North America Polyamide Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyamide 6, Polyamide 66, Bio-Based Polyamide, Specialty Polyamides), By Application (Automotive, Electrical & Electronics, Household Goods & Appliances, and Others), and North America Polyamide Market Insights, Industry Trends, Forecast to 2035.

Industry: Chemicals & MaterialsNorth America Polyamide Market Insights Forecasts to 2035

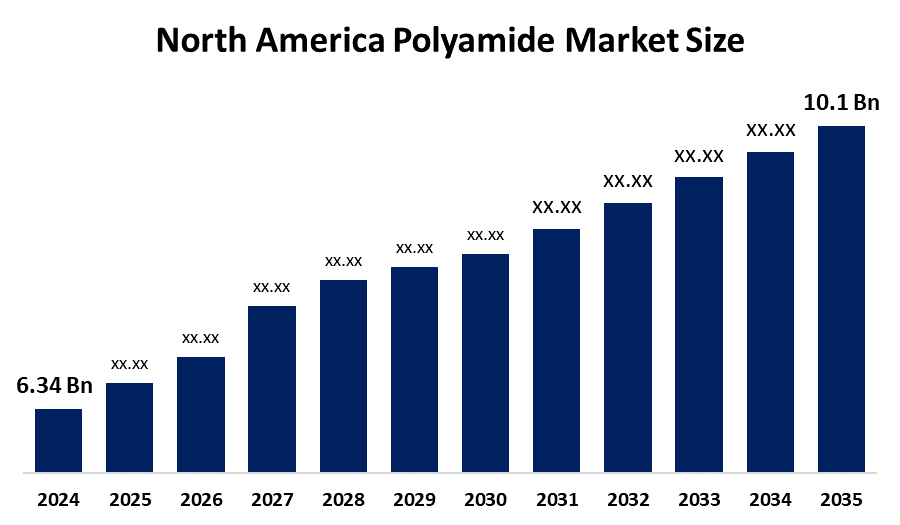

- The North America Polyamide Market Size Was Estimated at USD 6.34 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.32% from 2025 to 2035

- The North America Polyamide Market Size is Expected to Reach USD 10.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights Consulting, the North America Polyamide Market size is anticipated to reach USD 10.1 Billion by 2035, growing at a CAGR of 4.32% from 2025 to 2035. The market is driven by the increasing demand for high-performance materials in various industries, particularly automotive, textiles, and electronics.

Market Overview

Polyamide, a synthetic polymer, consists of repeated amide bonds, which happen naturally in some proteins, like wool and silk, and the synthetic types of it are nylon and sodium polyaramids. They are non stick and have low friction so that they could be used in many industries like aerospace, electronics, automotive, and telecommunications. The consumer shift towards electronic items like laptops, mobile phones, and smart devices came when companies started implementing the work from home paradigm and people began to create home offices.

In May 2025, Pilot Chemical Company made the announcement of partnering exclusively with Novvi LLC for the introduction of a new eco friendly surfactant technology, biobased alpha olefin sulfonates, to the North American region. Pilot's collaboration with Novvi will result in providing the markets of North Americans, household, industrial and institutional, and personal care with the CalCare AOS biobased alpha olefin sulfonates.

Increasing scrutiny and restrictions imposed by some states on per and polyfluoroalkyl substances PFAS in the products are forcing the manufacturers to look for and settle non- fluorinated high-performance alternatives. The Department of Energy DOE still continues to back the advancement of manufacturing technologies, thus enhancing the development of light-weight polyamide composites for the aircraft and electric cars industries.

Report Coverage

This research report categorizes the market for the North America polyamide market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America polyamide market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America polyamide market.

North America Polyamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.34 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.32% |

| 2035 Value Projection: | USD 10.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Application |

| Companies covered:: | Ascend Performance Materials,DuPont de Nemours Inc,AdvanSix inc,INVISTA, Celanese Co,Huntsman Corporation,BASF SE,Arkema,EMS Chemie, Envalior And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The polyamide market in North America is driven by the automotive industry’s transition from metal to polyamide in various applications such as interior parts, structures, and technical components can be traced to the demand for plastics that are light, safe, strong, and cheap. The growing concern for the environment among consumers has led the producers to channel their resources into R D to come up with bio polyamide made from specialty and castor oil, which in turn is fueling the market expansion.

Restraining Factors

The polyamide market in North America is hindered by the changes in the price of crude oil, geopolitical disruptions, and interruptions in the supply chain, which together make production costs unpredictable and are also the reasons behind the situation when the manufacturers in North America have tight profit margins. The market is also under pressure from competition from PBT, polypropylene, polyphenylene sulfide (PPS), and polyetheretherketone (PEEK), which are considered alternative materials.

Market Segmentation

The North America polyamide market share is categorised into product and application.

- The polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America polyamide market is segmented by product into polyamide 6, polyamide 66, bio based polyamide, specialty polyamides. Among these, the polyamide 6 segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2025, Polyamide 6 accouneted the largest share of the North American polyamide market with a leading position of 56.88 , attributed to wide processing window, low cost and established supply contracts with compounders in sectors such as automotive, flexible-packaging, and furniture. The segment's growth is mainly due to the engineering polymers being used, which are very well balanced in mechanical properties, thermal stability, and processing ease. Its impact resistance and abrasion resistance make it suitable for application in automotive parts, electrical & electronic goods, consumer appliances, and packaging.

- The automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America polyamide market is segmented into automotive, electrical electronics, household goods & appliances, and others. Among these, the automotive segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2025, the automotive segment occupied a largest share of the North America polyamide market of 30.12%. The growth of the segment is driven by the use of polyamides for the production of lightweight parts, including engine covers, fuel system parts, and inner parts, among others. Their outstanding mechanical characteristics, heat resistance, and durability properties make it possible for them to have the same applications in the industry as the heavier metals which thus leads to the manufacturing of more efficient and powerful vehicles. The transition to fuel-efficient and less polluting cars has been the major driving factor.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America polyamide market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asced Performance Materials

- DuPont de Nemours Inc.

- AdvanSix inc.

- INVISTA

- Celanese Co.

- Huntsman Corporation

- BASF SE

- Arkema

- EMS-Chemie

- Envalior

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2025, BASF expanded its sustainable nylon 6 portfolio in North America, launched the Ultramid LowPCF and Ultramid BMB and offered two new solutions that can help customers reduce PCF and achieve sustainability targets without sacrificing performance or changing existing operations or supply chains.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Polyamide Market based on the below mentioned segments:

North America Polyamide Market, By Product

- Polyamide 6

- Polyamide 66

- Bio-Based Polyamide

- Specialty Polyamides

North America Polyamide Market, By Application

- Automotive

- Electrical & Electronics

- Household Goods & Appliances

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America polyamide market size?A: The North America Polyamide Market size is expected to grow from USD 6.34 billion in 2024 to USD 10.1 billion by 2035, growing at a CAGR of 4.32% during the forecast period 2025-2035.

-

Q: What is polyamide, and its primary use?A: Polyamide, a synthetic polymer, consists of repeated amide bonds, which happen naturally in some proteins, like wool and silk, and the synthetic types of it are nylon and sodium polyaramids.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the automotive industry’s transition from metal to polyamide in various applications such as interior parts, structures, and technical components can be traced to the demand for plastics that are light, safe, strong, and cheap.

-

Q: What factors restrain the North America polyamide market?A: The market is restrained by the changes in the price of crude oil, geopolitical disruptions, and interruptions in the supply chain, which together make production costs unpredictable

-

Q: How is the market segmented by application?A: The market is segmented into automotive, electrical & electronics, household goods & appliances, and others

-

Q: Who are the key players in the North America polyamide market?A: Key companies include Ascend Performance Materials, DuPont de Nemours Inc., AdvanSix inc., INVISTA, Celanese Co., Huntsman Corporation, BASF SE, Arkema, EMS-Chemie, and Envalior.

Need help to buy this report?