North America Pulp and Paper Chemicals Market Size, Share, and COVID-19 Impact Analysis, By Type (Bleaching Chemicals, Process Chemicals, and Functional Chemicals), By Application (Speciality Pulp & Paper Additives, Binders, Blowing Agents, and Others), and North America Pulp and Paper Chemicals Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Pulp and Paper Chemicals Market Insights Forecasts to 2035

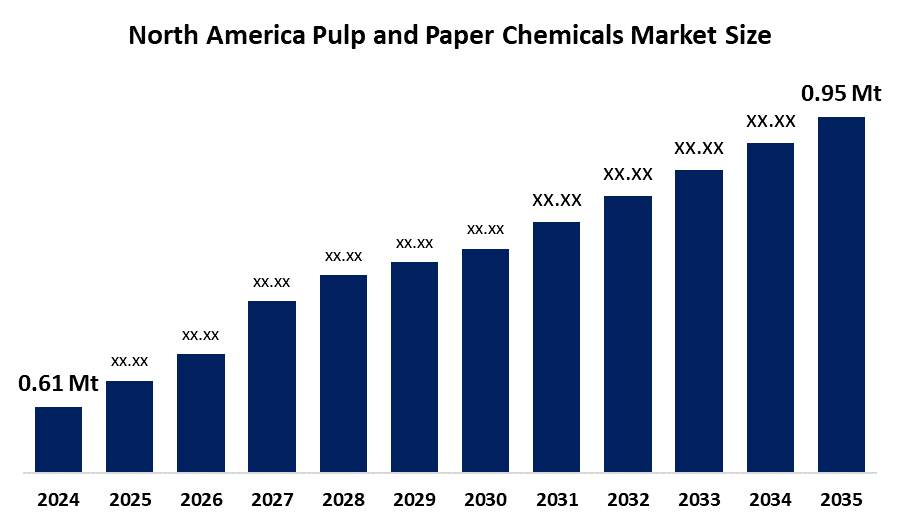

- The North America Pulp and Paper Chemicals Market Size Was Estimated at 0.61 Million Tonnes in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.11% from 2025 to 2035

- The North America Pulp and Paper Chemicals Market Size is Expected to Reach 0.95 Million Tonnes by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Pulp and Paper Chemicals Market size is anticipated to reach 0.95 million tonnes by 2035, growing at a CAGR of 4.11% from 2025 to 2035. The market is driven by the rising consumption of fast-moving consumer products, thereby leading to increasing demand for packaging paper in the U.S.

Market Overview

The North American pulp and paper chemicals market is a major industry, with the U.S. and Canada leading due to high demand for sustainable packaging, tissue, and paper-based products. Pulp and paper chemicals represent a collection of chemical substances that manufacturers use as essential components throughout the entire process that transforms wood, recycled fiber and other raw materials into finished paper products. The demand for packaging materials that meet sustainability standards, biodegradable requirements and recyclable capabilities has increased in e-commerce. The chemicals enhance product softness, water absorption and strength for use in napkins and paper towels.

Metsa Group launched its carbon capture pilot project at Rauma pulp mill through a partnership with Andritz technology supplier. The initiative marks the first testing of carbon capture technology on flue gases emitted by a pulp mill.

The latest announcement from Kemira reveals that the company intends to merge its pulp and paper chemical production facilities across North America which will lead to the shutdown of its Vancouver, B.C., manufacturing plant. Solenis, which serves as a top international supplier of specialized chemicals for water-dependent industries, has established a partnership with Beijing PhaBuilder Biotechnology Co to advance important PHA-based technologies used in the paper packaging industry.

Report Coverage

This research report categorizes the market for the North America pulp and paper chemicals market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America pulp and paper chemicals market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America pulp and paper chemicals market.

North America Pulp and Paper Chemicals Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 0.61 Million Tonnes |

| Forecast Period: | CAGR of 23.05% |

| Forecast Period CAGR CAGR of 23.05% : | CAGR of 4.11% |

| AGR of 23.05% Value Projection: | 0.95 Million Tonnes |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Type,By Application |

| Companies covered:: | International Paper Company,Sappi Ltd,Domtar,WestRock,Cascades,Verso And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The pulp and paper chemicals market in North America is driven by the rise of online shopping, which has created a demand for advanced corrugated boxes and protective materials that use specialized chemicals to achieve long-lasting durability and moisture protection. The Clean Air Act and U.S. recycling requirements force mills to implement environmentally friendly chemical solutions which produce low volatile organic compounds and biodegradable properties. Green chemistry innovations through enzymatic bleaching and bio-based sizing agents enable manufacturers to cut down their water and energy usage while achieving compliance with more rigorous wastewater discharge regulations.

Restraining Factors

The pulp and paper chemicals market in North America is hindered by a decrease in the need for traditional printing and writing materials. Stringent environmental rules on emissions and wastewater treatment force costly compliance which restricts organizations from expanding their operations.

Market Segmentation

The North America pulp and paper chemicals market share is categorised into type and application.

- The functional chemicals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America pulp and paper chemicals market is segmented by type into bleaching chemicals, process chemicals, and functional chemicals. Among these, the functional chemicals segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the growing need for value-added paper products because of their enhanced features results in maximum utilization of functional chemicals. The segment will experience growth because customers show rising interest in purchasing recycled paper products.

- The speciality pulp & paper additives segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America pulp and paper chemicals market is segmented into speciality pulp & paper additives, binders, blowing agents, and others. Among these, the speciality pulp & paper additives segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the textile industry, with the pulp industry using special pulp materials and their associated additives. The industry uses speciality pulp and paper products to improve the characteristics of both paper and mesh materials. Water treatment systems use speciality additives, which include defoamers, retention aids, flocculant polymers and other substances to decrease biodegradable waste.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America pulp and paper chemicals market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- International Paper Company

- Packaging Corporation of America

- Georgia-Pacific LLC

- WestRock Company

- Domtar Corporation

- Verso Corporation

- Kimberly-Clark Corporation

- Sappi Ltd.

- Sylvamo Corporation

- Cascades Inc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America pulp and paper chemicals market based on the below-mentioned segments:

North America Pulp and Paper Chemicals Market, By Type

- Bleaching Chemicals

- Process Chemicals

- Functional Chemicals

North America Pulp and Paper Chemicals Market, By Application

- Speciality Pulp & Paper Additives

- Binders

- Blowing Agents

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America pulp and paper chemicals market size?A: The North America pulp and paper chemicals market size is expected to grow from 0.61 million tonnes in 2024 to 0.95 million tonnes by 2035, growing at a CAGR of 4.11% during the forecast period 2025-2035.

-

Q: What are pulp and paper chemicals, and their primary use?A: The North American pulp and paper chemicals market is a major industry, with the U.S. and Canada leading due to high demand for sustainable packaging, tissue, and paper-based products. Pulp and paper chemicals represent a collection of chemical substances that manufacturers use as essential components throughout the entire process.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the rise of online shopping, which has created a demand for advanced corrugated boxes and protective materials that use specialized chemicals to achieve long-lasting durability and moisture protection.

-

Q: What factors restrain the North America pulp and paper chemicals market?A: The market is restrained by stringent environmental rules on emissions and wastewater treatment force costly compliance which restricts organizations from expanding their operations.

-

Q: How is the market segmented by type?A: The market is segmented into bleaching chemicals, process chemicals, and functional chemicals.

-

Q: Who are the key players in the North America pulp and paper chemicals market?A: Key companies include International Paper Company, Packaging Corporation of America, Georgia-Pacific LLC, WestRock Company, Domtar Corporation, Verso Corporation, Kimberly-Clark Corporation, Sappi Ltd., Sylvamo Corporation, and Cascades Inc.

Need help to buy this report?