North America Liquid Carbon Dioxide Market Size, Share, and COVID-19 Impact Analysis, By Source (Natural and Industrial), By Application (Food & Beverages, Chemicals, Pharmaceuticals, Oil & Gas, Metal Fabrication, and Others), and North America Liquid Carbon Dioxide Market Size Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Liquid Carbon Dioxide Market Size Insights Forecasts to 2035

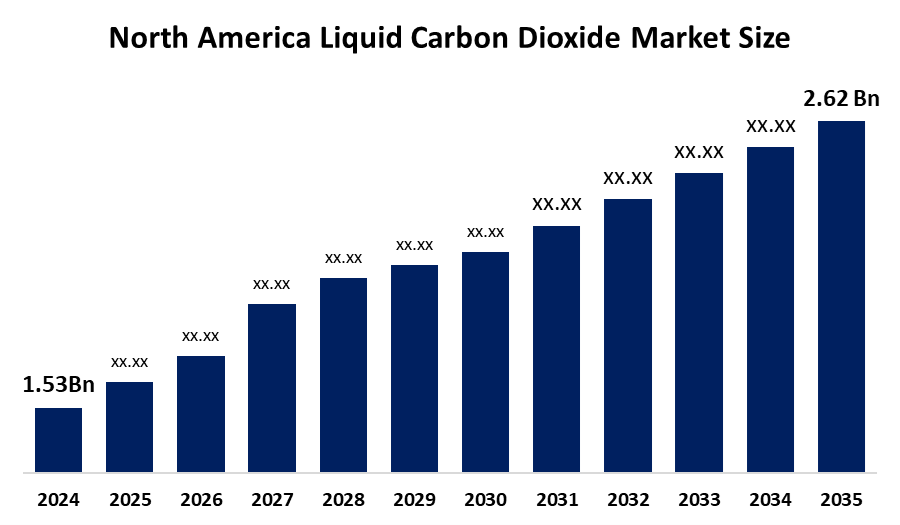

- The North America Liquid Carbon Dioxide Market Size Was Estimated at USD 1.53 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.01% from 2025 to 2035

- The North America Liquid Carbon Dioxide Market Size is Expected to Reach USD 2.62 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America Liquid Carbon Dioxide Market Size is anticipated to reach USD 2.62 Billion by 2035, growing at a CAGR of 5.01% from 2025 to 2035. The market is driven by growing industrial applications, rising demand in the food and beverage industries, growing use in the chemical and medical industries, and growing adoption of eco-friendly technology.

Market Overview

The North America Liquid Carbon Dioxide Market Size serves essential functions across multiple industrial sectors, which include food and beverage industries, as well as healthcare facilities, chemical manufacturing plants and oil and gas operations. The liquid carbon dioxide, exists when operators compress and chill carbon dioxide gas. The product serves three purposes, which include carbonating soft drinks and beer, flash-freezing food and using the Modified Atmosphere Packaging MAP method to extend shelf life. The rising need for carbon dioxide as a refrigerant and food preservation method due to its safe and eco-friendly attributes shows its increasing value.

Heirloom Carbon Technologies, Inc. announced its first decarbonization project at the Port of Caddo-Bossier through public and private funding in June 2024. The project will build two direct air capture (DAC) facilities at this location.

Alto Ingredients Inc., a US chemical company, purchased Kodiak Carbonic LLC in January 2025 for an undisclosed amount. Market leaders in the liquid carbon dioxide industry are funding research projects that develop liquid carbon dioxide carriers to improve system efficiency through better storage methods, transportation operations and better CO2 delivery stability during extended distance transport.

Report Coverage

This research report categorizes the market for the North America Liquid Carbon Dioxide Market Size based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America Liquid Carbon Dioxide Market Size. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America Liquid Carbon Dioxide Market Size.

North America Liquid Carbon Dioxide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.53 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 5.01% |

| 2035 Value Projection: | USD 2.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Linde Plc, Air Liquide USA, Air Products and Chemicals, Messer Group GmbH, Continental Carbonic Products, Matheson Tri-Gas Inc, Universal Industrial Gases, Inc, Gulf Cryo, Kodiak Carbonic LLC, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Liquid Carbon Dioxide Market Size in North America is driven by the need for industrial modernization together with performance improvement requirements, which is driving multiple industries to adopt new technologies. Government initiatives that support innovative projects and sustainable development are creating additional momentum for progress. Companies have increased their research and development funding, which has enabled them to create superior products and improve operational performance.

Restraining Factors

The Liquid Carbon Dioxide Market Size in North America is hindered by cost-related challenges, infrastructure limitations and regulatory hurdles. The need for significant capital investment often prevents smaller firms from entering the market. The production process and delivery system face disruptions because of the constant changes in international supply chains and the shortages of essential materials.

Market Segmentation

The North America Liquid Carbon Dioxide Market Size share is categorised into source and application.

- The natural segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Liquid Carbon Dioxide Market Size is segmented by source into natural and industrial. Among these, the natural segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the extraction process, which currently operates at established boundaries that permit natural well systems to deliver their full output. Natural gas deposits and volcanic emissions serve as two natural sources that produce liquid carbon dioxide. The extraction process and purifying procedures create obstacles that limit the utilization of carbon dioxide obtained from natural sources.

- The food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America Liquid Carbon Dioxide Market Size is segmented into food & beverages, chemicals, pharmaceuticals, oil & gas, metal fabrication, and others. Among these, the food & beverages segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the beverage industry's use of CO2 for carbonated drinks, while the frozen poultry sector and food products use it, and the substance also serves as a pH control agent. The demand for ready-to-make and frozen foods has grown because people choose different lifestyles, which has resulted in population growth that drives the need for food and beverage products, which will help the segment develop.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Liquid Carbon Dioxide Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Linde Plc

- Air Liquide USA

- Air Products and Chemicals

- Messer Group GmbH

- Continental Carbonic Products

- Matheson Tri-Gas Inc

- Universal Industrial Gases, Inc

- Gulf Cryo

- Kodiak Carbonic LLC

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In September 2025, Frontier Infrastructure Holdings LLC, a portfolio company of Tailwater Capital and a leading developer of low-carbon infrastructure across the Mountain West and Texas, announced a strategic partnership with Gevo, Inc. and its Verity platform to deliver North America's first fully integrated carbon management platform for ethanol producers.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Liquid Carbon Dioxide Market Size based on the below-mentioned segments:

North America Liquid Carbon Dioxide Market Size, By Source

- Nature

- Industrial

North America Liquid Carbon Dioxide Market Size, By Application

- Food & Beverages

- Chemicals

- Pharmaceuticals

- Oil & Gas

- Metal Fabrication

- Others

Frequently Asked Questions (FAQ)

-

What is the North America Liquid Carbon Dioxide Market Size?The North America Liquid Carbon Dioxide Market Size is expected to grow from USD 1.53 billion in 2024 to USD 2.6 billion by 2035, growing at a CAGR of 5.01% during the forecast period 2025-2035.

-

What is liquid carbon dioxide, and its primary use?The North America Liquid Carbon Dioxide Market Size serves essential functions across multiple industrial sectors, which include food and beverage industries, as well as healthcare facilities, chemical manufacturing plants and oil and gas operations.

-

What are the key growth drivers of the market?Market growth is driven by the need for industrial modernization together with performance improvement requirements, which is driving multiple industries to adopt new technologies.

-

What factors restrain the North America Liquid Carbon Dioxide Market Size?The market is restrained by cost-related challenges, infrastructure limitations and regulatory hurdles. The need for significant capital investment often prevents smaller firms from entering the market.

-

How is the market segmented by source?The market is segmented into natural and industrial.

-

Who are the key players in the North America Liquid Carbon Dioxide Market Size?Key companies include Linde Plc, Air Liquide USA, Air Products and Chemicals, Messer Group GmbH, Continental Carbonic Products, Matheson Tri-Gas Inc, Universal Industrial Gases, Inc, Gulf Cryo, and Kodiak Carbonic LLC.

Need help to buy this report?