Shrink Film Market Size is Expected to Reach USD 6.93 Billion by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global OPS Shrink Film Market Size was Worth around USD 3.10 Billion in 2024 and is predicted to Grow to around USD 6.93 Billion by 2035 with a compound annual growth rate (CAGR) of 7.59% from 2025 and 2035. The OPS shrink film market is driven by growing packaged food demand, expanding e-commerce and retail sectors, technological advancements enhancing film performance, and cost-effective, efficient packaging solutions that improve product protection, shelf appeal, and operational productivity across various industries.

Market Overview

The OPS (Oriented Polystyrene) Shrink Film industry is the global economy dedicated to the manufacturing, distribution, and application of heat-shrinkable packaging films based on oriented polystyrene. The films shrink snugly around products when they are exposed to heat, providing superior clarity, printability, and tamper-evident protection. OPS shrink films are extensively utilized in food, beverage, consumer goods, healthcare, and industrial product packaging, prized for clarity, strength, and printability. The objective of the OPS shrink film market is to provide efficient, appealing, and tamper-evident packaging solutions that increase product visibility, guarantee consumer protection, and facilitate branding. OPS films are particularly in demand for labeling and promotional packaging, where visual quality and product protection are critical. Furthermore, producers are aiming to create thinner, more robust, and more eco-friendly OPS films. These involve recyclable and eco-friendly solutions that meet international packaging standards. Improved barrier properties, improved shrink control, and better compatibility with automation systems are also domains of ongoing research and development. All in all, the OPS shrink film industry is transforming to suit contemporary packaging needs providing a blend of performance, efficiency, and aesthetic appeal for a wide spectrum of industrial and consumer applications.

Report Coverage

This research report categorizes the OPS shrink film market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the OPS shrink film market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the OPS shrink film market.

Global OPS Shrink Film Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.10 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.59% |

| 2035 Value Projection: | USD 6.93 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 245 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type of Film, By Application, By End User, By Region |

| Companies covered:: | Fuji Seal, CCL Industries, Hammer Packaging, Reynolds, Sigma Plastics, Clondalkin, Polyrafia, Crayex Corporation, Tri-Cor, Amcor, RKW, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As consumers across the globe increasingly embrace busier lifestyles, demand for packaged, ready-to-consume, and convenience foods increases. OPS shrink films offer transparent, protective packaging that maintains freshness and increases product attractiveness. Increasing demand within the food and beverage industry is one of the biggest drivers of growth for the OPS shrink film market. Additionally, OPS shrink films offer quick and easy packaging with good sealing and good machinability. Their capacity to enhance packaging speed and minimize material loss translates to reduced total production costs. The cost-effectiveness promotes adoption in various industries such as food, healthcare, and consumer products.

Restraining Factors

Despite the advances, OPS is a form of polystyrene, which is less biodegradable and harder to recycle than some other materials. Greater environmental regulations globally seek to decrease plastic waste and promote sustainable packaging, limiting OPS film application. The policies encourage firms to obtain more environmentally friendly solutions, capping OPS market expansion. Further, OPS films exhibit lower heat resistance than some others, limiting their application in temperature-sensitive areas. That restricts OPS film applicability for some of the industrial packaging requirements, reducing its scope of usage and affecting overall market growth.

Market Segmentation

The OPS shrink film market share is classified intotype of film, application, and end user.

- The polyolefin (POF) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type of film, the OPS shrink film market is divided into polyolefin (POF), polyvinyl chloride (PVC), and polyethylene (PE). Among these, the polyolefin (POF) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to POF films providing excellent optical clarity and uniform shrinkage, making them ideal for high-quality product presentation. Their ability to conform tightly to different shapes enhances packaging appeal. This superior performance compared to PVC and PE films makes POF the preferred choice for many packaging applications, driving its larger market share.

- The packaging segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the OPS shrink film market is divided into packaging, industrial, and retail. Among these, the packaging segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth is driven by OPS shrink films that offer excellent clarity, strength, and shrinkability, making them ideal for protecting and showcasing food and beverage products. They help maintain freshness, provide tamper evidence, and enhance shelf appeal, which drives high demand in this sector. The growth of packaged foods globally significantly boosts the packaging segment’s market share.

- The consumer products segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the end user, the OPS shrink film market is divided into agriculture, consumer products, and healthcare. Among these, the consumer products segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed due to the OPS shrink films are widely used beyond food, including in personal care, cosmetics, and household products. Their flexibility, high gloss, and ability to conform to different shapes make them perfect for retail-ready packaging. This versatility ensures consistent demand from diverse consumer goods, supporting the segment’s dominance in the market.

Regional Segment Analysis of the OPS Shrink Film Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the OPS shrink film market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the OPS shrink film market over the predicted timeframe. Asia-Pacific is home to a robust base of OPS film manufacturers and packaging converters, particularly in China, Japan, and South Korea. The availability of raw materials, low labor costs, and efficient manufacturing ecosystems give the region a price advantage in both domestic and export markets. Additionally, local supply chains help meet regional demand faster and more affordably. These factors make Asia-Pacific a production and supply hub, reinforcing its dominant position in the OPS shrink film industry.

North America is expected to grow at a rapid CAGR in the OPS shrink film market during the forecast period. North America’s strong consumer preference for premium, branded, and tamper-evident packaging is fueling demand for OPS shrink films. These films offer excellent printability and clarity, making them ideal for high-end labeling and shelf differentiation. Companies in the U.S. and Canada prioritize attractive, functional packaging to compete in saturated markets like beverages, cosmetics, and food. This emphasis on consumer experience and product presentation drives strong growth in OPS shrink film usage across the region.

Europe is predicted to hold a significant share of the OPS shrink film market throughout the estimated period. Europe’s large and mature food and beverage sector demands high-quality, attractive, and protective packaging. OPS shrink films are favored for their clarity, durability, and excellent printability, enhancing product visibility and shelf appeal. Premium packaged goods, especially in countries like Germany, France, and Italy, rely on OPS films for labeling, tamper evidence, and branding. This well-established industry significantly contributes to Europe’s strong OPS shrink film market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the OPS shrink film market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fuji Seal

- CCL Industries

- Hammer Packaging

- Reynolds

- Sigma Plastics

- Clondalkin

- Polyrafia

- Crayex Corporation

- Tri-Cor

- Amcor

- RKW

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the OPS shrink film market based on the below-mentioned segments:

Global OPS Shrink Film Market, By Type of Film

- Polyolefin (POF)

- Polyvinyl Chloride (PVC)

- Polyethylene (PE)

Global OPS Shrink Film Market, By Application

- Packaging

- Industrial

- Retail

Global OPS Shrink Film Market, By End User

- Agriculture

- Consumer Products

- Healthcare

Global OPS Shrink Film Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the OPS shrink film market over the forecast period?The global OPS shrink film market is projected to expand at a CAGR of 7.59% during the forecast period.

-

2. What is the market size of the OPS shrink film market?The global OPS shrink film market size is expected to grow from USD 3.10 Billion in 2024 to USD 6.93 Billion by 2035, at a CAGR of 7.59% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the OPS shrink film market?Asia Pacific is anticipated to hold the largest share of the OPS shrink film market over the predicted timeframe.

Need help to buy this report?