North America OTC Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Analgesics, Cough, Cold, and Flu Products, Vitamins and Minerals, Dermatological Products, Gastrointestinal Products, Ophthalmic Products, Sleep Aids Products, Weight Loss and Others), By Formulation Type (Tablets, Liquids, Ointments, and Others), By Distribution Channel (Pharmacies, Supermarkets/Hypermarkets, Convenience Store and Others), and North America OTC Drugs Market Insights, Industry Trends, Forecast to 2035

Industry: HealthcareNorth America OTC Drugs Market Insights Forecasts to 2035

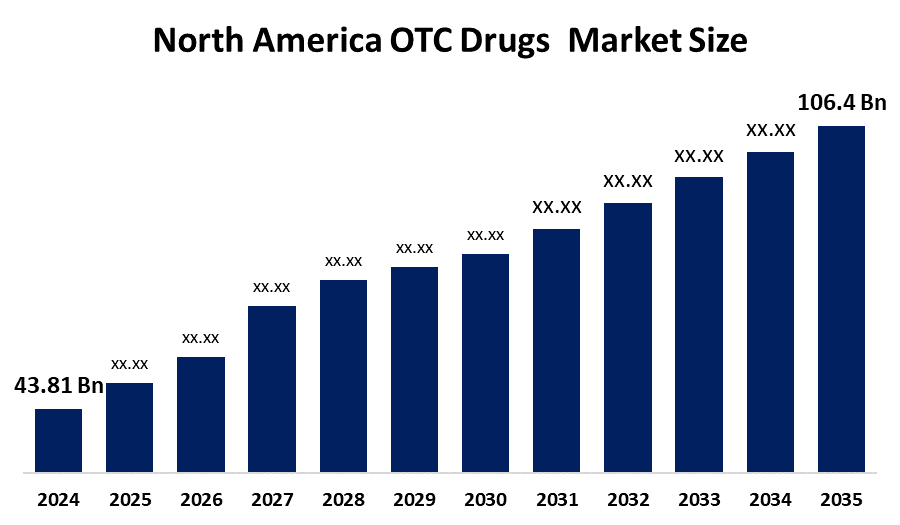

- The North America OTC Drugs Market Size Was Estimated at USD 43.81 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.4% from 2025 to 2035

- The North America OTC Drugs Market Size is Expected to Reach USD 106.4 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America OTC Drugs Market size is anticipated to reach USD 106.4 Billion by 2035, growing at a CAGR of 8.4% from 2025 to 2035. The market is driven by the increasing focus on preventive self-care and healthcare expense management, as well as the growing inclination of consumers towards ease and technological accessibility to medical supplies.

Market Overview

Over the counter OTC drugs are medicinal products that government agencies have certified as safe and effective for the public to use, if only according to the instructions on the label. OTC drugs in North America are widely used for the treatment of various minor ailments and their symptoms. Breathing difficulty and coughing are some of the symptoms that these medications such as dextromethorphan in Robitussin and cough suppressants aim to relieve, particularly in respiratory infection cases.

Eroxon, the first and only FDA approved gel that may be purchased over the counter to treat erectile dysfunction ED, is already available for pre-order on Amazon in the US and will be accessible at the majority of major shops in October 2024.

In December 2025, Novartis, which is a world-leading innovative medicines company, made a public announcement that they have entered an agreement with the US government, which is intended to reduce the cost of new drugs in the US and, at the same time, encourage further US investments in the areas of manufacturing, research, and development

.

Nonprescription Drug Product with Added Condition for Nonprescription Use. Such product requirements are now specified in the final rule and apply to a nonprescription drug product that has an additional condition for nonprescription use (ACNU). Health Canada has come up with an action plan that will gradually remove obstacles to the market entry of non-prescription drugs. The plan includes short-term solutions that are already effective as of December 2022, as well as ongoing efforts to make labeling and approval processes simpler.

Report Coverage

This research report categorizes the market for the North America OTC drugs market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America OTC drugs market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America OTC drugs market.

North America OTC Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 43.81 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.4% |

| 2035 Value Projection: | USD 106.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Formulation Type, By Distribution Channel |

| Companies covered:: | Johnson Johnson, Bayer AG,Haleon,Pfizer Inc,Sanofi,Reckitt Benckiser Group PLC,Novartis AG,Perrigo Company Plc,Procter Gamble,Takeda Pharmaceutical And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The OTC drugs market in North America is driven by a shift in consumer behavior when it comes to health and well being, as they opt for OTC products for minor ailments and preventive care, a trend that has been further augmented by health awareness campaigns that have reached the masses. The growing geriatric population is the major factor behind the demand, since more and more of them need medications for age-related and chronic conditions, which can be easily treated with OTC drugs.

Restraining Factors

The OTC drugs market in North America is hindered by the consumers is that they might misdiagnose their illness and therefore take the wrong medicine, which might cause them adverse health effects or even ignore more serious underlying problems.

Market Segmentation

The North America OTC drugs market share is categorised into product type, formulation type and distribution channel.

- The analgesics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America OTC Drugs market is segmented by product type into analgesics, cough, cold, and flu products, vitamins and minerals, dermatological products, gastrointestinal products, ophthalmic products, sleep aids products, weight loss and others. Among these, the analgesics segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The analgesics segment will represent 25.2 of the total market value in 2024. the leading position is the high prevalence of chronic and acute pain patients in the community. In the United States, more than 51 million adults suffer from chronic pain, and 19 million of those say that pain severely affects their daily life.

- The tablets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on formulation type, the North America OTC drugs market is segmented into tablets, liquids, ointments, and others. Among these, the tablets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The tablet segment accounted for 44.6 of total formulation-based sales in 2024. The dominance is driven by Consumers favor exact dosage, mobility, and easy storing. Painkillers, antihistamines, and digestive tract medicines are in tablet form because of their stable nature and extended shelf life. Tablet formulation is still the greatest in self-medication thanks to clinical reliability, consumer knowledge, and manufacturing efficiency.

- The pharmacies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America OTC drugs market is segmented by distribution channel into pharmacies, supermarkets/hypermarkets, convenience store and others. Among these, the pharmacies segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, the pharmacies segment dominated the market by accounting for 52.7 of total distribution channel sales. Its leading position is owing to the combination of consumer trust, professional advice and strategic product placement. These elements position pharmacies as trusted centres for educated self-care, which is the reason why they are so much more credible and offer a greater depth of service than other retail areas.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America OTC drugs market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Johnson Johnson

- Bayer AG

- Haleon

- Pfizer Inc.

- Sanofi

- Reckitt Benckiser Group PLC

- Novartis AG

- Perrigo Company Plc

- Procter Gamble

- Takeda Pharmaceutical

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2026, Dr Reddys launched over the counter olopatadine hydrochloride ophthalmic solution, 0.7 which is the generic of Novartis AGs Extra Strength Pataday Once Daily Relief.

In January 2025, Hikma Pharmaceuticals PLC, the multinational pharmaceutical group, announced that it had entered an exclusive commercial partnership with Emergent BioSolutions Emergent for the sale of KLOXXADO naloxone HCl nasal spray 8 mg in the U.S. and Canada.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America OTC Drugs Market based on the below-mentioned segments:

North America OTC Drugs Market, By Product Type

- Analgesics

- Cough

- Cold and Flu Products

- Vitamins and Minerals

- Dermatological Products

- Gastrointestinal Products

- Ophthalmic Products

- Sleep Aids Products

- Weight Loss

- Others

North America OTC Drugs Market, By Formulation Type

- Tablets

- Liquids

- Ointments

- Others

North America OTC Drugs Market, By Distribution Channel

- Pharmacies

- Supermarkets/Hypermarkets

- Convenience Store

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America OTC drugs market size?A: The North America OTC Drugs Market size is expected to grow from USD 43.81 billion in 2024 to USD 106.4 billion by 2035, growing at a CAGR of 8.4% during the forecast period 2025-2035.

-

Q: What are OTC drugs, and their primary use?A: Over-the-counter (OTC) drugs are medicinal products that government agencies (like the FDA in the U.S. or Health Canada) have certified as safe and effective for the public to use, if only according to the instructions on the label.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by a shift in consumer behavior when it comes to health and well-being, as they opt for OTC products for minor ailments and preventive care, a trend that has been further augmented by health awareness campaigns that have reached the masses.

-

Q: What factors restrain the North America OTC drugs market?A: The market is restrained by a prominent problem in North America, which is the misuse of some OTC medications that contain, for example, dextromethorphan or loperamide

-

Q: How is the market segmented by formulation type?A: The market is segmented into tablets, liquids, ointments, and others.

-

Q: Who are the key players in the North America OTC drugs market?A: Key companies include Johnson & Johnson, Bayer AG, Haleon, Pfizer Inc., Sanofi, Reckitt Benckiser Group PLC, Novartis AG, Perrigo Company Plc, Procter & Gamble, and Takeda Pharmaceutical.

Need help to buy this report?