Global Opaque Polymers Market Size, Share, and COVID-19 Impact Analysis, By Type (Solid Content (30%), Solid Content (40%)), By Application (Paint & Coatings, Personal Care, Detergents, Other), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Opaque Polymers Market Insights Forecasts to 2035

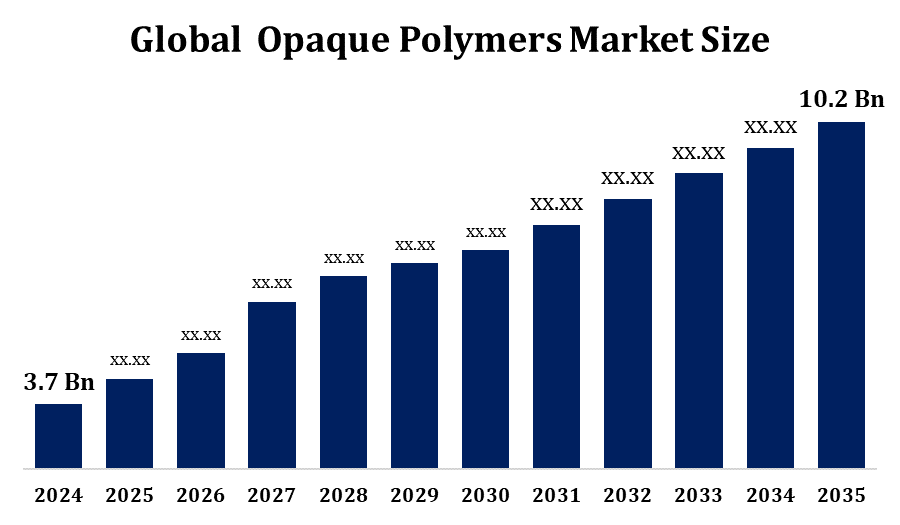

- The Opaque Polymers Market was valued at USD 3.7 Billion in 2024.

- The Market Size is Growing at a CAGR of 10.67% from 2025 to 2035.

- The Worldwide Global Opaque Polymers Market Size is Expected to Reach USD 10.2 Billion by 2035.

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Opaque Polymers Market Size is Expected to Reach USD 10.2 Billion by 2035, at a CAGR of 10.67% during the forecast period 2025 to 2035.

The opaque polymers market is witnessing steady growth, driven by rising demand in paints and coatings, adhesives, and personal care formulations. These polymers are widely used as cost-effective alternatives to titanium dioxide (Titanium dioxide ), offering opacity, whiteness, and improved film properties while reducing overall formulation costs. The construction and automotive industries are major end users, as opaque polymers enhance the durability, weather resistance, and aesthetic appeal of coatings. In addition, their growing use in the paper and packaging sectors to improve printability and brightness supports market expansion. Rapid urbanisation, infrastructure development, and increasing renovation activities across emerging economies are further fueling demand. However, fluctuations in raw material prices and environmental regulations pose challenges. Ongoing innovations in eco-friendly and high-performance grades create new opportunities for market players.

Opaque Polymers Market Value Chain Analysis

The opaque polymers market value chain begins with the procurement of raw materials such as styrene, acrylates, and other monomers, which are supplied by petrochemical companies. These raw materials undergo polymerisation and emulsification processes by opaque polymer manufacturers to produce hollow-sphere polymers with light-scattering properties. The finished opaque polymers are then distributed to formulators in industries like paints and coatings, adhesives, personal care, paper, and packaging. Coating and formulation companies integrate these polymers into end-use products to achieve opacity, brightness, and cost efficiency by reducing titanium dioxide usage. Distributors and suppliers play a key role in bridging manufacturers with regional markets. Finally, end users in construction, automotive, consumer goods, and packaging drive market demand, influencing innovation and sustainability across the value chain.

Opaque Polymers Market Opportunity Analysis

The opaque polymers market presents significant opportunities, primarily driven by the rising need for cost-effective alternatives to titanium dioxide (Titanium dioxide), whose price volatility continues to challenge manufacturers. Expanding applications in architectural and industrial coatings, especially in emerging economies experiencing rapid urbanization and infrastructure growth, create strong demand. Additionally, the personal care and packaging industries are increasingly adopting opaque polymers for improved aesthetics and performance. Growing environmental concerns are encouraging the development of eco-friendly, low-VOC, and high-performance opaque polymers, opening new avenues for sustainable innovation. The expansion of e-commerce and digital printing further boosts usage in paper and packaging applications. With ongoing R&D in advanced formulations, companies have the opportunity to differentiate through innovation, sustainability, and customized solutions tailored to diverse end-user needs.

Global Opaque Polymers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10.2 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 10.67% |

| 2035 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Application, By Type, By Region. |

| Companies covered:: | INEOS, Borealis, SABIC, Formosa Plastics, Dow, Reliance Industries, ExxonMobil, DuPont, Mitsubishi Chemical, Sumitomo Chemical, LG Chem, Eastman Chemical, Chevron Phillips Chemical, Toray Industries, LyondellBasell and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

Opaque Polymers Market Dynamics

Increased demand for personal care and cosmetics to drive the market growth

The growing demand for personal care and cosmetic products is emerging as a key driver for the opaque polymers market. Opaque polymers are widely used in shampoos, lotions, creams, and liquid detergents to enhance opacity, whiteness, and viscosity control, creating a premium look and improved consumer appeal. Rising disposable incomes, urban lifestyles, and increased focus on grooming and hygiene are fueling the expansion of the global personal care industry, particularly in Asia-Pacific and Latin America. As brands compete to deliver high-quality, visually attractive products, the adoption of opaque polymers is accelerating. Moreover, the shift toward eco-friendly and sustainable formulations presents opportunities for advanced bio-based opaque polymers. This growing alignment between consumer preferences and performance requirements continues to drive market growth.

Restraints & Challenges

The opaque polymers market faces several challenges that could restrain its growth. One of the primary issues is the volatility in raw material prices, particularly styrene and acrylates, which directly impacts production costs and profit margins. Intense competition from titanium dioxide, a well-established opacifying agent, also poses a challenge, as end users may hesitate to fully transition to polymer-based alternatives. Additionally, strict environmental regulations regarding VOC emissions and the use of petrochemical-based materials are pressuring manufacturers to invest heavily in sustainable and eco-friendly formulations, raising R&D and compliance costs. Limited awareness in certain emerging markets and fluctuations in demand from key end-use industries such as construction and automotive further create uncertainties. These challenges highlight the need for innovation, efficiency, and strategic partnerships.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the Opaque Polymers Market from 2025 to 2035. The region benefits from a well-established construction and automotive sector, where opaque polymers are used to enhance the durability, opacity, and cost-efficiency of coatings. Rising consumer preference for premium personal care and cosmetic products further drives adoption, as these polymers improve aesthetics and performance in shampoos, lotions, and detergents. Additionally, the presence of major manufacturers and ongoing investments in R&D fosters innovation in eco-friendly and high-performance formulations.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2025 to 2035. China, India, Japan, and South Korea are major contributors, supported by strong industrialisation, urbanisation, and rising consumer spending. In paints and coatings, opaque polymers are gaining traction as cost-effective alternatives to titanium dioxide, enhancing durability and aesthetics in residential and commercial projects. The booming personal care and cosmetics sector, fueled by growing middle-class populations and increasing focus on grooming, further supports demand. Additionally, the region’s large packaging and paper industries present significant opportunities.

Segmentation Analysis

Insights by Type

The solid content (40%) segment is expected to witness notable growth in the opaque polymers market, driven by its widespread use in paints and coatings, personal care, and packaging applications. These polymers offer excellent opacity, brightness, and cost efficiency, serving as a reliable substitute for titanium dioxide in various formulations. In architectural and decorative coatings, the 40% solid content grade is particularly valued for providing optimal balance between performance and affordability, making it suitable for large-scale construction and renovation projects. Additionally, personal care products such as shampoos, body washes, and detergents increasingly utilize this segment for enhanced visual appeal and viscosity control. Growing demand for high-performance, sustainable, and low-VOC formulations further supports expansion, positioning the 40% solid content segment for sustained growth globally.

Insights by Application

The paints & coatings segment accounted for the largest market share over the forecast period 2025 to 2035. Opaque polymers are extensively used in architectural, decorative, and industrial coatings as cost-effective alternatives to titanium dioxide, offering improved opacity, brightness, and film durability. Rising construction activities, infrastructure development, and renovation projects across both developed and emerging economies are fueling demand for high-performance coatings. In addition, the automotive and industrial sectors are adopting opaque polymers to enhance coating efficiency, weather resistance, and aesthetic appeal. Increasing emphasis on sustainable and low-VOC coatings is further accelerating the use of advanced opaque polymers. With growing urbanization and consumer preference for durable finishes, this segment is poised for continued expansion.

Recent Market Developments

- In December 2024, Arkema completed the acquisition of Dow's flexible packaging laminating adhesives business, representing a major step forward in strengthening its position within the speciality chemicals industry.

Competitive Landscape

Major players in the market

- INEOS

- Borealis

- SABIC

- Formosa Plastics

- Dow

- Reliance Industries

- ExxonMobil

- DuPont

- Mitsubishi Chemical

- Sumitomo Chemical

- LG Chem

- Eastman Chemical

- Chevron Phillips Chemical

- Toray Industries

- LyondellBasell

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2025 to 2035.

Opaque Polymers Market, Type Analysis

- Solid Content (40%)

- Solid Content (30%)

Opaque Polymers Market, Application Analysis

- Paint & Coatings

- Personal Care

- Detergents

- Other

Opaque Polymers Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the market size of the Opaque Polymers Market?The global Opaque Polymers Market is expected to grow from USD 3.7 billion in 2024 to USD 10.2 billion by 2035, at a CAGR of 10.67% during the forecast period 2025-2035.

-

2. Who are the key market players of the Opaque Polymers Market?Some of the key market players of the market are INEOS, Borealis, SABIC, Formosa Plastics, Dow, Reliance Industries, ExxonMobil, DuPont, Mitsubishi Chemical, Sumitomo Chemical, LG Chem, Eastman Chemical, Chevron Phillips Chemical, Toray Industries, LyondellBasell.

-

3. Which segment holds the largest market share?The solid content (40%) segment holds the largest market share and is going to continue its dominance.

Need help to buy this report?