North America Precision Medical Device Market Size, Share, and COVID-19 Impact Analysis, By Ecosystem Players Outlook (Pharmaceuticals and Biotechnology Companies, Diagnostic Companies, Healthcare IT Specialists/Big Data Companies, Clinical Laboratories, and Others), By Sub-Markets Outlook (Companion Diagnostics, Biomarker-Based Test, Targeted Therapeutics, Pharmacogenomics (PGX), Molecular Diagnostics, and Others), and North America Precision Medical Device Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareNorth America Precision Medical Device Market Insights Forecasts to 2035

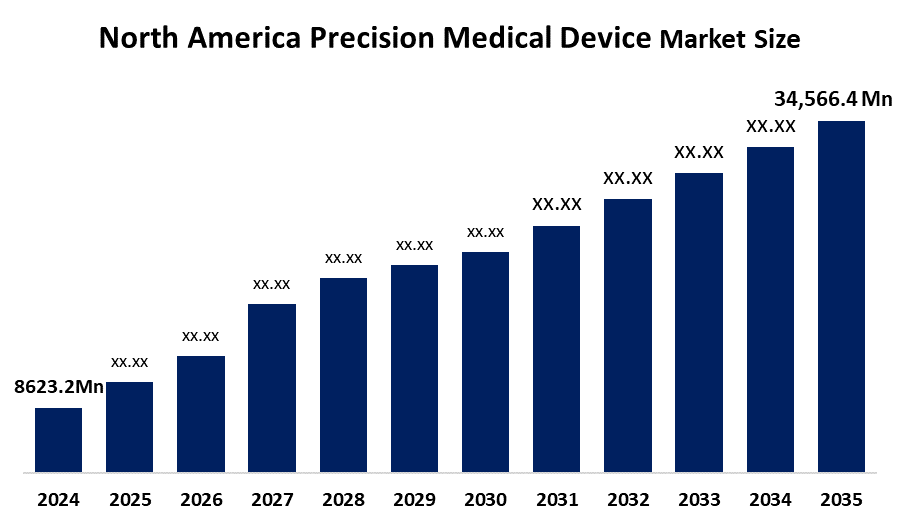

- The North America Precision Medical Device Market Size Was Estimated at USD 8,623.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.45% from 2025 to 2035

- The North America Precision Medical Device Market Size is Expected to Reach USD 34,566.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Precision Medical Device Market Is Anticipated To Reach USD 34,566.4 Million By 2035, Growing At A CAGR of 13.45% from 2025 to 2035. The primary drivers of the market are the rising demand for personalized treatments, the adoption of advanced technologies like robotics and AI, and the growing burden of chronic diseases.

Market Overview

The North American Precision Medical Device Market Size is a rapidly expanding segment of healthcare technology centered on exact, patient-specific diagnosis, monitoring, and therapy. These devices, which employ advanced techniques such as robotics, artificial intelligence, imaging, and sensor systems, offer personalized therapy tailored to individual genetic, environmental, and lifestyle characteristics. Precision devices are widely used in sectors such as oncology, cardiology, neurology, and minimally invasive surgery, and they rely on real-time data and enhanced imaging to guide clinical decisions. Moreover, Demand is increasing in North America as chronic disease prevalence rises, access to advanced healthcare improves, and there is a greater emphasis on precision-based clinical outcomes. Precision devices decrease problems, shorten recovery times, and improve treatment customization. In addition, Artificial intelligence is considerably enhancing the accuracy and speed of diagnostics in North America by allowing for the rapid interpretation of imaging data such as CT, MRI, and PET scans. AI algorithms help clinicians by recognizing minor irregularities that are difficult to spot manually, hence increasing early disease detection rates. Wearable medical gadgets that provide precise monitoring of heart rate, glucose levels, oxygen saturation, and neurological indicators are becoming increasingly popular across the nation. Precision devices that incorporate genomics for molecular diagnostics, sequencing support, and personalized medicines are gaining popularity in North America. These techniques allow clinicians to adapt medications based on genetic markers, which increases therapeutic efficacy. North America is set to become a major regional hub for precision healthcare research and device manufacture.

In December 2024, Precision Neuroscience, a brain-computer interface (BCI) company, raised $102 million in Series C funding, led by General Equity Holdings. This round brought the company’s total funding to $155 million. The capital will be directed toward clinical research and development of its AI-powered, minimally invasive brain implant, which is designed to enable paralyzed patients to control computers using their thoughts.

Report Coverage

This research report categorises the market for The North America Precision Medical Device Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America precision medical device market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America precision medical device market.

North America Precision Medical Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8,623.2 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 13.45% |

| 2035 Value Projection: | USD 34,566.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Abbott Laboratories Boston Scientific Corporation Stryker Corporation Edwards Lifesciences Medtronic Roche Diagnostics (North America) GE Healthcare Quest Diagnostics & LabCorp Illumina And Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North American Precision Medical Device Market Size is expanding fast as healthcare focuses on patient-specific diagnosis, monitoring, and treatment. The devices, which use technology such as AI, robotics, enhanced imaging, and sensor systems, allow for personalized therapy based on individual genetic, environmental, and lifestyle characteristics. They are commonly used in oncology, cardiology, neurology, and minimally invasive surgery, with real-time data guiding treatment decisions. The increased frequency of chronic diseases, an aging population, and considerable hospital investments are driving market growth, establishing precision medical devices as a critical component of the larger precision medicine ecosystem, in which North America dominates.

Restraining Factors

The North America Precision Medical Device Market Size faces key restraints such as high costs, strict regulatory hurdles, data privacy concerns, integration challenges, limited awareness & training, and reimbursement limitations.

Market segmentation

The North America precision Medical Device Market share is classified into ecosystem players outlook and sub-markets outlook.

- The pharmaceuticals and biotechnology companies segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America Precision Medical Device Market Size is divided by ecosystem players outlook into pharmaceuticals and biotechnology companies, diagnostic companies, healthcare IT specialists/big data companies, clinical laboratories, and others. Among these, the pharmaceuticals and biotechnology companies segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by creating drug-device combos and enhancing tailored treatments. They invest heavily in companion diagnostics and precision medical devices to guarantee therapies are personalized to individual genetic profiles, which drives innovation in patient-specific care. Pfizer, Amgen, and Johnson & Johnson are among the industry's leading companies.

- The companion diagnostics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The North America Precision Medical Device Market Size is segmented by sub-markets outlook into companion diagnostics, biomarker-based tests, targeted therapeutics, pharmacogenomics (PGX), molecular diagnostics, and others. Among these, the companion diagnostics segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is the dominant segment, driven by linking medications to patient-specific genetic profiles, which ensures that treatments are personalized to the individual's specific biology. By identifying biomarkers and genetic differences, these tests help clinicians choose the most effective medications while avoiding adverse responses, increasing patient outcomes, and reducing trial-and-error in therapy selection. Their capacity to directly link diagnostics and treatment decisions makes them critical to furthering personalized medicine and gaining a significant market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within North America Precision Medical Device Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Boston Scientific Corporation

- Stryker Corporation

- Edwards Lifesciences

- Medtronic

- Roche Diagnostics (North America)

- GE Healthcare

- Quest Diagnostics & LabCorp

- Illumina

- Others

Recent Developments

- In April 2025, ICU Medical achieved a major milestone by securing FDA 510(k) clearance for a new category of infusion devices: the Plum Solo™ and Plum Duo™ precision IV pumps. These devices are designed to enhance accuracy and safety in intravenous therapy, supported by the updated LifeShield™ infusion safety software

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America precision medical device market based on the below-mentioned segments:

North America Precision Medical Device Market, By Ecosystem Players Outlook

- Pharmaceuticals And Biotechnology Companies

- Diagnostic Companies

- Healthcare IT Specialists/Big Data Companies

- Clinical Laboratories

- Others

North America Precision Medical Device Market, By Sub-Markets Outlook

- Companion Diagnostics

- Biomarker-Based Test

- Targeted Therapeutics

- Pharmacogenomics (PGX)

- Molecular Diagnostics

- Others

Frequently Asked Questions (FAQ)

-

What is the current and forecasted size of the North America precision medical device market?The market was valued at approximately USD 8,623.2 million in 2024 and is projected to grow at a CAGR of 13.45%, reaching around USD 34,566.4 million by 2035

-

What are the primary ecosystem players' outlook in the North American precision medical device market?The primary ecosystem players' outlook is pharmaceuticals and biotechnology companies, diagnostic companies, healthcare IT specialists/big data companies, clinical laboratories, and others

-

What is the main sub-market outlook in the market?The main sub-markets outlook is companion diagnostics, biomarker-based tests, targeted therapeutics, pharmacogenomics (PGX), molecular diagnostics, and others.

-

What are the key driving factors for market growth?Growth is driven by the rising demand for personalized treatments, the adoption of advanced technologies like robotics and AI, and the growing burden of chronic diseases

-

What challenges does the market face?Challenges include high costs, strict regulatory hurdles, data privacy concerns, integration challenges, limited awareness & training, and reimbursement limitations

-

Who are some key players in the market?Key companies include Abbott Laboratories, Boston Scientific Corporation, Stryker Corporation, Edwards Lifesciences, Medtronic, Roche Diagnostics (North America), GE Healthcare, Quest Diagnostics & LabCorp, Illumina, and others.

Need help to buy this report?