North America IT Asset Disposition Market Size, Share, and COVID-19 Impact Analysis, By Asset Type (Computers/Laptops, Servers, Mobile Devices, Storage Devices, and Peripherals), By Service Type (De-Manufacturing & Recycling, Remarketing & Value Recovery, Data Destruction/Data Sanitation, Logistics Management & Reverse Logistics), and North America IT Asset Disposition Market Size Insights, Industry Trends, Forecast to 2035

Industry: Information & TechnologyNorth America IT Asset Disposition Market Size Insights Forecasts to 2035

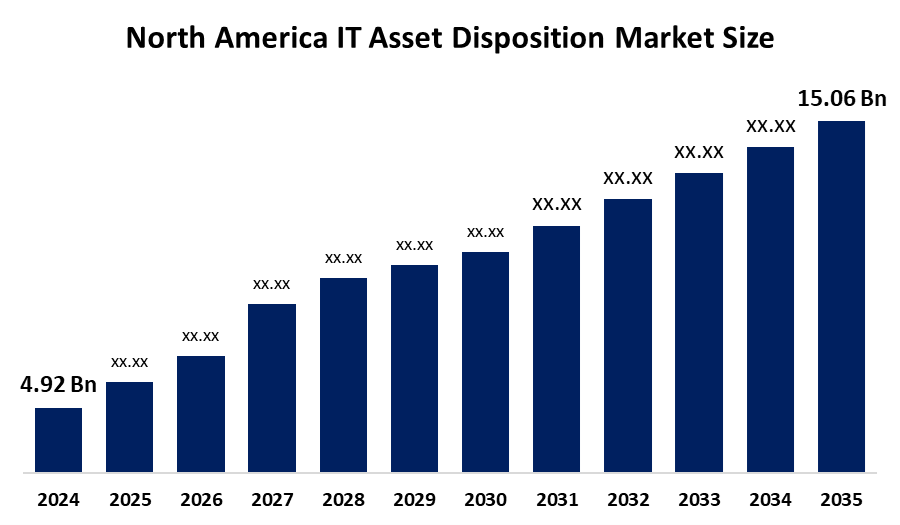

- The North America IT Asset Disposition Market Size Was Estimated at USD 4.92 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 10.71% from 2025 to 2035

- The North America IT Asset Disposition Market Size is Expected to Reach USD 15.06 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The North America IT Asset Disposition Market Size is anticipated to reach USD 15.06 Billion by 2035, growing at a CAGR of 10.71% from 2025 to 2035. The market is driven by large amounts of e-waste produced by growing tech adoption. Frequent hardware changes are necessary due to the rapid improvements in cloud, AI, and high-resolution technology in data centers and media.

Market Overview

The IT Asset Disposition (ITAD) Market Size is all about the secure and eco-friendly handling and getting rid of worn-out or dead IT devices. ITAD is not only about disposal; it is a strategy that covers the whole tech asset lifecycle from purchasing to scrapping. The focus is to reduce the environmental impact to a minimum, guarantee data security and recover the maximum residual value from the equipment. ITAD also secures compliance with the increasing number of strict governmental and industry regulations pertaining to e-waste disposal and data protection.

In January 2023, TES, a leading provider of IT lifecycle management services and sustainable IT asset disposition (ITAD), announced the launch of a new 40,000-square-foot facility in Las Vegas. ABB Robotics and US start-up Molg announced in October 2024 that they will work together to create robotic micro-factories to retrieve and recycle data center owners' abandoned electronic equipment.

The American Rescue Plan has contributed more than $1 billion, plus $175 million every year, to the TMF, which the U.S. government has set aside for the disposal of data-bearing IT assets and dealing with urgent security problems. In Canada, the adoption of circular economy policies is supported by provincial governments, which expand the definitions of e-waste products.

Report Coverage

This Research Report Categorizes the market for the North America IT asset disposition market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America IT asset disposition market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America IT asset disposition market.

North America IT Asset Disposition Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 4.92 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.71% |

| 2035 Value Projection: | 15.06 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Asset Type, By Service Type |

| Companies covered:: | Dell Technologies, IBM Corporation, Hewlett-Packard Enterprise, Iron Mountain Inc., Sims Limited, Apto Solutions Inc., ITRenew, Ingram Micro Services, Arrow Electronics, LifeSpan International Inc., and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The IT asset disposition market in North America is driven by strict data privacy laws like HIPAA and the CCPA, which are imposed mainly on North American organisations in the financial (BFSI) and healthcare sectors. One of the most critical factors of this scenario is the rising concern about the environment and the e-waste generated. Through remarketing and refurbishment, companies are now more than ever looking to gain the residual value from their IT assets.

Restraining Factors

The IT asset disposition market in North America is restrained by the fear of unauthorized access to data through the improper handling of IT assets during disposal. Not having a properly developed and uniform reverse logistics network, especially in the countryside, results in expensive pickup and low and varying service quality. The initial expenses linked to safe data removal, eco-friendly disposal, and acquiring necessary certifications can be very heavy.

Market Segmentation

The North America IT Asset Disposition Market Size share is categorised into asset type and service type.

- The computers/laptops segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America IT asset disposition market is segmented by asset type into computers/laptops, servers, mobile devices, storage devices, and peripherals. Among these, the computers/laptops segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, computers and laptops accounted for 43.4% of the North America IT Asset Disposition market. These are the devices that comprise the most precious elements, like CPUs, memory modules, hard drives, and displays, that can be either recovered or recycled.

- The data destruction/data sanitation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on service type, the North America IT asset disposition market is segmented into de-manufacturing & recycling, remarketing & value recovery, data destruction/data sanitation, logistics management & reverse logistics. Among these, the data destruction/data sanitation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. In 2024, Data Destruction and Sanitization generated the most revenue, accounting for 38.7% of the total revenue, which indicates strong regulatory monitoring of data privacy. ITAD Service providers provide data sanitization services consisting of secure wiping or erasing of data from the storage devices, thus preventing unauthorized access to the data. Besides, they provide physical destruction services for the data that are to be permanently destroyed and cannot be recovered.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America IT asset disposition market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dell Technologies

- IBM Corporation

- Hewlett-Packard Enterprise

- Iron Mountain Inc.

- Sims Limited

- Apto Solutions Inc.

- ITRenew

- Ingram Micro Services

- Arrow Electronics

- LifeSpan International Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2026, Liquid Technology, a leading provider of IT Asset Disposition (ITAD) services, announced the launch of its new website in 2026. The company has maintained exclusive focus on ITAD services. The website redesign reflects Liquid Technology’s evolution from a New York City-based startup to a global ITAD leader serving clients across North America.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America IT asset disposition market based on the below-mentioned segments:

North America IT Asset Disposition Market Size, By Asset Type

- Computers/Laptops

- Servers

- Mobile Devices

- Storage Devices

- Peripherals

North America IT Asset Disposition Market Size, By Service Type

- De-Manufacturing & Recycling

- Remarketing & Value Recovery

- Data Destruction/Data Sanitation

- Logistics Management & Reverse Logistics

Frequently Asked Questions (FAQ)

-

What is the North America IT Asset Disposition Market Size?The North America IT asset disposition market size is expected to grow from USD 4.92 billion in 2024 to USD 15.06 billion by 2035, growing at a CAGR of 10.71% during the forecast period 2025-2035.

-

What is IT asset disposition, and its primary use?The IT asset disposition (ITAD) market is all about the secure and eco-friendly handling and getting rid of worn-out or dead IT devices. ITAD is not only about disposal; it is a strategy that covers the whole tech asset lifecycle from purchasing to scrapping.

-

What are the key growth drivers of the market?Market growth is driven by strict data privacy laws like HIPAA and the CCPA, which are imposed mainly on North American organisations in the financial (BFSI) and healthcare sectors.

-

What factors restrain the North America IT Asset Disposition Market Size?The market is restrained by the fear of unauthorized access to data through the improper handling of IT assets during disposal.

-

How is the market segmented by asset type?The market is segmented into computers/laptops, servers, mobile devices, storage devices, and peripherals.

-

Who are the key players in the North America IT Asset Disposition Market Size?Key companies include Dell Technologies, IBM Corporation, Hewlett-Packard Enterprise, Iron Mountain Inc., Sims Limited, Apto Solutions Inc., ITRenew, Ingram Micro Services, Arrow Electronics, and LifeSpan International Inc.

Need help to buy this report?