Global Nylon Acid Dye Fixing Agent Market Size, Share, and COVID-19 Impact Analysis, By Formulation Type (Liquid Concentrate, Powder Form, Emulsion Type, Solid Granules, and Others), By Method (Dipping Method, Padding Method, Spray Application Method, Exhaust Method, and Others), By Application (Clothing, Home Textiles, Industrial Nylon, Automotive Textiles, Technical Textiles, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Nylon Acid Dye Fixing Agent Market Insights Forecasts to 2035

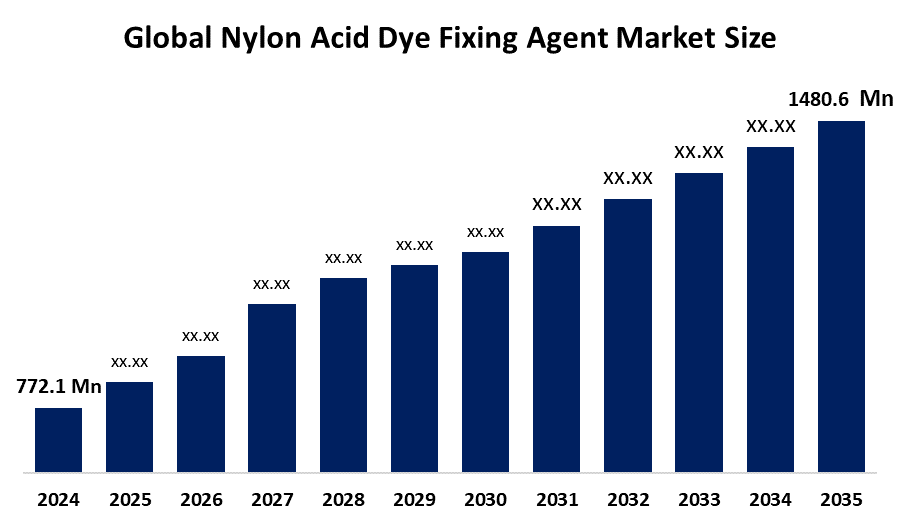

- The Global Nylon Acid Dye Fixing Agent Market Size Was Estimated at USD 772.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.1% from 2025 to 2035

- The Worldwide Nylon Acid Dye Fixing Agent Market Size is Expected to Reach USD 1480.6 Million by 2035

- North America is expected to grow the fastest during the forecast period.

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, the global nylon acid dye fixing agent market size was worth around USD 772.1 million in 2024 and is predicted to grow to around USD 1480.6 million by 2035 with a compound annual growth rate (CAGR) of 6.1% from 2025 to 2035. The market for nylon acid dye fixing agents is expanding due to increasing demand for high-quality nylon fabrics in clothing, sportswear and industrial applications. Growth in textile manufacturing across the Asia Pacific and progress in effective fixing methods also contribute to the market’s growth.

Market Overview

The worldwide nylon acid dye fixing agent market refers to chemical compounds designed to enhance dye adhesion, color retention and longevity in nylon textiles dyed with acid dyes. These agents boost wash durability, abrasion resistance and overall color permanence, making them crucial in textile industries, such as clothing, sportswear, carpets, automotive upholstery and industrial fabrics. The expansion of the market is propelled by increasing need for quality dyed nylon fabrics, the growth of textile production in the Asia Pacific, and a heightened consumer inclination towards bright, durable colors.

Prospects emerge from the creation of eco-low-formaldehyde and highly effective fixing agents that comply with stricter environmental standards. Additionally, advancements in textile processing technologies open up fresh opportunities for product development. Major participants in the market generally consist of speciality chemical and textile finishing firms that provide dye-fixation products within textile auxiliary ranges. These companies prioritise enhancing performance, ensuring adherence and offering tailored solutions for various nylon dyeing processes. In April 2025, OEKO-TEX enforced rigorous chemical thresholds and broadened its certification standards, introducing stricter BPA regulations along with increased demands for biodegradability and transparency in textile-related chemicals. ECO PASSPORT now covers commodity chemicals. Requires evidence of biodegradability, encouraging manufacturers of dye-fixing agents to develop safer, environmentally compliant formulations.

Report Coverage

This research report categorizes the nylon acid dye fixing agent market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the nylon acid dye fixing agent market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the nylon acid dye fixing agent market.

Nylon Acid Dye Fixing Agent Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 772.1 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 6.1% |

| 2035 Value Projection: | USD 1480.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Method, By Application |

| Companies covered:: | BASF SE, Archroma, Clariant AG, DyStar Group, Kiri Industries, Huntsman Corporation, Dymatic Chemicals, CHT Group, Evonik Industries, Dow, Piedmont Chemical Industries, Tanatex Chemicals, Matex Bangladesh Limited, Achitex Minerva, Syntha Group, Welsum Technology Corporation, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The worldwide market for nylon acid dye fixatives is propelled by increasing demand for premium color-retentive nylon fabrics used in clothing, home decor and industrial uses. Expansion in the sports apparel and automotive industries drives the requirement for wash-proof dyed materials, enhancing the use of dye fixatives. The growth of textile production in Asia-Pacific, environmental standards promoting sustainable fixing chemicals, and ongoing advancements in low-formaldehyde, high-performance agents also contribute to the market’s development. Furthermore, the growing consumer demand for durable colors and enhanced dyeing capabilities in nylon-based materials supports continuous market growth.

Restraining Factors

The nylon acid dye fixing agent market faces restraints, including strict environmental regulations on chemical emissions, rising demand for eco-friendly alternatives, and concerns about the toxicity of conventional fixing agents. High regulatory compliance costs, availability of substitute dyeing technologies, and fluctuating raw material prices also limit market growth.

Market Segmentation

The nylon acid dye fixing agent market share is classified into formulation type, method and application.

- The liquid concentrate segment dominated the market in 2024, approximately 40% and is projected to grow at a substantial CAGR during the forecast period.

Based on the formulation type, the nylon acid dye fixing agent market is divided into liquid concentrate, powder form, emulsion type, solid granules, and others. Among these, the liquid concentrate segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The liquid concentrate segment led the nylon acid dye fixing agent market due to its handling, excellent solubility and even distribution in dye baths. Its effectiveness, interaction with nylon fibers and suitability for automated textile dyeing processes make it favored by producers, encouraging broad usage and contributing to notable market expansion

.

- he dipping method segment accounted for the largest share in 2024, approximately 58% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the method, the nylon acid dye fixing agent market is divided into dipping method, padding method, spray application method, exhaust method, and others. Among these, the dipping method segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The dipping technique portion represented the expansion in the nylon acid dye fixing agent market owing to its ease, affordability and even dye absorption. This approach guarantees color durability on nylon textiles, minimizes chemical waste and can be readily scaled for mass textile manufacturing, making it a favorite among producers and fueling robust market acceptance.

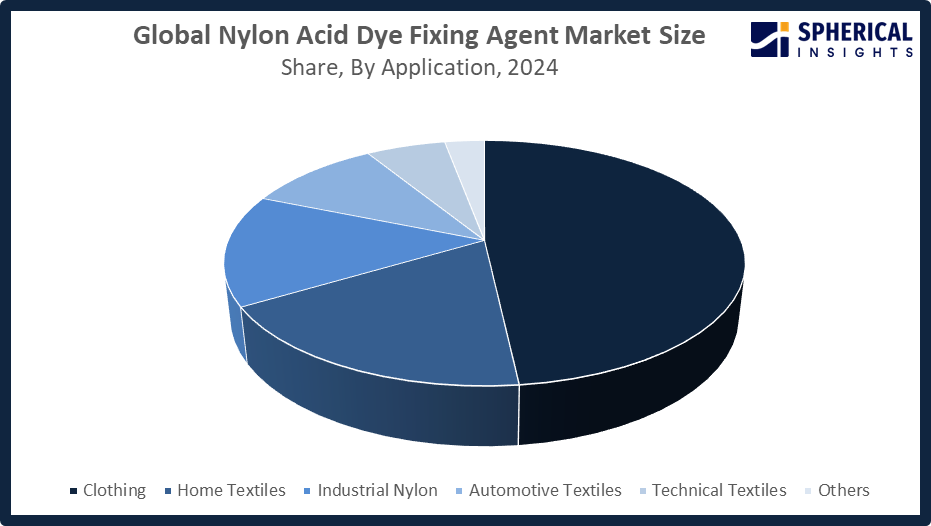

- The clothing segment accounted for the highest market revenue in 2024, approximately 48% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the nylon acid dye fixing agent market is divided into clothing, home textiles, industrial nylon, automotive textiles, technical textiles, and others. Among these, the clothing segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The clothing segment is growing in the nylon acid dye fixing agent market due to rising demand for vibrant, durable, and colorfast apparel, particularly in sportswear, activewear, and fashion garments. Increasing consumer preference for high-quality, long-lasting dyed fabrics, coupled with expanding textile manufacturing in regions such as the Asia Pacific, has significantly boosted market adoption in this segment.

Get more details on this report -

Regional Segment Analysis of the Nylon Acid Dye Fixing Agent Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

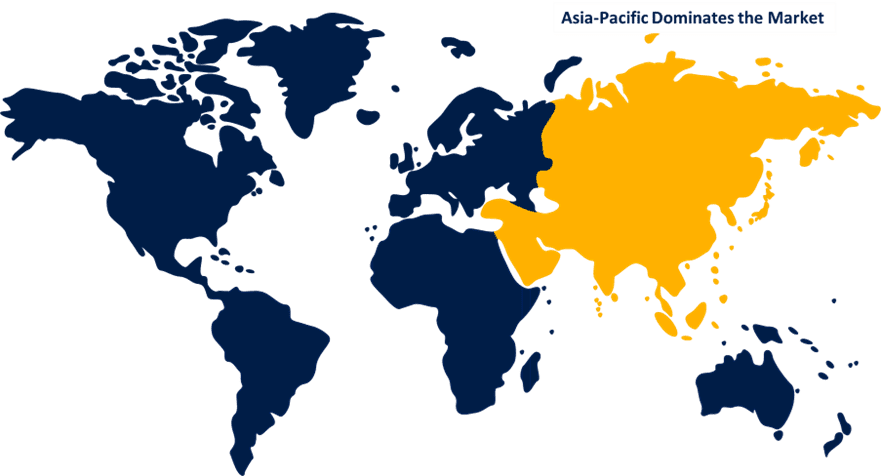

Asia Pacific is anticipated to hold the largest share of the nylon acid dye fixing agent market over the predicted timeframe

Asia Pacific is anticipated to hold the largest share of the nylon acid dye fixing agent market over the forecast period, accounting for approximately 38% of the global market. This dominance is driven by the rapid growth of textile and garment manufacturing, increasing exports of dyed fabrics, and rising demand for high-quality, colorfast nylon products. Countries such as China, India, Bangladesh, and Vietnam play a significant role due to their well-established textile industries, low production costs, and government initiatives supporting industrial development. Additionally, growing demand for apparel and sportswear, along with the adoption of advanced dyeing technologies, continues to support market expansion in the region.

Get more details on this report -

North America is expected to grow at a rapid CAGR in the nylon acid dye fixing agent market during the forecast period, holding an estimated 25% market share. Growth in this region is fueled by increasing demand for durable, colorfast nylon fabrics used in apparel, activewear, and automotive textiles. The United States and Canada contribute significantly, supported by strict environmental regulations, rising adoption of eco-friendly dye-fixing agents, and advancements in textile manufacturing technologies. Legislation such as California’s Responsible Textile Recovery Act (SB 707), enacted in September 2024, mandates textile collection and recycling, encouraging manufacturers to improve fabric longevity through effective dye-fixing solutions and sustainable practices.

Europe is also witnessing steady growth in the nylon acid dye fixing agent market, driven by demand for eco-friendly and durable fabrics, advanced manufacturing techniques, and stringent chemical regulations. Key countries including Germany, Italy, and the UK are leading the market by promoting sustainable color-preserving materials and investing in innovative dyeing technologies. In September 2025, OEKO-TEX updated its certification standards, effective October 6, introducing stricter PFOS limits, capped at 25 µg/kg for Standard 100, organic cotton, and ECO Passport certifications, with PFOS-related substances limited to 1 mg/kg.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the nylon acid dye fixing agent market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Archroma

- Clariant AG

- DyStar Group

- Kiri Industries

- Huntsman Corporation

- Dymatic Chemicals

- CHT Group

- Evonik Industries

- Dow

- Piedmont Chemical Industries

- Tanatex Chemicals

- Matex Bangladesh Limited

- Achitex Minerva

- Syntha Group

- Welsum Technology Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, Honghao Chemical launched a new reactive dye fixing agent with acid-compatible variants for blended nylon textiles, offering superior color fastness, durability, and a reduced environmental footprint through more efficient dye fixation.

- In March 2024, ALBAFIX ECO PLUS was launched as a next-generation fixing agent, offering maximum wet-fastness for reactive dyes on cotton, cellulosics, and polyester-cotton blends. It maintains shade and light-fastness while preventing foaming, acid hydrolysis, and migration issues, enhancing efficiency and ensuring high-quality dyed fabrics.

- In January 2024, BASF and Inditex launched Loopamid, a nylon 6 fiber made entirely from textile waste. Zara debuted a jacket using 100% Loopamid, designed for full recyclability, including fabrics, buttons, filling, and zippers, marking a major step in circular textile solutions.

- In October 2023, CHT Group introduced PIGMENTURA, an innovative pigment-based dyeing solution that eliminates water use for soaping and rinsing and reduces energy consumption by 60%. This technology saves up to 96% water, addressing textile industry challenges while promoting sustainable, energy-efficient continuous dyeing processes.

- In May 2023, DyStar launched Eco-Advanced Indigo Dyeing, a sustainable dyeing solution that reduces water usage by up to 90% and energy consumption by 30%. Applicable to traditional indigo, Sulphur dyes, and colored denim, it significantly lowers effluent discharge, promoting eco-friendly denim production.

- In March 2022, Archroma introduced two new metal-free and halogen-free acid dyes, Nylosan Navy S-3R and Black S-3N, in its Nylosan S range. Designed for polyamides and blends, they target dark outdoor and sportswear textiles, meeting sustainability goals while delivering high-quality blacks and navies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the nylon acid dye fixing agent market based on the below-mentioned segments:

Global Nylon Acid Dye Fixing Agent Market, By Formulation Type

- Liquid Concentrate

- Powder Form

- Emulsion Type

- Solid Granules

- Others

Global Nylon Acid Dye Fixing Agent Market, By Method

- Dipping Method

- Padding Method

- Spray Application Method

- Exhaust Method

- Others

Global Nylon Acid Dye Fixing Agent Market, By Application

- Clothing

- Home Textiles

- Industrial Nylon

- Automotive Textiles

- Technical Textiles

- Others

Global Nylon Acid Dye Fixing Agent Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the nylon acid dye fixing agent market over the forecast period?The global nylon acid dye fixing agent market is projected to expand at a CAGR of 6.1% during the forecast period.

-

2. What is the nylon acid dye fixing agent market?The nylon acid dye fixing agent market involves chemicals that enhance colorfastness, durability, and dye absorption in nylon textile fabrics.

-

3. What is the market size of the nylon acid dye fixing agent market?The global nylon acid dye fixing agent market size is expected to grow from USD 772.1 million in 2024 to USD 1480.6 million by 2035, at a CAGR of 6.1% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the nylon acid dye fixing agent market?Asia Pacific is anticipated to hold the largest share of the nylon acid dye fixing agent market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global nylon acid dye fixing agent market?BASF SE, Archroma, Clariant AG, DyStar Group, Kiri Industries, Huntsman Corporation, Dymatic Chemicals, CHT Group, Evonik Industries, Dow, Piedmont Chemical Industries, and Others

-

6. What factors are driving the growth of the nylon acid dye fixing agent market?Market growth is driven by increasing demand for colorfast, durable nylon fabrics, expanding textile manufacturing, rising sportswear and apparel consumption, and the adoption of eco-friendly, high-performance dye fixing agents globally.

-

7. What are the market trends in the nylon acid dye fixing agent market?Key trends include rising demand for eco-friendly, durable fixing agents, advanced dyeing technologies, and growth in textile and apparel manufacturing.

-

8. What are the main challenges restricting wider adoption of the nylon acid dye fixing agent market?The main challenges restricting the wider adoption of the nylon acid dye fixing agent market involve significant environmental and regulatory pressures, technical limitations leading to quality control issues, and price volatility of raw materials.

Need help to buy this report?