Global Open Gear Lubricants Market Size, Share, and COVID-19 Impact Analysis, By Base Oil (Mineral Oil, Synthetic Oil, and Bio-Based Oil), By End User (Mining, Cement, Construction, Power Generation, Oil & Gas, and Marine), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

Industry: Chemicals & MaterialsGlobal Open Gear Lubricants Market Size Insights Forecasts to 2033

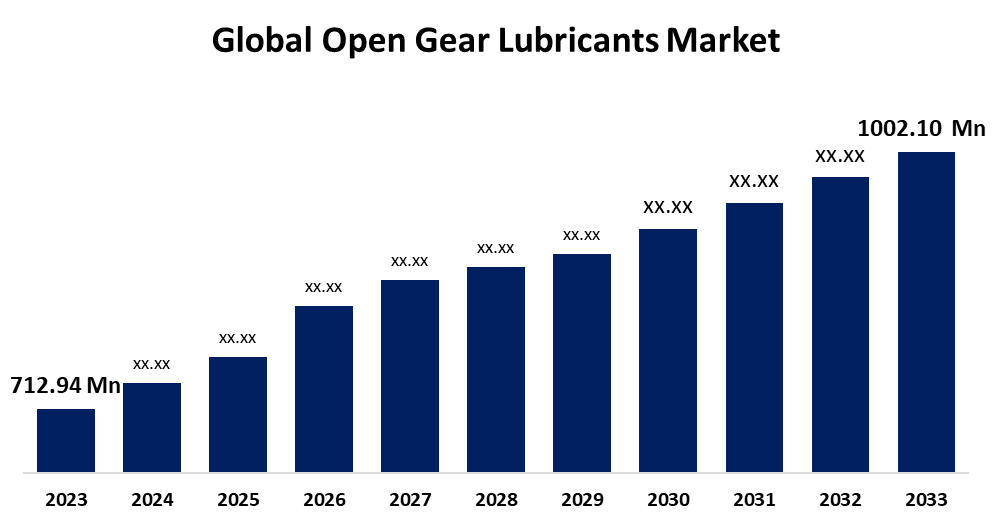

- The Global Open Gear Lubricants Market Size was estimated at USD 712.94 Million in 2023

- The Global Open Gear Lubricants Market Size is Expected to Grow at a CAGR of around 3.46% from 2023 to 2033

- The Worldwide Open Gear Lubricants Market Size is Expected to Reach USD 1002.10 Million by 2033

- Middle East and Africa is Expected to Grow the Fastest During The Forecast Period.

Get more details on this report -

The Global Open Gear Lubricants Market Size is Expected to Cross USD 1002.10 Million by 2033, Growing at a CAGR of 3.46% from 2023 to 2033. There is growing demand for innovative additives and nano-lubricants, strict equipment maintenance regulations, growing demand from the offshore and marine industries, and strategic OEM collaborations and mergers in the open gear lubricants market.

Market Overview

The global market for lubricants made for big, exposed gears that operate in harsh environments is known as the "open gear lubricants market." The efficiency and lifespan of heavy machinery used in mining, cement, construction, power generating, and maritime applications are ensured by these lubricants, which lessen wear, friction, and metal contact. The open gear lubricants market is driven by infrastructural initiatives and industrial expansion, and it comprises mineral, synthetic, and bio-based oils. Advanced formulations increase resistance to environmental pollutants and load-carrying capability.

The open gear lubricants market is experiencing a shift in demand for sustainable lubricants due to growing concerns about sustainability and environmental effects. For Instance, in January 2025, the German lubricants firm Boss Lubricants GmbH and Co. KG, which develops, manufactures, and sells lubricants used in mechanical engineering, metallurgy, medical technology, and safety technology, among other fields, is being purchased by the FUCHS Group.

There is an increased usage of synthetic base oil, rising demand in end-use sectors, expansion of bio-based lubricants, and developments in lubrication monitoring technology. The growing demand from various sectors, including mining, marine, power generation, construction, cement, and oil and gas, is driving the open gear lubricants market. The expansion of mining operations and the rising need for infrastructure projects are the main drivers of the open gear lubricants market.

Report Coverage

This research report categorizes the open gear lubricants market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the open gear lubricants market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the open gear lubricants market.

Global Open Gear Lubricants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 712.94 Million |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 3.46% |

| 2033 Value Projection: | USD 1002.10 Million |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Base Oil, By End User, By Region, and COVID-19 Impact Analysis. |

| Companies covered:: | Shell plc, BP P.L.C., Kluber Lubrications, Petron Corporation, Carl Bechem GmbH, Chevron Corporation, CWS Industrials, Inc., FUCHS SE, TotalEnergies SE, Exxon Mobil Corporation, Specialty Lubricants Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The open gear lubricants market is being driven by the growing need for high-performance lubricants across a range of industries, including manufacturing, construction, power generation, and mining. The need for open gear lubricants is being driven by the quick growth of sectors including manufacturing, construction, mining, oil and gas, and automobiles. The open gear lubricants market is expanding as a result of the rapid rise in infrastructure investments, which is driving demand for open gear lubricants. The need for high-performance lubricants in the open gear lubricants market is being driven by governments' growing spending in infrastructure development around the globe.

Adoption of specialized industrial lubricants is being driven by the expansion of infrastructure and industrialization, which are being pushed by government investments and initiatives. The need for open gear lubricants to improve efficiency and cost-effectiveness is being driven by the markets for these lubricants due to the fast growth of sectors such as manufacturing, construction, oil and gas, mining, and automobiles.

Restraining Factors

Economic and geopolitical slowdowns are the main factors restricting the market for open gear lubricants. Price swings and shortages are typically caused by trade restrictions, sanctions, and political unrest in the main oil-producing nations, which restrict the open gear lubricants market.

Market Segmentation

The open gear lubricants market share is classified into base oil and end user.

- The mineral oil segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on the base oil, the open gear lubricants market is divided into mineral oil, synthetic oil, and bio-based oil. Among these, the mineral oil segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The cost of mineral oils is lower than that of other oils. Mineral oils are preferred by industries like power generation and automobiles due to their superior performance, which includes high viscosity, low volatility, and thermal stability.

- The power generation segment is anticipated to witness the fastest CAGR growth during the forecast period.

Based on the end user, the open gear lubricants market is divided into mining, cement, construction, power generation, oil & gas, and marine. Among these, the power generation segment is anticipated to witness the fastest CAGR growth during the forecast period. The expansion of renewable energy projects and growing worldwide energy demands are the causes of the power generation segmental growth. In thermal, hydro, wind, and nuclear power facilities, heavy-duty open gear systems are utilized in turbines, compressors, and hydraulic equipment.

Regional Segment Analysis of the Open Gear Lubricants Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the open gear lubricants market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the open gear lubricants market over the predicted timeframe. Asia's need for open gear lubricants is being driven by the fast expansion of several industries, such as mining, cement, equipment, and construction. The fast improvements in infrastructure, including power plants, mining, and building projects, have made China the dominant player in the regional market for open gear lubricants. The need for electricity generation has grown as a result of rapid urbanization and industrialization. Furthermore, the region's use of open gear lubricants is growing as a result of increasing infrastructural investments.

Middle East and Africa is expected to grow at the fastest CAGR growth of the open gear lubricants market during the forecast period. The need for sophisticated lubricants to guarantee the seamless running of high-performance gear systems is being driven by the region's oil and gas sector, as well as expanding mining and construction operations. The use of technologically sophisticated lubricants that provide improved efficiency and environmental sustainability is also growing in the MEA area. The demand for dependable lubricants is being driven by the significant infrastructure investments made by nations like Saudi Arabia, the United Arab Emirates, and South Africa.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the open gear lubricants market along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shell plc

- BP P.L.C.

- Kluber Lubrications

- Petron Corporation

- Carl Bechem GmbH

- Chevron Corporation

- CWS Industrials, Inc.

- FUCHS SE

- TotalEnergies SE

- Exxon Mobil Corporation

- Specialty Lubricants Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, in a deal announced by Gear Energy Ltd., a major publicly listed corporation pay USD 110 million in cash to buy Gear Energy Ltd. and its heavy oil assets. The deal states that Gear would give its Tucker Lake property, Southeast Saskatchewan assets, and Central Alberta assets to a newly established organization.

- In May 2024, to be fully operational by the start of 2027, Klüber Lubrication announced a major expansion of its operations facility in Mysore. The 17,000-square-meter Klüber Corporation India manufacturing facility in Mysore creates premium specialty lubricants. To strengthen its operations in the nation and reaffirm its commitment to "Make in India" by boosting local manufacturing, the business announced an investment of USD 16.88 million.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the open gear lubricants market based on the below-mentioned segments:

Global Open Gear Lubricants Market, By Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-based Oil

Global Open Gear Lubricants Market , By End User

- Mining

- Cement

- Construction

- Power Generation

- Oil & Gas

- Marine

Global Open Gear Lubricants Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the open gear lubricants market over the forecast period?The open gear lubricants market is projected to expand at a CAGR of 3.46% during the forecast period.

-

2. What is the market size of the open gear lubricants market?The Global Open Gear Lubricants Market Size is Expected to Grow from USD 712.94 Million in 2023 to USD 1002.10 Million by 2033, at a CAGR of 3.46% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the open gear lubricants market?Asia Pacific is anticipated to hold the largest share of the open gear lubricants market over the predicted timeframe.

Need help to buy this report?