Global Online Food Delivery Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Containers, Plates, Bowls, Cups, and Others), By Material (Plastic, Paper and Paperboard, Aluminum, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Consumer GoodsGlobal Online Food Delivery Packaging Market Size Insights Forecasts to 2035

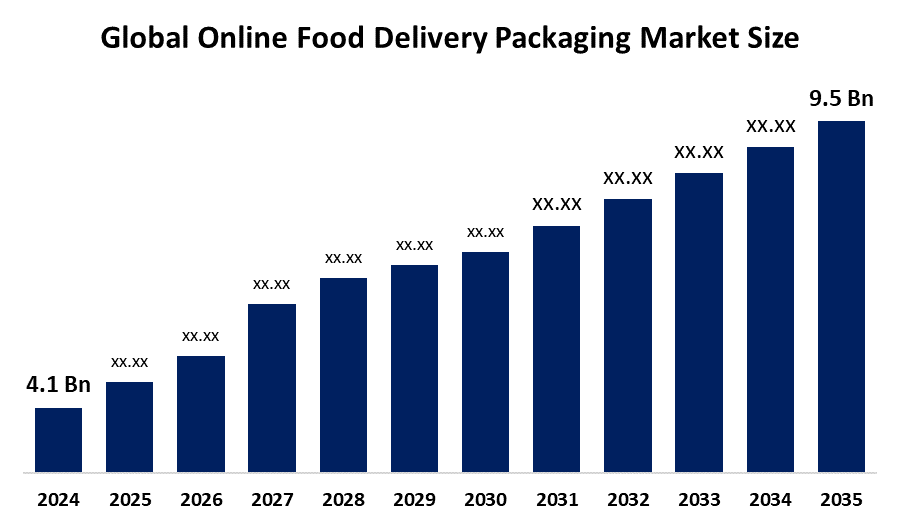

- The Global Online Food Delivery Packaging Market Size Was Estimated at USD 4.1 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.94% from 2025 to 2035

- The Worldwide Online Food Delivery Packaging Market Size is Expected to Reach USD 9.5 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Online Food Delivery Packaging Market Size was worth around USD 4.1 Billion in 2024 and is predicted to Grow to around USD 9.5 Billion by 2035 with a compound annual growth rate (CAGR) of 7.94% from 2025 and 2035. The market for online food delivery packaging has a number of opportunities to grow driven by growing customer demand for convenience, more stringent laws pertaining to food safety and sanitation, growing environmental consciousness that encourages the use of ecofriendly packaging, and the quick growth of delivery platforms and cloud kitchens.

Market Overview

Online food delivery packaging refers to the containers, bags, bottles, wraps, cups, trays, and similar packaging materials used to pack and transport food ordered online. In recent years, the online food delivery packaging market has expanded, driven by changes in consumer preferences and increasing use of meal delivery services. The increasing popularity of environmentally friendly packaging options, which has resulted from individuals’ greater awareness of environmental issues, is providing a positive market outlook. Thus, the market is developing as more and more environmentally friendly products use recycled materials, compostable packaging, and biodegradable plastics. Also, package delivery services and restaurants are using sustainable packing materials to lessen their carbon footprint. The market is growing as the demand for practical packaging solutions around the world has increased. And, more and more individuals’ order food online due to a busy work schedule and lifestyle. DoorDash has completed a $3.9 billion acquisition of U.K. based Deliveroo, enhancing its presence across Europe, Asia, and the Middle East. This acquisition follows DoorDash’s 2022 purchase of Helsinki's Wolt Enterprises, bringing its global footprint to 45 markets, including 30 in Europe.

The Ministry of Commerce and Industry's Department for Promotion of Industry and Internal Trade organized the second Plastic Free Future Packathon in partnership with Zomato. Startups are encouraged to create environmentally friendly food delivery packaging solutions for this competition. INR 10 lakh and INR 15 lakh are awarded to the prototype and ready to scale winners, respectively. The chance for shortlisted businesses to present their inventions to restaurant partners encourages the food delivery industry to adopt more environmentally friendly packaging. In 2024–2025, the FSSAI inspected 8,143 food storage facilities used by e-commerce businesses and issued notices to 526 of them for regulatory infractions. The government's dedication to guaranteeing respect for food safety requirements, particularly packaging rules, in the rapidly growing e-commerce food sector is demonstrated by this program.

Report Coverage

This research report categorizes the online food delivery packaging market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the online food delivery packaging market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the online food delivery packaging market.

Global Online Food Delivery Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.1 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.94% |

| 2035 Value Projection: | USD 9.5 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Material and COVID-19 Impact Analysis |

| Companies covered:: | Amcor Plc, Ball Corporation, Berry Global Inc., DS Smith Plc, Huhtamaki Oyj, International Paper Company, Mondi Group, Sealed Air Corporation, Smurfit Kappa Group, Stora Enso Oyj, WestRock Company, Genpak LLC, Dart Container Corporation, Reynolds Group Holdings Limited, Sabert Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The online food delivery packaging market is driven by the online food delivery packaging sector, particularly regarding sustainability. Companies that create unique biodegradable, compostable, and recyclable materials have much to gain as governments and consumers request more sustainable options. Emerging materials science and curating alternatives will provide propositions for new means of packaging, as well as ensure advances in sustainability. One emerging direction with great encouragement is smart packaging, which can provide functions like temperature controls and freshness indicators. Companies will likely be successful if they can bring advances like these to their sustainable packaging options.

Restraining Factors

The online food delivery packaging market is restricted by factors like cost deterrents to sustainable packaging materials, is price. While sustainable packaging is becoming very popular, the cost of materials such as aluminum, compostable paper, and biodegradable polymers is significantly higher than traditional plastic.

Market Segmentation

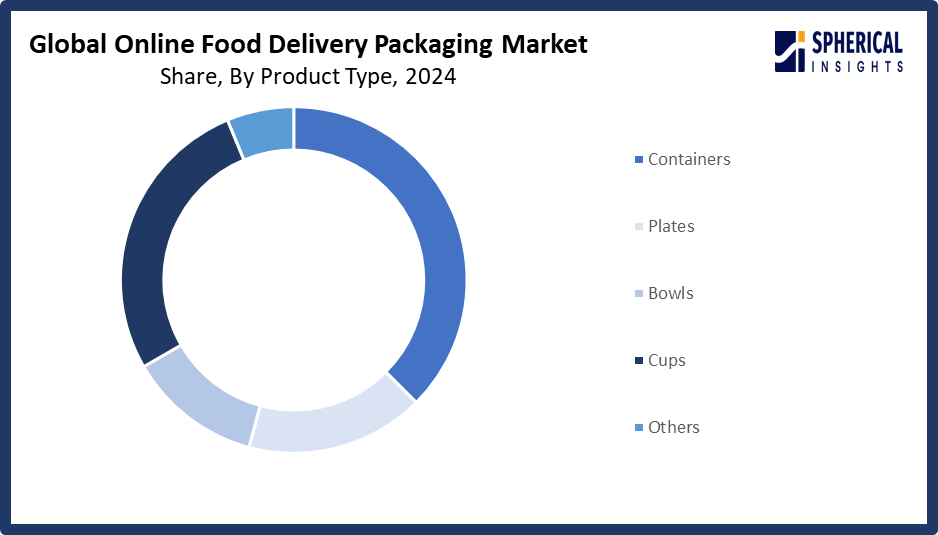

The online food delivery packaging market share is classified into product type and material.

- The containers segment dominated the market in 2024, accounting for approximately 43.1% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the online food delivery packaging market is divided into containers, plates, bowls, cups, and others. Among these, the containers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven as containers come in many options, such as plastic, paper, cardboard, and aluminum. Containers are created to hold a variety of food items, such as sandwiches, salads, and cooked meals. The growing popularity of containers, due to their additional durability and insulation properties to keep food fresh while on the go, is a trend that is supporting growth in the market. Moreover, there is an increase in the market for containers as individuals are looking for more convenience. Plates are used for many food items and dining occasions.

Get more details on this report -

- The paper and paperboard segment accounted for the largest share in 2024, accounting for approximately 47.7% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the online food delivery packaging market is divided into plastic, paper paperboard, aluminum, and others. Among these, the paper and paperboard segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is due to its eco-friendly options that carry a wide variety of food items, specifically for smaller orders or baked goods. Paper products are also lightweight, biodegradable, and customizable with branding. Paper boxes are also versatile and come with packing a variety of food items, largely, sandwiches and pastries.

Regional Segment Analysis of the Online Food Delivery Packaging Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 41.6% of the online food delivery packaging market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 41.6% of the online food delivery packaging market over the predicted timeframe. In the Asia Pacific market, the market is rising due to the growing demand from the general population for creative and effective food delivery packaging solutions. Additionally, the market is expanding due to the growing popularity of online meal delivery services brought on by individuals' shifting lifestyles. In addition, the market is expanding due to the growing demand for a variety of packaging choices that can hold various food items. Additionally, a favorable market outlook is being provided by the rising need for packaging solutions that guarantee food safety and quality while in transit.

China is growing with 30.7% due to rapid urbanization, a large population, and rising disposable incomes. The nation's thriving packaging industry serves a number of sectors, including consumer products, medicines, and food and beverage, all of which rely heavily on packaging. Furthermore, the demand for packaged goods is driven by China's high per capita income and changing consumer preferences for convenience, particularly in the retail, e-commerce, and food and beverage industries.

India is leading the APAC food packaging market with significant growth and market share. The need for food packaging, especially in urban areas, is driven by the nation's youthful population and increasing exposure to international cuisines.

North America is expected to grow at a rapid CAGR, representing nearly 35% in the online food delivery packaging market during the forecast period. The North American area has a thriving market for online food delivery packaging due to economic growth, namely the increased demand for recyclable and affordable packaging solutions. The market is being positively impacted because many individuals are concerned about the environment, which has led to the increased demand for environmentally friendly packaging material. The market is also being driven by advancements in packaging technologies, such as tamper proof seals, insulating materials, and environmentally friendly packaging alternatives.

The U.S. market is distinguished with 29.4% by high levels of innovation and a strong focus on sustainability. There is an obvious need for environmentally friendly packaging options, given the rising popularity of materials like fiber-based packaging, which is predicted to expand at the quickest rate in the years to come.

Europe continues to dominate the market due to the growing demand for effective and high-quality food delivery packaging solutions. The market is also expanding as a result of increased attention being paid to food safety and hygiene regulations. In addition, the market is expanding as more environmentally friendly packaging options are being developed to lessen carbon emissions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the online food delivery packaging market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amcor Plc

- Ball Corporation

- Berry Global Inc.

- DS Smith Plc

- Huhtamaki Oyj

- International Paper Company

- Mondi Group

- Sealed Air Corporation

- Smurfit Kappa Group

- Stora Enso Oyj

- WestRock Company

- Genpak LLC

- Dart Container Corporation

- Reynolds Group Holdings Limited

- Sabert Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, at MWC Barcelona 2025, cutting-edge AI-powered technology company TECNO brought its show theme of "Create the AI Future" to life was launching of TECNO Online Food Delivery Packaging Series. The series, which includes the most potent variants, TECNO Online Food Delivery Packaging and TECNO Online Food Delivery Packaging Pro, is TECNO's first Online Food Delivery Packaging product. It offers the best pixel Online Food Delivery Packaging photography technology available.

- In June 2025, BigBasket began piloting a 10-minute food delivery service in select areas of Bengaluru, featuring curated food and beverage offerings from Tata Group’s hospitality brands, notably Starbucks and Qmin. This initiative aims to cater to growing consumer demand for a rapid delivery experience.

- In May 2025, Zomato launched the second edition of the Plastic Free Future Packathon in collaboration with Startup India. This competition invites startups to present sustainable packaging solutions for food delivery orders. Winners in two categories, prototype and ready to scale, will receive INR 10 lakhs and INR 15 lakhs, respectively. Shortlisted startups will have the opportunity to showcase their innovations to restaurant partners.

- In August 2024, Pakka, a manufacturer of compostable packaging solutions, partnered with Brawny Bear to launch compostable flexible packaging. This innovation aims to address the challenge of hard to recycle flexible packaging, contributing to sustainability in the food delivery sector.

- In July 2023, Swiggy acquired LYNK, a retail logistics startup with a network of over 100,000 stores. This acquisition enables Swiggy to expand into the retail distribution market, serving store operators and enhancing its supply chain capabilities.

- In February 2023, Pactiv LLC, a leading manufacturer of fresh food and beverage packaging in North America, teamed up with AmSty, a manufacturer of polystyrene in North America and a pioneer in circular recycling of polystyrene. Pactiv Evergreen will offer innovative foam polystyrene packaging products with post-consumer recycled content of AmSty that is derived from advanced recycling technologies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the online food delivery packaging market based on the below-mentioned segments:

Global Online Food Delivery Packaging Market, By Product Type

- Containers

- Plates

- Bowls

- Cups

- Others

Global Online Food Delivery Packaging Market, By Material

- Plastic

- Paper and Paperboard

- Aluminum

- Others

Global Online Food Delivery Packaging Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the online food delivery packaging market over the forecast period?The global online food delivery packaging market is projected to expand at a CAGR of 7.94% during the forecast period.

-

2. What is the market size of the online food delivery packaging market?The global online food delivery packaging market size is expected to grow from USD 4.1 Billion in 2024 to USD 9.5 Billion by 2035, at a CAGR of 7.94% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the online food delivery packaging market?Asia Pacific is anticipated to hold the largest share of the online food delivery packaging market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global online food delivery packaging market?Amcor Plc, Ball Corporation, Berry Global Inc., DS Smith Plc, Huhtamaki Oyj, International Paper Company, Mondi Group, Sealed Air Corporation, Smurfit Kappa Group, Stora Enso Oyj, WestRock Company, Genpak LLC, Dart Container Corporation, Reynolds Group Holdings Limited, Sabert Corporation, and Others.

-

5. What factors are driving the growth of the online food delivery packaging market?The online food delivery packaging market growth is driven by stricter food safety laws, growing consumer demand for eco-friendly and convenient packaging options, and packaging technological breakthroughs. The growing popularity of online meal delivery services and consumers' preference for environmentally friendly products both support market growth.

-

6. What are the market trends in the online food delivery packaging market?The online food delivery packaging market trends include sustainable packaging solutions, advanced packaging technologies, customization and personalization, integration of drone delivery, and hygiene and safety features.

-

7. What are the main challenges restricting wider adoption of the online food delivery packaging market?The online food delivery packaging market trends include the high costs of sustainable materials, including bioplastics. This is made worse by the uneven supply and restricted accessibility of these resources in different geographical areas.

Need help to buy this report?