North America Organic Food and Beverages Market Size, Share, and COVID-19 Impact Analysis, By Product (Organic Food and Organic Beverages), By Distribution Channel (Supermarket and Hypermarkets, Online Stores, Speciality Stores, and Convenience Stores), and North America Organic Food and Beverages Market Insights, Industry Trends, Forecast to 2035

Industry: Food & BeveragesNorth America Organic Food and Beverages Market Insights Forecasts to 2035

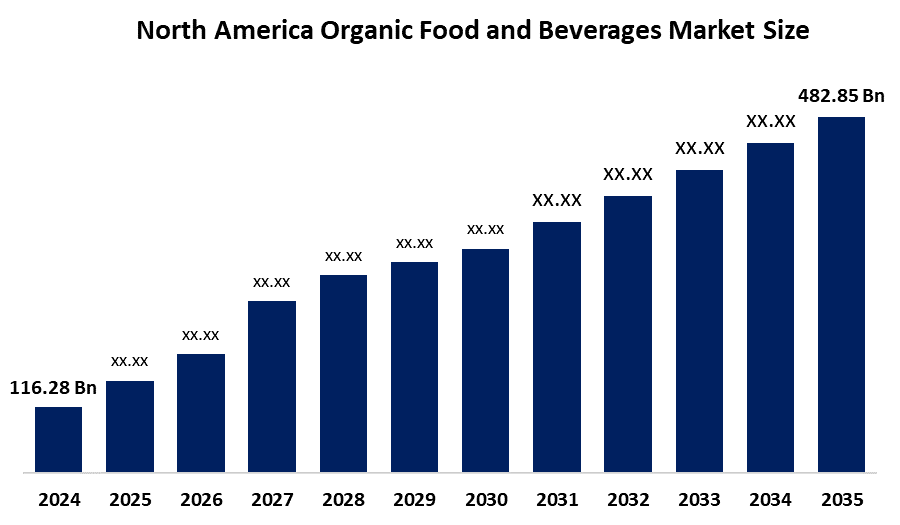

- The North America Organic Food and Beverages Market Size Was Estimated at USD 116.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 13.82% from 2025 to 2035

- The North America Organic Food and Beverages Market Size is Expected to Reach USD 482.85 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Organic Food and Beverages Market size is anticipated to reach USD 482.85 Billion by 2035, growing at a CAGR of 13.82% from 2025 to 2035. The market is driven by the growing health consciousness among consumers, increased demand for natural and sustainable products, and a rising awareness about the environmental impact of conventional farming. Additionally, advancements in organic farming practices, government support, and the expansion of organic products.

Market Overview

Organic food and beverages were produced, processed, and made during very strict agricultural methods with eco-friendliness, biodiversity, and total chemical input prohibition at the center. Health issues, environmental quality, flavor, and sustainable agriculture are among the reasons why consumers choose organic products. The application of these reasons is primarily in fresh fruits and vegetables, ready-to-eat meals, protein snacks, and functional drinks such as cold-pressed juices. The consumers' increasing demand for authenticity together with their greater health knowledge and a stronger focus on being transparent in sourcing and certification practices are creating a good situation for the organic food and beverages market to thrive.

Hewitt Foods USA, in the year 2025, introduced The Organic Meat Co. as a new brand of grass-fed beef with USDA organic certification to meet the increasing consumer demand. General Mills poured approximately $3 million into the new organic granola firm due to the organic food demand, which is on the rise. For example, a new company, Yumi, has pointed out baby organic foods and products, as well as organic vegetables and fruits.

In May 2024, the U.S. Department of Agriculture (USDA) released press statements about newly launched investments and programs that will assist producers in their organic production transitions and the organic market expansion. The Organic Transition Initiative and the Organic Certification Cost Share Program (OCCSP) are the main activities under which the financial burden of certification will be decreased, and farmers will be provided with technical support, respectively.

In particular, consumers have begun to select more and more organic items as their way of minimizing the intake of synthetic additives and pesticides, and thus organic fruits, vegetables, dairy, and plant-based alternatives become the main categories of this trend.

Report Coverage

This research report categorizes the market for the North America organic food and beverages market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America organic food and beverages market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America organic food and beverages market.

North America Organic Food and Beverages Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 116.28 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 13.82% |

| 2035 Value Projection: | USD 482.85 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product |

| Companies covered:: | Hain Celestial Group, Amy’s Kitchen, Organic Valley, Nature’s Path, SunOpta, New Barn Organics, Sprouts Farmers Markets, Imperfect Foods, Food Processing, Grimmway Farms, And Others players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The organic food and beverages market in North America is driven by the changes in lifestyles and the rise in health awareness; the demand for the product has reached its peak. The United States remains the main buyer of the product in the region. In addition, the expansion of the network of cafes and restaurants in the country will contribute to the sales of the products. Moreover, the rising prevalence of chronic diseases that include cancer, diabetes, and heart diseases, the uptake of infectious diseases, the rise in medical expenses, and the trend of people being health-conscious are making consumers demand healthy and high-quality food and drink more than ever.

Restraining Factors

The organic food and beverages market in North America is restrained by the methods and practices of organic farming require labour-intensive methods like manual weeding and using natural fertilisers, and this can lead to costlier production as compared to conventional farming.

Market Segmentation

The North America organic food and beverages market share is categorised into product and distribution channel.

- The organic food segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America organic food and beverages market is segmented by product into organic food and organic beverages. Among these, the organic food segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to the rising consumer cognisance of the health benefits and sustainability of organic products. That is the reason why organic fruits and vegetables, dairy, meat, and poultry are so sought after; they are at the very heart of the growing demand for healthy, natural, and chemical-free food. People's concern about the potential hazards of conventional farming techniques, such as pesticide use and genetic modification, pushes them towards the organic market.

- The supermarket and hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the North America organic food and beverages market is segmented into supermarket and hypermarkets, online stores, speciality stores, and convenience stores. Among these, the supermarket and hypermarkets segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the benefits in terms of attracting a larger audience, including even those who are not very knowledgeable about online shopping. Moreover, it gives quick access to items, which is a great advantage for people who like the comfort of instant gratification. The physical store setting gives companies the chance to communicate with buyers, build loyalty, and advise products according to personal likes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America organic food and beverages market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hain Celestial Group

- Amy’s Kitchen

- Organic Valley

- Nature’s Path

- SunOpta

- New Barn Organics

- Sprouts Farmers Markets

- Imperfect Foods

- Food Processing

- Grimmway Farms

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In November 2025, Nature's Path, an independent organic breakfast and snack food brand, launched two new protein-packed granolas made with organic pea protein and coconut oil, offering 10g of plant-based protein per serving.

In April 2025, Walmart launched Glen Powell's organic food line. The new range of organic condiments, which were free from high-fructose corn syrup, artificial colors, and other additives, was the highlight of the products. The selection included traditional ketchup, mayonnaise, mustard, and barbecue sauce as well as variations like Hot Honey Ketchup and Hot Honey BBQ Sauce.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America organic food and beverages market based on the below-mentioned segments:

North America Organic Food and Beverages Market, By Product

- Organic Food

- Organic Beverages

North America Organic Food and Beverages Market, By Distribution Channel

- Supermarket and Hypermarkets

- Online Stores

- Speciality Stores

- Convenience Stores

Frequently Asked Questions (FAQ)

-

Q: What is the North America organic food and beverages market size?A: The North America organic food and beverages market size is expected to grow from USD 116.28 billion in 2024 to USD 482.85 billion by 2035, growing at a CAGR of 13.82% during the forecast period 2025-2035.

-

Q: What are organic food and beverages, and their primary use?A: Organic food and beverages were produced, processed, and made during very strict agricultural methods with eco-friendliness, biodiversity, and total chemical input prohibition at the center. Health issues, environmental quality, flavor, and sustainable agriculture are among the reasons why consumers choose organic products. The application of these reasons is primarily in fresh fruits and vegetables, ready-to-eat meals, protein snacks, and functional drinks such as cold-pressed juices.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the changes in lifestyles and the rise in health awareness, the demand for the product has reached its peak. The United States remains the main buyer of the product in the region. In addition, the expansion of the network of cafes and restaurants in the country will contribute to the sales of the products.

-

Q: What factors restrain the North America organic food and beverages market?A: The market is restrained by the methods and practices of organic farming require labour-intensive methods like manual weeding and using natural fertilizers, and this can lead to costlier production as compared to conventional farming. On the other hand, this results in farmers having to bear the increased costs of labor, organic certification, and sourcing of organic inputs through their operation

-

Q: How is the market segmented by product?A: The market is segmented into organic food and organic beverages.

-

Q: Who are the key players in the North America organic food and beverages market?A: Key companies include Hain Celestial Group, Amy’s Kitchen, Organic Valley, Nature’s Path, SunOpta, New Barn Organics, Sprouts Farmers Markets, Imperfect Foods, Food Processing, and Grimmway Farms.

Need help to buy this report?