North America Testing and Commissioning Market Size, Share, and COVID-19 Impact Analysis, By Commissioning Type (Initial Commissioning, Retro Commissioning, Monitor-Based Commissioning, and Others), By End Use Industry (Oil and Gas, Consumer and Retail, Food and Agriculture, Construction and Chemicals, and Others), and North America Testing and Commissioning Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyNorth America Testing and Commissioning Market Insights Forecasts to 2035

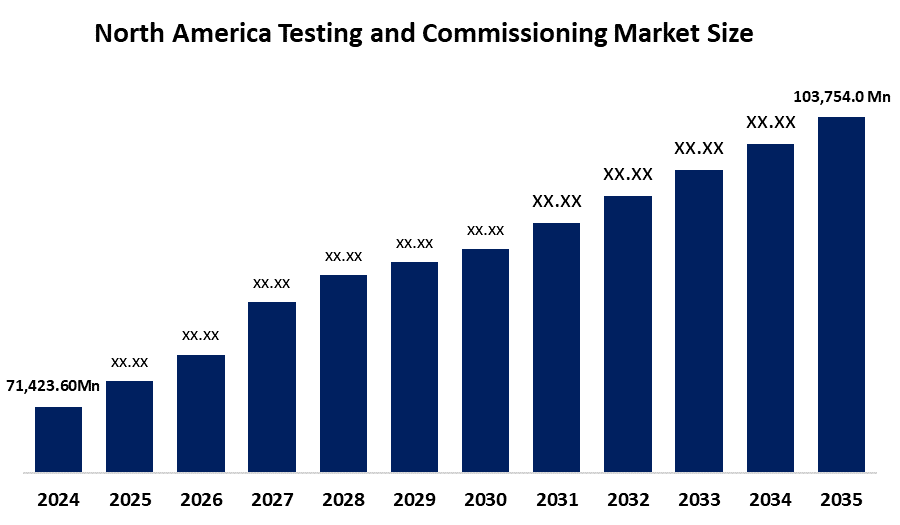

- The North America Testing and Commissioning Market Size Was Estimated at USD 71,423.60 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.45% from 2025 to 2035

- The North America Testing and Commissioning Market Size is Expected to Reach USD 103,754.0 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Testing and Commissioning Market is anticipated to reach USD 103,754.0 million by 2035, growing at a CAGR of 3.45% from 2025 to 2035. The primary drivers of the market are infrastructure growth, strict regulations, energy efficiency demands, aging assets, Technological Advancements, and safety concerns

Market Overview

The North American testing and commissioning market refers to the industry responsible for the verification and validation of various systems and equipment. This procedure guarantees that the systems and equipment meet the requirements and work as planned. The North American market is distinguished by the existence of several testing and commissioning companies that serve a variety of industries such as construction, manufacturing, energy, and transportation. Testing and commissioning play an essential role in guaranteeing the quality, safety, and reliability of systems and equipment. Moreover, the process consists of a series of tests, inspections, and performance evaluations to identify any faults, malfunctions, or noncompliance with regulatory standards. Companies can reduce risks, increase operational efficiency, and ensure optimal system performance by using rigorous testing and commissioning procedures. North America is experiencing major infrastructure development in a variety of areas, including electricity generation, oil and gas, transportation, and industry. This increases the demand for testing and commissioning services to ensure the safety, efficiency, and compliance of new infrastructure projects. Furthermore, innovations in technology like the Internet of Things (IoT), artificial intelligence (AI), and automation are increasing the demand for testing and commissioning services. As systems become increasingly complex and linked, extensive testing and commissioning are required to ensure their performance, interconnection, and security.

In March 2025, Siemens Energy won a significant contract from Hydro-Québec to design, supply, and commission high-voltage direct current (HVDC) converter stations, marking a major step in North America’s grid modernization efforts. HVDC technology allows efficient transmission of large amounts of power across long distances with minimal losses, making it essential for modernizing North America’s aging grid infrastructure.

Report Coverage

This research report categorises the market for the North America testing and commissioning market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America testing and commissioning market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America testing and commissioning market.

North America Testing and Commissioning Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 71,423.60 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 3.45% |

| 2035 Value Projection: | USD 103,754.0 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Commissioning Type |

| Companies covered:: | Intertek Group plc, Bureau Veritas, Eurofins Scientific, DNV (Det Norske Veritas), Applus+ Services, ALS Limited (ALS Global), BSI Group (British Standards Institution), And Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North America testing and commissioning market is being driven by its experience in services that verify, validate, and certify systems, equipment, and infrastructure to guarantee they fulfill safety, quality, and regulatory requirements. It assists industries such as oil and gas, construction, chemicals, food, agriculture, consumer goods, and retail by providing testing, certification, and commissioning procedures, including initial, retro, and monitor-based techniques. The market, using both in-house and outsourced models, plays an important role in improving dependability, efficiency, sustainability, and risk management while updating aging technologies, boosting market growth. In addition, demand for infrastructure construction: current infrastructure development projects in North America, such as transportation networks, power plants, and industrial facilities, necessitate extensive testing and commissioning to ensure successful implementation and operation.

Restraining Factors

The North America testing and commissioning market faces key restraints such as a shortage of skilled professionals, complex regulatory environments, economic uncertainty, high costs of services, economic uncertainty, and limited awareness among smaller enterprises.

Market segmentation

The North America testing and commissioning market share is classified into commissioning type and end-use industry.

- The initial commissioning segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America testing and commissioning market is divided by commissioning type into initial commissioning, retro commissioning, monitor-based commissioning, and others. Among these, the initial commissioning segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by new infrastructure projects in the construction, energy, and industrial sectors. It ensures that systems are correctly installed, tested, and function as intended, making it a necessity for compliance, safety, and efficiency. Because it is required to evaluate performance and regulatory criteria before facilities are completely operational, initial commissioning has become the most popular and dominating type in the market.

- The oil and gas segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The North America testing and commissioning market is segmented by end-use industry into oil and gas, consumer and retail, food and agriculture, construction and chemicals, and others. Among these, the oil and gas segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the dominant segment, driven by stringent safety, compliance, and dependability standards for pipelines, refineries, and operations off the coast. These services are critical for risk reduction, environmental protection, and regulatory compliance, making testing and commissioning a crucial component in maintaining operational integrity in the industry.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within North America testing and commissioning market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Intertek Group plc

- Bureau Veritas

- Eurofins Scientific

- DNV (Det Norske Veritas)

- Applus+ Services

- ALS Limited (ALS Global)

- BSI Group (British Standards Institution)

- Others

Recent Developments:

- In October 2025, Hitachi Energy announced a strategic partnership with Blackstone Energy Transition Partners and acquired a minority stake in Shermco, a leading North American provider of maintenance, repair, testing, and commissioning services. Hitachi Energy is investing more than $1 billion in the organic expansion of its global service business to strengthen power grid reliability and safety.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America testing and commissioning market based on the below-mentioned segments:

North America Testing and Commissioning Market, By Commissioning Type

- Initial Commissioning

- Retro Commissioning

- Monitor-Based Commissioning

- Others

North America Testing and Commissioning Market, By End-Use Industry

- Oil And Gas

- Consumer And Retail

- Food And Agriculture

- Construction And Chemicals

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current and forecasted size of the North America testing and commissioning market?A: The market was valued at approximately USD 71,423.60 million in 2024 and is projected to grow at a CAGR of 3.45%, reaching around USD 103,754.0 million by 2035.

-

Q: What are the primary commissioning types in the North America testing and commissioning market?A: The primary commissioning types are initial commissioning, retro commissioning, monitor-based commissioning, and others. Among these, the initial commissioning segment held a substantial share in 2024. The segment is driven by new infrastructure projects in the construction, energy, and industrial sectors. It ensures that systems are correctly installed, tested, and function as intended, making it a necessity for compliance, safety, and efficiency.

-

Q: What are the main end-use industries in the market?A: The main end-use industries are oil and gas, consumer and retail, food and agriculture, construction and chemicals, and others. Among these, the machine learning segment dominated the market in 2024. This is the dominant segment, driven by stringent safety, compliance, and dependability standards for pipelines, refineries, and operations off the coast.

-

Q: What are the key driving factors for market growth?A: Growth is driven by infrastructure growth, strict regulations, energy efficiency demands, aging assets, Technological Advancements, and safety concerns

-

Q: What challenges does the market face?A: Challenges include a shortage of skilled professionals, complex regulatory environments, economic uncertainty, high costs of services, economic uncertainty, and limited awareness among smaller enterprises.

-

Q: Who are some key players in the market?A: Key companies include Intertek Group plc, Bureau Veritas, Eurofins Scientific, DNV (Det Norske Veritas), Applus+ Services, ALS Limited (ALS Global), BSI Group (British Standards Institution), and Others.

Need help to buy this report?