Global Oncology Companion Diagnostics Market Size, Share, and COVID-19 Impact Analysis, By Technology (Polymerase Chain Reaction (PCR), Next-generation Sequencing (NGS), Immunohistochemistry (IHC), In Situ Hybridization (ISH)/Fluorescence In Situ Hybridization (FISH), and Others), By End Use (Hospital, Pathology/Diagnostic Laboratory, and Academic Medical Center), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Oncology Companion Diagnostic Market Insights Forecasts to 2035

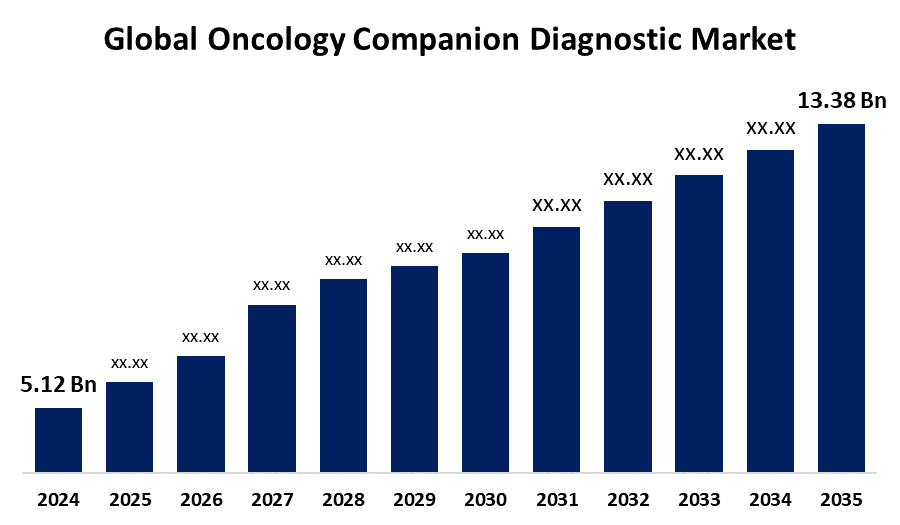

- The Global Oncology Companion Diagnostic Market Size Was Estimated at USD 5.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.13% from 2025 to 2035

- The Worldwide Oncology Companion Diagnostic Market Size is Expected to Reach USD 13.38 Billion by 2035

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Oncology Companion Diagnostic Market Size was worth around USD 5.12 Billion in 2024 and is predicted to Grow to around USD 13.38 Billion by 2035 with a compound annual growth rate (CAGR) of 9.13% from 2025 to 2035. Market growth is driven by the increasing incidence of cancer, the adoption of companion diagnostics, and the growing emphasis on personalized medicine to ensure the best possible outcomes for patients while creating efficiency considerations for developing targeted and personalized treatment strategies.

Global Oncology Companion Diagnostic Market Forecast and Revenue Outlook

- 2024 Market Size: USD 5.12 Billion

- 2035 Projected Market Size: USD 13.38 Billion

- CAGR (2025-2035): 9.13%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Market Overview

The oncology companion diagnostics market includes creating and marketing tests that detect certain biomarkers in cancer patients, assisting in the customisation of treatment choices by matching targeted therapies to unique genetic profiles, increasing efficacy, and cutting down on needless treatments. There is an urgent need for timely and effective diagnostics, as the number of cases of cancer is projected to increase to 30 million cases a year by 2040. As a mechanism for improving patient outcomes and lowering overall costs, companion diagnostics (CDx) streamline therapies and minimise those that are not valuable to a patient. CDx was developed alongside targeted medicines to enhance outcomes of clinical trials, while also reducing research and development expenses, which positions the field for considerable growth amid the rising demand for precision oncology. As the field of precision medicine evolves toward oncology, there are increased demands for cancer companion diagnostics that determine the appropriateness of a patient for targeted therapies. FoundationOne CDx tests for BRCA-mutated metastatic prostate cancer were authorised by the FDA in September 2024. This will allow for early and efficient therapy with olaparib combinations, enhancing results and reducing trial-and-error methods. The increasing use of Comprehensive Genomic Profiling (CGP), which offers comprehensive tumour genomic insights to support individualised treatment decisions, increases demand for oncology companion diagnostics. Compared to lesser tests, CGP provides a more comprehensive analysis, supporting treatments such as immunotherapies and tumour-agnostic medications. Continuous innovation in this sector is driven by the rapid breakthroughs in genomic technology. Illumina's TruSight Oncology Comprehensive test, for instance, was authorised by the FDA in August 2024 as a companion diagnostic for larotrectinib and selpercatinib in malignancies that are fusion-positive for NTRK and RET.

Key Market Insights

- North America is expected to account for the largest share in the Oncology Companion Diagnostic Market during the forecast period.

- In terms of technology, the polymerase chain reaction (PCR) segment is projected to lead the Oncology Companion Diagnostic Market throughout the forecast period.

- In terms of end use, the hospital segment captured the largest portion of the market.

Oncology Companion Diagnostic Market Trends

- Precision medicine is being used more often for individualised cancer treatment.

- Genetic technologies, such as Comprehensive Genetic Profiling (CGP), are developing quickly.

- FDA approvals for companion diagnostics associated with targeted treatments are increasing.

- Wider biomarker detection made possible by the expansion of pan-cancer testing.

- Enhancing international collaborations between educational institutions and medical institutions.

Report Coverage

This research report categorizes the oncology companion diagnostics market based on various segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oncology companion diagnostics market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oncology companion diagnostics market.

Global Oncology Companion Diagnostic Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.13% |

| 2035 Value Projection: | USD 13.38 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 226 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Agilent Technologies, Inc., Illumina, Inc., QIAGEN, Thermo Fisher Scientific Inc., Foundation Medicine, Inc., Myriad Genetics, Inc., F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Abbott, Leica Biosystems Nussloch GmbH, Guardant Health, EntroGen, Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving factors

The rising incidence of many cancers worldwide is leading to an increased demand for complex diagnostic tools that can determine which patients may benefit from more targeted therapies. In addition to personalised medicine, or evaluating patients with specific profiles for specific treatments, the use of diagnostic tools to determine what specific molecular pathways are altered in a patient's malignant tumours will also enhance growth in the oncology companion diagnostic market.

Restraining Factor

The development and validation of companion diagnostics requires substantial investments in research, clinical studies, and regulatory frameworks, which creates barriers for smaller companies and laboratories. Another factor that impedes the market development is the creation of limitations for technology, such as NGS, as a result of insufficient coverage of the tests via insurance payers, leading to lower uptake from the supplier market.

Market Segmentation

The Global oncology companion diagnostics market is divided into technology and end use.

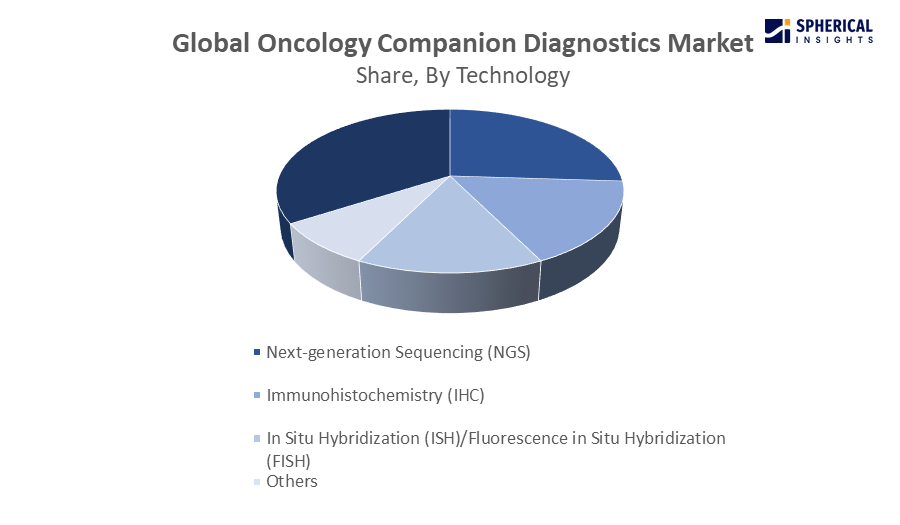

Global Oncology Companion Diagnostics Market, By Technology:

- The polymerase chain reaction (PCR) segment dominated the market with a share of 28.4% in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, the global oncology companion diagnostics market is segmented into polymerase chain reaction (PCR), next-generation sequencing (NGS), immunohistochemistry (IHC), in situ hybridization (ISH)/fluorescence in situ hybridization (FISH), and others. Among these, the polymerase chain reaction (PCR) segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Real-time PCR assays have become the method of choice for any type of cancer diagnosis due to their excellent sensitivity and specificity. In addition, real-time PCR methods are also a good choice for the analysis of cancer markers. The advantages of real-time PCR in clinical laboratories include internal controls, low reagent costs, the ability to detect many genes simultaneously, and the preservation of precious biopsy specimens for tumour profiling. A recently launched example would be Qiagen's release of the QIAcuityDx Digital PCR System for clinical oncology diagnosis in North America and Europe in September 2024. With accurate measurement of DNA/RNA, this technology makes liquid biopsy applications and running the laboratory easier.

Get more details on this report -

The next-generation sequencing (NGS) segment in the oncology companion diagnostics market is expected to grow at the fastest CAGR over the forecast period. Cancer diagnoses have advanced dramatically during the last decade as a result of the introduction of NGS. Advances in NGS technology have assisted the advancement in different fields of cancer research.

Global Oncology Companion Diagnostics Market, By End use:

- The hospital segment accounted for the largest share with a 30.4% in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on end use, the global oncology companion diagnostics market is segmented into hospital, pathology/diagnostic laboratory, and academic medical center. Among these, the hospital segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Over the last few years, cancer diagnostic devices have been increasingly used within hospitals due to the upwards trend of cancer incidence and the increased ageing population. The growing acceptance of diagnostic innovation has also increased the adoption by hospitals. Hospital labs are advancing to meet the needs of patients, as those needs shift. To assist with the early identification of cancer in patients whose symptoms are less-than-clear, NHS Forth Valley, a health authority in Scotland, established a Rapid Cancer Diagnostic Service (RCDS) in May 2025. By ruling cancer out or starting treatment earlier, this initiative aims to enhance patient care, reduce uncertainty, and improve the patient experience. The program involved a coordinated effort with testing and assessments and required the collaboration of multiple medical providers.

The pathology/diagnostic laboratory segment in the oncology companion diagnostics market is expected to grow at the fastest CAGR over the forecast period. In the market for oncology companion diagnostics, the pathology/diagnostic laboratory is essential. These labs are in charge of creating and executing tests that assist in locating particular biomarkers in cancer patients, allowing for the selection of suitable tailored treatments. To guarantee accurate test findings and wise treatment choices, they collaborate closely with patients, healthcare professionals, and pharmaceutical companies.

Regional Segment Analysis of the Global Oncology Companion Diagnostic Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America Oncology Companion Diagnostics Market Trends

Get more details on this report -

North America is expected to hold the largest share, 40.17 % in 2024, of the global oncology companion diagnostics market over the forecast period.

North America is expected to grow at the fastest CAGR in the oncology companion diagnostics market during the forecast period. The region's supremacy is ascribed to North America's high healthcare spending and sophisticated healthcare infrastructure, which promote the broad use of diagnostic technologies. Furthermore, cutting-edge diagnostic techniques are the focus of top research institutes and biotechnology companies. The nation's oncology companion diagnostic market is expected to be greatly boosted during the forecast period by these aspects, as well as a strong regulatory structure that guarantees prompt approval and commercialisation of novel diagnostic instruments.

U.S. Oncology Companion Diagnostics Market Trends

Cancer is so common in the United States, and sophisticated companion diagnostics are being adopted so quickly, that the market for oncology companion diagnostics is anticipated to expand throughout the projected period. For example, Nanostics and Protean BioDiagnostics introduced CDX Prostate in the United States in September 2024. Informed biopsy decisions are aided by this AI-powered blood test that evaluates aggressive prostate cancer risk. For men with abnormal DRE results or elevated PSA levels, Protean's CLIA-certified lab in Orlando, Florida, improves clinical decision-making. Significant technological developments, a rise in FDA test approvals, and increased competition among biotechnology firms are also anticipated to propel the market throughout the forecast period.

Asia Pacific Oncology Companion Diagnostics Market Trends

Asia Pacific is expected to grow at the fastest CAGR in the oncology companion diagnostics market during the forecast period. The rising population, improved infrastructure and healthcare reform, and inevitably, the arrival of more local businesses into the space, There is a humid focus on oncology in this region because it is populated, and there is high prevalence of cancer in the region, where nearly half of all cancer cases globally and approximately 56.1% of all deaths due to cancer occurred in Asia in 2022, according to Global Cancer Statistics 2022. Local businesses entering the marketplace will likely also influence the demand for companion diagnostics. The region is a significant market for oncology companion diagnostics due to the high cancer incidence and prevalence, which speaks to the need for effective diagnostic solutions.

Europe Oncology Companion Diagnostics Market Trends

This is due to established markets like Germany, Spain, the UK, France, and Italy. These countries' modern infrastructure is anticipated to significantly enhance the feasibility of clinical research in the area. A supportive and evolving regulatory environment is also conducive to the development and market entry of companion diagnostics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global oncology companion diagnostics market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Worldwide Top Key Players in The Oncology Companion Diagnostics Market Include

- Agilent Technologies, Inc.

- Illumina, Inc.

- QIAGEN

- Thermo Fisher Scientific Inc.

- Foundation Medicine, Inc.

- Myriad Genetics, Inc.

- F. Hoffmann-La Roche Ltd

- BIOMÉRIEUX

- Abbott

- Leica Biosystems Nussloch GmbH

- Guardant Health

- EntroGen, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent development

- In May 2025, the U.S. FDA approved the VENTANA MET (SP44) RxDx Assay as a companion diagnostic for telisotuzumab vedotin (Emrelis) in non-small cell lung cancer (NSCLC). This immunohistochemistry based test identifies patients with high c MET protein overexpression, a key biomarker for selecting candidates for this targeted therapy. The approval was supported by data from the Phase 2 LUMINOSITY trial, which demonstrated a 35% overall response rate in patients with high c MET expression treated with telisotuzumab vedotin.

- In Mar 2025, Agilent Technologies Inc. announced that its PD L1 IHC 28 8 pharmDx kit has received two new companion diagnostic indications approvals under EU IVDR. Simon May, senior vice president of Agilent's Life Sciences and Diagnostics Markets Group, replied that these two inserted indications of PD L1 IHC 28 8 pharmDx will deliver physicians in Europe crucial data to inform treatment decisions for patients with ordinary and certainly fatal cancers.

- In October 2024, Qiagen launched QiAcuityDx, which is a digital PCR system in ancology for clinical testing that assists in the precise quantification of target DNA and RNA.

- In April 2024, McKesson launched Precision Care Companion for biomarkers, which is used in genomic testing and targeted therapies.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oncology companion diagnostics market based on the following segments:

Global Oncology Companion Diagnostics Market, By Technology

- Polymerase Chain Reaction (PCR)

- Next-generation Sequencing (NGS)

- Immunohistochemistry (IHC)

- In Situ Hybridization (ISH)/Fluorescence in Situ Hybridization (FISH)

- Others

Global Oncology Companion Diagnostics Market, By End Use

- Hospital

- Pathology/Diagnostic Laboratory

- Academic Medical Center

Global Oncology Companion Diagnostics Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the Oncology Companion Diagnostics market over the forecast period?The global Oncology Companion Diagnostics market is projected to expand at a CAGR of 9.13% during the forecast period.

-

2. What is the market size of the Oncology Companion Diagnostics market?The global Oncology Companion Diagnostics market size is expected to grow from USD 5.12 billion in 2024 to USD 13.38 billion by 2035, at a CAGR 9.13% of during the forecast period 2025-2035.

-

3. Which region holds the largest share of the Oncology Companion Diagnostic market?North America is anticipated to hold the largest share of the Oncology Companion Diagnostics market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global Oncology Companion Diagnostic market?Agilent Technologies, Inc., Illumina, Inc., QIAGEN, Thermo Fisher Scientific Inc., Foundation Medicine, Inc., Myriad Genetics, Inc., F. Hoffmann-La Roche Ltd, BIOMÉRIEUX, Abbott, Leica Biosystems Nussloch GmbH.

-

5. What factors are driving the growth of the Oncology Companion Diagnostic market?The Oncology Companion Diagnostic market is driven by rising cancer incidence, growing adoption of precision medicine, advancements in genomic technologies, increased FDA approvals, and expanding global collaborations in research and healthcare.

Need help to buy this report?