Global OEM Insulation Market Size By Material (Glass Wool, Foamed Plastics, Mineral Wool), By End-Users (Automotive, Marine, Aerospace), By Region, And Segment Forecasts, By Geographic Scope And Forecast Global OEM Insulation Market Insights Forecasts to 2032

Industry: Chemicals & MaterialsGlobal OEM Insulation Market Size Insights Forecasts to 2032

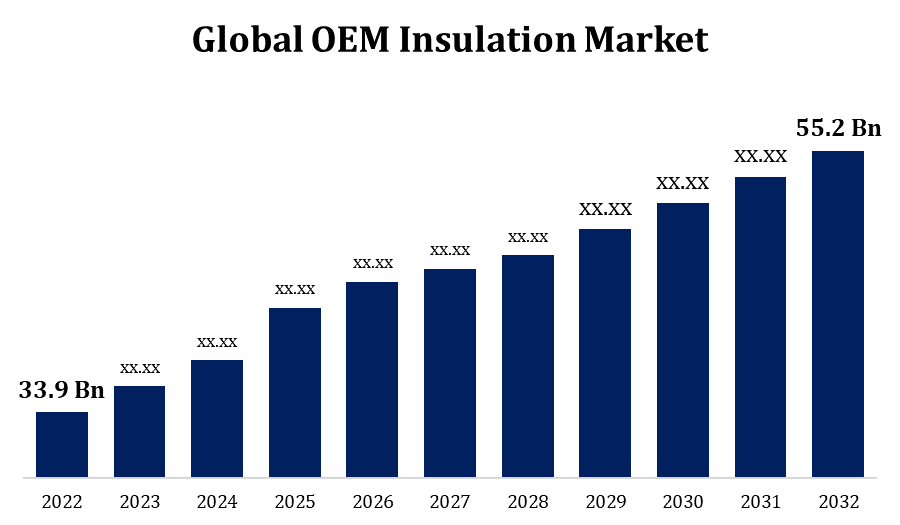

- The Global Insulation Market was valued at USD 33.9 Billion in 2022.

- The Market is growing at a CAGR of 5.00% from 2022 to 2032

- The Worldwide OEM Insulation Market is expected to reach USD 55.2 Billion by 2032

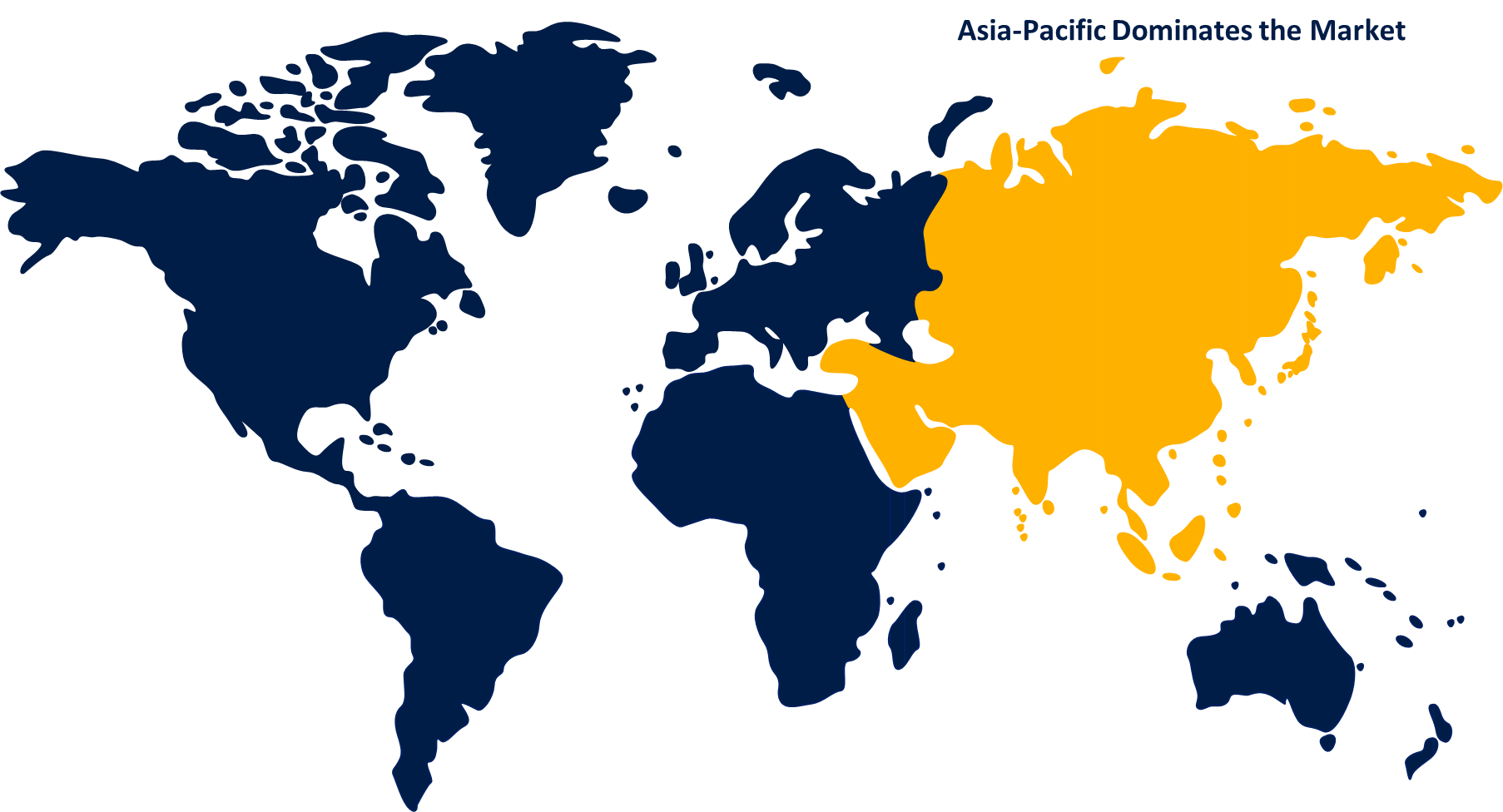

- Asia Pacific is expected to Grow the Fastest during the Forecast period

Get more details on this report -

The Global OEM Insulation Market Size is expected to reach USD 55.2 Billion by 2032, at a CAGR of 5.00% during the Forecast period 2022 to 2032.

OEM is an abbreviation for Original Equipment Manufacturer, and it refers to insulation materials and solutions that are integrated into goods throughout the production process. This market is driven by numerous industries such as automotive, aerospace, electronics, and appliances, where insulation plays an important role in improving energy efficiency, decreasing noise, and assuring appropriate equipment operation. The demand for lightweight and high-performance insulation materials is increasing, particularly in industries such as automotive and aerospace, where weight reduction is critical.

OEM Insulation Market Value Chain Analysis

The value chain starts with raw material providers such as fibreglass, foams, and other insulation materials. These vendors are critical in defining the final insulation product's quality and features. At this stage, businesses convert raw materials into insulating goods. They may make fibreglass insulation, foam boards, or specialised coatings for OEM purposes. These are the organisations that specialise in developing insulation solutions for Original Equipment Manufacturers. They design and manufacture insulating components or systems that can be smoothly incorporated into diverse industries' manufacturing processes. The next step in the value chain is OEMs from various industries such as automotive, aerospace, and electronics. During the production process, they include insulating materials into their products. When the insulation components are finished, they must be distributed to the OEMs. Logistics, warehousing, and transportation services are required to assure timely delivery to manufacturing facilities. End users are individuals or corporations who buy and use finished products incorporating OEM insulation.

OEM Insulation Market Opportunity Analysis

The growing global emphasis on energy efficiency and sustainability is fueling demand for high-performance insulating materials. The market may take advantage of technical breakthroughs to develop innovative insulating materials that are lighter, more durable, and have improved thermal and acoustic properties. With the car industry emphasising lightweighting for fuel efficiency and emissions reduction, OEM insulation materials that are both lightweight and effective in noise and temperature control are becoming more popular. Because of varied thermal and safety requirements, the rise of electric vehicles brings new issues for insulation. OEM insulation manufacturers might investigate solutions adapted to the specific requirements of electric vehicles. The expansion of the construction industry, especially in emerging economies, provides prospects for OEM insulation materials in building systems and HVAC applications.

Global OEM Insulation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 33.9 Billion |

| Forecast Period: | 2022 – 2032 |

| Forecast Period CAGR 2022 – 2032 : | 5.00% |

| 022 – 2032 Value Projection: | USD 55.2 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Material, By End-Users, By Region, By Geographic Scope And Forecast |

| Companies covered:: | ACH Foam Technologies LLC, Big Sky Insulations, Anco Products Inc., Johns Manville Corporation, E.I. du Pont de Nemours and Company, Armacell International S.A., Knauf Insulation, Demilec Inc., Autex Industries Ltd., Aspen Aerogels Inc., Owens Corning Corp., Morgan Advanced Materials, Rockwool International A/S, Paroc, Scott Industries LLC, Saint-Gobain S.A., Superglass Insulation Ltd., Triumph Group Inc., The 3M Company, and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Market Dynamics

OEM Insulation Market Dynamics

Demand for energy-efficient products and machinery

Energy-efficient machinery and products help OEMs save money in the long run. Insulation that improves the energy efficiency of equipment, such as lowering heat loss or increasing thermal management, corresponds with manufacturers' cost-cutting goals. Green building approaches and sustainable construction are becoming increasingly important in the construction industry. Insulation is critical in creating energy-efficient building designs. OEM insulation manufacturers can capitalise on this trend by providing materials that improve structural energy efficiency. Lightweighting for fuel economy is a goal shared by the automobile industry and the desire for energy-efficient solutions. Automotive OEMs are looking for insulation materials that give thermal and acoustic benefits without adding considerable weight to vehicles.

Restraints & Challenges

OEMs may prioritise economic considerations over advanced insulating technologies, particularly in competitive industries. Persuading manufacturers to invest in more expensive but more effective insulating materials might be difficult. Economic uncertainty and market changes in global marketplaces can have an impact on total industrial activity. In such volatile economic conditions, OEM insulation producers may confront issues relating to demand instability and financing. Insulation requirements vary by industry due to considerations such as temperature range, durability, and safety norms. OEM insulation producers must design their products to fit the unique needs of each industry, which necessitates a varied range of solutions. Like many industries, the OEM insulation industry is prone to supply chain interruptions. Natural disasters, geopolitical tensions, and worldwide pandemics can all have an impact on raw material availability.

Regional Forecasts

North America Market Statistics

Get more details on this report -

North America is anticipated to dominate the OEM Insulation Market from 2023 to 2032. North America has a robust industrial landscape, with OEMs in automotive, aerospace, electronics, and other manufacturing sectors having a significant presence. The necessity for energy efficiency and compliance with environmental standards drives the increased demand for insulating solutions. In North America, the automotive sector, a significant consumer of OEM insulation, is a dominant influence. As the industry evolves, there is a greater emphasis on lightweighting, emission reduction, and energy efficiency, which creates potential for innovative insulation solutions. North America's construction industry is a large consumer of insulating products. The increase in infrastructure projects and green building efforts stimulates demand for OEM insulation solutions even more. North America's OEM insulation industry is competitive, with both domestic and international companies.

Asia Pacific Market Statistics

Asia Pacific is witnessing the fastest market growth between 2023 to 2032. Asia-Pacific is a manufacturing powerhouse, with major players including China, Japan, South Korea, and India. Demand for OEM insulation solutions is driven by the region's strong industrial base, which includes automotive, electronics, and machinery manufacture. In the Asia-Pacific area, the automobile and electronics sectors are key consumers of OEM insulation. These industries' expansion, along with an emphasis on energy-efficient vehicles and electronics, presents significant potential for insulation makers. The Asia-Pacific region's economic growth is accompanied by an increase in energy demand. This has resulted in a greater emphasis on energy efficiency, fueling demand for insulating materials in a variety of industrial applications to optimise energy utilisation. Asia-Pacific is well-known for its quick adoption of new technology.

Segmentation Analysis

Insights by Material

The foamed plastics segment accounted for the largest market share over the forecast period 2023 to 2032. Foamed plastics have excellent thermal insulation qualities, making them appropriate for a wide range of OEM applications. In a variety of sectors, these materials effectively limit heat transfer and contribute to energy efficiency. Foamed plastics may be moulded and shaped to meet specific needs, making them useful for a wide range of OEM applications. They provide insulation in a variety of forms, including boards, sheets, and spray foams, and are utilised in industries such as automotive, appliances, electronics, and construction. The overall market desire for energy-efficient solutions has spurred the foamed plastics segment's rise. Foamed plastics are emerging as a favoured choice as enterprises prioritise energy efficiency to meet regulatory criteria and decrease operational expenses.

Insights by End Users

The automotive segment accounted for the largest market share over the forecast period 2023 to 2032. Lightweighting is becoming increasingly important in the automotive sector in order to enhance fuel efficiency and minimise pollutants. Insulation materials, such as foamed plastics and other lightweight options, are critical for reducing weight without sacrificing performance. The growing popularity of electric and hybrid vehicles offers new insulating issues. These vehicles have particular thermal and acoustic needs, and innovative insulating materials are required to suit the unique properties of electric drivetrains and battery systems. To satisfy rising performance and environmental requirements, the car industry is rapidly using improved insulation materials and technologies. The expansion of automobile markets in Asia-Pacific and emerging markets contributes to an increase in demand for OEM insulation.

Recent Market Developments

- In April 2022, Kingspan Group announced a USD 27 million investment to expand its operations at 200 Kingspan Way in Frederick County, Maryland.

Competitive Landscape

Major players in the market

- ACH Foam Technologies LLC

- Big Sky Insulations

- Anco Products Inc.

- Johns Manville Corporation

- E.I. du Pont de Nemours and Company

- Armacell International S.A.

- Knauf Insulation, Demilec Inc.

- Autex Industries Ltd.

- Aspen Aerogels Inc.

- Owens Corning Corp.

- Morgan Advanced Materials

- Rockwool International A/S

- Paroc

- Scott Industries LLC

- Saint-Gobain S.A.

- Superglass Insulation Ltd.

- Triumph Group Inc.

- The 3M Company

Market Segmentation

This study forecasts revenue at global, regional, and country levels from 2023 to 2032.

OEM Insulation Market, Material Analysis

- Glass Wool

- Foamed Plastics

- Mineral Wool

OEM Insulation Market, End Users Analysis

- Automotive

- Marine

- Aerospace

OEM Insulation Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- UAE

- Saudi Arabia

- South Africa

Frequently Asked Questions (FAQ)

-

What is the market size of the OEM Insulation Market?The global OEM Insulation Market is expected to grow from USD 33.9 Billion in 2023 to USD 55.2 Billion by 2032, at a CAGR of 5.00% during the forecast period 2023-2032.

-

Who are the key market players of the OEM Insulation Market?Some of the key market players of market are ACH Foam Technologies LLC, Big Sky Insulations, Anco Products Inc., Johns Manville Corporation, E.I. du Pont de Nemours and Company, Armacell International S.A., Knauf Insulation, Demilec Inc., Autex Industries Ltd., Aspen Aerogels Inc., Owens Corning Corp., Morgan Advanced Materials, Rockwool International A/S, Paroc, Scott Industries LLC, Saint-Gobain S.A., Superglass Insulation Ltd., Triumph Group Inc., The 3M Company.

-

Which segment holds the largest market share?The automotive segment holds the largest market share and is going to continue its dominance.

-

Which region is dominating the OEM Insulation Market?North America is dominating the OEM Insulation Market with the highest market share.

Need help to buy this report?