North America Playing Cards and Board Games Market Size, Share, and COVID-19 Impact Analysis, By Product (Chess, Scrabble, Monopoly, Ludo, and Others), By Distribution Channel (Offline, Online, and Others), and North America Playing Cards and Board Games Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsNorth America Playing Cards and Board Games Market Insights Forecasts to 2035

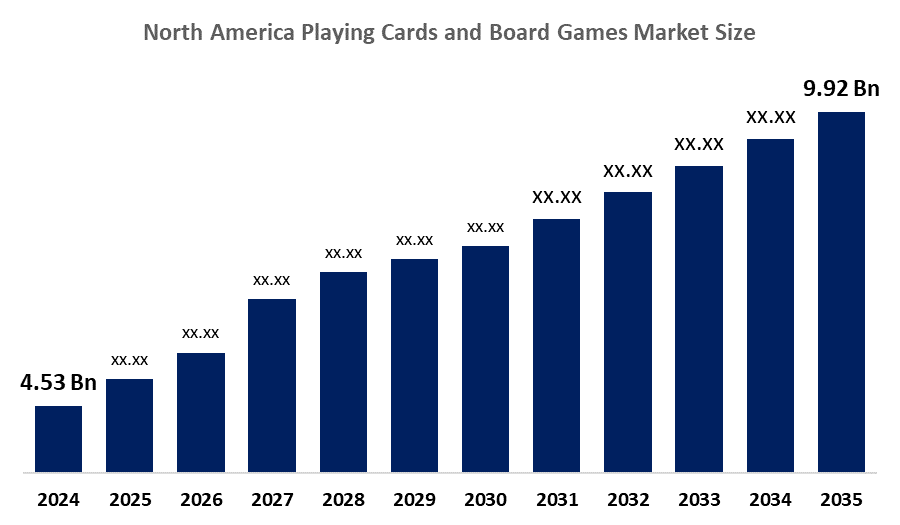

- The North America Playing Cards and Board Games Market Size Was Estimated at USD 4.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.39% from 2025 to 2035

- The North America Playing Cards and Board Games Market Size is Expected to Reach USD 9.92 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the North America Playing Cards and Board Games Market is anticipated to reach USD 9.92 billion by 2035, growing at a CAGR of 7.39% from 2025 to 2035. The primary drivers of the market are rising demand for indoor entertainment, family bonding activities, digital integration, nostalgia-driven purchases, and growth in online retail channels.

Market Overview

The North American playing cards and board games market is the industry that manufactures, distributes, and sells a variety of card games, such as poker, Uno, and blackjack, and board games such as Monopoly, Scrabble, and chess across the country. It caters to children, teens, and adults for both casual family entertainment and competitive play, with products available via online platforms and physical retail outlets at prices ranging from cheap to premium collection editions. This market is distinguished by its varied consumer base, numerous distribution channels, and consistent development spurred by demand for social connecting, nostalgia, and digital integration. Moreover, the industry is evolving with enhanced technological integration and rising demand for social, strategic, and recreational games. Although automation is most commonly associated with the transportation and port industries, comparable trends such as digitalization, AI-driven analytics, and product innovation are being replicated in the gaming business to improve distribution efficiency, user engagement, and production capacities.

Additionally, automated stacking systems (ASCS) and AI-based guided systems in logistics benefit game producers and distributors by allowing for optimum storage, shorter handling times, and constant inventory level monitoring. As the gaming business grows through e-commerce, licensed gaming items, and multinational collaborations, such technologies help to ensure supply consistency while lowering operational expenses. As subscription ecosystems grow, they improve paths for product discovery, customer retention, and portfolio monetization. Collectively, these variables lead to a market environment that encourages long-term subscription uptake, allowing industry participants to diversify revenue, stabilize demand, and improve their long-term strategic standing in the tabletop entertainment landscape.

In September 2025, the United States Playing Card Company (USPC), a subsidiary of the global Cartamundi Group and known for famous brands like Bicycle, will celebrate its 140th anniversary with a major milestone: the expansion of its Erlanger, Kentucky factory. This strategic move required a $5.8 million investment and resulted in the creation of 200 new jobs, demonstrating both the company's long-standing presence in the playing card market and its commitment to future expansion and regional economic development.

Report Coverage

This research report categorises the market for the North America playing cards and board games market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America playing cards and board games market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America playing cards and board games market.

North America Playing Cards and Board Games Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.39% |

| 2035 Value Projection: | USD 9.92 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Distribution Channel |

| Companies covered:: | Hasbro Inc., Mattel Inc., United States Playing Card Company (USPC), Ravensburger North America, Spin Master Corp., Goliath Games LLC, Cartamundi Group (North America arm), Buffalo Games, Pressman Toy Corporation, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The North American playing card and board game industry is being driven by rising demand for home-based entertainment, as families and friends resort to these games for social bonding and stress relief. Classic titles continue to survive because of nostalgia and collection appeal, whilst digital integration and hybrid formats appeal to younger, tech-savvy consumers. Expanding e-commerce platforms make games more accessible, while casino culture maintains a significant demand for playing cards. Furthermore, educational and therapeutic uses increase their significance, setting the market for long-term growth despite competition from digital entertainment and growing production costs.

Restraining Factors

The North America playing cards and board games market faces key restraints such as competition with digital entertainment, high production costs, market saturation of classic titles, counterfeit products, and shifting consumer preferences.

Market segmentation

The North America playing cards and board games market share is classified into product and distribution channel.

- The monopoly segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period.

The North America playing cards and board games market is divided by product into chess, scrabble, monopoly, ludo, and others. Among these, the monopoly segment held a substantial share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The segment is driven by its strong brand recognition and a long-standing cultural presence. With countless themed editions, special variations, and digital adaptations, it continues to captivate players of all ages and generations.

- The offline segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The North America playing cards and board games market is segmented by distribution channel into offline, online, and others. Among these, the offline segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This segment dominates the market with toy stores, bookstores, supermarkets, and specialized shops being the biggest suppliers. Customers like to purchase board and card games in person since it allows them to directly judge the quality, packaging, and special editions. These retailers also profit from impulse purchases and increased demand over the holiday season, which reinforces their dominant position in overall sales.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within North America playing cards and board games market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hasbro Inc.

- Mattel Inc.

- United States Playing Card Company (USPC)

- Ravensburger North America

- Spin Master Corp.

- Goliath Games LLC

- Cartamundi Group (North America arm)

- Buffalo Games

- Pressman Toy Corporation

- Others

Recent Developments:

- In July 2025, Hansen Company announced a regional distribution agreement that gives University Games exclusive worldwide rights to distribute the entire Hansen product line, which includes Hoberman Spheres, Fame Master models, handheld electronic games, Hansen-branded classic games, and various distributed games and dolls. This exclusive partnership will broaden University Games' product offerings and boost its presence in the regional market.

- In May 2024, The Op Games has released MONOPOLY One Piece Edition under license from Hasbro to commemorate the 25th anniversary of the renowned manga and anime series. This edition includes a specialized gameboard, nine special character tokens, and gameplay centered around forming formidable Dressrosa teams. Lovers may buy, sell, and trade favorite characters like Luffy, Zoro, and Nami, and this launch allows The Op Games to broaden its market reach, attract anime lovers, and develop its library of licensed games.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America playing cards and board games market based on the below-mentioned segments:

North America Playing Cards and Board Games Market, By Product

- Chess

- Scrabble

- Monopoly

- Ludo

- Others

North America Playing Cards and Board Games Market, By Distribution Channel

- Offline

- Online

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the current and forecasted size of the North America playing cards and board games market?A: The market was valued at approximately USD 4.53 billion in 2024 and is projected to grow at a CAGR of 7.39%, reaching around USD 9.92 billion by 2035.

-

Q: What are the primary products in the North America playing cards and board games market?A: The primary products are chess, scrabble, monopoly, ludo, and others. Among these, the monopoly segment held a substantial share in 2024. The segment is driven by its strong brand recognition and a long-standing cultural presence.

-

Q: What is the main distribution channel in the market?A: The main distribution channels are offline, online, and others. Among these, the offline segment dominated the market in 2024. This segment dominates the market with toy stores, bookstores, supermarkets, and specialized shops being the biggest suppliers.

-

Q: What are the key driving factors for market growth?A: Growth is driven by rising demand for indoor entertainment, family bonding activities, digital integration, nostalgia-driven purchases, and growth in online retail channels.

-

Q: What challenges does the market face?A: Challenges include competition with digital entertainment, high production costs, market saturation of classic titles, counterfeit products, and shifting consumer preferences.

-

Q: Who are some key players in the market?A: Key companies include Hasbro Inc., Mattel Inc., United States Playing Card Company (USPC), Ravensburger North America, Spin Master Corp., Goliath Games LLC, Cartamundi Group (North America arm), Buffalo Games, Pressman Toy Corporation, and Others.

Need help to buy this report?