North America HVAC Systems Market Size, Share, and COVID-19 Impact Analysis, By Application (Residential, Ventilation, Cooling), By Distribution Channel (Online, Retail Stores, Wholesale, and Others), and North America HVAC Systems Market Insights, Industry Trends, Forecast to 2035.

Industry: Machinery & EquipmentNorth America HVAC Systems Market Insights Forecasts to 2035

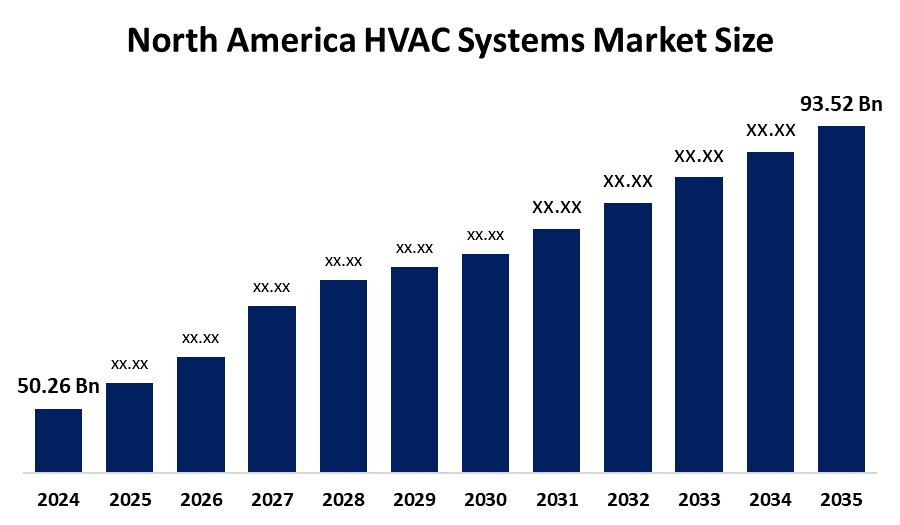

- The North America HVAC Systems Market Size Was Estimated at USD 50.26 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.81% from 2025 to 2035

- The North America HVAC Systems Market Size is Expected to Reach USD 93.52 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America HVAC Systems Market Size is Anticipated to Reach USD 93.52 Billion by 2035, Growing at a CAGR of 5.81% from 2025 to 2035. The market is driven by the need for systems that offer high operational performance and minimal energy consumption. The production of HVAC is expected to increase in the forecast period due to the rising demand for automobiles.

Market Overview

HVAC systems refer to heating, ventilation, and air conditioning systems, which are responsible for the regulation of temperature and air quality, thus ensuring the comfort of indoor areas like houses, workplaces, and industries. The assembly of these systems includes various components such as air conditioners, heat pumps, furnaces, ducting, and ventilation. The systems are very effective in providing a uniform and non-wasting indoor climate by controlling the temperature, humidity, and movement of air. They can be installed in both single and multi-family housing to regulate temperature and moisture content, thereby providing a pleasant indoor climate year-round.

Red Dot Corporation joins hands with Millennium Aero Dynamics of India to accelerate the production of mobile HVAC in South Asia in 2025.

In June 2025, Lennox International, the climate control company recognised for its HVAC and refrigeration systems, located in North Texas, is going to step into the water heater market by forming a joint venture with Ariston Group, a producer of high-efficiency water heating technologies based in Italy and having its headquarters there.

The tax credits for high-efficiency heat pumps offered by the U.S. Department of Energy (DOE) and schemes under the Inflation Reduction Act (IRA) continue to be as much as $2,000, thus making the heat pump segment the fastest-growing among all the heating options. Favouring the installation of HVAC systems are increased construction activities, extreme weather conditions, and the presence of high-efficiency systems.

Report Coverage

This research report categorizes the market for the North America HVAC systems market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America HVAC systems market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America HVAC systems market.

North America HVAC Systems Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 50.26 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.81% |

| 2035 Value Projection: | USD 93.52 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Application, By Distribution Channel |

| Companies covered:: | Trane Technologies, Daikin Industries, Johnson Controls, Bosch Thermotechnology, Nortek Global HVAC, LG Electronics & Samsung, Mitsubishi Electric, Rheem Manufacturing, Lennox International, Carrier Global Corporation, and other key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The HVAC systems market in North America is driven by the cloud thermostats and cellular technology-enabled systems adoption facilitate distant supervision along with maintenance based on predictions, which, in turn, can help cut down the power usage by as much as 30%. The growing consciousness of air quality significance is driving the investment in HVAC systems that are capable of filtering and purifying the indoor air effectively, while at the same time reducing the outdoor emissions by both residential and commercial property owners.

Restraining Factors

The HVAC systems market in North America is restrained by the shortage of technicians who have been trained to install and maintain up-to-date smart HVAC systems, resulting in longer waiting times for service and higher service rates. The constant interruptions in the supply of essential parts such as semiconductors, electronic expansion valves, and low-GWP refrigerants will be reflected in price fluctuations and project delays.

Market Segmentation

The North America HVAC systems market share is categorised into application and distribution channel.

- The residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America HVAC systems market is segmented by application into residential, ventilation, cooling. Among these, the residential segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In 2024, residential emerged as the largest segment with its revenue share of 41.58%. Heating and cooling systems are now considered indispensable for every home as they provide a pleasant atmosphere in winter and summer and let air circulate in the house. Their presence in households is a major factor in determining the quality of life and health since they offer a proper environment that changes with the weather and is also according to users' moods.

- The retail stores segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on end user, the North America HVAC systems market is segmented into online, retail stores, wholesale, and others. Among these, the retail stores segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by customers who can choose between the comfort and the variety of products offered in both the physical and online stores. The most significant home improvement retailers, for example, Home Depot and Lowe’s, not only have a vast range of HVAC brands and models to choose from but also provide financial assistance, along with installation support, thus facilitating the whole purchasing process.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America HVAC systems market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Trane Technologies

- Daikin Industries

- Johnson Controls

- Bosch Thermotechnology

- Nortek Global HVAC

- LG Electronics & Samsung

- Mitsubishi Electric

- Rheem Manufacturing

- Lennox International

- Carrier Global Corporation

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2025, Alpha Degree, a leading HVAC products wholesaler in Ontario, announced its strategic expansion into the broader North American market, reinforcing its position as a trusted supplier of UL-certified aluminium foil tape and preparing for the launch of new HVAC manufacturing capabilities in 2026.

In January 2025, Panasonic Corporation announced that its Heating & Ventilation A/C Company (HVAC Company) would release the OASYS Residential Central Air Conditioning System in the US market.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America HVAC systems market based on the below-mentioned segments:

North America HVAC Systems Market, By Application

- Residential

- Ventilation

- Cooling

North America HVAC Systems Market, By Distribution Channel

- Online

- Retail Stores

- Wholesale

- Others

Frequently Asked Questions (FAQ)

-

Q: What is the North America HVAC systems market size?A: The North America HVAC systems market size is expected to grow from USD 50.26 billion in 2024 to USD 93.52 billion by 2035, growing at a CAGR of 5.81% during the forecast period 2025-2035.

-

Q: What is HVAC systems, and its primary use?A: HVAC systems refer to heating, ventilation, and air conditioning systems, which are responsible for the regulation of temperature and air quality, thus ensuring the comfort of indoor areas like houses, workplaces, and industries.

-

Q: What are the key growth drivers of the market?A: Market growth is driven by the cloud thermostats and cellular technology-enabled systems adoption facilitate distant supervision along with maintenance based on predictions which, in turn, can help cut down the power usage by as much as thirty percent.

-

Q: What factors restrain the North America HVAC systems market?A: The market is restrained by the shortage of technicians who have been trained to install and maintain up-to-date smart HVAC systems is resulting in longer waiting times for service and higher service rates.

-

Q: How is the market segmented by application?A: The market is segmented into residential, ventilation, cooling.

-

Q: Who are the key players in the North America HVAC systems market?A: Key companies include Trane Technologies, Daikin Industries, Johnson Controls, Bosch Thermotechnology, Nortek Global HVAC, LG Electronics & Samsung, Mitsubishi Electric, Rheem Manufacturing, Lennox International, and Carrier Global Corporation.

Need help to buy this report?