North America Inulin Market Size, Share, and COVID-19 Impact Analysis, By Source (Chicory Inulin, Jerusalem Artichoke Inulin, Agave Inulin), By Form (Liquid, Powder), By Application (Food and Beverages, Dietary Supplements, Animal Feed Additive, Others), By Sales Channel (Direct Sales, Indirect Sales), and North America Inulin Market Insights, Industry Trends, Forecast to 2035

Industry: Consumer GoodsNorth America Inulin Market Insights Forecasts to 2035

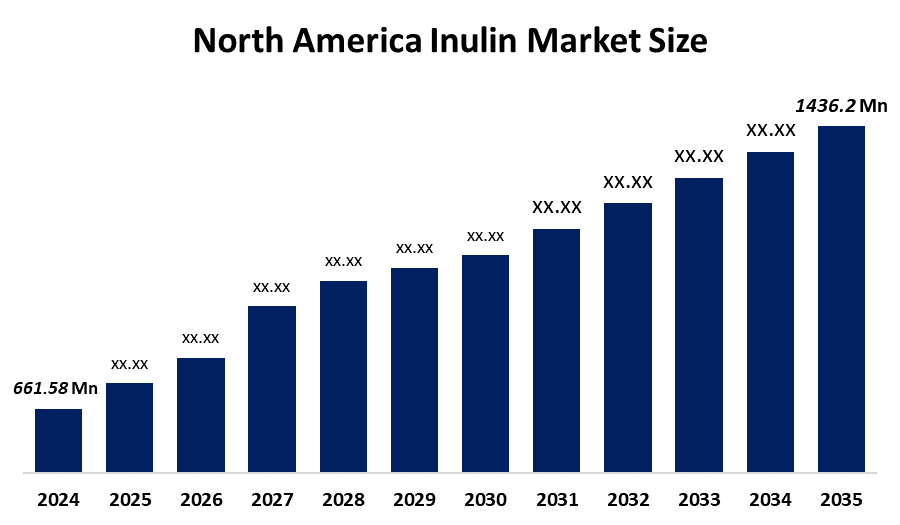

- The North America Inulin Market Size Was Estimated at USD 661.58 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.3% from 2025 to 2035

- The North America Inulin Market Size is Expected to Reach USD 1436.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Inulin Market size is anticipated to reach USD 1436.2 Million by 2035, growing at a CAGR of 7.3% from 2025 to 2035. The market is driven by the increasing consumer demand for natural and functional ingredients, rising health awareness, and the growing application of inulin in the food and beverage, pharmaceutical, and dietary supplement industries.

Market Overview

Inulin, a plant-derived soluble fibre, has received a lot of attention in the market owing to its health benefits and the increasing awareness of consumers. The incorporation of inulin in the marketing of dietary supplements is expected to record a remarkable surge over the period under consideration. In May 2024, researchers from the Centenary Institute and the University of Sydney revealed that delta inulin is a novel type of vaccine adjuvant that improves immune responses against a variety of ailments, including flu and tuberculosis. Not only does it improve the vaccine potency by increasing and fortifying the immune response, but it also influences the direction of the inulin market, thereby altering its course.

In August 2025, the company known as ADM made a statement indicating that it will be implementing measures aimed at simplifying and fortifying the entire soy protein supply chain, which is the world-wide production of soy protein, thus, increasing the efficiency of their operations and making it possible for them to better cater to their customers all over the globe by utilizing the operational leverage as well as the excellence at its soy protein facility located in Decatur, Illinois, which has recently been recommissioned, and so are the companies in other parts of the world.

The FDA, which is the US Food and Drug Administration, has acknowledged chicory root inulin-type fructans as a source of dietary fibre for the new nutrition facts label. The guidelines for nutrient content claims from the U.S. Food and Drug Administration enable manufacturers to bring attention to the fibre advantages of inulin.

Report Coverage

This research report categorizes the market for the North America inulin market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America inulin market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America inulin market.

North America Inulin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 661.58 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.3% |

| 2035 Value Projection: | USD 1436.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Archer Daniels Midland Company (ADM), Cargill, Ingredion Incorporated, Sensus America Inc., The Green Labs LLC, Jarrow Formulas, Inc, NOW Health Group, Inc., The Tierra Group, Intrinsic Organics, Nova Green Inc., Others, and Key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The inulin market in North America is driven by the increasing rates of obesity and diabetes have caused people to look for low-calorie and sugar-free options; thus, inulin has become an appealing ingredient. Besides, the growing e-commerce market makes it easier for people to get inulin-containing dietary supplements, which also helps the health-oriented consumers to adopt it faster. Cargill Incorporated produces premium chicory root inulin for multiple applications, especially in the food and beverage industries. Cargill seeks to satisfy the ever-growing market for healthier alternatives and hence becomes a significant player in the rising inulin market.

Restraining Factors

The inulin market in North America is restrained by the high inulin consumption can cause some adverse side effects, including bloating and gas, which can lead to low consumer awareness in emerging markets, high costs of production related to extraction yield and extraction, and logistics costs due to the dependency on particular plants such as chicory, and strict regulations on food labeling and health claims. In the absence of proper consumer education about the advantages of inulin, its market penetration and growth potential in these regions remain constrained.

Market Segmentation

The North America inulin market share is categorised into source, form, application and sales channel.

- The chicory inulin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America inulin market is segmented by source into chicory inulin, jerusalem artichoke inulin, agave inulin. Among these, the chicory inulin segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by the inulin of chicory acts as a prebiotic, causing the increase of good intestinal bacteria, which, in turn, improves not only digestive but also general health. Approvals from regulatory agencies for its safety and effectiveness have built trust among both manufacturers and consumers, thus helping the market growth.

- The powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on form, the North America inulin market is segmented into liquid, powder. Among these, the powder segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment growth is driven incorporation of powdered inulin has been made easy due to it can be used in various food products, such as baked goods and dietary supplements, without changing the original taste and texture of the product while still enhancing the nutritional values. Moreover, the increasing consumer demand for high-fibre and functional foods makes this segment's fastest-growing if not the only segment, as an ingredient, powdered inulin is quite effective in improving digestive health, and also increasing the feeling of fullness.

- The food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America inulin market is segmented by application into food and beverages, dietary supplements, animal feed additive, others. Among these, the food and beverages segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is driven by growing consumer interest in functional foods that are related to health and wellness. Inulin's prebiotic properties make it a good candidate for gut health and general wellness as human digestive health becomes more and more recognized. Besides, inulin acts as a natural sugar and fat replacement, thus enabling the producers to develop healthier products with low calories but good taste and texture at the same time.

- The indirect sales segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on sales channel, the North America inulin market is segmented into direct sales, indirect sales. Among these, the indirect sales segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segment growth is driven by the ever-increasing demand of customers for health-related products. In addition, the retailers and distributors are launching new products with inulin, exploiting the rising awareness of its health benefits, like aiding digestion and managing weight.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America inulin market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company (ADM)

- Cargill

- Ingredion Incorporated

- Sensus America Inc.

- The Green Labs LLC

- Jarrow Formulas, Inc

- NOW Health Group, Inc.

- The Tierra Group

- Intrinsic Organics

- Nova Green Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In August 2025, Activia, the pioneer in gut health and the doctor-recommended probiotic food and beverage brand in Canada, launched Activia EXPERT, its most advanced yogurt yet.

In February 2025, Coca-Cola announced that it's expanding its beverage lineup with its all-new Simply Pop line, the company's first-ever prebiotic soda made with "real fruit juice, no added sugar, and no compromises," under its Simply Beverages brand umbrella.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Inulin Market based on the below-mentioned segments:

North America Inulin Market, By Source

- Chicory Inulin

- Jerusalem Artichoke Inulin

- Agave Inulin

North America Inulin Market, By Form

- Liquid

- Powder

North America Inulin Market, By Application

- Food and Beverages

- Dietary Supplements

- Animal Feed Additive

- Others

North America Inulin Market, By Sales Channel

- Direct Sales

- Indirect Sales

Frequently Asked Questions (FAQ)

-

Q: What is the North America inulin market size?A: The North America Inulin Market size is expected to grow from USD 661.58 million in 2024 to USD 1436.2 million by 2035, growing at a CAGR of 7.3% during the forecast period 2025-2035.

-

Q: What is inulin, and its primary use?A: Inulin, a plant-derived soluble fibre, has received a lot of attention in the market owing to its health benefits and the increasing awareness of consumers. The incorporation of inulin in the marketing of dietary supplements is expected to record a remarkable surge over the period under consideration.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the increasing rates of obesity and diabetes have caused people to look for low-calorie and sugar-free options; thus, inulin has become an appealing ingredient. Besides, the growing e-commerce market makes it easier for people to get inulin-containing dietary supplements, which also helps the health-oriented consumers to adopt it faster.

-

Q: What factors restrain the North America inulin market?A: The market is restrained by the high inulin consumption can cause some adverse side effects, including bloating and gas, which can lead to low consumer awareness in emerging markets, high costs of production related to extraction yield and extraction, and logistics costs due to the dependency on particular plants such as chicory, and strict regulations on food labeling and health claims

-

Q: How is the market segmented by source?A: The market is segmented into chicory inulin, jerusalem artichoke inulin, and agave inulin.

-

Q: Who are the key players in the North America inulin market?A: Key companies include Archer Daniels Midland Company (ADM), Cargill, Ingredion Incorporated, Sensus America Inc., The Green Labs LLC, Jarrow Formulas, Inc, NOW Health Group, Inc., The Tierra Group, Intrinsic Organics, and Nova Green Inc.

Need help to buy this report?