North America Hydrogen Market Size, Share, and COVID-19 Impact Analysis, By Production Method (Steam Methane Reforming, Electrolysis, Biomass Gasification, Coal Gasification and By Product Production), By Application (Transportation, Industrial Processes, Power Generation, and Residential and Commercial Heating), and North America Hydrogen Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Hydrogen Market Insights Forecasts to 2035

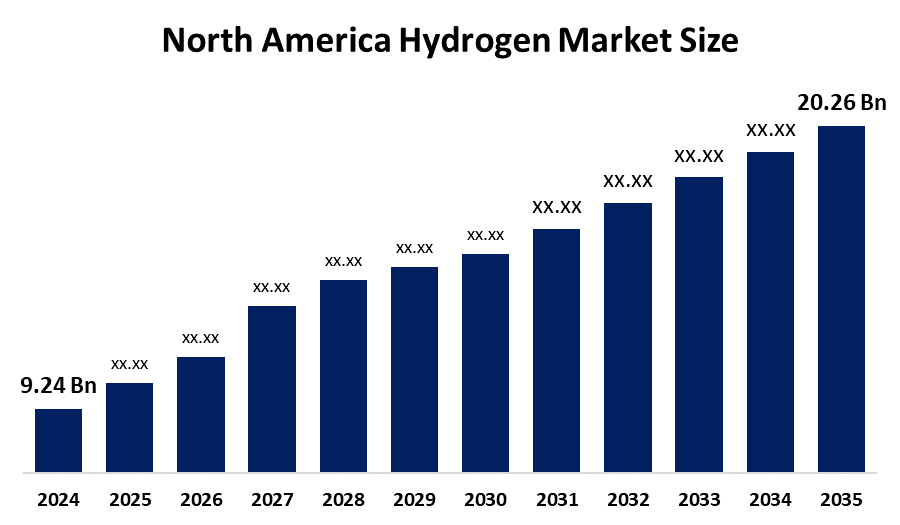

- The North America Hydrogen Market Size Was Estimated at USD 9.24 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.4% from 2025 to 2035

- The North America Hydrogen Market Size is Expected to Reach USD 20.26 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the North America Hydrogen Market size is anticipated to reach USD 20.26 Billion by 2035, growing at a CAGR of 7.4% from 2025 to 2035. The market is driven by an increasing trend of switching to low-emission and sustainable energy solutions for transportation, power generation, and industrial uses.

Market Overview

The North American hydrogen market includes all hydrogen production facilities, storage facilities, distribution networks and hydrogen consumption points that operate between the United States, Canada and Mexico. Hydrogen fuel cells serve as a better option for long-haul transportation because they enable quicker refueling times and provide extended travel distances. Surplus renewable energy generates hydrogen, which functions as long term energy storage that will be converted into electricity during peak demand times.

The University of Michigan and the University of California, Riverside established a partnership in March 2025 to advance hydrogen fuel technology for internal combustion engine vehicles. In April 2025, Cummins introduced its H2 ICE turbochargers, which became the first product of its kind for heavy duty on highway use, and the company also secured a supply agreement with a leading European original equipment manufacturer to support Euro VII compliant hydrogen engines.

Canada is establishing itself as a dependable choice, which now serves as its primary international role. Linde announced a $2 billion investment in a clean hydrogen facility in Alberta, and Atlantic firms recently welcomed 200 million in German investment to support future exports. The current market price of green hydrogen stands between USD 4 and USD 6 per kilogram, which needs to decrease to USD 1 per kilogram according to the DOEs Hydrogen Shot target to achieve market competitiveness.

Report Coverage

This research report categorizes the market for the North America hydrogen market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America hydrogen market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America hydrogen market.

North America Hydrogen Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 20.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.4% |

| 2035 Value Projection: | USD 20.26 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Production Method , By Application |

| Companies covered:: | Air Products and Chemicals Inc,Linde PLC,Air Liquide,Plug Power Inc,Bloom Energy,Ballard Power Systems,Cummins Inc,Mitsubishi Power Americas Inc,Chevron,Shell And Others Players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The hydrogen market in North America is driven by the 45V Clean Hydrogen Production Tax Credit in the U.S., which provides a 3 per kilogram payment for low carbon hydrogen which makes green hydrogen economically viable through its financial support. The U.S. Department of Energy DOE has allocated billion to establish seven regional hydrogen hubs to build integrated production and storage ecosystems. Canadas Clean Hydrogen Investment Tax Credit CHITC provides a refundable credit for eligible assets operational through 2034.

Restraining Factors

The hydrogen market in North America is hindered by the green hydrogen production costs being two to four times higher than grey hydrogen production costs, which results in its uncompetitive status. There exists a severe shortage of hydrogen refueling stations and distribution networks including pipelines and specialized trailers, throughout the United States and Canada, preventing hydrogen-powered transportation from expanding.

Market Segmentation

The North America hydrogen market share is categorised into production method and application.

- The steam methane reforming segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America hydrogen market is segmented by production method into steam methane reforming, electrolysis, biomass gasification, coal gasification and by-product production. Among these, the steam methane reforming segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the existing infrastructure of the project, together with its economic feasibility assessment, which shows proof of its viability. The North American natural gas reserves create an affordable solution for this method, even though carbon emissions present a challenge. U.S. companies are adopting carbon capture technology together with steam methane reforming to achieve emission reductions while keeping operational expenses low.

- The transportation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on application, the North America hydrogen market is segmented into transportation, industrial processes, power generation, and residential and commercial heating. Among these, the transportation segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the rising financial commitments to hydrogen fuel cell vehicles and the demand for environmentally sustainable transportation solutions create market growth opportunities. The energy density of hydrogen combined with its rapid refueling capability establishes hydrogen as a viable solution for applications in long distance freight transportation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America hydrogen market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Air Products and Chemicals, Inc

- Linde PLC

- Air Liquide

- Plug Power Inc.

- Bloom Energy

- Ballard Power Systems

- Cummins Inc

- Mitsubishi Power Americas Inc

- Chevron

- Shell

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In January 2026, CF Industrial Holdings, Inc., a global leader in hydrogen and nitrogen based products, joined forces with POET, the world's largest biofuel producer, along with several major agricultural cooperatives, to launch a pilot initiative focused on building a low-carbon fertiliser supply chain.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America Hydrogen Market based on the below-mentioned segments:

North America Hydrogen Market, By Production Method

- Steam Methane Reforming

- Electrolysis

- Biomass Gasification

- Coal Gasification

- By-Product Production

North America Hydrogen Market, By Application

- Transportation

- Industrial Processes

- Power Generation

- Residential and Commercial Heating

Frequently Asked Questions (FAQ)

-

Q: What is the North America hydrogen market size?A: The North America Hydrogen Market size is expected to grow from USD 9.24 billion in 2024 to USD 20.26 billion by 2035, growing at a CAGR of 7.4% during the forecast period 2025-2035.

-

Q: What is hydrogen, and its primary use?A: The North American hydrogen market includes all hydrogen production facilities, storage facilities, distribution networks and hydrogen consumption points that operate between the United States, Canada and Mexico.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the 45V Clean Hydrogen Production Tax Credit in the U.S., which provides a $3 per kilogram payment for low-carbon hydrogen which makes green hydrogen economically viable through its financial support.

-

Q: What factors restrain the North America hydrogen market?A: The market is restrained by the green hydrogen production costs being two to four times higher than grey hydrogen production costs, which results in its uncompetitive status.

-

Q: How is the market segmented by production method?A: The market is segmented into steam methane reforming, electrolysis, biomass gasification, coal gasification and by-product production.

-

Q: Who are the key players in the North America hydrogen market?A: Key companies include Air Products and Chemicals, Inc, Linde PLC, Air Liquide, Plug Power Inc., Bloom Energy, Ballard Power Systems, Cummins Inc, Mitsubishi Power Americas Inc, Chevron, and Shell.

Need help to buy this report?