Global Omeprazole Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Capsules, Tablets, and Powder), By Application (Gastroesophageal Reflux Disease, Peptic Ulcer Disease, Zollinger-Ellison Syndrome, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: HealthcareGlobal Omeprazole Market Insights Forecasts to 2035

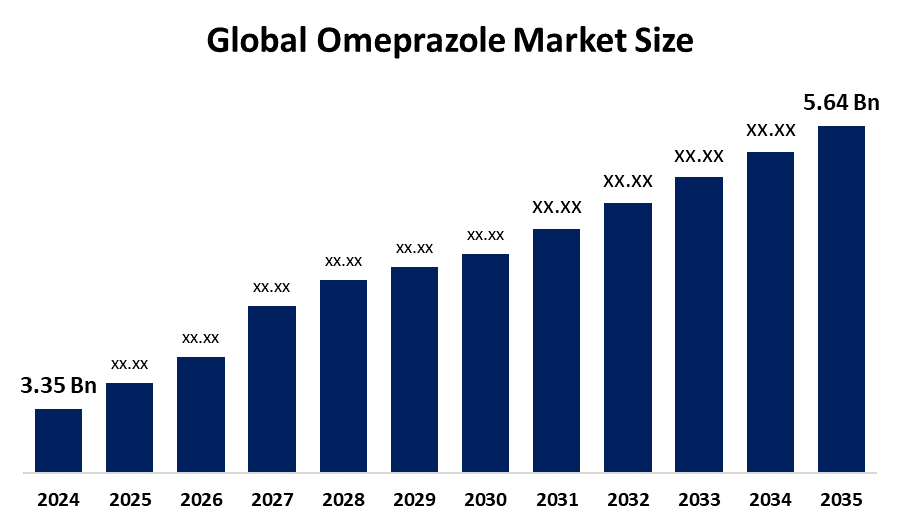

- The Global Omeprazole Market Size Was Estimated at USD 3.35 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.85% from 2025 to 2035

- The Worldwide Omeprazole Market Size is Expected to Reach USD 5.64 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Global Omeprazole Market Size was worth around USD 3.35 Billion in 2024 and is predicted to grow to around USD 5.64 Billion by 2035 with a compound annual growth rate (CAGR) of 4.85% from 2025 to 2035. The market for omeprazole is expanding as the prevalence of gastrointestinal diseases increases, and populations are aging and becoming increasingly over-the-counter oriented. Growing healthcare access in developing economies also spurs demand for this cheap yet effective therapy for the such as GERD and ulcers.

Market Overview

The global omeprazole market refers to the production and supply of omeprazole, a proton pump inhibitor (PPI) commonly prescribed for treating gastroesophageal reflux disease (GERD), ulcers, and other acid-related disorders of the stomach. Omeprazole operates by retarding the production of stomach acid, easing heartburn symptoms, and enabling healing of the esophagus and gastric lining. The market has shown consistent growth fueled by the rising prevalence of acid reflux diseases, sedentary lifestyles, and rising consumption of processed foods. The ageing population and enhanced awareness of gastrointestinal health also led to demand. Innovation in drug delivery systems, such as orally disintegrating tablets and extended-release capsules, has helped enhance patient compliance and convenience.

Growth opportunities are present in emerging nations due to more healthcare infrastructure, rising insurance coverage, and greater consumer access to over-the-counter medications. The large pharma companies, such as AstraZeneca, Dr. Reddy's Laboratories, Teva Pharmaceuticals, and Sun Pharma, control the market, competing among themselves with generic versions and price models. Supportive government policies for generic drugs and essential medicines lists have contributed to the growth of the market. Regulatory support, combined with increased R&D spending, beckons ongoing innovation and cost-saving. On July 1, 2025, the National Centre for Pharmacoeconomics (NCPE) recommends reimbursement by the Health Service Executive (HSE) of omeprazole (Appizped) only if cost-effectiveness is improved over current therapy. This NCPE recommendation mirrors the high degree of attention. Payers are placing value on clinical and economic thought as pharmaceutical companies seek Irish market entry.

Report Coverage

This research report categorizes the omeprazole market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the omeprazole market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the omeprazole market.

Global Omeprazole Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product Type, By Application, By Distribution Channel and By Region |

| Companies covered:: | Dr. Reddys Laboratories, AstraZeneca, Sandoz (Novartis), Teva Pharmaceutical Industries, Mylan N.V. (Viatris), Sun Pharmaceutical Industries, Aurobindo Pharma, Zydus Cadila, Bayer AG, Lupin Pharmaceuticals, Pfizer, Abbott Laboratories, Apotex Inc., Perrigo Company PLC, Others, and |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The omeprazole market globally is led by the increasing incidence of gastroesophageal reflux disease (GERD), peptic ulcers, and acid-related disorders. Sedentary lifestyles, increased intake of processed food, and stress drive demand upward. Increasing gastrointestinal awareness, an aging population, and extensive availability of over-the-counter products also drive market growth. Generic drug uptake and increased healthcare access in the emerging economies further drive continued market growth.

Restraining Factors

Key limiting factors for the global omeprazole market are intense generic competition, fears of long-term side effects (e.g., kidney illness, bone fractures), and growing access to other proton pump inhibitors. Increased regulatory pressures and price pressures also limit market expansion.

Market Segmentation

The omeprazole market share is classified into product type, application, and distribution channel.

- The capsules segment dominated the market in 2024, approximately 48% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the omeprazole market is divided into capsules, tablets, and powder. Among these, the capsules segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. This market is dominated due to they are easy to swallow and promote better patient compliance, particularly for individuals with difficulty swallowing tablets. Capsules are intended for both immediate and extended drug release and promote better therapeutic effectiveness. Their use is growing consistently with the support of efficacy and the increasing incidence of gastrointestinal diseases necessitating long-term medication.

Get more details on this report -

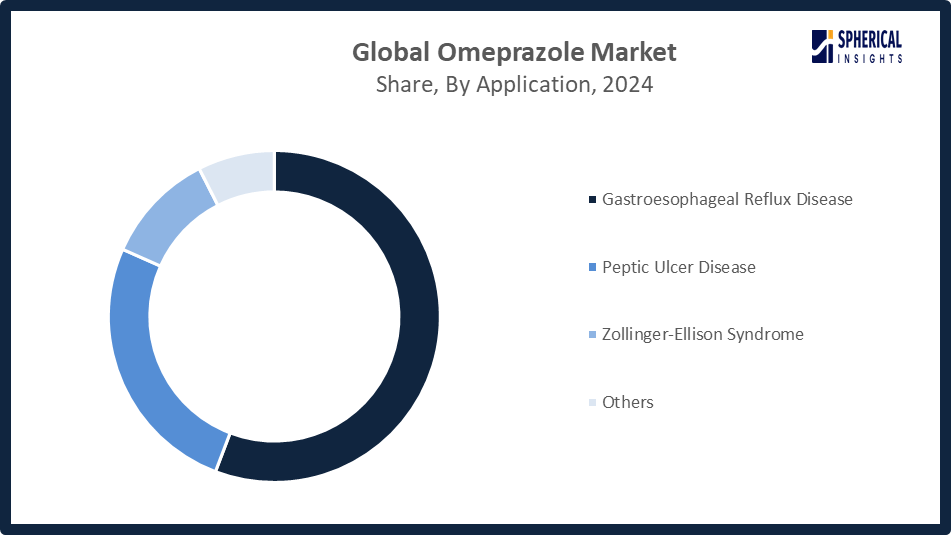

- The gastroesophageal reflux disease segment accounted for the largest share in 2024, approximately 56% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the omeprazole market is divided into gastroesophageal reflux disease, peptic ulcer disease, Zollinger-Ellison syndrome, and others. Among these, the gastroesophageal reflux disease segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Omeprazole has its main application for GERD, a long-term condition in which stomach acid moves back up into the esophagus. The increased global prevalence of GERD fuels demand for omeprazole, which provides effective relief from heartburn and acid regurgitation. Increased awareness of GERD and its severe complications if left untreated further bolsters such growing demand globally.

- The retail pharmacies segment accounted for the highest market revenue in 2024, approximately 43% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the omeprazole market is divided into hospital pharmacies, retail pharmacies, online pharmacies, and others. Among these, the retail pharmacies segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Retail pharmacies are an essential channel for distributing omeprazole, providing ready access in urban and rural settings. Since they are typically the first place that many patients go for treatment, they generate demand through prescription and over-the-counter sales. Channel growth is stimulated by heightened consumer awareness, escalating healthcare expenditures, and demand for easy treatment of gastrointestinal symptoms.

Regional Segment Analysis of the Omeprazole Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the omeprazole market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the omeprazole market over the predicted timeframe. North America is expected to account for 38% market share of the omeprazole market during the forecast period due to the high incidence of gastroesophageal reflux disease (GERD), extensive healthcare penetration, and robust pharma infrastructure. The United States alone plays a major role owing to its large elderly population, high obesity, and growing use of processed foods, major risk factors for GERD. Also, the availability of leading pharmaceutical firms, sophisticated drug development, and elevated use of over-the-counter medication drive market growth regionally.

Asia Pacific is expected to grow at a rapid CAGR in the omeprazole market during the forecast period. Asia Pacific is rapidly growing in the omeprazole market throughout the forecast period, with approximately 26% of market share, spurred by the increasing incidence of acid-related diseases, increased awareness of gastrointestinal illness, and greater access to healthcare. India and China are leading contributors, with their huge population, growing middle class, and increasing usage of generics. Omeprazole is prevalently utilized both as a prescription drug and as an over-the-counter drug in India, aided by government efforts for low-cost generics and enhanced accessibility in rural and urban healthcare infrastructure.

On 24 July 2025, in a decisive move against what it viewed as an unjustified price escalation, the Multi-Disciplinary Committee (MDC) under India's drug pricing regulator, the National Pharmaceutical Pricing Authority (NPPA), has rejected Dr Reddy's Laboratories' application for a special price of Rs 17.90 per tablet (excluding GST) for its Omeprazole orally disintegrating tablet (ODT) 20 mg, branded as Omez ODT.

Europe holds a steady growth in the omeprazole market, driven by an aging population, rising healthcare spending, and increasing acid-related disorders. Key countries such as Germany, France, and the UK focus on improving healthcare access and treatment outcomes. High demand for prescription omeprazole, supported by government initiatives, fuels growth. The region is expected to see moderate growth, emphasizing innovation and expanded therapeutic uses.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the omeprazole market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dr. Reddy's Laboratories

- AstraZeneca

- Sandoz (Novartis)

- Teva Pharmaceutical Industries

- Mylan N.V. (Viatris)

- Sun Pharmaceutical Industries

- Aurobindo Pharma

- Zydus Cadila

- Bayer AG

- Lupin Pharmaceuticals

- Pfizer

- Abbott Laboratories

- Apotex Inc.

- Perrigo Company PLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2022, Perrigo received FDA approval for its Omeprazole Magnesium Delayed-Release Mini Capsules, 20 mg OTC, launching later that year. These mini capsules are 70% smaller than traditional tablets, offering a first-to-market, consumer-preferred option for frequent heartburn, marketed under retailer store brands such as Prilosec OTC.

- In May 2018, Zydus Cadila received final approval to market Omeprazole and Sodium Bicarbonate capsules (20 mg/1100 mg and 40 mg/1100 mg) for treating acid reflux and ulcers. The capsules are manufactured at their formulation facility in Moraiya, Ahmedabad.

- In April 2018, Perrigo and Dexcel Pharma launched store-brand Omeprazole Delayed Release Orally Disintegrating Tablets (20 mg) OTC for frequent heartburn. Featuring MelTech melt-in-mouth technology, the FDA-approved tablets dissolve without water and are marketed under retailers' own-label brands, offering consumers a convenient, high-quality treatment option.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the omeprazole market based on the below-mentioned segments:

Global Omeprazole Market, By Product Type

- Capsules

- Tablets

- Powder

Global Omeprazole Market, By Application

- Gastroesophageal Reflux Disease

- Peptic Ulcer Disease

- Zollinger-Ellison Syndrome

- Others

Global Omeprazole Market, By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Others

Global Omeprazole Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the omeprazole market over the forecast period?The global omeprazole market is projected to expand at a CAGR of 4.85% during the forecast period.

-

2. What is the market size of the omeprazole market?The global omeprazole market size is expected to grow from USD 3.35 billion in 2024 to USD 5.64 billion by 2035, at a CAGR of 4.85% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the omeprazole market?North America is anticipated to hold the largest share of the omeprazole market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the global omeprazole market?The major players operating in the omeprazole market are Dr. Reddy's Laboratories, AstraZeneca, Sandoz (Novartis), Teva Pharmaceutical Industries, Mylan N.V. (Viatris), Sun Pharmaceutical Industries, Aurobindo Pharma, Zydus Cadila, Bayer AG, Lupin Pharmaceuticals, Pfizer, Abbott Laboratories, Apotex Inc., Perrigo Company PLC, and Others.

-

5. What is the omeprazole market?The omeprazole market is a global market for the drug omeprazole, a proton pump inhibitor used to treat acid-related gastrointestinal disorders like GERD and peptic ulcers.

-

6. What factors are driving the growth of the omeprazole market?The omeprazole market is growing due to the rising prevalence of gastrointestinal disorders, the increasing number of elderly and obese individuals, and increased access to affordable generic and over-the-counter (OTC) products.

-

7. What are the market trends in the omeprazole market?The main market trends for omeprazole include the rising prevalence of gastrointestinal disorders, an increase in self-medication and over-the-counter (OTC) sales, and growth in emerging markets due to affordability.

-

8. What are the main challenges restricting wider adoption of the omeprazole market?Several main challenges restrict the wider adoption of the omeprazole market, including significant competition from alternative drugs, growing concerns about the side effects of long-term use, and pricing pressure from generic versions.

Need help to buy this report?