North America Viral Vector Market Size, Share, and COVID-19 Impact Analysis, By Vector Type (Adeno Associated Virus, Lentivirus, Retrovirus, Adeno Virus and Others), By Application (Cell & Gene Therapy, Vaccine, Biopharmaceutical & Pharmaceutical Discovery), By End User (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, CROs and CMOs), and North America Viral Vector Market Insights, Industry Trends, Forecast to 2035

Industry: HealthcareNorth America Viral Vector Market Insights Forecasts to 2035

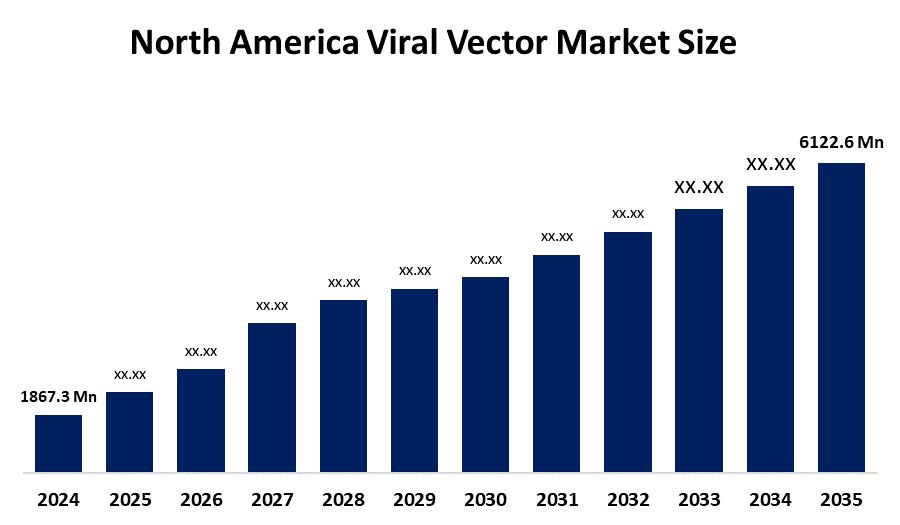

- The North America Viral Vector Market Size Was Estimated at USD 1867.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.4% from 2025 to 2035

- The North America Viral Vector Market Size is Expected to Reach USD 6122.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Viral Vector Market Size is anticipated to reach USD 6122.6 million by 2035, growing at a CAGR of 11.4% from 2025 to 2035. The market is driven by the rising demand for gene therapy, vaccines, and other innovative therapeutics to tackle the growing burden of genetic disorders, chronic diseases, and infectious diseases, among others.

Market Overview

Viral vectors represent a method to penetrate cells and deposit the genetic material. The procedure can be done either in living organisms or in vitro. Viruses in nature have mastered certain molecular mechanisms to efficiently deliver their genomic material to the host cells they infect. It is considered a method for curing monogenic diseases and rare genetic disorders by introducing or adding functional genes to replace malfunctioning ones. It plays a part in at least two treatments: CAR-T cell therapy and oncolytic viruses' treatments, the latter being periodically employed to either kill tumor cells or reinforce the immune system's ability to identify them as being tumors. Viral vectors are paramount in functional genomics, CRISPR/Cas9 delivery for gene editing, and tracing of cell lineages in developmental biology.

Lonza, a manufacturer that cooperates with pharma, biotech and nutrition sectors, has made it public that it will be enlarging its labs for the development of the CGT (cell and gene therapies) process and analytical at the sites in Houston (US) and Geleen (NL).

The largest increase in area for AAV gene therapy was rare and super-rare diseases that were treated only with AAV or had no treatment at all. The viral vector manufacturing market in the North American region is expected to grow throughout the forecast period. In November 2023, the annual expenditure on gene therapy in the United States was USD 20.4 billion. The larger investment in the biotech industry is expected to have a positive impact on the market growth.

The New South Wales (NSW) Government declared in June 2023 that it will invest $49.6 million to build a commercial-scale viral vector manufacturing plant at the Westmead Health and Innovation District. The use of advanced therapies, such as gene and cell therapies, which depend on viral vectors to transfer genetic and cellular information into cells, would greatly benefit the market.

Report Coverage

This research report categorizes the market for the North America Viral Vector Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America viral vector market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America viral vector market.

North America Viral Vector Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1867.3 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 11.4% |

| 2035 Value Projection: | USD 6122.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Vector Type, By Application |

| Companies covered:: | Regenxbio Inc, Oxford Biomedical Research, Biogen Inc, Thermo Fisher Scientific Inc, Vector Builder, AGC Biologics, Origene Technologies, Genezen laboratories, Aldevron, Vector Biosystems, and Other Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The viral vector market in North America is driven by the growing prevalence of chronic conditions, and the heights of the regulatory approvals of vector-based therapies, and the demand for the production of viral vectors is going up. In November of the year 2023, Genezen, a U.S.-based contract development and manufacturing organization (CDMO), obtained financing of USD 18.5 million led by Ampersand Capital Partners to reinforce its growth path in the production of viral vectors and also providing better assistance to the innovators of cell and gene therapies.

Restraining Factors

The viral vector market in North America is restrained by the manufacturing and cost barriers in viral vector research and production, and the high price associated with the production of viral vectors. Notwithstanding the great increase in demand, the market for AAV gene therapies is still hindered by the very difficult and expensive vector production process. Creating an AAV of clinical-grade quality means very strict control of the surroundings, the use of the best bioreactors, very thorough purification methods, and a lot of quality testing to guarantee safety and consistency.

Market Segmentation

The North America Viral Vector Market share is categorised into vector type, application and end user.

- The adeno associated virus segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Viral Vector Market Size is segmented by vector type into adeno associated virus, lentivirus, retrovirus, adeno virus and others. Among these, the adeno associated virus segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The adeno-associated virus was the dominant sector in terms of revenue share, accounting for 47.55% of the total market in 2023. The adeno-associated virus (AAV) gene therapy market is on the threshold of a major growth transformation due to the increasing demand for gene delivery technologies that are safer, more stable, and more efficient. AAV vectors have been the choice of many gene therapy trials due to they provide a robust mix of safety, targeting, and longevity of gene expression.

- The cell & gene therapy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America Viral Vector Market Size is segmented into cell & gene therapy, vaccine, biopharmaceutical & pharmaceutical discovery. Among these, the cell & gene therapy segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the escalating occurrence of hereditary diseases and the corresponding rise of gene therapy methods. The progress made in viral vector technologies, particularly with adeno-associated viruses (AAVs), has contributed to the betterment of gene transfer regarding safety and efficiency. Moreover, the growing R&D expenditure and supportive regulatory clearances have sped up the process of developing and marketing gene therapies.

- The pharmaceutical and biotechnology companies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Viral Vector Market Size is segmented by end user into pharmaceutical and biotechnology companies, academic and research institutes, CROs and CMOs. Among these, the pharmaceutical and biotechnology companies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the requirements are increasing requirements for gene and cell therapies, mainly in the fields of cancer and rare genetic diseases. Such organisations made considerable investments not only for R&D but also for the expansion of manufacturing capabilities in-house, to support both clinical and commercial production. Their presence was enhanced by the strategic partnerships and takeovers, whereas the approvals of viral vector-based therapies by regulatory bodies played a role, too.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Viral Vector Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Regenxbio Inc

- Oxford Biomedical Research

- Biogen Inc

- Thermo Fisher Scientific Inc

- Vector Builder

- AGC Biologics

- Origene Technologies

- Genezen laboratories

- Aldevron

- Vector Biosystems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, OXB, a global quality and innovation-led cell and gene therapy CDMO, announced that it had signed and closed an asset purchase transaction to acquire a custom-built, state-of-the-art cell and gene therapy viral vector manufacturing facility in North Carolina from RTP Operating, LLC, a subsidiary of National Resilience Holdco, Inc.

In June 2025, ProBio, a global contract development and manufacturing organization (CDMO) specializing in cell and gene therapy, announced the opening of its flagship Cell and Gene Therapy Center of Excellence at the Princeton West Innovation Campus in Hopewell, New Jersey.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented theNorth America Viral Vector Market Size based on the below-mentioned segments:

North America Viral Vector Market, By Vector Type

- Adeno Associated Virus

- Lentivirus

- Retrovirus

- Adeno Virus and Others

North America Viral Vector Market, By Application

- Cell & Gene Therapy

- Vaccine

- Biopharmaceutical & Pharmaceutical Discovery

North America Viral Vector Market, By End User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- CROs and CMOs

Frequently Asked Questions (FAQ)

-

What is the North America viral vector market size?The North America Viral Vector Market size is expected to grow from USD 1867.3 million in 2024 to USD 6122.6 million by 2035, growing at a CAGR of 11.4% during the forecast period 2025-2035.

-

What is viral vector, and its primary use?Viral vectors represent a method to penetrate cells and deposit the genetic material. The procedure can be done either in living organisms or in vitro. Viruses in nature have mastered certain molecular mechanisms to efficiently deliver their genomic material to the host cells they infect. It is considered a method for curing monogenic diseases and rare genetic disorders by introducing or adding functional genes to replace malfunctioning ones.

-

What are the key growth drivers of the market?Market growth is driven by the growing prevalence of chronic conditions, and the heights of the regulatory approvals of vector-based therapies, and the demand for the production of viral vectors is going up. In November of the year 2023, Genezen, a U.S.-based contract development and manufacturing organization (CDMO), obtained financing of USD 18.5 million led by Ampersand Capital Partners to reinforce its growth path in the production of viral vectors

-

What factors restrain the North America viral vector market?The market is restrained by the manufacturing and cost barriers in viral vector research and production, and the high price associated with the production of viral vectors. Notwithstanding the great increase in demand, the market for AAV gene therapies is still hindered by the very difficult and expensive vector production process. Creating an AAV of clinical-grade quality means very strict control of the surroundings

-

How is the market segmented by vector type?The market is segmented into adeno associated virus, lentivirus, retrovirus, adeno virus and others

-

Who are the key players in the North America viral vector market?Key companies include Regenxbio Inc, Oxford Biomedical Research, Biogen Inc, Thermo Fisher Scientific Inc, Vector Builder, AGC Biologics, Origene Technologies, Genezen laboratories, Aldevron, and Vector Biosystems.

Need help to buy this report?