North America Real-Time Locating Systems Market Size, Share, and COVID-19 Impact Analysis, By Offering (Tags/Badges, Readers/Trackers), By Technology (RFID, Wi-Fi, UWB, BLE, Infrared, Ultrasound, Zigbee), By Application (Inventory Tracking, Personnel Tracking), and North America Real-Time Locating Systems Market Insights, Industry Trends, Forecast to 2035

Industry: Information & TechnologyNorth America Real-Time Locating Systems Market Insights Forecasts to 2035

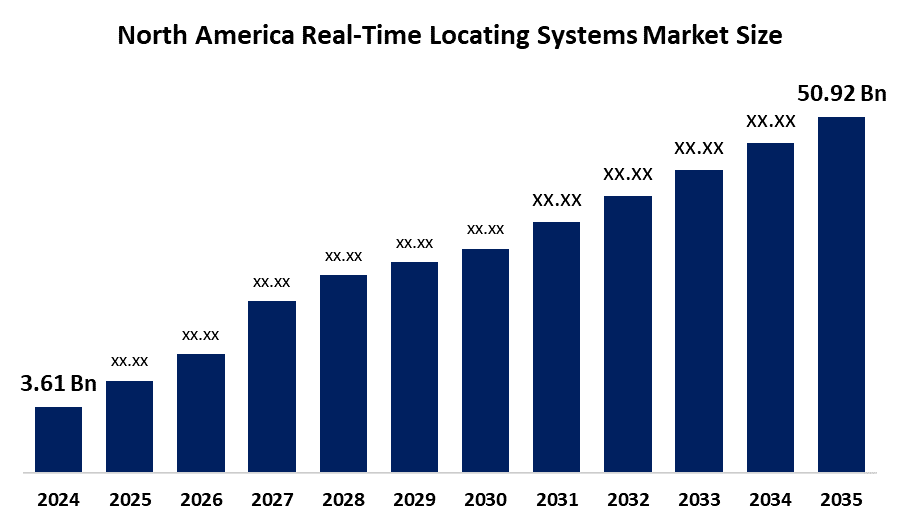

- The North America Real-Time Locating Systems Market Size Was Estimated at USD 3.61 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 27.2% from 2025 to 2035

- The North America Real-Time Locating Systems Market Size is Expected to Reach USD 50.92 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Real-Time Locating Systems Market Size Is Anticipated To Reach USD 50.92 Billion By 2035, Growing At a CAGR of 27.2% From 2025 to 2035. The market is driven by the increasing demand for enhanced operational efficiency, asset management, and workforce tracking across various industries. RTLS technologies provide real-time visibility into the location of assets and personnel, enabling organizations to optimize their operations and improve safety and security compliance.

Market Overview

The term Real-Time Location System (RTLS) signifies a technological apparatus that pinpoints the position of objects or individuals in real-time within the port area. Tracking systems in real-time location (RTLS) are high-tech solutions that apply contemporary technologies such as RFID, GPS, Wi-Fi, infrared, and Bluetooth Low Energy (BLE) to the recognition and monitoring of the precise point of assets, equipment, or humans with no limit to the area. Precious and instant data to organizations that guide them to streamline the operation, maximize safety, and make better use of the resources is provided by these systems. RTLS is not only common but essential in a diversity of sectors such as healthcare, transport and logistics, manufacturing, retail, and military.

The Census Bureau of the United States, which is under the Department of Commerce, has forecasted a 5.3% rise in e-commerce in the U.S. by the year 2025 compared to the second quarter of 2024. Such an event would consequently result in the implementation of Real-Time Location Systems (RTLS) in warehouses and distribution centers for the instant location tracking of goods and assets.

AiRISTA Flow and Lowry Solutions are providing personalized RTLS implementations, usually merging with present enterprise systems. The industry is marked by tech convergence, alliances, and a move to using cloud analytics and IoT integration as major factors, which, in turn, help to innovate and differentiate the vendors that, at the same time, are competing for accuracy, scalability, and total cost of ownership.

Report Coverage

This research report categorizes the market for the North America Real-Time Locating Systems Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America real-time locating systems market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America real-time locating systems market.

North America Real-Time Locating Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.61 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 27.2% |

| 2035 Value Projection: | USD 50.92 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Zebra Technologies Corporation Securitas Stanley Healthcare CenTrak AiRISTA Flow TeleTracking Ubisense Siemens American RFID Solutions, LLC Guard RFID Solutions And Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Real-Time Locating Systems Market Size in North America is driven by a rising need for connected devices like smartphones, tablets, and various types of wearables such as smartwatches, fitness trackers, VR headsets, internet-connected eyeglasses, smart jewellery, and Bluetooth speakers. By 2022, there were 6.4 billion mobile users worldwide using smartphones. This is expected to rise to 9 billion by 2030, with 92% predicted smartphone penetration. There is rapid adoption of these technologies in US and Canadian hospitals, mega warehouses, and fulfilment centres for patient and staff tracking, inventory management, and robot navigation, respectively.

Restraining Factors

The Real-Time Locating Systems Market in North America is restrained by concerns about data security and privacy, in addition to high installation and maintenance costs. The integration of RTLS with present-day, usually scattered legacy IT systems and operations can be quite difficult and demand a lot of customization and expert IT knowledge. The setting up of an RTLS system requires a large upfront investment for hardware (tags, sensors, readers) and software, and also for continuous maintenance and support

Market Segmentation

The North America real-time locating systems market share is categorised into offering, technology, and application.

- The tags/badges segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Real-Time Locating Systems Market Size is segmented by offering into tags/badges, readers/trackers. Among these, the tags/badges segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the readers are static devices that pick-up signals sent by the tags, which help them determine the locations and transmit the information to the RTLS software. Tags are tiny gadgets with batteries that are either fixed to the assets or individuals for the purpose of providing their IDs and sensor data.

- The RFID segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on technology, The North America Real-Time Locating Systems Market Size is segmented into RFID, Wi-Fi, UWB, BLE, infrared, ultrasound, zigbee. Among these, the RFID segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is driven by the hospitals using RFID technology in the form of tags and badges for the purposes of finding medical devices, observing the flow of patients, and securing personnel, whereas retailers employ it for the enhancement of stock visibility and the reduction of losses. Line-of-sight-free nature was one of the factors that contributed to the widespread use of the technology, along with its low price, high scalability, and other advantages. Most manufacturers turned to RFID due to its reliability, and thus being the easiest and most economical solution for massive installations by trading off some initial costs with those of advanced options

- The inventory tracking segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Real-Time Locating Systems Market Size is segmented by application into inventory tracking, personnel tracking. Among these, the inventory tracking segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven due to its critical role in minimizing mistakes, reducing downtime, and increasing productivity in areas like logistics, healthcare (medical equipment) and manufacturing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Real-time Locating Systems Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Zebra Technologies Corporation

- Securitas

- Stanley Healthcare

- CenTrak

- AiRISTA Flow

- TeleTracking

- Ubisense

- Siemens

- American RFID Solutions, LLC

- Guard RFID Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2025, Cisco announced Cisco Unified Edge, an integrated computing platform for distributed AI workloads. Cisco Unified Edge brings together compute, networking, storage, and security closer to the data for real-time AI inferencing and agentic workloads

In March 2025, CenTrak, the leader in real-time location system (RTLS) solutions, announced the expansion of its comprehensive RTLS portfolio with the launch of a fully integrated, plug-and-play Bluetooth Low Energy (BLE) platform.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Real-Time Locating Systems Market based on the below-mentioned segments:

North America Real-Time Locating Systems Market, By Offering

- Tags/Badges

- Readers/Trackers

North America Real-Time Locating Systems Market, By Technology

- RFID

- Wi-Fi

- UWB

- BLE

- Infrared

- Ultrasound

- Zigbee

North America Real-Time Locating Systems Market, By Application

- Inventory Tracking

- Personnel Tracking

Frequently Asked Questions (FAQ)

-

What is the North America real-time locating systems market size?The North America Real-Time Locating Systems Market size is expected to grow from USD 3.61 billion in 2024 to USD 50.92 billion by 2035, growing at a CAGR of 27.2% during the forecast period 2025-2035

-

What are real-time locating systems, and their primary use?The term real-time location system (RTLS) signifies a technological apparatus that pinpoints the position of objects or individuals in real-time within the port area. Tracking systems in real-time location (RTLS) are high-tech solutions that apply contemporary technologies such as RFID, GPS, Wi-Fi, infrared, and Bluetooth Low Energy (BLE) to the recognition and monitoring of the precise point of assets, equipment, or humans with no limit to the area.

-

What are the key growth drivers of the market?Market growth is driven by а rising need for connected devices like smartphones, tablets, and various types of wearables such as smartwatches, fitness trackers, VR headsets, internet-connected eyeglasses, smart jewellery, and Bluetooth speakers. By 2022, there were 6.4 billion mobile users worldwide smartphone usage

-

What factors restrain the North America real-time locating systems market?The market is restrained by concerns about data security and privacy, in addition to high installation and maintenance costs. The integration of RTLS with present-day, usually scattered legacy IT systems and operations can be quite difficult and demand a lot of customization and expert IT knowledge

-

How is the market segmented by technology?The market is segmented into RFID, Wi-Fi, UWB, BLE, infrared, ultrasound, zigbee.

-

Who are the key players in the North America real-time locating systems market?Key companies include Zebra Technologies Corporation, Securitas, Stanley Healthcare, CenTrak, AiRISTA Flow, TeleTracking, Ubisense, Siemens, American RFID Solutions, LLC, and Guard RFID Solutions.

Need help to buy this report?