Global Oil Absorbent Pads Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Universal Pads, Oil-Only Pads, Chemical Pads, and Others), By Material Type (Polypropylene, Cellulose, Natural Fibers, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Oil Absorbent Pads Market Insights Forecasts to 2035

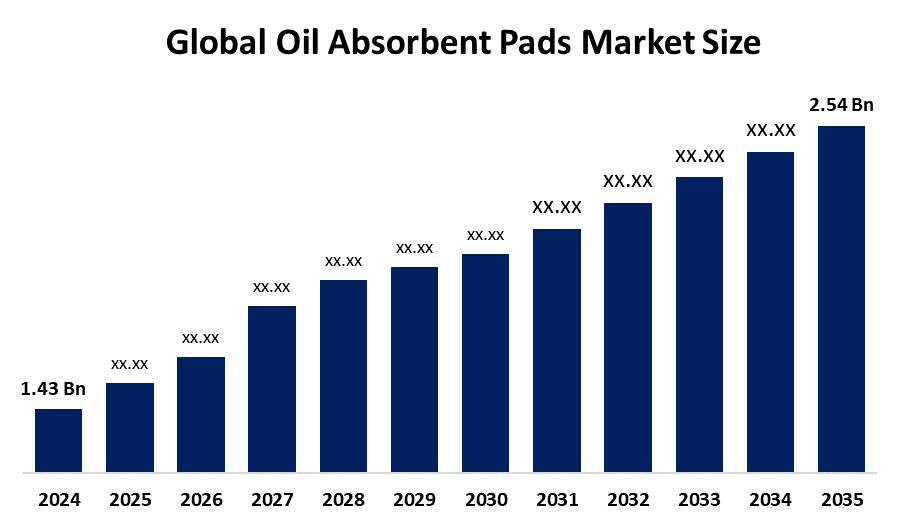

- The Global Oil Absorbent Pads Market Size Was Estimated at USD 1.43 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.36% from 2025 to 2035

- The Worldwide Oil Absorbent Pads Market Size is Expected to Reach USD 2.54 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global Oil Absorbent Pads market size was worth around USD 1.43 Billion in 2024 and is predicted to grow to around USD 2.54 Billion by 2035 with a compound annual growth rate (CAGR) of 5.36% from 2025 and 2035. The market for oil absorbent pads has a number of opportunities to grow due to a rise in industrial activity, stricter environmental laws, and growing occupational safety concerns. Effective oil absorbents are necessary for maintenance and safety because the growth of sectors like industry, transportation, and oil and gas increases the likelihood of spills and leaks.

Market Overview

An oil absorbent pad is a sheet like substance that is often oleophilic and hydrophobic and is intended to absorb oil or petroleum-based substances while keeping water out. The market for pads for absorbing oil is an important market of the larger aggregate related to industry and environmental management. Effective solutions for cleanup are in high demand with businesses becoming more aware of the effects of oil spills and leaks. Every year, about 14,000 oil spills are noted each year in the United States, and this indicates the need for effective technologies for absorbents noted by the U.S. Environmental Protection Agency. The materials and technology used in oil absorbent pads have evolved due to this awareness, as have environmental protection regulations. Awareness for environmental sustainability and workplace safety is one of the main driving forces for the market for oil absorbent pads. Companies from multiple industries, including but not limited to manufacturing, construction, and transportation, are investing more resources into safety equipment to minimize the hazards of working in oil leaks. In addition, government programs that promote following workplace safety regulations also play a major role in the expansion of this market.

Governments all over the world have implemented policy based and regulatory measures that encourage oil absorbent pads by requiring readiness, response, and prevention measures. In the United States, for instance, the EPA enforces the Facility Response Plan and Spill Prevention, Control, and Countermeasure regulations, which mandate that facilities handling oil have the proper containment and spill cleanup equipment, such as absorbents.

Report Coverage

This research report categorizes the oil absorbent pads market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the oil absorbent pads market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the oil absorbent pads market.

Global Oil Absorbent Pads Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.43 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.36% |

| 2035 Value Projection: | USD 2.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product Type , By Material Type |

| Companies covered:: | 3M Company, Brady Corporation, New Pig Corporation, Oil-Dri Corporation of America, SpillTech LLC, Darcy Spillcare Manufacture, ENPAC LLC, Fentex Ltd., Sellars Absorbent Materials Inc., Global Spill Control, Chemtex Inc., Sorbent Products Company, EcoTechnologies, AbsorbentsOnline.com, Meltblown Technologies Inc., And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The oil absorbent pads market is driven to make products that are more efficient and ecofriendly, and manufacturers are spending more money on research and development. Oil absorbent pads should become much more effective at soaking up spills as a result of the development of nanotechnology and sophisticated polymer materials. Businesses that are prepared to invest in new technology can benefit greatly from this innovation. The usage of ecofriendly absorbents is one of the more sustainable practices that companies are being encouraged to implement by the growing emphasis on corporate social responsibility. Natural and biodegradable materials, which not only lessen their negative effects on the environment but also appeal to consumers' growing environmental conscience, are becoming more and more popular.

Restraining Factors

The oil absorbent pads market is restricted by factors like the high cost of advanced absorbent materials that may be prohibitively expensive for a new start up or small business. Intense competition is another market descriptor, with many competitors fighting for market share. Price wars resulting from competition may adversely impact profitability.

Market Segmentation

The oil absorbent pads market share is classified into product type and material type.

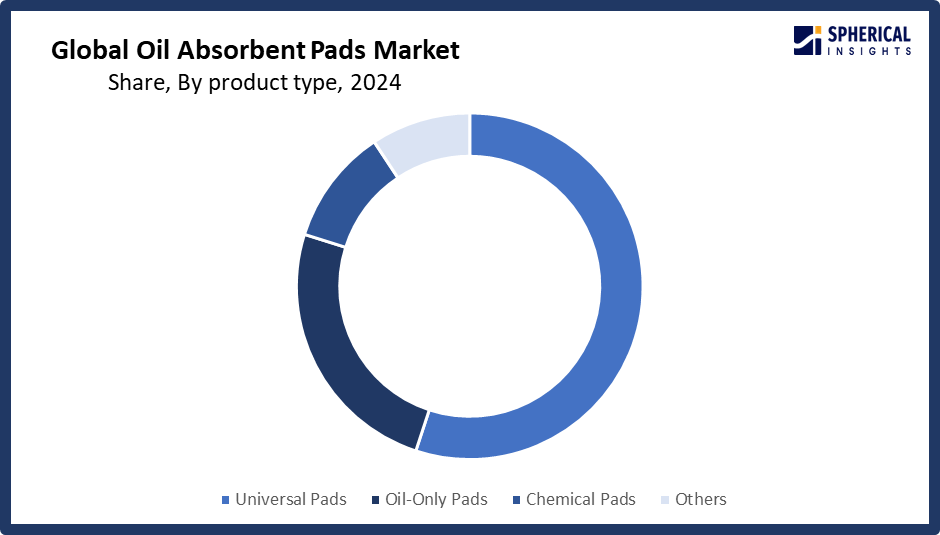

- The oil-only pads segment dominated the market in 2024, accounting for approximately 55% and is projected to grow at a substantial CAGR during the forecast period.

Based on the product type, the oil absorbent pads market is divided into universal pads, oil-only pads, chemical pads, and others. Among these, the oil-only pads segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven as it is crucial for transportation centers, oil refineries, and marine applications because they are designed to absorb hydrocarbons while repelling water. They are frequently used in industries with a high probability of oil spills because of their targeted absorption, which ensures minimal waste and efficient cleanups. Universal pads are also gaining traction because they can absorb a variety of liquids, including oil, water, and chemicals. This is particularly true in commercial and manufacturing environments where a variety of spills are the norm.

Get more details on this report -

- The polypropylene segment accounted for the largest share in 2024, accounting for approximately 46% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material type, the oil absorbent pads market is divided into polypropylene, cellulose, natural fibers, and others. Among these, the polypropylene segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because of their high oil absorption level, lightweight, and chemical resistance. Polypropylene has become the material of choice for various industrial applications. The widespread use of polypropylene pads in manufacturing, automotive, and marine applications demonstrates their versatility and effectiveness in cleaning up oil spills. However, greater concern about sustainability and government support for biodegradable products has led to increasing demand for cellulose and natural fiber pads within the marketplace.

Regional Segment Analysis of the Oil Absorbent Pads Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share, representing nearly 35% of the oil absorbent pads market over the predicted timeframe.

North America is anticipated to hold the largest share, representing nearly 35% of the oil absorbent pads market over the predicted timeframe. In the North American market, it is bolstered by an established oil and gas sector with stringent regulations governing environmental practices and a robust industrial base. The United States, in particular, has heightened importance, owing to well resourced spill response infrastructure and elevated frequency of leaks in industrial and marine processes. Also, North America's presence of major market participants and solid distribution structure reinforces its positioning as the principal center for oil absorbent pad absorption. Further, an ongoing proactive stance to worker safety and environmental stewardship during the forecast period enables the region's steady demand to evolve.

The United States leads the market for oil absorbent pads due to its extensive oil and gas infrastructure, stringent environmental and spill response laws such as those set forth by the EPA and SPCC, developed industrial and marine sectors, and a strong emphasis on environmental compliance and occupational safety.

Asia Pacific is expected to grow at a rapid CAGR, representing nearly 21.5% in the oil absorbent pads market during the forecast period. The Asia Pacific area has a thriving market for oil absorbent pads due to its contribution to the rising popularity of oil absorbent pads in countries like China, India, and Japan. Growing regulatory enforcement and enhanced societal awareness of environmental threats are driving demand in the region. Growing demand for oil absorbent solutions is also being spurred by increased automotive and transit activity and growing maritime traffic. In the Asia Pacific, emerging local producers and the influx of foreign investment are each contributing significantly to oil absorbent pads becoming more accessible and affordable.

The Asia-Pacific market for oil absorbent pads because to its extensive manufacturing and industrial base, robust oil and gas operations, stricter environmental and spill regulation rules, and increasing use of safety and pollution control measures in industries like chemicals, marine, and automobiles.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the oil absorbent pads market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- 3M Company

- Brady Corporation

- New Pig Corporation

- Oil-Dri Corporation of America

- SpillTech LLC

- Darcy Spillcare Manufacture

- ENPAC LLC

- Fentex Ltd.

- Sellars Absorbent Materials Inc.

- Global Spill Control

- Chemtex Inc.

- Sorbent Products Company

- EcoTechnologies

- AbsorbentsOnline.com

- Meltblown Technologies Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In June 2024, MAG started exporting its new line of oil-based absorbent pads with large orders abroad, showcasing global acceptance of its meltblown nonwoven-fabric-based pads.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the oil absorbent pads market based on the below-mentioned segments:

Global Oil Absorbent Pads Market, By Product Type

- Universal Pads

- Oil-Only Pads

- Chemical Pads

- Others

Global Oil Absorbent Pads Market, By Material Type

- Polypropylene

- Cellulose

- Natural Fibers

- Others

Global Oil Absorbent Pads Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

What is the CAGR of the oil absorbent pads market over the forecast period?The global oil absorbent pads market is projected to expand at a CAGR of 5.36% during the forecast period.

-

What is the market size of the oil absorbent pads market?The global oil absorbent pads market size is expected to grow from USD 1.43 Billion in 2024 to USD 2.54 Billion by 2035, at a CAGR of 5.36% during the forecast period 2025-2035.

-

Which region holds the largest share of the oil absorbent pads market?North America is anticipated to hold the largest share of the oil absorbent pads market over the predicted timeframe.

-

Who are the top 15 companies operating in the global oil absorbent pads market?3M Company, Brady Corporation, New Pig Corporation, Oil-Dri Corporation of America, SpillTech LLC, Darcy Spillcare Manufacture, ENPAC LLC, Fentex Ltd., Sellars Absorbent Materials Inc., Global Spill Control, Chemtex Inc., Sorbent Products Company, EcoTechnologies, AbsorbentsOnline.com, Meltblown Technologies Inc., and Others.

-

What factors are driving the growth of the oil absorbent pads market?The oil absorbent pads market growth is driven by ecofriendly & biodegradable materials, stricter regulations & spill response mandates, growth in end‑Use industrial sectors, innovation in performance & design, and regional expansion & localization

-

What are the market trends in the oil absorbent pads market?The oil absorbent pads market trends include rising demand for synthetic grafts, advancements in biocompatible materials, increasing minimally invasive procedures, and strategic partnerships for innovative product development and distribution.

-

What are the main challenges restricting wider adoption of the oil absorbent pads market?The oil absorbent pads market trends include that the cost of producing absorbent pads is high due to fluctuating raw material prices. There are legislative and environmental challenges associated with the disposal of spent, non-biodegradable pads.

Need help to buy this report?