North America Optical Coherence Tomography Market Size, Share, and COVID-19 Impact Analysis, By Technology (Time Domain Optical Coherence Tomography, Frequency Domain Optical Coherence Tomography, and Spatially Encoded Frequency Domain), By Type (Tabletop, Handheld, Catheter Based, and Doppler OCT), By Application (Ophthalmology, Oncology, Dermatology, and Cardiology), and North America Optical Coherence Tomography Market Size Insights, Industry Trends, Forecast to 2035

Industry: HealthcareNorth America Optical Coherence Tomography Market Size Insights Forecasts to 2035

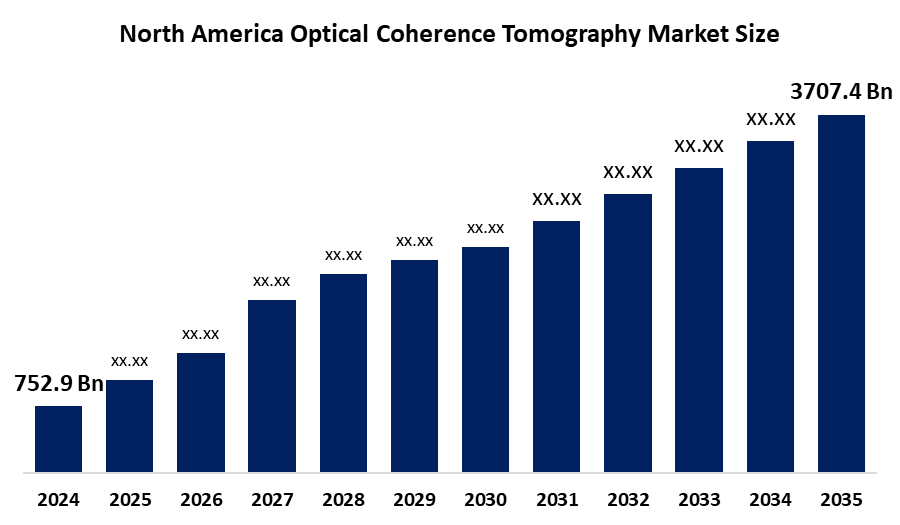

- The North America Optical Coherence Tomography Market Size Was Estimated at USD 752.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 15.6% from 2025 to 2035

- The North America Optical Coherence Tomography Market Size is Expected to Reach USD 3707.4 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Optical Coherence Tomography Market Size is anticipated to reach USD 3707.4 Million by 2035, growing at a CAGR of 15.6% from 2025 to 2035. The market is driven by an increase due to the rising prevalence of eye disorders. The growing need for early disease diagnosis and demand for non-invasive devices.

Market Overview

The market for Optical Coherence Tomography is a non-invasive imaging procedure that employs low-coherence interferometry to produce images of high resolution. The major cause for the rising demand for optical coherence tomography devices is the growing number of patients diagnosed with chronic diseases that involve the eye, skin, and other organs. The main user of the OCT technology is still the ophthalmology industry, as the number of people suffering from eye-related diseases keeps rising. However, the technology is also being used in dermatology, cardiology, and oncology. The latter of these, where the increased risk of skin cancer is leading to the adoption of more advanced methods in optical coherence tomography, is one reason for the recent changes in the technology.

The Enabling Technologies for Photonic Chips-based Optical Coherence Tomography (PIC-OCT) initiative was announced by the Advanced Research Projects Agency for Health (ARPA-H) in February 2024 with the goal of creating a quicker and more reasonably priced eye scanner.

In North America, the incidence of glaucoma is rising. The optical coherence tomography market in North America is supported by new product launches, mergers, and collaborations for the expansion of their portfolio of products by major key market players, who are also working to improve the efficiency of these tomography devices with the intensive use of advanced technologies. The pharmaceutical firms and the government are making major contributions in terms of research and development investments, which are aimed at increasing the speed, sensitivity, and resolution capacities of OCT devices. This has a spectacular impact on the growth of the optical coherence tomography market.

Report Coverage

This research report categorizes the market for the North America optical coherence tomography market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America optical coherence tomography market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America optical coherence tomography market.

North America Optical Coherence Tomography Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 752.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 15.6% |

| 2035 Value Projection: | 3707.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By Type |

| Companies covered:: | Optovue Inc., Thorlabs Inc, Novacam Technologies Inc., Abbott Laboratories, Imaluz Corporation, INO, Notal Vision, Nidek Inc., Optopol USA, Canon Medical Systems, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The optical coherence tomography market in North America is driven by the usefulness of OCT in its ability to diagnose many eye diseases, such as age-related macular degeneration, macular puckering, macular hole, diabetic retinopathy, glaucoma and central serous retinopathy, which has established its main role. The North American continent has a high and growing prevalence of eye diseases like AMD, DR and glaucoma. Among the factors contributing to this situation, the aging population is the main one since it poses these diseases a risk, thus enhancing the need for cutting-edge diagnostic tools like OCT.

Restraining Factors

The optical coherence tomography market in North America is restrained by the device is costly to use as a routine ophthalmology device, in addition to suffering from several technical issues that restrict its usage for treatments like heavy vitreous bleeding, where interfacing with light through the eye is necessary. The remarkable initial cost that has to be incurred for OCT systems, which can be from $40,000 to more than $150,000, is a significant obstacle for minor clinics and healthcare centers with tight budgets.

Market Segmentation

The North America Optical Coherence Tomography Market Size share is categorised into technology, type, and application.

- The frequency domain optical coherence tomography segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America optical coherence tomography market is segmented by technology into time domain optical coherence tomography, frequency domain optical coherence tomography, and spatially encoded frequency domain. Among these, the frequency domain optical coherence tomography segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The largest segment of the market, with a revenue share of 42.48%, was the frequency domain optical coherence tomography in 2024. The FD-OCT technology gives rise to a revolutionary and high-definition intravascular imaging technique to facilitate scrutiny. Enhanced detection of minute alterations is given with this technology to the retinal and choroidal structures.

- The handheld segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on type, the North America optical coherence tomography market is segmented into tabletop, handheld, catheter-based, and doppler OCT. Among these, the handheld segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the high adoption of handheld OCT devices, which can be attributed to their portability and user-friendliness. Through the use of handheld OCT devices, early detection of many diseases, especially in ophthalmology and dermatology, can be done. The rising demand for point-of-care imaging by the healthcare community is the main reason for the switch to handheld OCT devices.

- The ophthalmology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America optical coherence tomography market is segmented by application into ophthalmology, oncology, dermatology, and cardiology. Among these, the ophthalmology segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the retina and optic nerve, which are among the areas in ophthalmology that benefit the most from OCT technology, which is the basis of ophthalmology's diagnostic imaging. The continuous advances in OCT technology, one of which is the production of spectral-domain OCT and swept-source OCT, are not only bringing about faster and more sensitive and higher resolution devices, but they have also made the devices perfectly suited for functionality in the ophthalmology environment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America optical coherence tomography market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Optovue Inc.

- Thorlabs Inc

- Novacam Technologies Inc.

- Abbott Laboratories

- Imaluz Corporation

- INO

- Notal Vision

- Nidek Inc.

- Optopol USA

- Canon Medical Systems

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America optical coherence tomography market based on the below-mentioned segments:

North America Optical Coherence Tomography Market Size, By Technology

- Time Domain Optical Coherence Tomography

- Frequency Domain Optical Coherence Tomography

- Spatially Encoded Frequency Domain

North America Optical Coherence Tomography Market Size, By Type

- Tabletop

- Handheld

- Catheter Based

- Doppler OCT

North America Optical Coherence Tomography Market Size, By Application

- Ophthalmology

- Oncology

- Dermatology

- Cardiology

Frequently Asked Questions (FAQ)

-

What is the North America Optical Coherence Tomography Market Size?The North America optical coherence tomography market size is expected to grow from USD 752.9 million in 2024 to USD 3707.4 million by 2035, growing at a CAGR of 15.6% during the forecast period 2025-2035.

-

What is optical coherence tomography, and its primary use?The market for optical coherence tomography is a non-invasive imaging procedure that employs low-coherence interferometry to produce images of high resolution. The major cause for the rising demand for optical coherence tomography devices is the growing number of patients diagnosed with chronic diseases that involve the eye, skin, and other organs.

-

What are the key growth drivers of the market?Market growth is driven by the usefulness of OCT in its ability to diagnose many eye diseases, such as age-related macular degeneration, macular puckering, macular hole, diabetic retinopathy, glaucoma and central serous retinopathy, which has established its main role.

-

What factors restrain the North America Optical Coherence Tomography Market Size?The market is restrained by the device is costly to use as a routine ophthalmology device, in addition to suffering from several technical issues that restrict its usage for treatments like heavy vitreous bleeding.

-

How is the market segmented by type?The market is segmented into tabletop, handheld, catheter based, and doppler OCT

-

Who are the key players in the North America Optical Coherence Tomography Market Size?Key companies include Optovue Inc., Thorlabs Inc, Novacam Technologies Inc., Abbott Laboratories, Imaluz Corporation, INO, Notal Vision, Nidek Inc., Optopol USA, and Canon Medical Systems.

Need help to buy this report?