North America Sulphuric Acid Market Size, Share, and COVID-19 Impact Analysis, By Raw Material (Elemental Sulfur, Pyrite Ore, Base Metal Smelters and Others), By Application (Petroleum Refining, Chemical Manufacturing, Metal Processing, Textile Industry, Automotive, Fertilizers, and Others), and North America Sulphuric Acid Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Sulphuric Acid Market Insights Forecasts to 2035

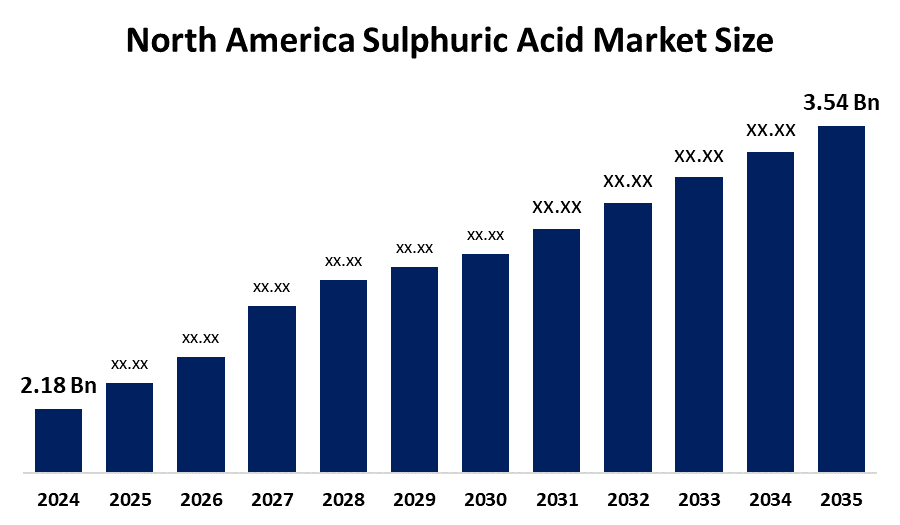

- The North America Sulphuric Acid Market Size Was Estimated at USD 2.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.51% from 2025 to 2035

- The North America Sulphuric Acid Market Size is Expected to Reach USD 3.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Sulphuric Acid Market size is anticipated to reach USD 3.54 Billion by 2035, growing at a CAGR of 4.51% from 2025 to 2035. The market is driven by expanding metals and mining activities, particularly in copper and non-ferrous metal processing where sulfuric acid is a critical input for leaching and refining.

Market Overview

Sulfuric acid functions as a strong acid that exhibits both hygroscopic behavior and oxidizing capabilities. The fertilizer and, chemical, synthetic textile and pigment industries use this substance. Sulfuric acid exists as a highly corrosive colourless liquid which has a thick consistency and serves as one of the most frequently used substances across multiple industrial sectors, including fertilizer production and pulp and paper manufacturing, mining operations and chemical processing. The production of phosphoric acid through sulfuric acid requires sulfuric acid, which then produces phosphate-based fertilizers through its use in creating calcium dihydrogen phosphate and ammonium phosphates. The process also produces ammonium sulfate, which functions as a vital fertilizer for fields that lack sulfur.

The American industrial partners obtain Veolia North America's sulfuric acid regeneration business through their acquisition deal. Nexpera runs 13 operational sites throughout the United States, which employ about 300 workers. The acquisition purpose exists to speed up business growth while the company intends to benefit from market development.

The country exported approximately 1.8 million tons of sulfuric acid in 2023, which represented more than 8 of the worlds sulfuric acid production. The United States received almost all of those shipments. The US Environmental Protection Agency established new regulations in May 2024, which enforced tighter limits on sulfur dioxide and nitrogen oxides emissions to support environmental sustainability efforts. The regulations are driving copper smelters to implement efficient acid recovery systems, which will reduce SO2 emissions and enable them to use their by-products.

Report Coverage

This research report categorizes the market for the North America sulphuric acid market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America sulphuric acid market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America sulphuric acid market.

North America Sulphuric Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.18 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.51% |

| 2035 Value Projection: | USD 3.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Raw Material, By Application |

| Companies covered:: | PVS Chemicals,The Mosaic Co,Nutrien Ltd,Chemtrade Logistics,DuPont de Nemours, Inc,The Dow Chemical Company,NorFalco,BASF SE,Solvay And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sulphuric acid market in North America is driven by rising requirements for fertilizers while various industries show increasing needs for sulfuric acid. Sulfuric acid is essential for the leaching and refining of metals, particularly copper and non-ferrous metals. The rising need for metals used in infrastructure construction and electric vehicles and renewable energy systems results in this particular industrial use. The rising use of electric vehicles and energy storage systems increases the need for high-purity sulfuric acid, which manufacturers use to create lead-acid and lithium-ion batteries.

Restraining Factors

The sulphuric acid market in North America is hindered by the Environmental Protection Agency's establishment of strict emissions controls, which require organizations to invest in environmentally friendly production technologies and compliance systems. The chemical substance sulfuric acid functions as a material that possesses both strong corrosive properties and dangerous characteristics.

Market Segmentation

The North America sulphuric acid market share is categorised into raw material and application.

- The elemental sulfur segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America sulphuric acid market is segmented by raw material into elemental sulfur, pyrite ore, base metal smelters and others. Among these, the elemental sulfur segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2025, elemental sulfur generated the highest revenue of 55.16%. The process produces fewer emissions because it uses elemental sulfur instead of pyrite ore and base metal smelting. The production of elemental sulfur through sulfur recovery units SRUs uses thermal hydrogen sulfide H2S processing which creates less pollution than the restricted sulfur oxide gas emissions from metal smelting and pyrite ore roasting.

- The fertilizers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America sulphuric acid market is segmented into petroleum refining, chemical manufacturing, metal processing, textile industry, automotive, fertilizers, and others. Among these, the fertilizers segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by chemicals needed to convert insoluble phosphate rock into phosphoric acid, which serves as the primary raw material for this process. The acid functions as the essential chemical needed to produce phosphate fertilizers which include Diammonium Phosphate and Monoammonium Phosphate. The process begins with ammonia, which reacts with the substance to form ammonium sulfate, an important fertilizer that provides nitrogen and sulfur to soils lacking sulfur.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America sulphuric acid market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PVS Chemicals

- The Mosaic Co

- Nutrien Ltd

- Chemtrade Logistics

- DuPont de Nemours, Inc.

- The Dow Chemical Company

- NorFalco

- BASF SE

- Solvay

- Others

Key Target Audience

- Market Players

- Investors

- End users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In March 2025, Cornerstone Chemical Company, operator of the Cornerstone Energy Park, announced the sale of its Sulfuric Acid operations to Ecovyst, a global provider of advanced materials, specialty catalysts, sulfuric acid and regeneration services.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Sulphuric Acid Market based on the below-mentioned segments:

North America Sulphuric Acid Market, By Raw Material

- Elemental Sulfur

- Pyrite Ore

- Base Metal Smelters

- Others

North America Sulphuric Acid Market, By Application

- Petroleum Refining

- Chemical Manufacturing

- Metal Processing

- Textile Industry

- Automotive

- Fertilizers

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America sulphuric acid market size?A: The North America Sulphuric Acid Market size is expected to grow from USD 2.18 billion in 2024 to USD 3.54 billion by 2035, growing at a CAGR of 4.51% during the forecast period 2025-2035.

-

Q: What is sulphuric acid, and its primary use?A: Sulfuric acid functions as a strong acid that exhibits both hygroscopic behavior and oxidizing capabilities. The fertilizer and, chemical, synthetic textile and pigment industries use this substance.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by rising requirements for fertilizers while various industries show increasing needs for sulfuric acid. Sulfuric acid is essential for the leaching and refining of metals, particularly copper and non-ferrous metals.

-

Q: What factors restrain the North America sulphuric acid market?A: The market is restrained by the Environmental Protection Agency's establishment of strict emissions controls, which require organizations to invest in environmentally friendly production technologies and compliance systems.

-

Q: How is the market segmented by raw material?A: The market is segmented into elemental sulfur, pyrite ore, base metal smelters and others.

-

Q: Who are the key players in the North America sulphuric acid market?A: Key companies include PVS Chemicals, The Mosaic Co, Nutrien Ltd, Chemtrade Logistics, DuPont de Nemours, Inc., The Dow Chemical Company, NorFalco, BASF SE, and Solvay.

Need help to buy this report?