Global Oleochemicals Market Size, Share, and COVID-19 Impact Analysis, By Product (Specialty Esters, Fatty Acid Methyl Ester, Glycerol Esters, Alkoxylates, Fatty Amines, and Other Products), By Application (Food & Beverages, Chemicals, Animal Feed, and Other Applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Oleochemicals Market Insights Forecasts to 2035

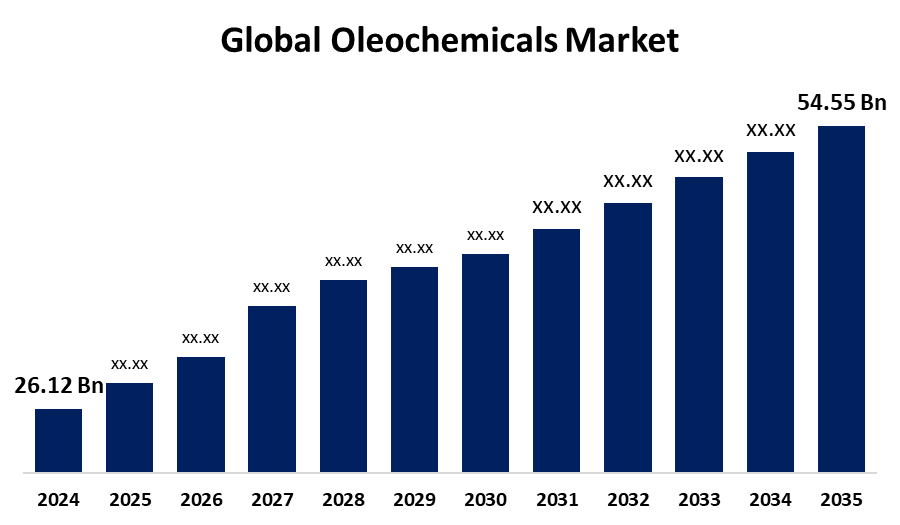

- The Global Oleochemicals Market Size Size Was Estimated at USD 26.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.92% from 2025 to 2035

- The Worldwide Oleochemicals Market Size is Expected to Reach USD 54.55 Billion by 2035

- North America is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Oleochemicals Market Size was Worth Around USD 26.12 Billion in 2024 and is Predicted to Grow to Around USD 54.55 Billion by 2035 with a Compound Annual Growth Rate (CAGR) of 6.92% from 2025 to 2035. The growing demand for biodegradable products, low cost & sustainability of raw materials, and restrictions on the use of petrochemical-based products are driving the oleochemicals market.

Market Overview

The Oleochemicals Market Size refers to the production and consumption of chemical compounds derived from natural fats and oils, primarily from plant and animal sources. Oleochemicals are the analogues to petrochemicals, derived from renewable resources such as plant oils and rendered animal fats. The widespread application of oleochemicals across the personal care, cosmetics, food, detergents, and industrial lubricants sectors is driving the market. Further, the gentle and eco-friendly properties of oleochemicals, including coconut oil and palm oil, are driving their usage in the manufacturing of soaps, shampoos, and skin care products. The market growth is further driven by the personal care industry's increasing focus on maximizing the product visibility via online promotional activities, sweepstakes, and other initiatives in the developed regions. The growing demand for sustainable and renewable products as an alternative to petrochemical products across diverse sectors, especially in food & beverages and feed products, is offering growth opportunities in the oleochemicals market.

Report Coverage

This research report categorizes the oleochemicals market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oleochemicals market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oleochemicals market.

Global Oleochemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.92% |

| 2035 Value Projection: | USD 54.55 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Application, By Region |

| Companies covered:: | Vantage Specialty Chemicals Inc., Emery Oleochemicals, Evonik Industries AG, Wilmar International Ltd., Kao Chemicals Global, Ecogreen Oleochemicals, Corbion N.V, Cargill, Incorporated, Oleon NV, Godrej Industries, IOI Corporation Berhad, KLK OLEO, Evyap, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

An increasing demand for biodegradable products for a diverse range of applications, such as cosmetics, detergents, and lubricants driving the demand for oleochemicals, as it's derived from natural sources such as vegetable oils and animal fats. The use of vegetable oil as an excellent raw material for oleochemicals with low cost and sustainability is propelling the market for oleochemicals. The restrictions in the use of petroleum-based products due to their non-renewable nature and health risks, including toxicity and carcinogenic potential responsible for propelling the oleochemicals market.

Restraining Factors

The growing environmental concerns associated with the production process are challenging the oleochemicals market. Further, the volatility in raw material prices is hampering the market growth.

Market Segmentation

The oleochemicals market share is classified into product and application.

- The glycerol esters segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the product, the oleochemicals market is divided into specialty esters, fatty acid methyl ester, glycerol esters, alkoxylates, fatty amines, and other products. Among these, the glycerol esters segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Glycerol ester compounds, including monoglycerides, diglycerides, and triglycerides, are formed through the reaction of glycerol (also known as glycerin) with fatty acids. The significant use of food-grade glycerol esters in the production of ice creams, chewing gums, flavoured beverages, and cosmetics is driving the market demand.

- The food & beverages segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the oleochemicals market is divided into food & beverages, chemicals, animal feed, and others. Among these, the food & beverages segment held the largest market share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. Oleochemicals are serving as food additives, emulsifiers, and processing aids in the food and beverage industry, which aids in improving the consistency, texture, and shelf life of food products, particularly in the baking, confectionery, and dairy products. The application of specialty oleochemical derivatives in frozen foods, confectionery, and beverage processing is propelling the market.

Regional Segment Analysis of the Oleochemicals Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the oleochemicals market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the oleochemicals market over the predicted timeframe. The restricted use of petroleum-based products owing to their harmful environmental effects and strict government regulations is propelling the demand for oleochemicals, thereby escalating the market. Further, the awareness about the detrimental effects of the exploitation of fossil fuels and petrochemical resources is contributing to promoting the oleochemicals market.

North America is expected to grow at a rapid CAGR in the oleochemicals market during the forecast period. The strict regulations associated with practising sustainability with the increasing plant-based product demand, are responsible for propelling the market demand for oleochemicals. The presence of key companies in countries like Malaysia and Indonesia is responsible for driving the regional market.

Europe is anticipated to hold a substantial share of the oleochemicals market during the projected timeframe. An increasing demand for biodiesel over conventional petroleum diesel is driving the oleochemical demand, thereby propelling the market. An increasing awareness about climate change, pollution, and other environmental issues is contributing to promoting the use of oleochemicals, thereby escalating the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oleochemicals market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vantage Specialty Chemicals, Inc.

- Emery Oleochemicals

- Evonik Industries AG

- Wilmar International Ltd.

- Kao Chemicals Global

- Ecogreen Oleochemicals

- Corbion N.V

- Cargill, Incorporated

- Oleon NV

- Godrej Industries

- IOI Corporation Berhad

- KLK OLEO

- Evyap

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2024, Corbion, a leading global supplier of world-class ingredient solutions, announced the expansion of its partnership with IMCD, a global distribution partner and formulator of specialty chemicals and ingredients, to include Corbion products for the Food and Beverage market in Thailand.

- In April 2024, Vantage Specialty Chemicals, a leading manufacturer and supplier of bio-based ingredients built on core surfactant chemistries, is expanding taurate capacity at its major manufacturing site in Leuna, Germany.

- In January 2024, the Chemical Division of Godrej Industries Limited announced that the company had signed a nonbinding memorandum of understanding (MoU) with the Government of Gujarat. As part of the MoU, the Company may plan to invest Rs 600 crore over the next four years on the significant expansion in Valia with employment of around 250.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oleochemicals market based on the below-mentioned segments:

Global Oleochemicals Market, By Product

- Specialty Esters

- Fatty Acid Methyl Ester

- Glycerol Esters

- Alkoxylates

- Fatty Amines

- Other Products

Global Oleochemicals Market, By Application

- Food & Beverages

- Chemicals

- Animal Feed

- Other Applications

Global Oleochemicals Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the oleochemicals market over the forecast period?The global oleochemicals market is projected to expand at a CAGR of 6.92% during the forecast period.

-

2. What is the market size of the oleochemicals market?The global oleochemicals market size is expected to grow from USD 26.12 Billion in 2024 to USD 54.55 Billion by 2035, at a CAGR of 6.92% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the oleochemicals market?Asia Pacific is anticipated to hold the largest share of the oleochemicals market over the predicted timeframe.

Need help to buy this report?