North America Liquefied Petroleum Gas Market Size, Share, and COVID-19 Impact Analysis, By Source (Refinery, Associated Gas, and Non Associated Gas), By Application (Residential, Commercial, Chemical, Industrial, and Others), and North America Liquefied Petroleum Gas Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerNorth America Liquefied Petroleum Gas Market Insights Forecasts to 2035

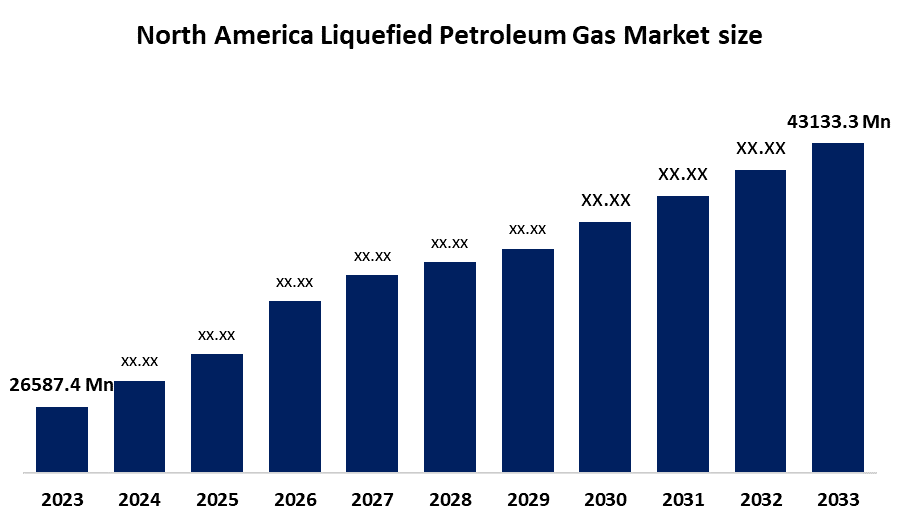

- The North America Liquefied Petroleum Gas Market size Was Estimated at USD 26587.4 Million in 2024.

- The Market Size is Growing at a CAGR of 4.5% between 2025 and 2035.

- The North America Liquefied Petroleum Gas market is Anticipated to Reach USD 43133.3 Million by 2035.

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Liquefied Petroleum Gas Market Size is anticipated to hold USD 43133.3 Million by 2035, Growing at a CAGR of 4.5% from 2025 to 2035. North America's liquefied petroleum gas market will benefit from rising residential heating demand, expanding petrochemical production, cleaner fuel adoption, shale gas output growth, and increasing LPG export opportunities across global emerging markets.

Market Overview

The North America liquefied petroleum gas (LPG) market refers to the production, distribution, and consumption of propane, butane, and their blends used across residential, commercial, industrial, and petrochemical applications. The market is witnessing steady growth due to abundant shale gas reserves and strong domestic production, particularly in the United States. LPG continues to be adopted as a clean-burning fuel for cooking, heating, transportation, and chemical feedstock needs. Rising petrochemical expansion, growing residential demand, and increasing export volumes further strengthen the region’s market position. Supportive policies promoting cleaner energy alternatives and technological improvements in storage and distribution infrastructure also enhance market performance. Overall, North America remains a key global supplier and consumer, driving consistent market expansion.

Get more details on this report -

Report Coverage

This research report categorizes the market for the North America liquefied petroleum gas market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America liquefied petroleum gas market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America liquefied petroleum gas market.

North America Liquefied Petroleum Gas Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26587.4 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | CAGR of 4.5% |

| 2035 Value Projection: | USD 43133.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 171 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Source, By Application |

| Companies covered:: | Bharat Petroleum Corp, Petredec, Petrofac Ltd, Phillips 66, Qatargas, Saudi Aramco, UGI Corp, Vitol, and Other Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Shale output, clean fuel demand, petrochemical growth, and rising exports.

The North America LPG market is driven by abundant shale gas production, which ensures consistent and cost-effective supply across the region. Growing demand from residential heating, commercial applications, and the petrochemical sector further accelerates market expansion. Increasing use of LPG as a cleaner alternative to conventional fuels supports adoption in transportation and industrial operations. Rising export activities, infrastructure modernization, and supportive regulations promoting low-emission energy sources also contribute significantly to market growth, strengthening North America’s global leadership in LPG supply.

Restraining Factors

Price volatility, infrastructure gaps, renewable shift, safety risks, and fuel competition.

The North America LPG market faces restraints due to price volatility linked to fluctuating crude oil and natural gas markets. Limited infrastructure in certain regions, including storage and distribution gaps, can hinder efficient supply. Environmental concerns and increasing regulatory pressure to shift toward renewable energy sources may reduce long-term LPG dependence.

Opportunities

Export growth, petrochemical demand, cleaner fuel adoption, and infrastructure modernization.

The North America LPG market presents substantial opportunities driven by increasing global demand, particularly from Asia and Latin America, where supply gaps continue to widen. Expanding petrochemical manufacturing, utilizing LPG as a key feedstock, further boosts growth potential. Rising adoption of cleaner fuels in residential, commercial, and industrial sectors enhances market penetration. Technological improvements in storage, transportation, and export infrastructure also open new avenues. Additionally, the shift toward low-carbon energy solutions positions LPG as a transitional fuel, strengthening long-term market prospects.

Market Segmentation

The North America liquefied petroleum gas market share is classified into source and application.

- The Non Associated gas segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America liquefied petroleum gas market is segmented by source into refinery, associated gas, and non associated gas. Among these, the non associated gas segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Non-Associated Gas segment dominated in 2024 because rapidly expanding shale gas production, advanced gas-processing infrastructure, and strong NGL output ensured stable, cost-efficient LPG supply. Its continued growth is supported by rising petrochemical demand, increasing export volumes, and ongoing investments in natural gas processing capacity.

- The chemical segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America liquefied petroleum gas market is segmented by application into residential, commercial, chemical, industrial, and others. Among these, the chemical segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is driven by its extensive use of LPG especially propane and butane as key feedstocks for producing petrochemicals like ethylene, propylene, and other derivatives, supported by expanding petrochemical capacities across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America liquefied petroleum gas market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bharat Petroleum Corp

- Petredec

- Petrofac Ltd

- Phillips 66

- Qatargas

- Saudi Aramco

- UGI Corp

- Vitol

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Europe, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America liquefied petroleum gas market based on the following segments:

North America Liquefied Petroleum Gas Market, By Source

- Refinery

- Associated Gas

- Non Associated Gas

North America Liquefied Petroleum Gas Market, By Application

- Residential

- Commercial

- Chemical

- Industrial

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America liquefied petroleum gas market size?A: North America liquefied petroleum gas market size is expected to grow from USD 26587.4 Million in 2024 to USD 43133.3 Million by 2035, growing at a CAGR of 4.5% during the forecast period 2025-2035.

-

Q: What are the key growth drivers of the market?A: The North America LPG market is driven by abundant shale gas production, which ensures consistent and cost-effective supply across the region.

-

Q: What factors restrain the North America liquefied petroleum gas market?A: The North America LPG market faces restraints due to price volatility linked to fluctuating crude oil and natural gas markets.

-

Q: How is the market segmented by source?A: The market is segmented into source into refinery, associated gas, and non associated gas.

-

Q: Who are the key players in the North America liquefied petroleum gas market?A: Key companies include Bharat Petroleum Corp, Petredec, Petrofac Ltd, Phillips 66, Qatargas, Saudi Aramco, UGI Corp, and Vitol.

-

Q: Who are the target audiences for this market report?A: The report targets market players, investors, end-users, government authorities, consulting and research firms, venture capitalists, and value-added resellers (VARs).

Need help to buy this report?