North America Smart Hardware ODM Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Smart Home Devices, Smart Wearables, Industrial IoT Equipment, Automotive Electronics, Healthcare Devices, Consumer Electronics and Peripherals, and Others), By Application (Consumer Electronics, Healthcare and Medical Devices, Automotive and Transportation, Industrial Automation, Smart Home and Building Automation, Telecommunications, and Others), and North America Smart Hardware ODM Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsNorth America Smart Hardware ODM Market Insights Forecasts to 2035

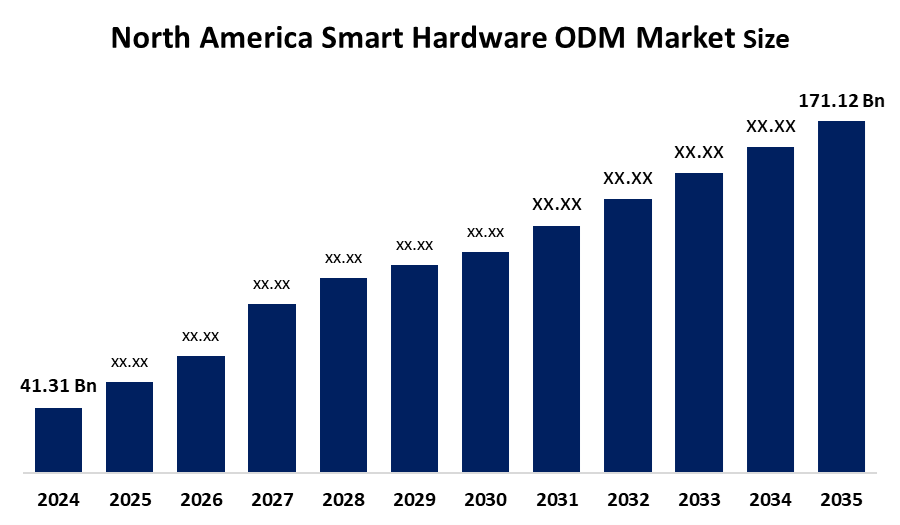

- The North America Smart Hardware ODM Market Size Was Estimated at USD 41.31 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.79% from 2025 to 2035

- The North America Smart Hardware ODM Market Size is Expected to Reach USD 171.12 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Smart Hardware ODM Market is anticipated to reach USD 171.12 Billion by 2035, rowing at a CAGR of 13.79% from 2025 to 2035. The primary drivers of the market are IoT integration, AI-powered consumer electronics, 5G adoption, industrial automation, and rising demand for smart wearables, home automation, and connected healthcare systems.

Market Overview

The North America smart hardware ODM market refers to the ecosystem where original design manufacturers (ODMs) design, develop, and produce smart hardware devices such as consumer electronics, smart home systems, wearables, industrial IoT equipment, and connected healthcare solutions for technology brands that focus on branding, marketing, and distribution. In North America, the smart hardware ODM ecosystem is quickly emerging, with increased competence in embedded electronics, software integration, and smart connectivity solutions. ODMS serves a wide range of applications, including smart home appliances, wearable electronics, industrial sensors, and telemedicine devices. The growing complexity of connected devices, along with the necessity for cross-platform compatibility, has positioned ODMS as a critical player in the smart device value chain. With global technology businesses looking for flexible and cost-effective development approaches, North America's ODM sector is becoming increasingly critical. In addition, AI and machine learning are rapidly being used in ODM product development procedures. In North America, AI algorithms are used to optimize circuit design, predictive testing, and power management systems. Furthermore, North American ODMs will diversify their portfolio beyond consumer electronics into new markets such as automotive electronics, healthcare wearables, and industrial automation. Strategic collaborations between ODMS, semiconductor companies, and software providers will result in synergistic innovation clusters, bolstering North America's position as a hub for smart device manufacturing and design excellence.

In December 2025, San Jose-based Axiado Corporation raised over $100 million in an oversubscribed Series C+ funding round, led by Maverick Silicon with participation from Prosperity7 Ventures, Orbit Venture Partners, Crosslink Capital, and Nosterra Ventures. The funding is aimed at scaling AI-driven, hardware-anchored security and system management solutions for AI data centers, while also supporting global expansion and deepening R&D capabilities, particularly in India.

Report Coverage

This research report categorises the market for the North America smart hardware ODM market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America smart hardware ODM market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America smart hardware ODM market.

North America Smart Hardware ODM Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 171.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 13.79% |

| 2035 Value Projection: | USD 41.31 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type |

| Companies covered:: | Flex Ltd., Jabil Inc., Celestica Inc., Sanmina Corporation, Benchmark Electronics, SFO Technologies (NeST Group), and Other key palyers |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North American smart hardware ODM market is being driven by technology businesses that are increasingly relying on original design manufacturers to provide connected, AI-enabled products in the consumer, industrial, and healthcare sectors. Rising demand for smart wearables, home automation systems, and IoT-powered solutions, as well as the introduction of 5G, edge computing, and cloud analytics to boost device performance and scalability, are propelling growth. Outsourcing design and manufacture allows firms to save costs, accelerate innovation, and bring customized goods to market faster, cementing ODMs' position as key enablers of the region's burgeoning smart hardware ecosystem.

Restraining Factors

The North America smart hardware ODM market faces key restraints such as supply chain disruptions, rising cybersecurity risks, regulatory compliance challenges, high competition with shrinking margins, and dependence on global semiconductor availability.

Market segmentation

The North America smart hardware ODM market share is classified into product type and application.

The smart home devices segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America smart hardware ODM market is divided by product type into smart home devices, smart wearables, industrial IoT equipment, automotive electronics, healthcare devices, consumer electronics and peripherals, and others. Among these, the smart home devices segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by smart speakers, thermostats, security systems, and connected lights, which have all seen considerable adoption. Consumers are increasingly lured to home automation solutions that improve convenience and energy efficiency, and seamless integration with voice assistants like Alexa, Google Assistant, and Siri speeds up usage. As a result, this sector constantly holds the biggest market share, owing to strong household penetration and regular device upgrades.

The smart home and building automation segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The North America smart hardware ODM market is segmented by application into consumer electronics, healthcare and medical devices, automotive and transportation, industrial automation, smart home and building automation, telecommunications, and others. Among these, the smart home and building automation segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the dominant segment because of the widespread use of devices such as smart speakers, thermostats, connected lighting, and security systems. Consumers increasingly favor solutions that enhance convenience, energy efficiency, and overall home automation, while seamless integration with voice assistants like Alexa, Google Assistant, and Siri further boosts adoption. With high household penetration and frequent device upgrades, this segment consistently secures the largest share of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within North America smart hardware ODM market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Flex Ltd.

- Jabil Inc.

- Celestica Inc.

- Sanmina Corporation

- Benchmark Electronics

- SFO Technologies (NeST Group)

- Others

Recent Developments:

- In December 2025, Focus Universal Inc. announced the launch of a cost-effective commercial IoT platform. This move underlines the industry-wide drive to transition from costly, fragmented development processes to universal smart IoT platforms in order to expedite adoption and reduce project failure rates.

- In November 2024, Taipei– Foxconn announced today it is collaborating with NVIDIA to build digital twins to reshape the future of manufacturing processes and supply chain management while opening new pathways for global deployment of advanced facilities and enhancing corporate resilience.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

- This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America smart hardware ODM market based on the below-mentioned segments:

North America Smart Hardware ODM Market, By Product Type

- Smart Home Devices

- Smart Wearables

- Industrial IoT Equipment

- Automotive Electronics

- Healthcare Devices

- Consumer Electronics and Peripherals

- Others

North America Smart Hardware ODM Market, By Application

- Consumer Electronics

- Healthcare and Medical Devices

- Automotive and Transportation

- Industrial Automation

- Smart Home and Building Automation

- Telecommunications

- Others

Frequently Asked Questions (FAQ)

-

What is the current and forecasted size of the North America smart hardware ODM market?The market was valued at approximately USD 41.31 billion in 2024 and is projected to grow at a CAGR of 13.79%, reaching around USD 171.12 billion by 2035.

-

What are the primary product types in the North America smart hardware ODM market?The primary product types are smart home devices, smart wearables, industrial IoT equipment, automotive electronics, healthcare devices, consumer electronics and peripherals, and others. Among these, the smart home devices segment held a substantial share in 2024.

-

The primary product types are smart home devices, smart wearables, industrial IoT equipment, automotive electronics, healthcare devices, consumer electronics and peripherals, and others. Among these, the smart home devices segment held a substantial share in 2024.The primary product types are smart home devices, smart wearables, industrial IoT equipment, automotive electronics, healthcare devices, consumer electronics and peripherals, and others. Among these, the smart home devices segment held a substantial share in 2024.

-

What are the key driving factors for market growth?Growth is driven by the IoT integration, AI-powered consumer electronics, 5G adoption, industrial automation, and rising demand for smart wearables, home automation, and connected healthcare systems.

-

Growth is driven by the IoT integration, AI-powered consumer electronics, 5G adoption, industrial automation, and rising demand for smart wearables, home automation, and connected healthcare systems.Challenges include intense supply chain disruptions, rising cybersecurity risks, regulatory compliance challenges, high competition with shrinking margins, and dependence on global semiconductor availability.

-

Who are some key players in the market?Key companies include Flex Ltd., Jabil Inc., Celestica Inc., Sanmina Corporation, Benchmark Electronics, SFO Technologies (NeST Group), and others

Need help to buy this report?