Global Nylon Feedstock and Fibers Market Size, Share, and COVID-19 Impact Analysis, By Type (Nylon 6, Nylon 6,6, and Others), By Form (Staple Fibers and Filament Yarns), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Nylon Feedstock and Fibers Market Size Insights Forecasts to 2035

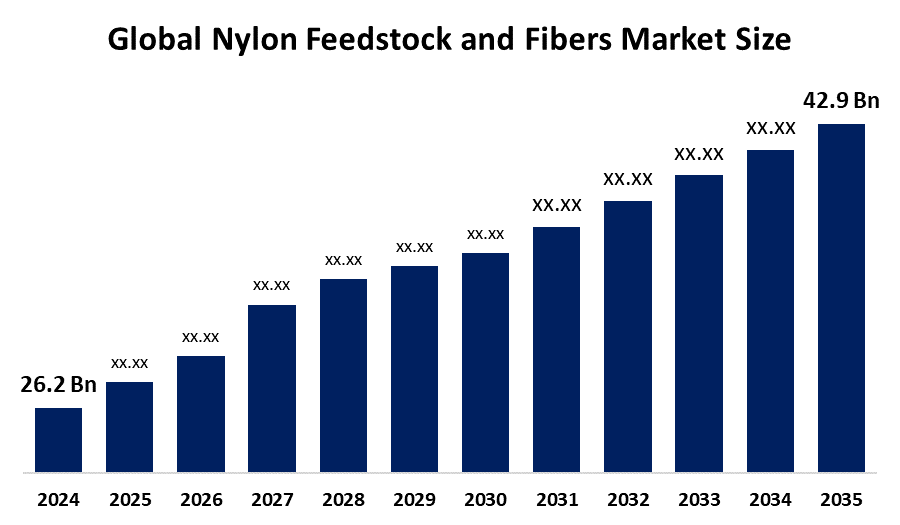

- The Global Nylon Feedstock and Fibers Market Size Was Estimated at USD 26.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.58% from 2025 to 2035

- The Worldwide Nylon Feedstock and Fibers Market Size is Expected to Reach USD 42.9 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Nylon Feedstock and Fibers Market Size was worth around USD 26.2 Billion in 2024 and is predicted to Grow to around USD 42.9 Billion by 2035 with a compound annual growth rate (CAGR) of 4.58% from 2025 and 2035. The market for nylon feedstock and fibers has a number of opportunities to grow due to the growing need for high performance textiles in a variety of industries, such as sportswear, automotive, and aerospace. Because of its strength, resistance to abrasion, and low weight, nylon is perfect for use in tire cords, seat belts, airbags, and specialized fabrics.

Market Overview

The nylon feedstock and fibers market encompasses the entire value chain of nylon production, starting with the fundamental chemical inputs and concluding with the final fiber products. The market for nylon feedstock and fibers is a crucial sector of the worldwide textile and materials industry, distinguished by its rapid expansion and development. Synthetic polymer nylon has been widely employed in a variety of applications, ranging from industrial and automotive components to apparel and upholstery. The market has demonstrated tremendous encouragement in recent years due to the growing need for materials that are lightweight, strong, and adaptable. The global nylon market is anticipated to increase at a compound annual growth rate of 4.5% from 2020 to 2025, reaching around $30 billion, according to the U.S. Department of Commerce. The textile industry's overall tendency toward high performance and sustainable materials is reflected in this rise.

The Indian government announced a five year, $1.45 billion PLI program to reward producers of technological textiles and manmade fibers. Products made of nylon, such as upholstery fabrics, are eligible. Incremental output incentives range from 3 to 11%. The plan aims to increase exports and domestic production of innovative synthetic fibers. India has implemented policies such as the PLI plan, enhanced manufacturing of technological textiles, and the development of standardized HS codes for export tracking. A substantial investment outlay, such as INR 10,683 crore under PLI, boosts the capacity for technical textiles and MMF fibers.

Report Coverage

This research report categorizes the nylon feedstock and fibers market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the nylon feedstock and fibers market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the nylon feedstock and fibers market.

Global Nylon Feedstock and Fibers Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.58% |

| 2035 Value Projection: | USD 42.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 166 |

| Tables, Charts & Figures: | 133 |

| Segments covered: | By Type, By Form and COVID-19 Impact Analysis |

| Companies covered:: | Invista, Toray Industries, Asahi Kasei Corporation, BASF SE, DSM Engineering Materials, DuPont, Aquafil S.p.A., RadiciGroup, Formosa Plastics Corporation, Shenma Industrial Co., Ltd., Ube Industries, Lanxess AG, Kolon Industries, Solvay S.A., Nilit Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The nylon feedstock and fibers market is driven by potential opportunities, especially in light of the ongoing advances in fiber technology and production. Innovations such as the development of high tenacity nylon fibers in the military and industrial markets are opening the application of new uses for nylon. Producers utilizing ecofriendly processes in producing nylon have more opportunities as a result of the demand for sustainability. Growth in the demand for technical textiles, especially in healthcare and agriculture, presents more positive opportunities. The National Institute of Standards and Technology has estimated that the global technical textile market will grow significantly to approximately $200 billion by 2025.

Restraining Factors

The nylon feedstock and fibers market is restricted by factors like rapid price fluctuations of raw materials, such as crude oil and natural gas create a barrier that could impact the cost of producing nylon. The cost of the production of nylon is affected by oil price changes since nylon is produced from petrochemicals.

Market Segmentation

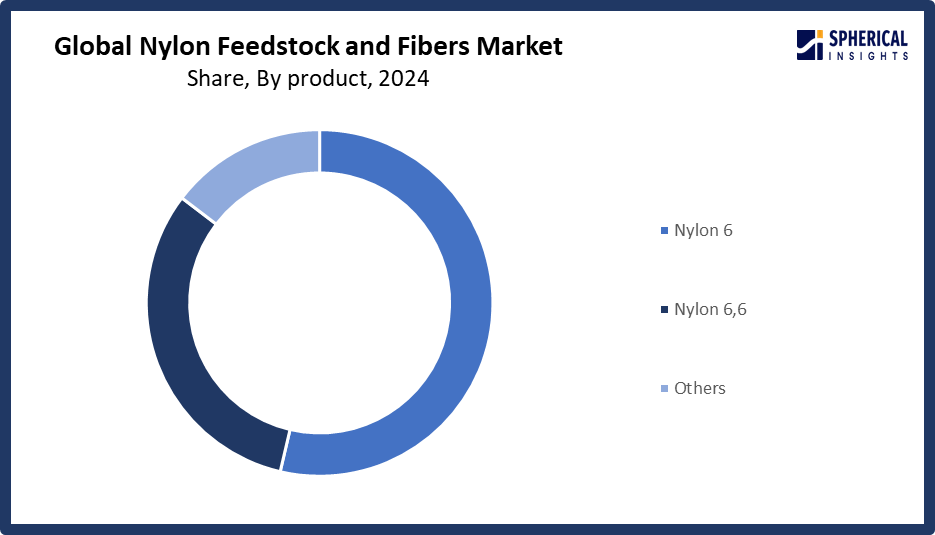

The nylon feedstock and fibers market share is classified into type and form.

- The nylon 6 segment dominated the market in 2024, accounting for approximately 54% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the nylon feedstock and fibers market is divided into nylon 6, nylon 6,6, and others. Among these, the nylon 6 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment is driven by lower production costs and a wide array of uses in carpets, industrial yarns, and apparel. Nylon 6, mostly made by caprolactam polymerization, is produced in large volumes in the Asia Pacific, particularly in China, India, and South Korea, where huge integrated chemical plants guarantee production advantages. Due to its strength and elasticity, nylon 6 is often used for swimwear, sportswear, and hosiery. Nylon 6 also meets the needs of residential and commercial construction by retaining strength characteristics and color fastness in flooring applications.

Get more details on this report -

- The filament yarns segment accounted for the largest share in 2024, accounting for approximately 62% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the nylon feedstock and fibers market is divided into staple fibers and filament yarns. Among these, the filament yarns segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dominance is because it is used in tire cords, airbags, carpets, industrial yarns, and textiles because of their strength, smoothness, and dyeability. Nylon filaments continue to be a large share of carpet manufacturing in North America and the Middle East, and volume growth will also be sustained with use in clothing and hosiery. More technical applications, such as industrial textiles and conveyor belts, sustain a preeminent position for nylon filaments.

Regional Segment Analysis of the Nylon Feedstock and Fibers Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share, representing nearly 65% of the nylon feedstock and fibers market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share, representing nearly 65% of the nylon feedstock and fibers market over the predicted timeframe. In the Asia Pacific market, the rise is due to China's vast textile, apparel, and automotive industries. In 2023, UNCTAD trade data indicates China is the world's leading exporter of nylon fibers and yarns, with over USD 5.8 billion exported. Consumption is rapidly increasing in India and Southeast Asia, caused by expanding middle class populations, growing demand for vehicles, and increasing garment exports. Japan and South Korea remain core centers of innovation in two areas, bio based and high-performance fibers.

North America is expected to grow at a rapid CAGR, representing nearly 14% in the nylon feedstock and fibers market during the forecast period. The North America area has a thriving nylon feedstock and fibers market due to in the US, there remains greater than 40% of residential flooring that contains nylon, which makes the US a prominent area for both carpet and rug applications, i.e, U.S. Department of Commerce. There is considerable consumption of nylon in both the US and Mexico due to its applications in airbags and vehicle interiors.

Europe is expected to grow due to France, Italy, and Germany are the leaders in fashion applications, automotive fibers, and technical textiles. Europe's dependence on Asia Pacific suppliers is evident in the consistent imports of nylon filament yarn, according to Eurostat data. The EU Textile Strategy 2030's sustainability rules are encouraging European manufacturers to take part in recycled and bio-based nylon projects.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the nylon feedstock and fibers market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Invista

- Toray Industries

- Asahi Kasei Corporation

- BASF SE

- DSM Engineering Materials

- DuPont

- Aquafil S.p.A.

- RadiciGroup

- Formosa Plastics Corporation

- Shenma Industrial Co., Ltd.

- Ube Industries

- Lanxess AG

- Kolon Industries

- Solvay S.A.

- Nilit Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In October 2025, Toray launched the Toray Premium GOUSEN select series GIGADULL (opacity & sun protection), SPRINGFIT (eco stretch), QUUP (comfort), and Lightygram (fine & light nylon fiber) brands.

- In June 2025, Taekwang Industry (South Korea) unveiled ACECOOL BIO, a plant based cool touch nylon fiber yarn.

- In March 2025, Aquafil launched a demonstration plant to separate elastic fiber from nylon in blended fabrics, e.g., sportswear/swimwear mixes, addressing a major recycling challenge.

- In December 2024, Ascend Performance Materials produced nylon 6,6 using used cooking oil feedstock under its Bioserve portfolio, achieving 25% lower carbon footprint vs fossil raw materials.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the nylon feedstock and fibers market based on the below-mentioned segments:

Global Nylon Feedstock and Fibers Market, By Type

- Nylon 6

- Nylon 6,6

- Others

Global Nylon Feedstock and Fibers Market, By Form

- Staple Fibers

- Filament Yarns

Global Nylon Feedstock and Fibers Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the nylon feedstock and fibers market over the forecast period?The global nylon feedstock and fibers market is projected to expand at a CAGR of 4.58% during the forecast period.

-

2. What is the market size of the nylon feedstock and fibers market?The global nylon feedstock and fibers market size is expected to grow from USD 26.2 Billion in 2024 to USD 42.9 Billion by 2035, at a CAGR of 4.58% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the nylon feedstock and fibers market?Asia Pacific is anticipated to hold the largest share of the nylon feedstock and fibers market over the predicted timeframe.

-

4. Who are the top 15 companies operating in the global nylon feedstock and fibers market?Invista, Toray Industries, Asahi Kasei Corporation, BASF SE, DSM Engineering Materials, DuPont, Aquafil S.p.A., RadiciGroup, Formosa Plastics Corporation, Shenma Industrial Co., Ltd., Ube Industries, Lanxess AG, Kolon Industries, Solvay S.A., Nilit Ltd., and Others.

-

5. What factors are driving the growth of the nylon feedstock and fibers market?The nylon feedstock and fibers market growth is driven by rising demand for technical plastics, textiles, and automobiles, among other industries. Because of its strength, resilience, and adaptability, nylon is a material of choice in several industries.

-

6. What are the market trends in the nylon feedstock and fibers market?The nylon feedstock and fibers market trends include sustainability and circular economy, technological advancements in recycling, growth in bio-based nylon production, regional expansion and market penetration, and collaborations and strategic partnerships.

-

7. What are the main challenges restricting wider adoption of the nylon feedstock and fibers market?The nylon feedstock and fibers market trends include that recycled nylon's high production costs make it less competitive when compared to virgin materials. Scalability is further complicated by low recycling infrastructure and variable recycled feedstock quality.

Need help to buy this report?