North America Next Generation Batteries Market Size, Share, and COVID-19 Impact Analysis, By Technology (Lithium-Sulphur Batteries, Solid-State Batteries, Lithium-Air Batteries, and Flow Batteries), By Application (Electric Vehicles, Consumer Electronics, Energy Storage Systems, and Aerospace and Defence), and North America Next Generation Batteries Market Insights Forecasts to 2035

Industry: Chemicals & MaterialsNorth America Next Generation Batteries Market Insights Forecasts to 2035

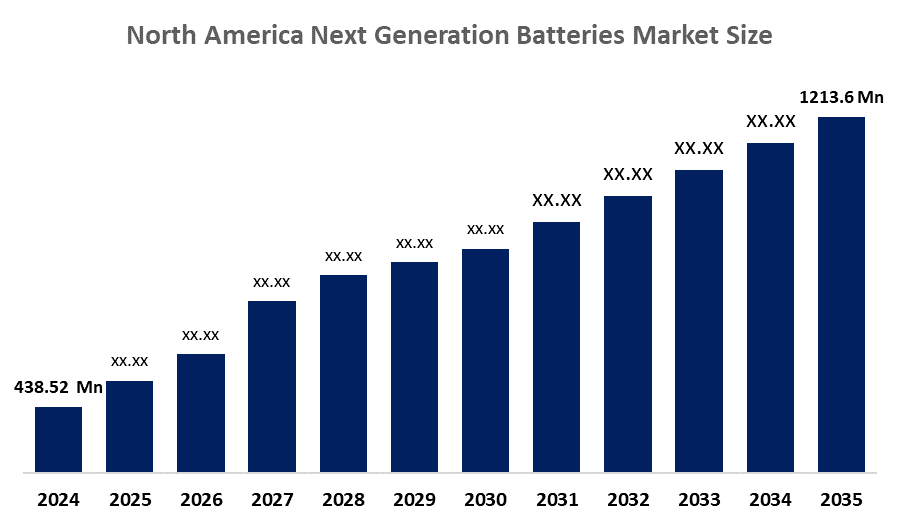

- The North America Next Generation Batteries Market Size Was Estimated at USD 438.52 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 9.7% from 2025 to 2035

- The North America Next Generation Batteries Market Size is Expected to Reach USD 1213.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Next Generation Batteries Market size is anticipated to reach USD 1213.6 Million by 2035, growing at a CAGR of 9.7% from 2025 to 2035. The market is driven by the rise in electric vehicle use, the expansion of renewable energy, and continuous development in battery technology. Increasing investments in renewable energy storage and government grants for battery innovation are the main factors contributing to this trend.

Market Overview

The next generation batteries are the study of exhaustive research on the existing situation and the prospects of the increasing chances of next-gen batteries were studied. In particular, not only rechargeable lithium-ion variants, but also innovative ones like lithium polymer (LiPo), solid-state, thin film, and printed batteries are the main ones investigated in this study, along with their possible development after a decade or so.

In March 2025, Nissan Motor Co., Ltd. showcased a range of new and refreshed models, as well as next-generation technologies, that would be introduced in the USA and Canada from FY 2025 to FY 2027. Panasonic, in 2021, was to introduce a cutting-edge product in its comprehensive solar energy portfolio, which was titled Total Home Energy Solution offerings; it was the EverVolt 2.0.

The Inflation Reduction Act and comparable local measures are stimulating the need for nearby battery production facilities and renewable energy projects. Moreover, the increase in grid upgrading initiatives and neighbourhood energy storage projects is strengthening energy security.

Next-generation batteries in North America are basically the U.S., all due to government incentives, the establishment of large electric vehicle factories, and the increased funding for local battery production. Besides, a solid research and development infrastructure and alliances among the automakers and energy firms are the other major factors providing the country with the leadership in the region.

Report Coverage

This research report categorizes the market for the North America next generation batteries market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America next generation batteries market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America next generation batteries market.

North America Next Generation Batteries Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 438.52 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 9.7% |

| 2035 Value Projection: | USD 1213.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Enovix, Microvast, Exide Technologies, Inventus Power, SES, Alkegen, Solid Power, Alsym Energy, Ultium Cells LLC, MPI Narada, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The next generation batteries market in North America is driven by the demand for next-generation batteries is rising. The strict emissions regulations enforced by the countries and the banning of internal combustion engines have resulted in the automotive industry leading the way in EV production. The government support in the form of subsidies, carbon emission penalties, and large-scale investments in EV infrastructure are all facilitating this transition, and in turn making next generation batteries a crucial factor for achieving the clean transportation targets and the implementation of climate policies. Moreover, deep learning and AI applications are being increasingly incorporated in battery research and development to speed up the invention of materials, foresee performance, and improve designs.

Restraining Factors

The next generation batteries market in North America is restrained by the production process and costs can be affected negatively by the supply constraints and the erratic availability of these raw materials. Furthermore, the recycling infrastructure dealing with new battery chemistries is still under construction, which complicates even more the acquisition of the required resources.

Market Segmentation

The North America next generation batteries market share is categorised into technology and application.

- The solid-state batteries segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America next generation batteries market is segmented by technology into lithium-sulphur batteries, solid-state batteries, lithium-air batteries, and flow batteries. Among these, the solid-state batteries segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is due to their higher energy density and safety advantages. The continuous innovations and advancements in manufacturing technologies by the manufacturers are the main reasons why this sector is still receiving great investments and is recognized as the reigning technology in batteries. This is due to they can provide energy efficiency and safety that are far better than those of conventional lithium-ion batteries.

- The electric vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America next generation batteries market is segmented into electric vehicles, consumer electronics, energy storage systems, and aerospace and defence. Among these, the electric vehicles segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is due to its important technological developments, including lithium-ion and solid-state batteries, which are responsible for this. The new technologies are based on the idea of increased energy density and shorter charging times, which are very important for the electric cars among users.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America next generation batteries market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Enovix

- Microvast

- Exide Technologies

- Inventus Power

- SES

- Alkegen

- Solid Power

- Alsym Energy

- Ultium Cells LLC

- MPI Narada

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In October 2024, Benchmark announced the launch of its new Sodium-ion Batteries Forecast. This comprehensive report is designed for battery, cathode and anode market participants, OEMs, and investors, providing essential guidance through the complexities of the sodium ion battery sector

In May 2024, Accelera by Cummins, the zero-emissions business segment of Cummins Inc. launched the next generation of several of its cutting-edge decarbonizing technologies that are shaping the future of clean transportation

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Next Generation Batteries Market based on the below-mentioned segments:

North America Next Generation Batteries Market, By Technology

- Lithium-Sulphur Batteries

- Solid-State Batteries

- Lithium-Air Batteries

- Flow Batteries

North America Next Generation Batteries Market, By Application

- Electric Vehicles

- Consumer Electronics

- Energy Storage Systems

- Aerospace and Defence

Frequently Asked Questions (FAQ)

-

Q: What is the North America next generation batteries market size?A: The North America Next Generation Batteries Market size is expected to grow from USD 438.52 million in 2024 to USD 1213.6 million by 2035, growing at a CAGR of 9.7% during the forecast period 2025-2035.

-

Q: What are next generation batteries, and their primary use?A: The next generation batteries are the study of exhaustive research on the existing situation and the prospects of the increasing chances of next-gen batteries was prepared. In particular, not only rechargeable lithium-ion variants, but also innovative ones like lithium polymer (LiPo), solid-state, thin film, and printed batteries are the main ones investigated in this study, along with their possible development after a decade or so.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the demand for next-generation batteries is rising. The strict emissions regulations enforced by the countries and the banning of internal combustion engines have resulted in the automotive industry leading the way in EV production. The government support in the form of subsidies, carbon emission penalties, and large-scale investments in EV infrastructure are all facilitating this transition.

-

Q: What factors restrain the North America next generation batteries market?A: The market is restrained by the production process and costs can be affected negatively by the supply constraints and the erratic availability of these raw materials. Furthermore, the recycling infrastructure dealing with new battery chemistries is still under construction, which complicates even more the acquisition of the required resources.

-

Q: How is the market segmented by application?A: The market is segmented into electric vehicles, consumer electronics, energy storage systems, and aerospace and defence.

-

Q: Who are the key players in the North America next generation batteries market?A: Key companies include Enovix, Microvast, Exide Technologies, Inventus Power, SES, Alkegen, Solid Power, Alsym Energy, Ultium Cells LLC, and MPI Narada.

Need help to buy this report?