North America Tablet POS Systems Market Size, Share, and COVID-19 Impact Analysis, By Type (Card Reader, Chip & Pin Reader, and Others), By Application (Retail, Hospitality, Hotels & Restaurants, and Others), and North America Tablet POS Systems Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsNorth America Tablet POS Systems Market Size Insights Forecasts to 2035

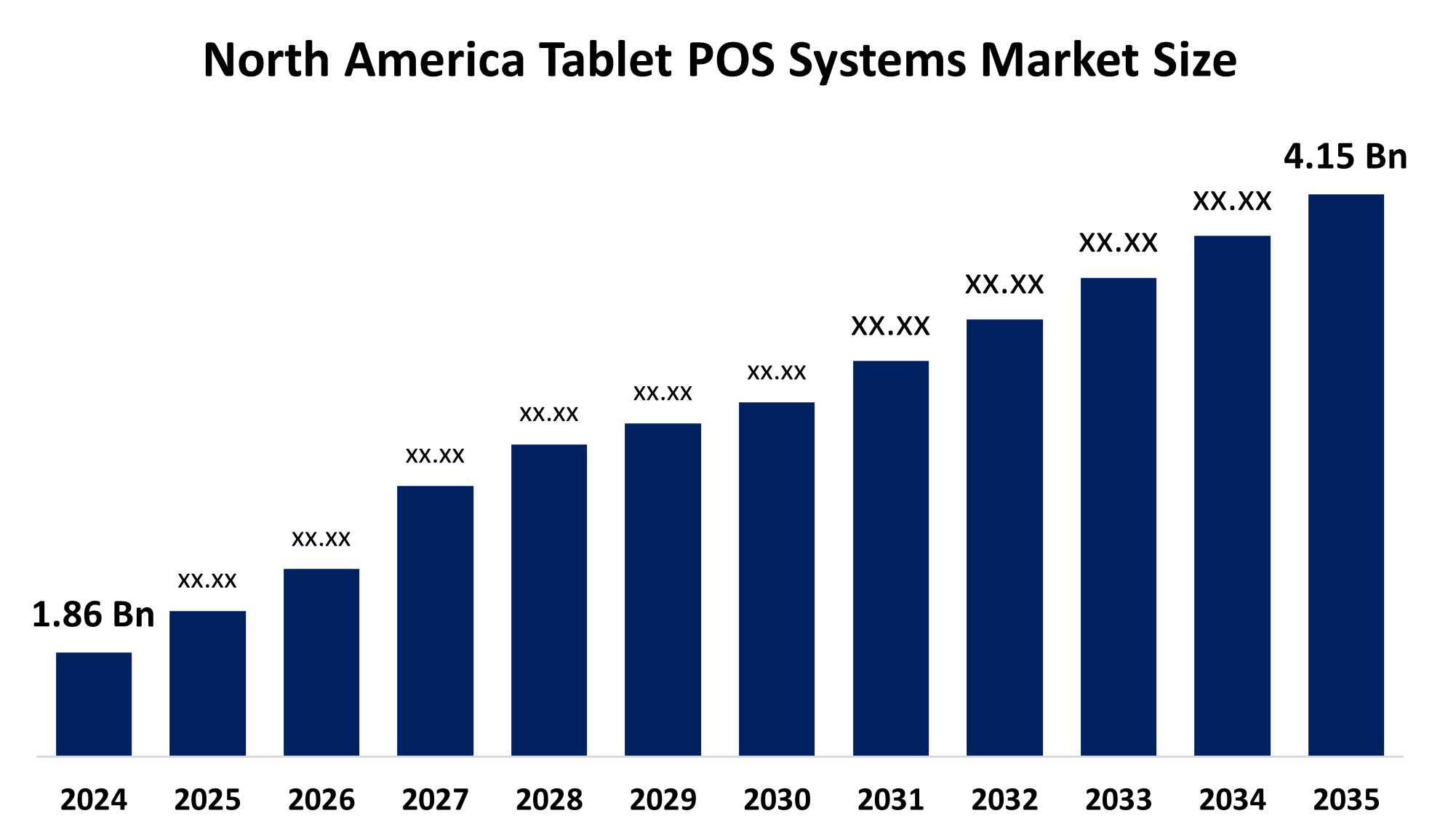

- The North America Tablet POS Systems Market Size Was Estimated at USD 1.86 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.56% from 2025 to 2035

- The North America Tablet POS Systems Market Size is Expected to Reach USD 4.15 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Tablet POS Systems Market Size is Anticipated to Reach USD 4.15 Billion by 2035, Growing at a CAGR of 7.56% from 2025 to 2035. The primary drivers of the market are e-commerce and hospitality digitization, SME adoption, cloud-based integration, contactless payments, and AI-enabled analytics.

Market Overview

The North America Tablet POS Systems Market Size refers to tablet-based point of sale solutions often used in retail, hospitality, restaurants, and other service industries. These systems use portable tablets, POS software, card readers, and cloud connectivity to process transactions, manage inventory, and provide real-time analytics. Their appeal stems from the fact that they allow for faster checkout, tableside ordering, and mobile payments, while also providing a low-cost alternative to traditional cash registers for small and medium-sized enterprises. With strong demand driven by digitization, improved customer experience, and cloud-based analytics, the market includes both hardware sales and service income, establishing tablet POS as a key driver of modern commerce in the region. Additionally, personalization in tablet POS systems offers an improved in-store experience, individualized product recommendations, expanded loyalty programs, targeted discounts, and self-service options. The tablet POS system can recommend things or products that a consumer is likely to buy at the POS based on their purchase history, inferred preferences, and browsing behavior. It promotes upselling and cross-selling opportunities. Moreover, North America controls more than one-third of the global tablet POS market. Demand is skyrocketing in hotels, restaurants, and retail chains as firms shift to contactless payments, real-time inventory management, and omnichannel interaction.

Dawn Capital sponsored a $47 million Series B funding round for Flatpay (Europe-based POS for small retailers) in April 2024, with an emphasis on field sales and tablet-compatible card terminals. Andreessen Horowitz (a16z) and HV Capital fund POS-related startups such as those in Y Combinator's payments cohort, with an emphasis on AI-enabled retail checkout. Is it relevant to the market?

Report Coverage

This research report categorises the market for the North America Tablet POS Systems Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America tablet POS systems market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America tablet POS systems market.

North America Tablet POS Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.86 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.56% |

| 2035 Value Projection: | USD 4.15 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Block, Inc. (Square), Toast, Inc., Shopify Inc., Lightspeed Commerce Inc., Clover (Fiserv, Inc.), Verifone Systems, Inc., Ingenico (Worldline Group), PAX Technology, and Others key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North America Tablet POS Systems Market Size is focused on the adoption of tablet-based point-of-sale solutions in the retail, hospitality, restaurant, and other service industries. These systems use portable tablets, card readers, POS software, and cloud connectivity to simplify transactions, manage inventory, and deliver real-time analytics. Their appeal arises from the fact that they allow for faster checkout, tableside ordering, and mobile payments, while also providing a low-cost alternative to traditional cash registers for small and medium-sized enterprises. With digitization, improved customer experience, and cloud-based insights driving demand, the market includes both hardware and software sales, establishing tablet POS as a critical instrument for modern commerce in the region. Furthermore, rising understanding of the products and the convergence of stable business process apps and pervasive tablet equipment on new technologies will drive market growth in the coming years.

Restraining Factors

The North America Tablet POS Systems Market Size faces key restraints such as data security & privacy concerns, hardware limitations, integration challenges, dependence on internet connectivity, market saturation & competition, and regulatory & compliance barriers.

Market segmentation

The North America Tablet POS Systems Market Size, share is classified into type and application.

- The card reader segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America Tablet POS Systems Market Size is divided by type into card reader, chip & pin reader, and others. Among these, the card reader segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by small enterprises and retail stores that use it extensively. Their appeal originates from their low cost and ease of implementation, as well as seamless connection with tablets, making them the most convenient and accessible alternative for retailers looking for adaptable POS solutions.

- The retail segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The North America Tablet POS Systems Market Size is segmented by application into retail, hospitality, hotels & restaurants, and others. Among these, the retail segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the dominant segment driven by its widespread use in supermarkets, boutiques, and retail stores. Retailers choose these solutions because they simplify inventory management, allow for faster checkout processes, and offer interaction with reward programs, making them a key tool for increasing productivity and consumer engagement.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within North America Tablet POS Systems Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

Block, Inc. (Square)

Toast, Inc.

Shopify Inc.

Lightspeed Commerce Inc.

Clover (Fiserv, Inc.)

Verifone Systems, Inc.

Ingenico (Worldline Group)

PAX Technology

Others

Recent Developments:

- In August 2025, iVend introduced a mobile POS system in the US designed to be fast, flexible, and compliant with the new PCI DSS v4.0 security standards. The system supports omnichannel capabilities like curbside pickup. Meets the latest payment security standards, addressing one of the major restraints in the market.

- In March 2025, Square, Inc. introduced a next-generation Square Point of Sale app, consolidating payment and business operations tools into a unified platform. This update improves the ability for sellers to manage various business types (restaurant, retail, service) from a single interface.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Tablet POS Systems Market Size based on the below-mentioned segments:

North America Tablet Pos Systems Market Size, By Type

- Card Reader

- Chip & Pin Reader

- Others

North America Tablet Pos Systems Market Size, By Application

- Retail

- Hospitality

- Hotels & Restaurants

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current and forecasted size of the North America tablet POS systems market?A: The market was valued at approximately USD 1.86 billion in 2024 and is projected to grow at a CAGR of 7.56%, reaching around USD 4.15 billion by 2035.

-

Q: What are the primary types in the North America tablet POS systems market?A: The primary types of card reader chip & pin readers, and others. Among these, the card reader segment held a substantial share in 2024. The segment is driven by small enterprises and retail stores that use it extensively.

-

Q: What are the main applications in the market?A: The main applications are retail, hospitality, hotels & restaurants, and others. Among these, the retail segment dominated the market in 2024. This is the dominant segment driven by its widespread use in supermarkets, boutiques, and retail stores.

-

Q: What are the key driving factors for market growth?A: Growth is driven by e-commerce and hospitality digitization, SME adoption, cloud-based integration, contactless payments, and AI-enabled analytics.

-

Q: What challenges does the market face?A: Challenges include data security & privacy concerns, hardware limitations, integration challenges, dependence on internet connectivity, market saturation & competition, and regulatory & compliance barriers.

-

Q: Who are some key players in the market?A: Key companies include Block, Inc. (Square), Toast, Inc., Shopify Inc., Lightspeed Commerce Inc., Clover (Fiserv, Inc.), Verifone Systems, Inc., Ingenico (Worldline Group), PAX Technology, and others.

Need help to buy this report?