North America Mutual Fund Market Size, Share, and COVID-19 Impact Analysis, By Fund Type (Equity, Bond, Hybrid, and Others), By Investor Type (Retail and Institutional), By Management Style (Active, Passive), By Distribution Channel (Online Trading Platform, Banks, Securities Firm and Others), and North America Mutual Fund Market Insights, Industry Trends, Forecast to 2035

Industry: Banking & FinancialNorth America Mutual Fund Market Insights Forecasts to 2035

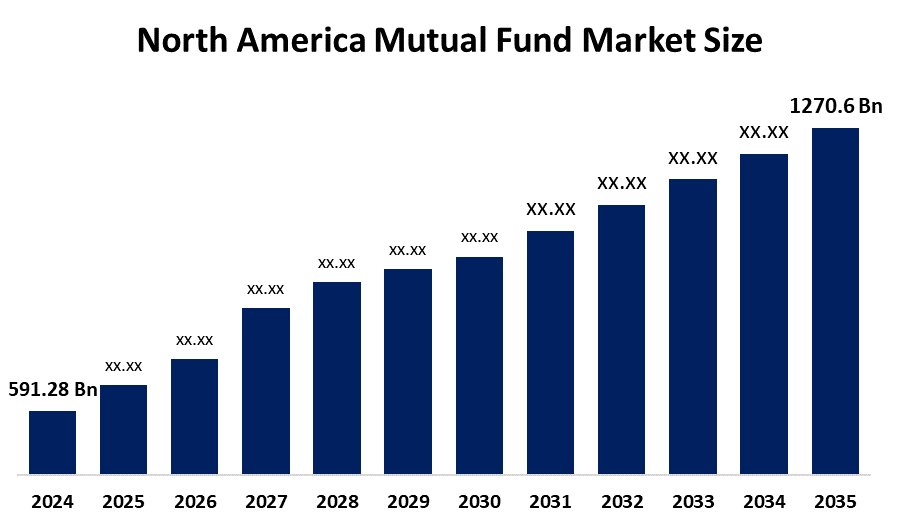

- The North America Mutual Fund Market Size Was Estimated at USD 591.28 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.2% from 2025 to 2035

- The North America Mutual Fund Market Size is Expected to Reach USD 1270.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Mutual Fund Market Size Is Anticipated To Reach USD 1270.6 Billion By 2035, Growing At A CAGR of 7.2% from 2025 to 2035. The market is driven by growth is supported by rising household participation in capital markets, increasing awareness of diversified investment products, and steady inflows into equity and debt mutual funds.

Market Overview

A mutual fund market is an investment vehicle that allows the individual investors to pool their funds into a single entity and invest in various securities like stocks, bonds, and other assets, thus achieving the diversification of their portfolios. Mutual funds are popular among both institutional and retail investors for retirement savings, wealth management, and risk reduction purposes. A wider range of people, particularly younger generations who prefer to manage their finances online, can now invest in mutual funds thanks to digital investment platforms.

BC Indigo Asset Management Inc. disclosed proposed fund mergers, closures, and other adjustments to the RBC Indigo Mutual Funds and/or RBC Indigo Pooled Funds in January 2025. With the introduction, Manulife John Hancock Investment's ETF portfolio now consists of 18 funds with approximately $7.5 billion in assets under management. The portfolio of investments may cover government and corporate bonds, preferred shares, stocks from both native and overseas markets, and securities backed by mortgages.

The United States Securities and Exchange Commission (SEC) has taken a more severe stance toward the regulation of mutual funds and has demanded risk management and transparency accordingly. The U.S. suggested GROWTH Act would enable investors in mutual fund to postpone their capital gains tax until they leave the fund which will help to harmonize their tax treatment with other investment vehicles and promote the habit of investing for a long time.

Report Coverage

This research report categorizes the market for the North America Mutual Fund Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Mutual Fund Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America mutual fund market.

North America Mutual Fund Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 591.28 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.2% |

| 2035 Value Projection: | USD 1270.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Fund Type, By Investor Type |

| Companies covered:: | Vanguard Group Fidelity Investments BlackRock American Funds T. Rowe Price Charles Schwab Invesco PIMCO Franklin Templeton Dimensional Fund Advisors And Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Mutual Fund Market in North America is driven by growing demand for varied investment products and growing financial literacy. These platforms are increasingly offering mutual funds due to they offer a simple way to invest in a variety of assets without requiring in-depth market expertise or expensive fees. Mutual funds are now more easily accessible, convenient, and reasonably priced thanks to online investment platforms and robo-advisors. Consistent funding is provided by inflows from retirement accounts like IRAs and 401(k) plans. Low-cost index funds, ETFs, and ESG funds are becoming more and more popular among investors.

Restraining Factors

The Mutual Fund Market in North America is restrained by the fierce rivalry among fund managers is a major problem. Managers are under pressure to reduce fees and boost performance as more funds enter the market and making it harder to differentiate offerings and attract investor interest. Traditional mutual funds face a serious threat from the emergence of inexpensive, transparent, and tax-efficient Exchange-Traded Funds (ETFs) and index funds.

Market Segmentation

The North America mutual fund market share is categorised into fund type, investor type, management style, and distribution channel.

- The equity segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Mutual Fund Market Size is segmented by fund type into equity, bond, hybrid, and others. Among these, the equity segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, equity funds held a 47.55% market share for mutual funds in North America. This is due to its potential to yield larger profits than other investing strategies. Investors looking to expand their investment portfolios find equity funds appealing since they invest mostly in stocks and aspire to grow more rapidly than money market or fixed income funds.

- The retail segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on investor type, the North America Mutual Fund Market Size is segmented into retail and institutional. Among these, the retail segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2024, 66.94% of the assets in the North American mutual fund market were owned by retail investors. The predominance is a reflection of the variety of customized investment options and the availability of mutual funds to those who want to improve their financial situation. Provide them with expert savings management, asset diversification, and the freedom to select funds that align with their financial objectives and risk tolerance.

- The passive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Mutual Fund Market Size is segmented by management style into active, passive. Among these, the passive segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, 53.32% of the assets of the mutual fund market share in North America were managed passively. When compared to actively managed funds, passive funds usually have much lower fees and management expense ratios (MERs). Even though this cost difference might not seem like much each year, it compounds over time and can give investors far higher long-term profits.

- The securities firm segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on distribution channel, the North America Mutual Fund Market Size is segmented into online trading platform, banks, securities firm and others. Among these, the securities firm segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. With 37.19% of the North American mutual fund market in 2024, securities firms led distribution. These companies make use of large networks of financial advisors and regional offices that offer wealth management services and individualized investment advice. This is appealing to investors who want expert advice when making investment selections. Both proprietary and third-party mutual funds are among the many financial products and services they provide, enabling thorough portfolio management catered to different investor requirements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Mutual Fund Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Vanguard Group

- Fidelity Investments

- BlackRock

- American Funds

- T. Rowe Price

- Charles Schwab

- Invesco

- PIMCO

- Franklin Templeton

- Dimensional Fund Advisors

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2026, BV Investment Partners announced the raising of fund XII at its hard cap with 2.465 billion of capital commitments.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Mutual Fund Market Size based on the below-mentioned segments:

North America Mutual Fund Market, By Fund Type

- Equity

- Bond

- Hybrid

- Others

North America Mutual Fund Market, By Investor Type

- Retail

- Institutional

North America Mutual Fund Market, By Management Style

- Active

- Passive

North America Mutual Fund Market, By Distribution Channel

- Online Trading Platform

- Banks

- Securities Firm

- Others

Frequently Asked Questions (FAQ)

-

What is the North America mutual fund market size?:The North America mutual fund market size is expected to grow from USD 591.28 billion in 2024 to USD 1270.6 billion by 2035, growing at a CAGR of 7.2% during the forecast period 2025-2035.

-

What is mutual fund, and its primary use?A mutual fund market is an investment vehicle that allows the individual investors to pool their funds into a single entity and invest in various securities like stocks, bonds, and other assets, thus achieving the diversification of their portfolios. Mutual funds are popular among both institutional and retail investors for retirement savings, wealth management, and risk reduction purposes

-

A mutual fund market is an investment vehicle that allows the individual investors to pool their funds into a single entity and invest in various securities like stocks, bonds, and other assets, thus achieving the diversification of their portfolios. Mutual funds are popular among both institutional and retail investors for retirement savings, wealth management, and risk reduction purposes.Market growth is driven by growing demand for varied investment products and growing financial literacy. These platforms are increasingly offering mutual funds because they offer a simple way to invest in a variety of assets without requiring in-depth market expertise or expensive fees

-

What factors restrain the North America mutual fund market?The market is restrained by the fierce rivalry among fund managers is a major problem. Managers are under pressure to reduce fees and boost performance as more funds enter the market and making it harder to differentiate offerings and attract investor interest

-

How is the market segmented by fund type?The market is segmented into equity, bond, hybrid, and others.

-

Who are the key players in the North America mutual fund market?Key companies include Vanguard Group, Fidelity Investments, BlackRock, American Funds, T. Rowe Price, Charles Schwab, Invesco, PIMCO, Franklin Templeton, and Dimensional Fund Advisors

Need help to buy this report?