North America Sodium Sulphate Market Size, Share, and COVID-19 Impact Analysis, By Nature (Natural and Synthetic), By End User (Paper & Pulp, Detergents, Glass, Food & Beverages, and Others), and North America Sodium Sulphate Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Sodium Sulphate Market Insights Forecasts to 2035

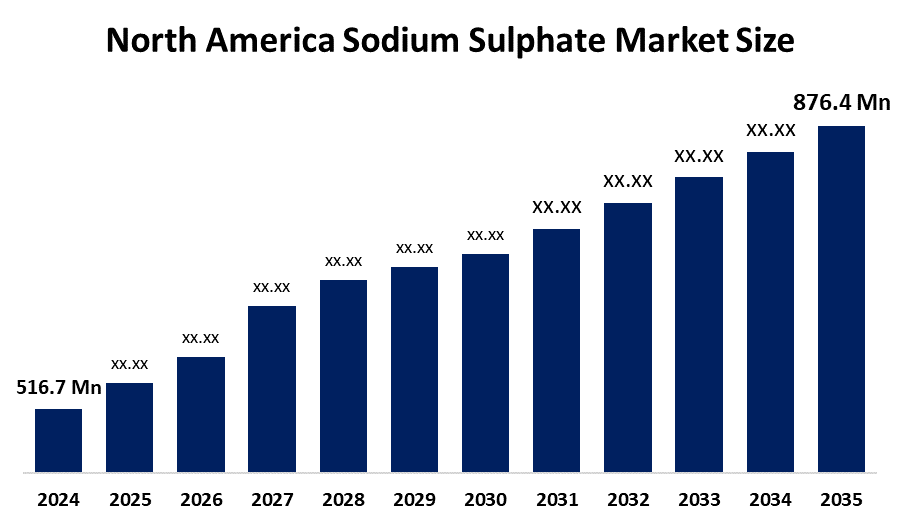

- The North America Sodium Sulphate Market Size Was Estimated at USD 516.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.92% from 2025 to 2035

- The North America Sodium Sulphate Market Size is Expected to Reach USD 876.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Sodium Sulphate Market size is anticipated to reach USD 876.4 Million by 2035, growing at a CAGR of 4.92% from 2025 to 2035. The market is driven by the increasing focus on environmental regulations and the push for greener alternatives, which are influencing production methods and sourcing strategies.

Market Overview

The sodium sulphate market demonstrated the demand and supply of sodium sulphate, which is a white, soluble inorganic substance used in glassmaking, detergent production, textile manufacturing and drying operations. Sodium sulphate, also referred to as Glaubers salt, exists in a chemical form that combines two sodium atoms with one sulfate ion. The substance exists as a product that companies create by combining sodium chloride and sulfuric acid, although natural sources of the substance exist in rocks such as Thenardite and Mirabilite. The product functions as a filler material for powdered surfactants, which improves the texture and performance of the product.

In September 2023, Cinis Fertilizer announced plans to build a new sodium sulphate creation site in Hopkinsville, Kentucky. They partnered with Ascend Elements to obtain sodium sulphate for the project. Aepnus Technology, the developer of an electrochemical platform for circularity improvement and emission reduction in the battery supply chain chemicals, raised $8 million in seed financing to accelerate its development of an innovative end to end sodium sulphate recycling technology.

The U.S. Food and Drug Administration (FDA) is continuing its multi-phase voluntary sodium reduction efforts in processed foods, with Phase II draft guidance issued in August 2024, which aims to reduce average sodium intake to 2,750 mg per day by the year 2030. A U.S. International Trade Commission ruling in September 2022 found no injury from Canadian imports of anhydrous sodium sulphate.

Report Coverage

This research report categorizes the market for the North America sodium sulphate market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America sodium sulphate market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America sodium sulphate market.

North America Sodium Sulphate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 516.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.92% |

| 2035 Value Projection: | USD 876.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Nature , By End User |

| Companies covered:: | igma Aldrich,Searles Valley Minerals,Cooper Natural Resources,Saskatchewan Mining and Minerals Inc,Elementis PLC,Minera de Santa Marta,Nippon Chemical Industrial Co., Ltd,Grasim Industries And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The sodium sulphate market in North America is driven by the expansion of the glass manufacturing sector. Sodium sulphate functions as a fining agent in glass production because it enables the elimination of bubbles and impurities. The glass manufacturing industry will experience continuous growth because the demand for glass products in the construction and packaging sectors continues to increase. The chemical manufacturing sector is expected to grow because industrial activities increase and there is a rising need for specialty chemicals. The textile industry is expected to expand at approximately 5% each year because consumers increasingly demand fashionable and sustainable clothing.

Restraining Factors

The sodium sulphate market in North America is hindered by the rising costs and decreased availability of raw materials, which include salt cake and energy resources, resulting in higher production costs and lower profit margins for manufacturers. The implementation of stricter environmental regulations and waste disposal standards especially affects sulphate emissions from industrial and mining operations.

Market Segmentation

The North America sodium sulphate market share is categorised into nature and end user.

- The nature segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America sodium sulphate market is segmented by nature into natural and synthetic. Among these, the nature segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the natural sodium sulphate, which exists as an inexpensive mineral resource that provides environmentally friendly properties. The company maintains its leading market position because it operates sustainable mining operations, which require minimal processing of the material.

- The detergents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the North America sodium sulphate market is segmented into paper & pulp, detergents, glass, food & beverages, and others. Among these, the detergents segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. Detergents accounted for 43% of the market in 2022. The cleaning agent within this compound helps to remove tough stains and deep-seated dirt while protecting the fabric material from damage. The substance functions as a strong anti-caking agent, which stops lumps from forming while it improves material flow. The product functions as a rust prevention system when used in washing machines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America sodium sulphate market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sigma-Aldrich

- Searles Valley Minerals

- Cooper Natural Resources

- Saskatchewan Mining and Minerals Inc.

- Elementis PLC

- Minera de Santa Marta

- Nippon Chemical Industrial Co., Ltd.

- Grasim Industries

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Sodium Sulphate Market based on the below-mentioned segments:

North America Sodium Sulphate Market, By Nature

- Natural

- Synthetic

North America Sodium Sulphate Market, By End User

- Paper & Pulp

- Detergents

- Glass

- Food & Beverages

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America sodium sulphate market size?A: The North America Sodium Sulphate Market size is expected to grow from USD 516.7 million in 2024 to USD 876.4 million by 2035, growing at a CAGR of 4.92% during the forecast period 2025-2035.

-

Q: What is sodium sulphate, and its primary use?A: The sodium sulphate market demonstrated the demand and supply of sodium sulphate, which is a white, soluble inorganic substance used in glassmaking, detergent production, textile manufacturing and drying operations. Sodium sulphate, also referred to as Glaubers salt, exists in a chemical form that combines two sodium atoms with one sulphate ion.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the expansion of the glass manufacturing sector. Sodium sulphate functions as a fining agent in glass production because it enables the elimination of bubbles and impurities.

-

Q: What factors restrain the North America sodium sulphate market?A: The market is restrained by the rising costs and decreased availability of raw materials, which include salt cake and energy resources, resulting in higher production costs and lower profit margins for manufacturers.

-

Q: How is the market segmented by nature?A: The market is segmented into natural and synthetic.

-

Q: Who are the key players in the North America sodium sulphate market?A: Key companies include Sigma-Aldrich, Searles Valley Minerals, Cooper Natural Resources, Saskatchewan Mining and Minerals Inc., Elementis PLC, Minera de Santa Marta, Nippon Chemical Industrial Co., Ltd., and Grasim Industries.

Need help to buy this report?