North America Watches Market Size, Share, and COVID-19 Impact Analysis, By Type (Digital, Analog, and Quartz), By Usage (Sports Watches, Military Watches, Fashion Watches), By End User (Men and Women), By Distribution Channel (Offline and Online), and North America Watches Market Insights, Industry Trends, Forecast to 2035

Industry: Information & TechnologyNorth America Watches Market Insights Forecasts to 2035

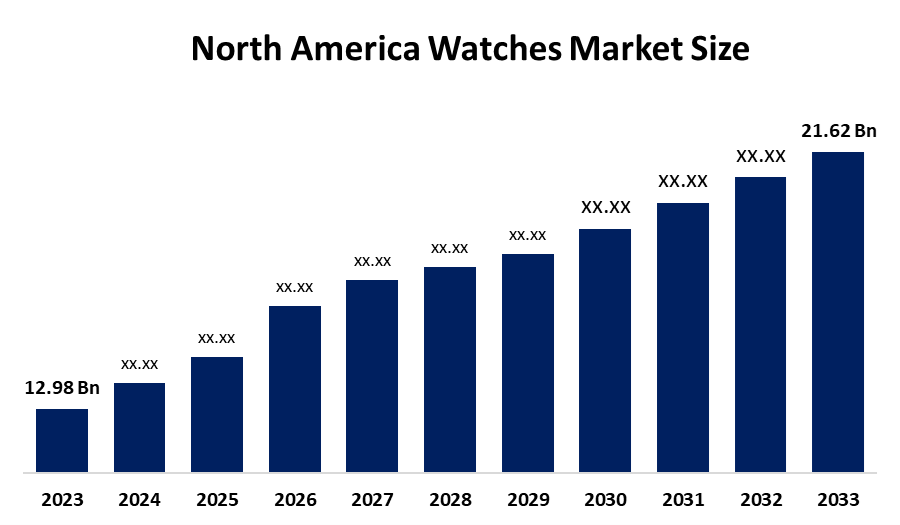

- The North America Watches Market Size Was Estimated at USD 12.98 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.75% from 2025 to 2035

- The North America Watches Market Size is Expected to Reach USD 21.62 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Watches Market Size is anticipated to reach USD 21.62 Billion by 2035, Growing at a CAGR of 4.75% from 2025 to 2035. The market is driven by brand-conscious consumers seeking luxury, mid-range, and affordable mechanical and quartz watches for style, gifting, and investment purposes, drives the market growth.

Market Overview

A watch can be defined as a small device that shows time and is generally worn on the wrist or put in the pocket. Each watch has a type of movement which provides the energy to the watch hands or display and, as a result, communicates the time very accurately to the viewer. In addition to these, modern wristwatches are available in various types, including analog, digital, and smartwatches, and hybrid ones, which are all very amazing and include lots of features such as chronographs, water resistance, fitness tracking, and GPS connectivity.

The United States government has accepted the proposal to cut the Swiss tariffs down to 15%. The situation is made worse by the fact that many Swiss firms have already felt the impact of the 39% tariff, which was imposed in August 2025. Patek Philippe, among others, decided to increase its prices in order to cover the costs, while others were rushing to ship out their stock before the onset of the tariff.

The Wear OS ecosystem in 2025 was alive and kicking, due to the lifecycle updates not only for the original but also for the new Pixel Watch generations; the very first Pixel Watch finally reached its end of the official support cycle in 2025. As of November 2024, Tissot has presented a new 25 mm quartz timepiece to be included in its PRX family. The timepiece perfectly blends the 1970s integrated-bracelet design of the brand with a contemporary ambience. It comes equipped with a Swiss quartz movement featuring an End-of-Life indicator and is also 100 meters water-resistant.

Social media outlets and trendy influencers have played huge roles in making watches an essential part of fashion today. Nevertheless, watches are getting much better in terms of eco-friendly practices and this is done through solar power, rechargeable batteries, etc., which again has been a great advantage for the consumer.

Report Coverage

This research report categorizes the market for the North America watches market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America watches market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America watches market.

North America Watches Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 12.98 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.75% |

| 2035 Value Projection: | USD 21.62 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | Segment By Type |

| Companies covered:: | Seiko, Fossil Group Inc, Watch IT, Watchonista, CRM Jewelers, Womble Watch LLC, Watch Works, Makrwatch, Watch Skins, Brighton Collectibles, and Other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The watches market in North America is driven by the rising power of consumers to buy, especially in the case of the developing markets, which is greatly increasing the demand for luxury and also mid-range watches. People are buying smartwatches that can provide them with real-time data on their physical activity, sleep, and general health. Smartwatches that come with medical-grade sensors, ECG tracking, and oxygen saturation measurement have gained even more popularity as health-mate products due to their quality and very good usability.

Restraining Factors

The watches market in North America is restrained by smartphones and smartwatches are offering advanced functionalities that go beyond mere timekeeping and are gradually overtaking traditional watches. The luxury timepieces are generally considered symbols of status, made from superior materials, with very complex mechanisms and superb craftsmanship involved.

Market Segmentation

The North America watches market share is categorised into type, usage, end user and distribution channel.

- The analog segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America watches market is segmented by type into digital, analog, and quartz. Among these, the analog segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the year 2024, the analog category accounted for the biggest part with a whopping revenue share of 97.49%. The analog watches were preferred because of their workmanship, history, and luxury. The collectors and the people who are conscious about their style prefer the mechanical or quartz analog watches from such brands as Rolex, Omega, and TAG Heuer due to their complex movements, classic designs, and being a symbol of high social status.

- The sports watches segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on usage, the North America watches market is segmented into sports watches, military watches, fashion watches. Among these, the sports watches segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The North American market, especially the United States, accounts for more than 30% of the revenue generated by the sports watch market. The smartwatches, with the provision of such functions as fitness tracking, health monitoring, and connectivity, are being widely used by the tech-friendly population which is becoming more and more health and wellness conscious. Apple and Garmin are among the brands that dominate this category.

- The men segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America watches market is segmented by end user into men and women. Among these, the men segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by most collectors, and status-driven buyers are male, especially for luxury and sporty lines such as the Rolex Submariner, Omega Seamaster, and TAG Heuer Carrera. These watches are marketed as tools, investment pieces, or symbols of achievement.

- The offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the North America watches market is segmented into offline and online. Among these, the offline segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the luxury market, including that of Swiss watches, has very strict rules regarding the authenticity of products, and therefore the buyers are allowed to check them physically. The same applies to collectors and gifting customers who prefer to select watches according to comfort and style, while the New York boutique named Bulgari, for instance, not only offers repairs and warranty support, but also has exclusive in-store editions which greatly contribute to the luxury experience and promote sales of expensive items.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America watches market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Seiko

- Fossil Group Inc

- Watch IT

- Watchonista

- CRM Jewelers

- Womble Watch LLC

- Watch Works

- Makrwatch

- Watch Skins

- Brighton Collectibles

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In February 2025, Casio officially launched new rugged AE1600H watches in the US. Casio describes these watches as “heavy-duty”, with 100 m water resistance and a 10-year battery life estimate.

In May 2024, Audemars Piguet launched the new 23mm "Mini Oak" collection. Self-referential in its re-interpretation of the 20mm Mini Royal Oak from 1997, but brand new in its 2024 packaging. It comes in three iterations: yellow, pink, and white, all with the Frosted Gold finish

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Watches Market based on the below-mentioned segments:

North America Watches Market, By Type

- Digital

- Analog

- Quartz

North America Watches Market, By Usage

- Sports Watches

- Military Watches

- Fashion Watches

North America Watches Market, By End User

- Men

- Women

North America Watches Market, By Distribution Channel

- Offline

- Online

Frequently Asked Questions (FAQ)

-

What is the North America watches market size?The North America Watches Market size is expected to grow from USD 12.98 billion in 2024 to USD 21.62 billion by 2035, growing at a CAGR of 4.75% during the forecast period 2025-2035

-

What are watches, and their primary use?A watch can be defined as a small device that shows time and is generally worn on the wrist or put in the pocket. Each watch has a type of movement which provides the energy to the watch hands or display and, as a result, communicates the time very accurately to the viewer

-

What are the key growth drivers of the market?Market growth is driven by the rising power of consumers to buy, especially in the case of the developing markets, which is greatly increasing the demand for luxury and also mid-range watches. People are buying smartwatches that can provide them with real-time data on their physical activity, sleep, and general health

-

What factors restrain the North America watches market?The market is restrained by smartphones and smartwatches are offering advanced functionalities that go beyond mere timekeeping and are gradually overtaking traditional watches. The luxury timepieces are generally considered symbols of status, made from superior materials, with very complex mechanisms and superb craftsmanship involved

-

How is the market segmented by type?The market is segmented into digital, analog, and quartz

-

Who are the key players in the North America watches market?Key companies include Seiko, Fossil Group Inc., Watch IT, Watchonista, CRM Jewelers, Womble Watch LLC, Watch Works, Makrwatch, Watch Skins, and Brighton Collectibles.

Need help to buy this report?