North America Plastic Bottle Market Size, Share, and COVID-19 Impact Analysis, By Resin (Polyethylene, Polyethylene Terephthalate, Polypropylene, and Other), By End-User (Food, Beverage, Pharmaceuticals, Personal Care and Toiletries, Industrial, Household Chemicals, Paints and Coatings, and Other)

Industry: Consumer GoodsNorth America Plastic Bottle Market Insights Forecasts to 2035

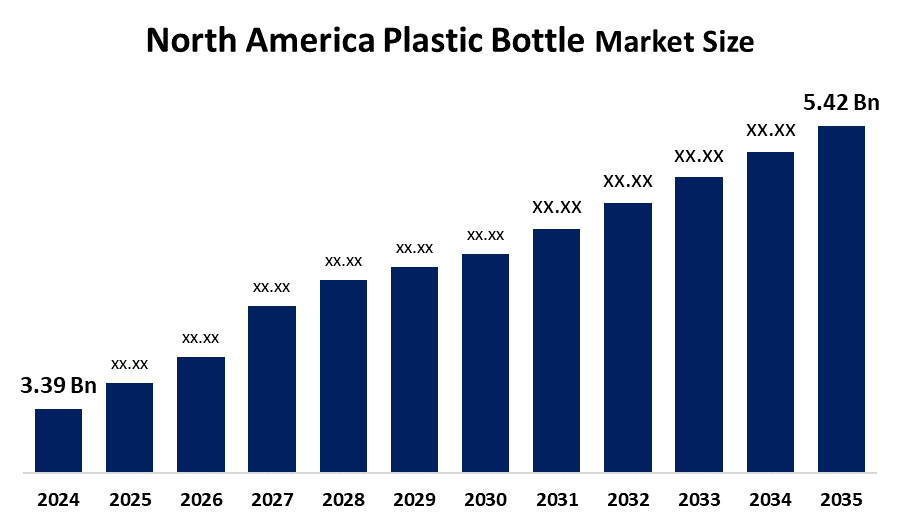

- The North America Plastic Bottle Market Size Was Estimated at USD 3.39 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 4.36% from 2025 to 2035

- The North America Plastic Bottle Market Size is Expected to Reach USD 5.42 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Plastic Bottle Market Size Is Anticipated To Reach USD 5.42 Billion By 2035, Growing At a CAGR of 4.36% from 2025 to 2035. The market is driven by its large population, high consumption of packaged beverages, and established manufacturing infrastructure.

Market Overview

A plastic bottle is a container made of high-density or low-density plastic, used mainly as a liquid storage vessel. The use of these bottles has increased greatly due to their lightness, cost-efficiency, and high resistance to breaking when compared to glass. Polyethylene terephthalate (PET) is most popular material that accounting for more than 68% of total plastic bottles produced in 2024, praised for its transparency, strength, and recyclability.

In May 2023, the Closed Loop Partners Association made it public that Sumitomo Mitsui Banking Corporation (SMBC), the Japanese multinational banking services institution, made a closure of a deal amounting to USD 10 million in its Closed Loop Circular Plastics Fund. The Coca-Cola Company introduced 100% Recycled Plastic Bottles Across Canada in October 2023.

The FDA supports producers by issuing opinion letters one by one that give them advice on how to assess the purity and safety of food-contact materials obtained from their particular recycling processes of plastics. The government of Ontario announces the investment of more than $533 million from Lee Li Holdings Inc. as a welcome gesture, which includes not only the upgrade and expansion of the current facility but also the construction of a cutting-edge bottling and packing facility in Mississauga. The administration has a plan to implement a deposit return scheme for plastic bottles and cans in January 2025, which will help in the cleaning process of the communities.

Report Coverage

This research report categorizes the market for the North America Plastic Bottle Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America plastic bottle market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America plastic bottle market.

North America Plastic Bottle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.39 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR Of 4.36% |

| 2035 Value Projection: | USD 5.42 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type, By Application |

| Companies covered:: | Plastic Bottle Corporation Container and Packaging Silgan Plastics Graham Packaging Parker Plastics, Inc Plastic Bottles Inc Southeastern Container Mega Empack Mauser Packaging Solutions Drug Plastics and Glass Company And Others Key Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The plastic Bottle Market In North America is driven due to cost-effectiveness, and consumers are now shifting their preference from canned to bottled drinks. By 2040, increasing recycling could lead to a reduction of plastic waste by 20% as a result of the adoption of measures like the elimination of trouble-causing and non-essential plastics. Hence, the recycling of plastic bottles is going to have a favorable impact on the market. The market is also being driven by the trend of functional beverages like sports drinks and energy drinks gaining popularity. Furthermore, the continuous improvement in printing and labeling technologies gives the brands more scope for customization, and thus, the market gets further fueled.

Restraining Factors

The Plastic Bottle Market In North America is restrained by the environmental concerns about plastic waste getting more intense and the regulations on plastic pollution getting stricter. This means that there is a need for changing to more eco-friendly practices, which would consist of higher recycling rates, the use of substitutes that are biodegradable and compostable, and the invention of new recycling methods that are more efficient. Policy measures surrounding plastic waste and recycling affect production and waste disposal practices.

Market Segmentation

The North America Plastic Bottle Market share is categorised into resin and end user.

- The polyethylene terephthalate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Plastic Bottle Market Size is segmented by solution type into polyethylene, polyethylene terephthalate, polypropylene, and other. Among these, the polyethylene terephthalate segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the high strength-to-weight ratio, along with other outstanding properties of chemical resistance and recyclability come together to make the material an excellent candidate for manufacturers looking for sustainable practices, thus it also gets the most preference from them.

The beverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the North America Plastic Bottle Market Size is segmented into food, beverage, pharmaceuticals, personal care and toiletries, industrial, household chemicals, paints and coatings, and other. Among these, the beverage segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth of the segment is since soft drinks, water, and other liquid consumables being heavily packed. Brands trying to make their products more convenient and appealing have resulted in this segment being the most innovative one in the industry, introducing such innovations as lightweight designs and the use of recyclable materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Plastic Bottle Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Plastic Bottle Corporation

- Container and Packaging

- Silgan Plastics

- Graham Packaging

- Parker Plastics, Inc

- Plastic Bottles Inc

- Southeastern Container

- Mega Empack

- Mauser Packaging Solutions

- Drug Plastics and Glass Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In April 2025, Gravis announced the launch of its groundbreaking Sustainabulk 100% Recycled FIBC Bulk Bag.

In February 2025, Berry Global Group, Inc. collaborated with snacks and treats leader Mars to transition its pantry jars for M&M’S, SKITTLES and STARBURST brands to 100% recycled plastic packaging, exclusive of jar lids.

In October 2024, Vaseline created a new recyclable pump for its pump-action bottles in North America. Vaseline has redesigned its packaging and increased its use of recycled content, avoiding the use of virgin plastic, equivalent to approximately 11 million plastic lotion bottles

In May 2024, BlueTriton launches premium water bottles as aluminium packaging grows in the market.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Plastic Bottle Market Size based on the below-mentioned segments:

North America Plastic Bottle Market, By Resin

- Polyethylene

- Polyethylene Terephthalate

- Polypropylene

- Other

North America Plastic Bottle Market, By End User

- Food

- Beverage

- Pharmaceuticals

- Personal Care and Toiletries

- Industrial

- Household Chemicals

- Paints and Coatings

- Other

Frequently Asked Questions (FAQ)

-

What is the North America plastic bottle market size?The North America Plastic Bottle Market size is expected to grow from USD 3.39 billion in 2024 to USD 5.42 billion by 2035, growing at a CAGR of 4.36% during the forecast period 2025-2035

-

What is plastic bottle, and its primary use?A plastic bottle is a container made of high-density or low-density plastic, used mainly as a liquid storage vessel. The use of these bottles has increased greatly because of their lightness, cost-efficiency, and high resistance to breaking when compared to glass.

-

What are the key growth drivers of the market?Market growth is driven by due to cost-effectiveness, and consumers are now shifting their preference from canned to bottled drinks. By 2040, increasing recycling could lead to a reduction of plastic waste by 20% as a result of the adoption of measures like the elimination of trouble-causing and non-essential plastics. Hence, the recycling of plastic bottles is going to have a favorable impact on the market

-

What factors restrain the North America plastic bottle market?The market is restrained by the environmental concerns about plastic waste getting more intense and the regulations on plastic pollution getting stricter. This means that there is a need for changing to more eco-friendly practices, which would consist of higher recycling rates, use of substitutes that are biodegradable and compostable, and the invention of new and more efficient recycling methods

-

How is the market segmented by solution type?The market is segmented into polyethylene, polyethylene terephthalate, polypropylene, and other.

-

Who are the key players in the North America plastic bottle market?Key companies include Plastic Bottle Corporation, Container and Packaging, Silgan Plastics, Graham Packaging, Parker Plastics, Inc., Plastic Bottles Inc., Southeastern Container, Mega Empack, Mauser Packaging Solutions, Drug Plastics and Glass Company

Need help to buy this report?