Global Oil & Gas Exploration & Production Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural Gas and Crude Oil), By Application (Onshore and Shallow Water), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Construction & ManufacturingGlobal Oil & Gas Exploration & Production Market Insights Forecasts to 2035

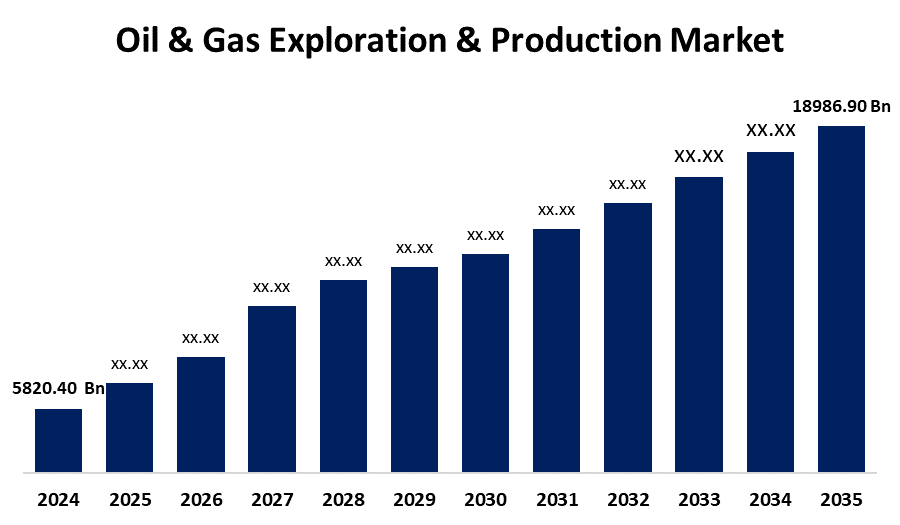

- The Global Oil & Gas Exploration & Production Market Size Was Estimated at USD 5820.40 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.35% from 2025 to 2035

- The Worldwide Oil & Gas Exploration & Production Market Size is Expected to Reach USD 18986.90 Billion by 2035

- North America is Expected to grow the fastest during the forecast period.

Get more details on this report -

The Global Oil & Gas Exploration & Production Market Size was worth around USD 5820.40 Billion in 2024 and is predicted to grow to around USD 18986.90 Billion by 2035 with a compound annual growth rate (CAGR) of 11.35% from 2025 and 2035. The market for oil and gas exploration and production has opportunities in the areas of offshore development, unconventional resource extraction, digitization, energy security improvement, new drilling technology, and strategic investments in uncharted and developing areas.

Market Overview

The energy sector devoted to the discovery, extraction, and preliminary processing of natural gas and crude oil resources is known as the oil & gas exploration & production market. Drilling exploration and production wells, analyzing seismic data, developing oil and gas fields, and conducting geological surveys are just a few of the many activities that fall under this category. It is essential to the world's energy supply because it transforms subterranean hydrocarbon reserves into resources that can be sold. The oil & gas exploration & production industry is being driven by the pressing need to meet growing energy demands while converting to more environmentally friendly energy sources. Increased capacity for liquefied natural gas and the tracking of carbon emissions and footprint are driving the market's expansion. The motivating force behind this investment surge is the pressing requirement to meet growing energy demands while transitioning to more environmentally friendly energy sources.

Report Coverage

This research report categorizes the oil & gas exploration & production market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oil & gas exploration & production market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oil & gas exploration & production market.

Global Oil & Gas Exploration & Production Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5820.40 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.35% |

| 2035 Value Projection: | USD 18986.90 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Type, By Application and By Region |

| Companies covered:: | Shell Plc, TotalEnergies, Vedanta Limited, Oilex Group Lp, Saudi Arabian Oil Co, Reliance Industries Limited, Exxon Mobil Corporation, Indian Oil Corporation Limited, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

A number of factors, including commodity pricing, technological developments, regulatory frameworks, geopolitical events, and environmental considerations, influence the E&P sector. Investments in both conventional and unconventional oil and gas reserves are encouraged by the growing demand for energy security and energy source diversification. The number of automobiles and the overall demand for oil-based transportation fuels, such as gasoline and diesel, are rising as a result of urbanization, the expanding global population, and increased industrial activity. The growing demand for energy worldwide, especially in developing nations that are rapidly industrializing and urbanizing, is the main factor propelling the oil and gas exploration and production market.

Restraining Factors

Environmental laws, high operating costs, volatile oil prices, geopolitical tensions, technological difficulties, and growing trends toward renewable energy sources are some of the major reasons holding back the oil and gas exploration and production market.

Market Segmentation

The oil & gas exploration & production market share is classified into type and application.

- The natural gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the oil & gas exploration & production market is divided into natural gas and crude oil. Among these, the natural gas segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Drilling is a technique used to extract natural gas from subterranean rock formations. Non-associated reservoirs and oil combine to generate natural gas. There are two types of gas: wet, which contains other hydrocarbons, and dry, or pure methane.

- The onshore segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the oil & gas exploration & production market is divided into onshore and shallow water. Among these, the onshore segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The use of onshore drilling operations at exploration and production locations is increased by the strong demand for onshore rigs. Crude oil production and exploration via land are referred to as onshore. Drilling into subterranean reserves is necessary for the onshore extraction of geothermal energy and crude oil.

Regional Segment Analysis of the Oil & Gas Exploration & Production Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the oil & gas exploration & production market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the oil & gas exploration & production market over the predicted timeframe. Growing energy demand, continuous exploration expenditures, and substantial reserves in nations like China, India, Indonesia, and Australia are the main drivers of the Asia Pacific region. The region's leading market position is also a result of its emphasis on growing unconventional and offshore oil and gas developments. China's enormous population and growing economy, which generate an endless demand for energy resources, have a major impact on the country's importance in the oil and gas production industry.

North America is expected to grow at a rapid CAGR in the oil & gas exploration & production market during the forecast period. Technology developments in shale oil and gas production, greater exploration of unconventional resources, and continuous infrastructural investments are the main drivers of North America's growth. Due their vast shale deposits and benevolent regulatory frameworks that promote production growth, the United States and Canada in particular make significant contributions. The United States' advantageous geographic location and strategic influence over the Middle East are driving the oil and gas sector there.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oil & gas exploration & production market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shell Plc

- TotalEnergies

- Vedanta Limited

- Oilex Group Lp

- Saudi Arabian Oil Co

- Reliance Industries Limited

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In September 2024, Huawei and industry customers unveiled the latest collaborative achievements in large model construction, refined exploration, intelligent oilfield reconstruction, and natural gas industry upgrades at the Global Oil and Gas Summit. These innovations aim to enhance the industry's quality with intelligence, increase reserves and production, ensure safe operations, and achieve high-quality development.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oil & gas exploration & production market based on the below-mentioned segments:

Global Oil & Gas Exploration & Production Market, By Type

- Natural Gas

- Crude Oil

Global Oil & Gas Exploration & Production Market, By Application

- Onshore

- Shallow Water

Global Oil & Gas Exploration & Production Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the oil & gas exploration & production market over the forecast period?The global oil & gas exploration & production market is projected to expand at a CAGR of 11.35% during the forecast period.

-

2. What is the market size of the oil & gas exploration & production market?The global oil & gas exploration & production market size is expected to grow from USD 5820.40 billion in 2024 to USD 18986.90 billion by 2035, at a CAGR of 11.35% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the oil & gas exploration & production market?Asia Pacific is anticipated to hold the largest share of the oil & gas exploration & production market over the predicted timeframe.

-

4. Who are the top 10 companies operating in the Global oil & gas exploration & production market?Key players include Shell Plc, Total Energies, Vedanta Limited, Oilex Group Lp, Saudi Arabian Oil Co, Reliance Industries Limited, Exxon Mobil Corporation, Indian Oil Corporation Limited, and Others.

-

5. What are the main drivers of growth in the oil & gas exploration & production market?Key drivers of growth in the oil & gas exploration & production market include rising global energy demand, technological advancements, increasing investments, favorable government policies, and the discovery of new hydrocarbon reserves.

-

6. What are the latest trends in the oil & gas exploration & production market?The latest trends in the oil & gas exploration & production market include digital transformation, adoption of AI and automation, enhanced oil recovery techniques, increased focus on sustainability, and expansion into unconventional resources.

-

7. What are the top investment opportunities in the global oil & gas exploration & production market?Top investment opportunities in the global oil & gas exploration & production market include offshore drilling projects, shale gas development, digital oilfield technologies, carbon capture initiatives, and strategic partnerships in emerging energy-rich regions.

-

8. What challenges are limiting the adoption of the oil & gas exploration & production market?Regulatory uncertainty, environmental concerns, high capital requirements, geopolitical risks, fluctuating oil prices, and mounting pressure to switch to greener energy sources are some of the obstacles that are impeding the adoption of oil and gas exploration and production.

Need help to buy this report?