Global Oil-immersed Iron Core Series Reactor Market Size, Share, and COVID-19 Impact Analysis, By Type (Single Phase and Three Phase), By Voltage Rating (Low Voltage, Medium Voltage, and High Voltage), By Application (Power System, New Energy, Rail, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Machinery & EquipmentGlobal Oil-immersed Iron Core Series Reactor Market Insights Forecasts to 2035

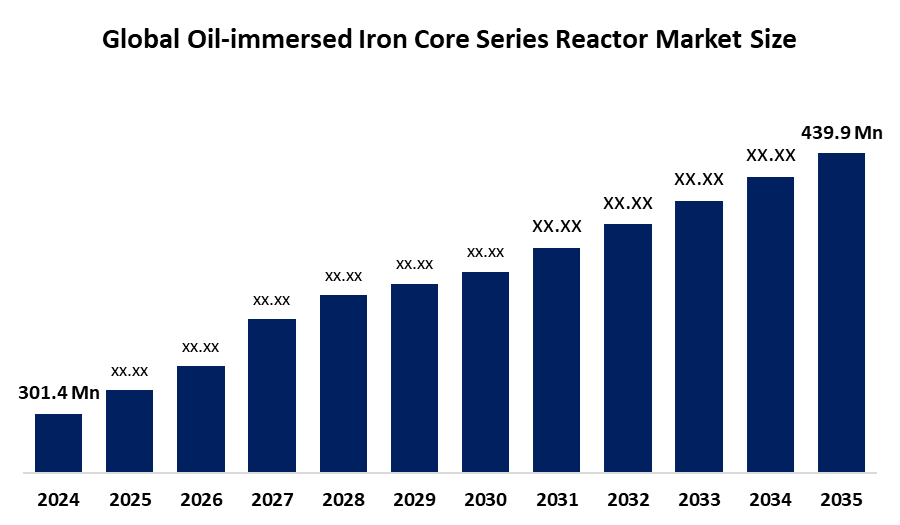

- The Global Oil-immersed Iron Core Series Reactor Market Size Was Estimated at USD 301.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.5% from 2025 to 2035

- The Worldwide Oil-immersed Iron Core Series Reactor Market Size is Expected to Reach USD 439.9 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global oil-immersed iron core series reactor market size was worth around USD 301.4 million in 2024 and is predicted to grow to around USD 439.9 million by 2035 with a compound annual growth rate (CAGR) of 3.5% from 2025 to 2035. The worldwide market for oil-immersed iron core series reactors is expanding due to rising electricity requirements, the incorporation of renewable energy sources (such as wind and solar) and the necessity for updating and stabilizing the grid. These reactors assist in controlling voltage variations and the distribution of power in high-voltage transmission networks.

Market Overview

The worldwide market for oil-immersed iron-core series reactors refers to voltage electrical devices created to restrict fault currents, control voltage levels and enhance power quality within transmission and distribution systems. These reactors feature an oil-cooled iron core to guarantee thermal stability and dependable long-term performance. They are extensively utilized in substations, points of energy integration and industrial power setups. Market expansion is fueled by increasing electricity usage, improvements to the grid and the need for reliability as the proportion of renewable energy rises.

In December 2024, the U.S. Grid Deployment Office (GDO) announced $14.5 billion in grants to enhance grid reliability, resilience, and transmission capability. This funding consequently drives demand for high-voltage gear, such as transformers and oil-immersed iron-core series reactors, facilitating upgrades to the country's power infrastructure. Possible growth opportunities involve building power infrastructure in emerging nations and modernizing grids in developed countries. Producers are prioritizing insulation technologies, more compact configurations and enhanced efficiency to align with changing utility demands. Prominent industry players generally consist of power equipment firms such as ABB, Siemens Energy, GE Grid Solutions and Toshiba Energy Systems, which all play roles in technological progress and wider market acceptance.

Report Coverage

This research report categorizes the oil-immersed iron core series reactor market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oil-immersed iron core series reactor market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oil-immersed iron core series reactor market.

Driving Factors

Global Oil-immersed Iron Core Series Reactor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 301.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.5% |

| 2035 Value Projection: | USD 439.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type |

| Companies covered:: | Siemens Energy, GE Grid Solutions, ABB, Fuji Electric, Hitachi Energy, Schneider Electric, Toshiba Energy Systems, Eaton Corporation, CG Power and Industrial Solutions, SGB-Smit, Mitsubishi Electric Corporation, Hyosung Heavy Industries, GBE SpA, Nissin Electric Co Ltd, Shrihans Electricals Pvt. Ltd., and other players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

The worldwide market for oil-immersed iron-core series reactors is propelled by increasing electricity consumption, modernization of power grids and the growth of high-voltage transmission infrastructures. The escalating incorporation of energy necessitates enhanced voltage control, fault current restriction and reactive power support, capabilities provided by these reactors. Rising investments in substations in emerging regions additionally boost demand. Utility companies also aim for grid reliability and protection of equipment as electrification advances in industrial sectors and cities. Moreover, innovations that improve efficiency, dependability and heat management drive adoption while rigorous grid safety regulations and the imperative to minimize power losses keep advancing the market.

Restraining Factors

The market for oil-immersed iron-core series reactors encounters challenges including upfront expenses, complicated installation processes and a demand for ongoing upkeep of oil-insulated devices. Additionally, environmental issues stemming from oil spills, the presence of dry-type options and prolonged utility acquisition procedures hinder quicker adoption and expansion of the market.

Market Segmentation

The oil-immersed iron core series reactor market share is classified into type, voltage rating, and application.

- The three phase segment dominated the market in 2024, approximately 64% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the oil-immersed iron core series reactor market is divided into single phase and three phase. Among these, the three phase segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Utilities and electrical experts extensively utilize three-phase systems due to their power capacity, dependability and economical management of power quality across various grid applications. Offering compatibility and demonstrated effectiveness, they enable optimal system accuracy. Increasing utility investments in innovative three-phase technology continue to bolster their use, positioning these systems as elements in contemporary power quality and grid reliability approaches.

- The high voltage segment accounted for the largest share in 2024, approximately 52% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the voltage rating, the oil-immersed iron core series reactor market is divided into low voltage, medium voltage, and high voltage. Among these, the high voltage segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The high-voltage segment growth is driven by the expansion of long-range transmission lines, greater incorporation of renewable energy sources and heightened requirement for consistent voltage control. Oil-immersed iron-core series reactors offer insulation, heat management and dependability for high-voltage uses, rendering them crucial for contemporary grid systems and extensive power system enhancements.

The power system segment accounted for the highest market revenue in 2024, approximately 58%, and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the oil-immersed iron core series reactor market is divided into power system, new energy, rail, and others. Among these, the power system segment dominated the market in 2024. It remains the primary application area for oil-immersed iron-core series reactors due to their ability to enhance grid stability, improve power quality, and support effective load management. Backed by advanced grid automation and well-established industry standards, these reactors ensure efficient and reliable infrastructure protection. As smart grid technologies continue to expand, the power system segment is expected to drive substantial market growth and further strengthen overall electrical system performance.

Get more details on this report -

Regional Segment Analysis of the Oil-immersed Iron Core Series Reactor Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the oil-immersed iron core series reactor market over the predicted timeframe.

Asia Pacific is projected to account for approximately 39% of the market share, driven by rapid urbanization, industrial expansion, and substantial investments in power infrastructure. Key contributing countries include China, India, and Japan. China continues to strengthen its high-voltage transmission network to support large-scale renewable energy integration. India is modernizing its grid under the National Electricity Plan 2023–2032, which aims to increase transmission capacity from 4.85 lakh to 6.48 lakh circuit-km. Japan is advancing grid automation and smart grid technologies. The region’s dominant position is supported by growing requirements for voltage control, reactive power management, and reliable power quality across these major economies.

In July 2024, India approved a nearly 14% increase in capital investment for eight state-owned power companies, as announced in the Union Budget. This initiative underscores the government’s commitment to strengthening the power sector and advancing national grid development.

North America is expected to grow at a rapid CAGR in the oil-immersed iron core series reactor market during the forecast period. The region is projected to hold approximately 23% of the market share, supported by significant investments in grid modernization, infrastructure upgrades, and the integration of renewable energy. Both the U.S. and Canada are prioritizing grid stability, high-voltage transmission, clean energy advancement, and reliable power delivery. Rising requirements for voltage regulation, reactive power management, and improved power quality further propel market expansion.

In November 2025, UNEZA participants at COP30 announced USD 148 billion in energy-transition funding, contributing to a planned investment of over USD 1 trillion by 2030, including USD 82 billion per year dedicated to grid and storage development to support decarbonization efforts.

Europe is expected to witness steady growth in the oil-immersed iron-core series reactor market during the forecast period, driven by investments in renewable energy integration and transmission network upgrades. Germany, France, and the UK are key contributors, focusing on grid stability, power quality, and compliance with strict regulatory standards. The increasing need for reactive power management and reliable voltage regulation across utility and industrial applications supports market expansion in the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oil-immersed iron core series reactor market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Siemens Energy

- GE Grid Solutions

- ABB

- Fuji Electric

- Hitachi Energy

- Schneider Electric

- Toshiba Energy Systems

- Eaton Corporation

- CG Power and Industrial Solutions

- SGB-Smit

- Mitsubishi Electric Corporation

- Hyosung Heavy Industries

- GBE SpA

- Nissin Electric Co Ltd

- Shrihans Electricals Pvt. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

• In August 2025, Eaton unveiled advanced solutions for hazardous environments at Automation Expo 2025 in Mumbai. Key launches included the CEAG VLL Series Ex Lights, B-Line support systems, Flextray system, MTL Zone Guardian series, and an ROI LED lighting calculator—strengthening Eaton’s intelligent power management portfolio.

• In May 2025, Hitachi-GE Nuclear Energy announced the supply of major components for Ontario Power Generation’s Darlington New Nuclear Project, North America’s first Small Modular Reactor. The BWRX-300 SMR, co-developed with GE Vernova, focuses on enhanced safety, performance, and economic efficiency, with Hitachi-GE contributing to its advanced design.

• In February 2025, Siemens Energy partnered with Rolls-Royce SMR to serve as the exclusive supplier of steam turbines, generators, and auxiliary systems for the company’s Generation 3+ Small Modular Reactors in the UK. The final contract outlining all commercial and technical terms is expected to be completed by the end of 2025.

• In October 2024, CG Power and Industrial Solutions launched two new low-voltage induction motors, AXELERA 3.0 and AXELERA 4.0 (up to 7.5 kW). The launch underscores the company’s commitment to delivering high-efficiency, reliable motor technologies tailored for industrial applications.

• The company’s focus remains on improving efficiency, reducing carbon emissions, and enhancing client operations.

• In February 2024, GE Vernova’s Grid Solutions secured multi-million-dollar orders from Power Grid Corporation of India (PGCIL) to supply 765 kV Shunt Reactors for major transmission projects. These deployments strengthen electricity transmission networks and support large-scale renewable energy integration, particularly across Rajasthan and Karnataka.

• In September 2021, SGB-SMIT Group and CRRC Zhuzhou Electric Jiangsu signed a cooperation agreement focused on wind power oil-immersed transformers. Following extensive discussions since 2020, the partnership aims to drive innovation in liquid-filled transformer technology for both onshore and offshore wind applications, leveraging the technical strengths of both companies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oil-immersed iron core series reactor market based on the below-mentioned segments:

Global Oil-immersed Iron Core Series Reactor Market, By Type

- Single Phase

- Three Phase

Global Oil-immersed Iron Core Series Reactor Market, By Voltage Rating

- Low Voltage

- Medium Voltage

- High Voltage

Global Oil-immersed Iron Core Series Reactor Market, By Application

- Power System

- New Energy

- Rail

- Others

Global Oil-immersed Iron Core Series Reactor Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the oil-immersed iron core series reactor market over the forecast period?The global oil-immersed iron core series reactor market is projected to expand at a CAGR of 3.5% during the forecast period.

-

2. What is the oil-immersed iron core series reactor market?The oil-immersed iron-core series reactor market involves manufacturing and supplying reactors that stabilize voltage, manage reactive power, and protect electrical grids.

-

3. What is the market size of the oil-immersed iron core series reactor market?The global oil-immersed iron core series reactor market size is expected to grow from USD 301.4 million in 2024 to USD 439.9 million by 2035, at a CAGR of 3.5% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the oil-immersed iron core series reactor market?Asia Pacific is anticipated to hold the largest share of the oil-immersed iron core series reactor market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global oil-immersed iron core series reactor market?Siemens Energy, GE Grid Solutions, ABB, Fuji Electric, Hitachi Energy, Schneider Electric, Toshiba Energy Systems, Eaton Corporation, CG Power and Industrial Solutions, SGB-Smit, and Others.

-

6. What factors are driving the growth of the oil-immersed iron core series reactor market?The growth of the oil-immersed iron core reactor market is driven by rising global electricity demand, urbanization, industrialization, and the need for grid stability, harmonic filtering, and voltage regulation, especially with increasing renewable energy integration and grid modernization efforts, making them crucial for reliable power transmission and distribution.

-

7. What are the market trends in the oil-immersed iron core series reactor market?Key trends include high-efficiency core designs (better silicon steel), advanced cooling (ester oils), compact sizes, smart grid integration, and sustainability focus, with Asia-Pacific leading.

-

8. What are the main challenges restricting wider adoption of the oil-immersed iron core series reactor market?The main challenges restricting the wider adoption of oil-immersed iron core series reactors involve high costs, significant environmental and safety concerns, demanding maintenance requirements, and competition from alternative technologies

Need help to buy this report?