North America Preclinical Imaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Systems and Services), By Application (Research and Development, Drug Discovery, Bio-Distribution, Cancer Cell Detection, Bio-Markers, and Others), and North America Preclinical Imaging Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareNorth America Preclinical Imaging Market Insights Forecasts to 2035

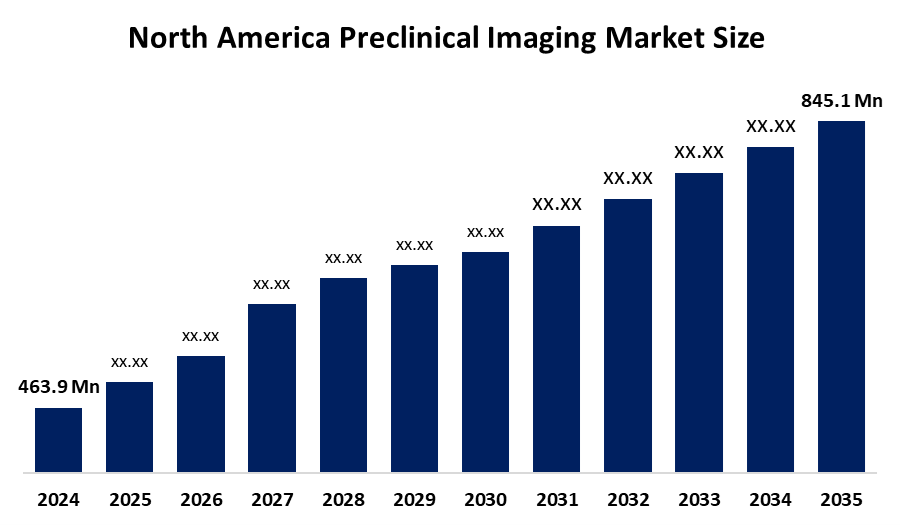

- The North America Preclinical Imaging Market Size Was Estimated at USD 463.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.6% from 2025 to 2035

- The North America Preclinical Imaging Market Size is Expected to Reach USD 845.1 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Preclinical Imaging Market Size is anticipated to reach USD 845.1 Million by 2035, Growing at a CAGR of 5.6% from 2025 to 2035. The North America preclinical imaging market is growing due to the rising R&D investments, increasing demand for faster drug development, technological advances in high-resolution and molecular imaging, and growing adoption of preclinical studies by pharma, biotech, and CROs.

Market Overview

The North America preclinical imaging market is defined as the market for imaging technologies and services used in North America for preclinical research, including MRI, CT, PET, SPECT, optical, and ultrasound imaging, primarily by pharma, biotech, CROs, and academic labs to accelerate drug discovery, disease research, and safety evaluation before clinical trials. The market is used across drug discovery, oncology, neurology, cardiovascular research, molecular imaging, and toxicology to accelerate preclinical studies, assess drug efficacy, and ensure safety. The preclinical imaging market is growing due to rising R&D investments, increasing demand for faster drug development, technological advances in high-resolution and molecular imaging, and growing adoption of preclinical studies by pharma, biotech, and CROs.

The North America preclinical imaging market offers opportunities like expansion of molecular and multimodal imaging, AI & digital integration, shift toward human-based models, rising biopharma R&D investment, government grants& public-private programs, and growth in biotech and contract research organizations. In April 2025, the FDA and NIH launched an HHS-backed initiative to reduce animal testing in preclinical studies, promoting NAMs and creating ORIVA to advance human-based research methods. NIH plans to establish the Office of Research Innovation, Validation and Application (ORIVA) to coordinate efforts across NIH, expand funding and training for non-animal methods, and make alternative approaches more accessible to researchers.

Report Coverage

This research report categorizes the market for the North America preclinical imaging market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America preclinical imaging market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America preclinical imaging market.

North America Preclinical Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 463.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.6% |

| 2035 Value Projection: | USD 845.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Bruker Corporation, Revvity Inc, FUJIFILM VisualSonic Inc., TriFoil Imaging Inc., Siemens Healthineers, MILabs B.V., MR Solutions Ltd, Mediso Ltd, Cubresa Inc., and Other key players |

| Pitfalls & Challenges: | and COVID-19 Impact Analysis |

Get more details on this report -

Driving Factors

The preclinical imaging market in North America is driven by rising R&D investments from pharmaceutical and biotechnology companies, which are accelerating drug discovery and development, while the growing adoption of advanced imaging technologies, such as MRI, PET, CT, optical, and ultrasound, enables more precise and efficient preclinical studies. Regulatory and research initiatives promoting human-based models, organ-on-a-chip systems, and other alternatives to animal testing further support market growth. Additionally, government funding, grants, and infrastructure development strengthen research capabilities, creating significant opportunities for innovation and expansion in the sector.

Restraining Factors

The North America preclinical imaging market is restrained by high equipment and maintenance costs, stringent regulatory and ethical requirements, complexity of multimodal imaging data, and slow adoption of emerging technologies like organ-on-a-chip and advanced in vitro models.

Market Segmentation

The North America preclinical imaging market share is classified into product and application.

- The systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America preclinical imaging market is segmented by product into systems and services. Among these, the systems segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high-resolution, non-invasive imaging platforms like MRI, PET, CT, and optical systems. The systems segment, which includes maintenance, training, and imaging support, also contributes to market growth by enabling efficient system utilization, workflow optimization, and technical support for pharma, biotech, and academic research, further strengthening the overall preclinical imaging ecosystem.

- The drug discovery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America preclinical imaging market is segmented by application into research and development, drug discovery, bio-distribution, cancer cell detection, bio-markers, and others. Among these, the drug discovery segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. This is due to its role in evaluating drug efficacy, safety, and pharmacokinetics. High-resolution, non-invasive imaging enables faster, data-driven R&D decisions, reduces late-stage failures, and accelerates development. Adoption is supported by regulatory encouragement for ethical animal studies and enhanced by AI and multimodal imaging, boosting efficiency and analytical precision across pharmaceutical and CRO workflows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America preclinical imaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bruker Corporation

- Revvity Inc

- FUJIFILM VisualSonic Inc.

- TriFoil Imaging Inc.

- Siemens Healthineers

- MILabs B.V.

- MR Solutions Ltd

- Mediso Ltd

- Cubresa Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

-

September 2025: Revvity Inc. launched Living Image Synergy AI, a multimodal analysis software for preclinical imaging data analysis. This AI-driven platform integrates optical, microCT, and ultrasound modalities to enhance throughput and reproducibility in preclinical workflows.

-

June 2025: FUJIFILM VisualSonics Inc. introduced the Vevo F2 LAZR-X20 photoacoustic and ultrasound imaging platform, offering advanced multimodal imaging capabilities for detailed tissue characterization in preclinical research.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America preclinical imaging market based on the below-mentioned segments:

North America Preclinical Imaging Market, By Product

- Systems

- Services

North America Preclinical Imaging Market, By Application

- Research and Development

- Drug Discovery

- Bio-Distribution

- Cancer Cell Detection

- Bio-Markers

- Others

Frequently Asked Questions (FAQ)

-

What is the projected market size of the North America preclinical imaging market by 2035?The North America preclinical imaging market is expected to reach USD 845.1 million by 2035, growing from USD 463.9 million in 2024 at a CAGR of 5.6% during 2025-2035.

-

What factors are driving growth in the North America preclinical imaging market?Growth is driven by rising pharmaceutical and biotechnology R&D investments, increasing demand for faster drug development, advancements in high-resolution imaging technologies, regulatory support, and expanded adoption by CROs and research institutions.

-

What are the key restraints impacting the North America preclinical imaging market?The market faces restraints, including high equipment and maintenance costs, strict regulatory and ethical requirements, complex multimodal data integration, and slow adoption of emerging technologies like organ-on-a-chip models.

-

What are the key opportunities in the North America preclinical imaging market?Opportunities include expansion of molecular and multimodal imaging, AI and digital integration, the shift toward human-based models, rising biopharma R&D investment, government grants and public-private programs, and growth in the biotech and CRO sectors

-

Why did the drug discovery segment lead the market in 2024?The drug discovery segment led due to its importance in evaluating drug efficacy, safety, and pharmacokinetics, enabling faster R&D decisions, reducing late-stage failures, and accelerating development timelines efficiently.

Need help to buy this report?